The COVID-19 pandemic has impacted businesses across many sectors, including the real estate industry. Retail and hospitality sectors have been hit hard during the crisis, while residential real estate agents express concerns for their livelihoods. An international proptech company specializing in new development properties, Juwai IQI, recently published a survey where they spoke to agents from more than 60 countries to learn about the impact of COVID-19 on the industry.

All countries share the problem of lost earnings, and agents are turning to foreign buyers in order to preserve their incomes. Prospective Chinese buyers are spending more time browsing listings online, and Juwai IQI has seen more inquiries about overseas properties in the past few months, signaling that these potential clients are still looking to purchase news homes.

Juwai IQI was formed in 2019 after the merger of Juwai, a Chinese online marketplace for overseas properties, and IQI Global, a real estate network serving Southeast Asia and the Middle East. According to Juwai IQI’s executive chairman Georg Chmiel, the company has recorded positive growth in all dimensions since the merger. This includes an increasing number of transactions, project sales, as well as new agents. “We have seen strong demand from new partners who want to work with us to provide cross-border loans, as well as a significant uptick in developers approaching us to represent their projects,” Chmiel told KrASIA. The portal currently has around seven million listings from more than 90 countries, with 3.5 million monthly unique users, he added.

KrASIA recently spoke to Chmiel to learn more about how the COVID-19 pandemic is affecting real estate business in Southeast Asia, and how proptech plays a crucial role in keeping Juwai IQI’s business running during hard times.

KrASIA (Kr): How has Southeast Asia’s real estate market fared as COVID-19 spreads across the region? Which country is seeing the biggest earnings losses?

Georg Chmiel (GC): There has certainly been an impact, which varies in every country. I would say, for the last month, the real estate market has slowed down across all Southeast Asian markets. We did a survey where we queried 800 agents around the world, including this region. The common feedback was that most people expect the impact will be truly felt in the next two or three months. However, when it comes to earnings expectations, most people estimate their earnings to drop during this crisis. In Singapore, 88% of agents expect to make less, while in Malaysia and the Philippines, 74% and 68% of agents, respectively, believe they would earn less in 2020. Singapore is a bit more pessimistic because they are very dependent on overseas buyers. What is quite noticeable is that agents in Southeast Asian nations are more positive than agents in other countries, especially those in the western world who have taken a far more pessimistic view on this situation.

Kr: How has foreign buyer activity in Southeast Asia changed in the past three months? What countries attract foreign buyers the most?

GC: Singapore is the country with the highest foreign buyer activity, but it is currently down by 47%. However, I wouldn’t draw too many conclusions from it, because China is coming back into business and Chinese buyers are the biggest purchaser group of overseas properties, including in Southeast Asia. Thailand, Vietnam, and Malaysia are also very popular among Chinese buyers and activities there have been changing a bit over a few weeks.

Even so, I believe that Southeast Asia will continue to be a very important market for overseas buyers as the region has many advantages, like affordable prices and political stability. There is also very good technology and infrastructure in place. Countries like Vietnam and Thailand have improved and simplified their regulations, which makes it easier for overseas buyers to invest. Malaysia also has very transparent regulations up to a certain threshold, so from that perspective, these countries are open for overseas investment. Southeast Asia’s economy is also growing very fast, which makes it very attractive.

Kr: After slowing down in January and February, China’s real estate started to bounce back in March. Why is real estate in China able to recover quickly? Will we see this trend also happening in Southeast Asia?

GC: The real estate sector [in China] went into decline very quickly, but it is now moving back up because people are back to work and confidence is coming back to the market. Since the economy is recovering, China is deploying more stimulus measures to give the economy a boost, which help buyers find their way back into the market. The speed of property transactions is really remarkable. Earlier this month, we had one big building worth more than USD 150 million sold in an hour. In fact, the property transaction volume in March was higher than it was before the crisis. This means, even during the crisis, there are still property transactions happening.

