China’s Science and Technology Innovation Board, also known as the Shanghai Star Market, has come to the fore as Chinese technology firms are increasingly viewing domestic exchanges as favorable environments to raise capital. The Star Market, inaugurated in June 2019, is meant to embody China’s vision for a modern international finance center with less stringent regulation, allowing easier access to capital for the country’s technology startups. It outperformed China’s A-share market in the first quarter of 2020, dominating the domestic IPO market.

The Star board differs from other Chinese stock exchanges in Shanghai or Shenzhen by allowing greater trading volatility and public listing of loss-making firms in sectors including artificial intelligence (AI), cloud computing, biotech, and green energy. The less restrictive regulatory process is meant to facilitate the fast-tracking of Chinese technology startups to an initial public offering (IPO) by lowering the entry barrier.

This simplified listing mechanism, referred to as a registration-based system, is set to be implemented countrywide after its viability is tested with the Star Market.

As the impact of COVID-19 continues to wreak havoc on many businesses, the Star Market’s accessibility could provide vital fundraising to a wider range of Chinese tech startups.

However, the Star Market has experienced difficult periods since its first trading day on July, 22, 2019. An initial flood of companies rushed to list on the exchange, followed by a significant dry spell. While bigger stocks on the exchange tend to perform well, there are many minnows and outsiders suffering from low trading volume. The reignition of activity on the exchange in the post-virus period could be the spark plug the Star Market needs to reach its long-term ambitions and list more high-quality technology companies.

Q1 2020 resilience

Despite the global financial meltdown brought on by the COVID-19 pandemic, the Star Market outperformed other Chinese exchanges, with its companies generating RMB 2.2 billion in net profit, a 14% increase compared to the same period in 2019.

Meanwhile, the China Securities Journal released data showing that all publicly listed companies in Shanghai and Shenzhen, including those on the Star Market, experienced a cumulative 19% decrease in net profit.

By the end of 2019, the Star Market comprised just 0.44% of the entire A-share market in terms of free-float volume, but that proportion increased to 0.85% as of March 31. It also listed the majority of new Chinese companies during the first quarter of 2020, hosting 24 of the 51 total IPOs on the mainland.

The best performing verticals on the Star Market during the first quarter were semiconductors and software growing by 14.50% and 17.91% respectively.

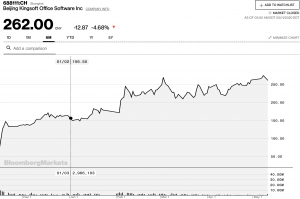

The software sector was boosted by an over 30% growth in Kingsoft Office’s (CH:688111) share price on the Star Market, following the company’s successful debut on the Nasdaq.

Of the chipmakers, Advanced Micro-Fabrication Equipment (AMEC) (CH:688012) had a standout first quarter with its stock price climbing more than 79% since the beginning of the year, from RMB 103.85 (USD 14.63) to RMB 186.26 (USD 26.24) as of May 11. Founded in 2004 in Shanghai, the company produces semiconductors and other adjacent high-tech materials.

AMEC saw an 18.77% increase in revenues, generating a net profit of RMB 189 million (USD 26.62 million), up 107.51% compared to last year, according to the company’s recently released 2019 financial results.

Star Market outlook

In years past, successful Chinese technology giants often pursued IPOs in New York, occasionally accompanied by a dual-listing in Hong Kong. Now, there is a growing trend of Chinese tech firms exploring the possibility of listing on the Star Market instead of the US, amid rising skepticism around Chinese companies from US investors following recent scandals including Luckin Coffee.

In fact, Semiconductor Manufacturing International Corporation (SMIC) (HK: 0981), one of China’s leading producers of semiconductors, delisted from the New York Stock Exchange and filed for an IPO on the Star Market on May 7, aiming to sell 1.69 billion shares which would net USD 3.2 billion at the company’s current market cap.

Although SMIC’s confidence may be buoyed by the performance of industry peers on the Star Market, consulting firm McKinsey predicts that semiconductor demand will decrease in 2020 compared to last year. However, within the overall drop in demand, there are various shifts across verticals.

For example, demand for chips in consumer electronics, wireless communication, and automotive sectors is likely to slow because of reduced consumption, as people are buying fewer smartphones and cars. Meanwhile, semiconductor demand in areas like wired communication and servers could be set to increase as enterprises’ IT demand expand and employees work from home.

Chinese unicorn Megvii, which specializes in artificial intelligence and computer vision, had previously applied for an IPO in Hong Kong but is now considering the Star Market as an attractive option, as this board is the only in the Chinese mainland that would accept Megvii’s IPO, considering that the Beijing-based firm is not profitable and according to official filings, it booked operating losses of RMB 115 million (USD 16.2 million) in the first half of 2019.

Read more: Will the latest wave of fraud involving US-listed Chinese firms influence global capital markets?

In late April, Shanghai’s government selected 1,000 technology startups in a shortlist for public offerings on the Star Market. The initiative seeks to use the Star board as a growth engine in the post-pandemic recovery, with companies involved in basic sciences receiving priority.

In addition to Chinese firms, some international companies are also considering this board to expand its presence in the Chinese market. AMC Research (NASDAQ: ACMR), a California-based company in the semiconductor industry, revealed on their earnings call last week that following the acquisition of land for their Shanghai headquarters, the company will submit an application for an IPO on the Shanghai Star Market, aiming for the middle of 2020.

Hailed as China’s answer to the Nasdaq, the Star Market’s resilience to the COVID-19 pandemic should position the exchange to garner more public offerings in 2020.