When analyzing businesses, going against intuition often proves effective.

Whenever mainstream market players look at Pinduoduo, they often first attribute its success to “luck.” Consumer behavior tends to become more conservative each time economic rebounds fall short of expectations, benefiting Pinduoduo, which focuses on “consumption downgrade.”

At first glance, this perspective seems reasonable and logically clear, and can almost be considered the mainstream market opinion. However, delving into the business details reveals some peculiarities. Industry peers have already set their sights on the market for consumption downgrading, with JD.com notably reinstating its “billion-dollar subsidy” initiative. Since “consumption upgrading” has become a trend and industry giants are strategically positioning themselves in this space, why is it that only Pinduoduo has managed to create an independent market position?

This necessitates a deeper understanding of the industry and the company by considering operational conditions, rather than using broad strokes for description.

The core points of this article are:

- Pinduoduo’s current performance has a certain “luck” factor, but it’s also related to the expansion of new businesses. Previously, it was community group buying, and now it’s going international. The latter, while not yet profitable, has created new momentum for revenue generation.

- Unlike conventional “cash burn” strategies for international expansion, Pinduoduo is cautious. Its additional expenses for going international are partially offset by reducing its investment in domestic operations.

- Currently, Temu, Pinduoduo’s cross-border e-commerce platform, needs to consider how to improve its efficiency and reduce costs for its domestic operations after achieving scale.

Luck and business operations are intertwined

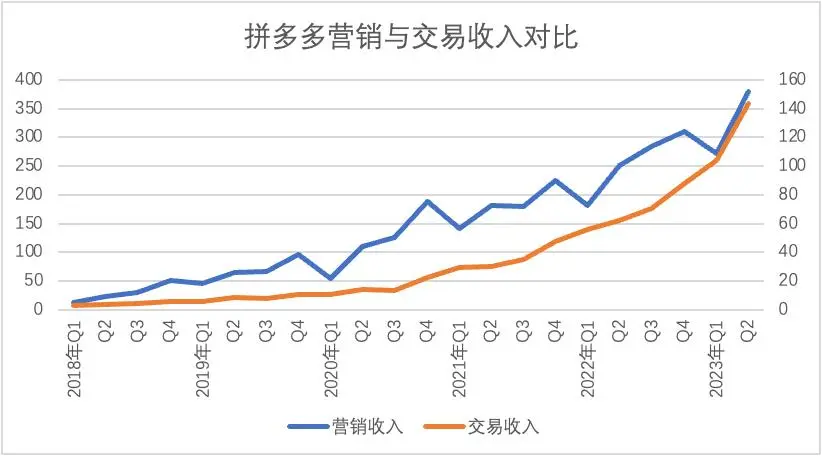

In Q2 2023, Pinduoduo’s total revenue reached RMB 52.28 billion (USD 7.14 billion), a year-on-year increase of 66%. Marketing revenue increased by 50% year-on-year, reaching RMB 37.93 billion (USD 5.18 billion), and transaction revenue increased by 131% year-on-year, reaching RMB 14.35 billion (USD 1.96 billion).

Pinduoduo’s marketing revenue is primarily generated from its merchants’ advertising investments, which is the main business model of platform-based e-commerce. The composition of its transaction revenue is more complex, mainly comprising:

- Third-party payment costs, accounting for 0.6% of its transaction volume. Pinduoduo still maintains a commission-free policy for merchants, who only need to cover payment transaction fees.

- Community group buying revenue, gaining the price difference after deducting procurement costs mainly reflected in transaction revenue.

- Cross-border e-commerce Temu adopts a “fully managed” model, gaining the price difference after deducting purchase and fulfillment costs also recorded in transaction revenue.

In the early stages of Pinduoduo’s development, under the condition of maintaining a stable overall monetization rate, both transaction and marketing revenues maintained synchronized growth. Subsequently, with the introduction of more revenue sources, the growth of transaction revenue started to significantly outpace the latter.

Since 2021, with the launch and growth of its community group buying business (Duoduo Maicai), Pinduoduo’s transaction revenue immediately entered a phase of rapid growth, while the growth of marketing revenue began to slow down under the special macroeconomic background (especially in 2021). After 2022, the slopes of both lines synchronized an upward trajectory.

Should this be entirely attributed to “consumption downgrading?”

Under the special macroeconomic background, industrial enterprises entered a passive destocking cycle. Pinduoduo, as a platform that still has user growth, naturally prefers to lower prices and increase its marketing investment to stabilize cash flow quickly and reduce its inventory. If consumption downgrading describes the spending preferences of consumers, active destocking by merchants represents a significant change on the supply side. For Pinduoduo (and also livestreaming e-commerce in general), this is akin to a windfall. Business operations somewhat depend on timing and luck.

In Q1 2023, Pinduoduo launched its cross-border e-commerce platform Temu. Unlike other companies that chose Southeast Asia and other regions as their primary destination for going international, Temu targeted the North American market right from the start. Moreover, it adopted a “fully managed” operating strategy, which means merchants only need to supply goods and are not responsible for logistics, but hold less control over pricing. On one hand, this lowered the cost of going international for small merchants. On the other hand, after successive victories in the North American market (with the app downloads ranking high locally), it contributed significantly to the growth of Pinduoduo’s transaction revenue after Q2 2023, which is the main reason for transaction revenue in Q2 2023 growing nearly twice as fast as marketing revenue.