I think the same trend will happen in Southeast Asia, because this is not a financial crisis which was caused by a high degree of debt in the market. It is caused by people simply not being able to go to work as they normally are. People are waiting to be productive again, and even though we are currently isolated at home, lots of things happen online, which help accelerate the recovery.

Read this: This Vietnam-based startup will co-invest in your dream home

Kr: In your view, how has the crisis impacted proptech so far? What kind of technology is helping agents in this time of crisis?

GC: Some of the mandatory tech that we use includes online virtual tours and online advertising. Online expos have been really effective in replacing physical property shows. Meanwhile, on the transaction side, we are able to close deals online too. This is what makes us different, because we use technology not only for marketing purposes, but to solve the underlying problems and make transactions digitally.

Kr: Do you think governments will start to invest to create smart systems for the real estate industry?

GC: I think a situation like the COVID pandemic is a wake up call for governments; we need to be more open to new technology and trends. It is not only limited to digitizing offline activities in property, but also to create a smart government and smart living concept, where people and developers can get transparent information quickly. Transparent information is critical as it helps developers build properties that suit people’s needs. Fortunately, Southeast Asia is very welcoming and embraces new technology. For example, in Singapore, all essential administration tasks can be done online now, including key collection, and I believe it will continuously get better over time.

Kr: Will we see more capital invested to digitize the real estate business and to build up proptech companies this year?

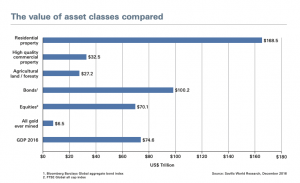

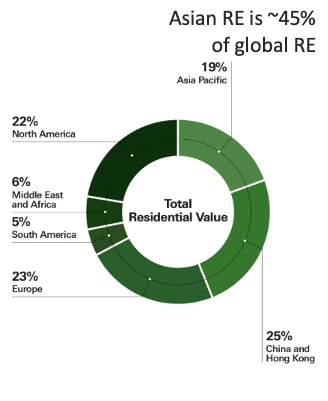

GC: I absolutely do believe there will be more investment in this segment because real estate is a massive industry. According to HSBC’s global real estate survey in 2019, the residential property market is worth about USD 200 trillion globally. Real estate is the preferred asset class globally. Particularly, in Asia, where roughly half of all real estate is found, there is a growing demand from Asian buyers for global real estate. If there is at least 10% transactions every year [in the global residential real estate sector], we’ll get USD 20 trillion, which is roughly the size of the US economy. Anything that can improve this industry and boost transaction speed will certainly get investment. Online property services have proven effective during the crisis. For instance, online expos are not expensive, as we’d probably pay around USD 4,000 to participate, which is a fraction of what we would spend on an offline show. And we’d get the same advantage. As all the discussions can be done online, everyone is more open and welcoming to virtual showings and expos.

Kr: According to Juwai’s recent survey, Chinese buyers’ inquiries about overseas properties have been increasing. Why is that? And why are these buyers seeking properties abroad?

GC: When travel restrictions are in place, people have more time to do research, search for a property, and make inquiries. Now, they are allowed to go back to work and able to earn full incomes again, which means companies are back in operation, and the real estate market will flourish again. People are looking for properties overseas for different reasons, like education, migration, retirement, or purely for investment. We have noticed that there is a new trend now, where people look for properties in a place that offers a good lifestyle and a high quality healthcare system. This means COVID-19 has certainly made people more aware of the importance of reliable healthcare. I’ve seen more inquiries for Germany and Singapore lately. Foreign buyers make up around 10% of the overall residential purchases in every country, with Chinese buyers being the largest investor.

Kr: What is the price point for most transactions on Juwai or similar platforms?

GC: I would say that the most common price point for the Southeast Asia residential market is somewhere in the area of USD 250,000–500,000. Although it seems high in domestic terms, it is quite affordable from an investment point of view. If you think of markets like New York or London, there’s not actually much you can get with that kind of money, but if you invest in Indonesia or Vietnam, you’ll get something really nice. That is why Southeast Asia is a favorite destination for foreign property buyers.

The interview has been edited for length and clarity.