Considering the above points, while luck does play a role in Pinduoduo’s revenue success, it’s also closely related to the extension of its business (cross-border e-commerce) and external macroeconomic conditions. Luck will eventually fade away, and continuous innovation in business models is what ensures sustainability.

Careful internationalization to seize the time window

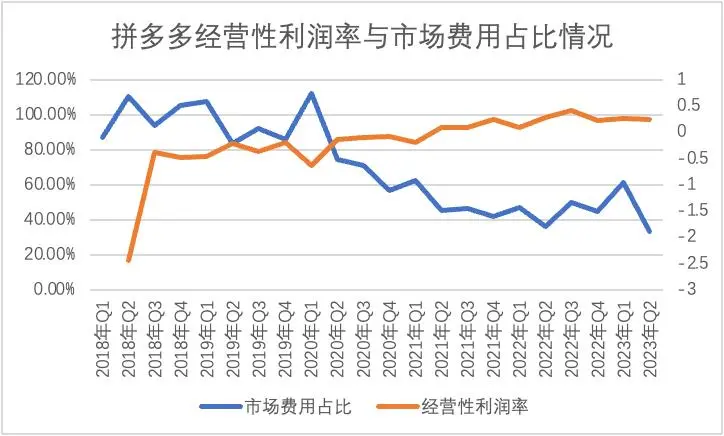

Market expenses were once a point of controversy for Pinduoduo. In the chart above, we can see that at the beginning of the company’s founding, market expenses consumed the majority of Pinduoduo’s gross profit (mainly for user acquisition), leading to huge annual losses. After 2021, the ratio of market expenses to revenue began to fall below 50%, and in Q2 2023, it dropped to around 30%. The result is evident: the contraction of market expenses directly improved the profit condition, and the operating profit margin began to improve.

Both Pinduoduo’s community group buying and cross-border e-commerce businesses needed to raise awareness among consumers by spending significantly on marketing at the beginning of their development. For example, Temu used various methods such as content-based promotion on public platforms, advertising, and affiliate marketing to attract customers. As its new businesses subsequently grew, Pinduoduo had more room to cut its costs by reducing its marketing expenses.

As a platform e-commerce company, its business model can be summarized as “traffic arbitrage,” meaning the platform leverages both in-house and externally acquired traffic (acquisition and advertising buys were also beneficial in stimulating user activity) to distribute to merchants using an advertising-based model, earning the difference. This necessitates the platform to maintain its ability to keep user activity high while retaining a certain level of advertising investment to stabilize its total traffic within a reasonable range.

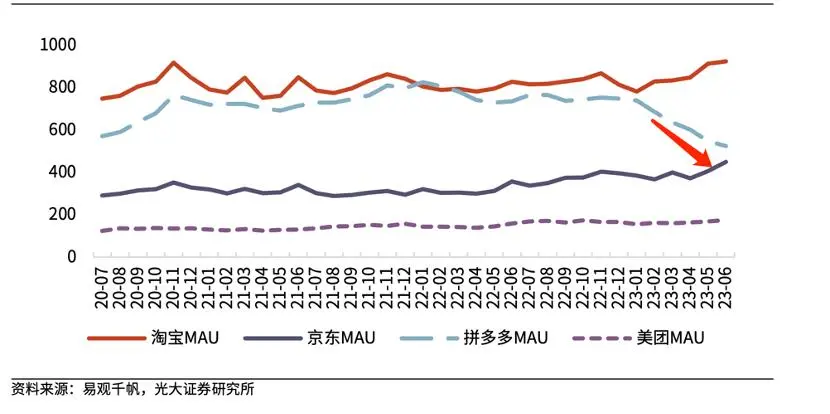

For the first half of 2023, AppGrowing reviewed the promotion ranking of apps and reported that Pinduoduo dropped from second place in the same period last year to seventh place. This raises a question: while similar enterprises, such as Taobao, are increasing their advertising investment, can Pinduoduo maintain its user base steadily?

According to a report from Everbright Securities, since 2023, Pinduoduo has experienced a significant decline in monthly active users (MAU), while Taobao has had a clear boost. The industry has now become a zero-sum game. To balance its finances, Pinduoduo has been investing heavily in its international business while reducing the expenses for its original business. This has lowered its efficiency of customer acquisition. Coupled with rising competition, its active user numbers have therefore been affected.

While Pinduoduo’s new business is still in a “cash burn” phase (pursuing extreme cost-effectiveness), it has little choice but to take this risky move in order to maintain healthy financial margins. Nonetheless, the decline in MAU is unprecedented for Pinduoduo.

Under this pressure, however, how did Pinduoduo achieve a 50% increase in marketing revenue?

According to data compiled by Everbright Securities, electronics and homeware have become the main product categories for Pinduoduo, and the reason is quite simple. After the real estate industry took a heavy hit, home appliance and furniture companies started considering Pinduoduo as a crucial sales channel. This also indirectly reflects JD.com’s anxiety in recent times: such changes have caused Pinduoduo to penetrate deeper into its territory. Users have started shifting from purchasing low-cost goods to high value-added products. This has a clear impact on JD.com, which primarily targets high-net-worth users. This is also a major reason why JD.com initiated a price war this year.

By combining the effects of its “billion-dollar subsidy” and changes in the macro environment, Pinduoduo’s average revenue per user (ARPU) has risen rapidly. To some extent, this offsets the impact of its MAU decline on total advertising revenue. Moreover, Pinduoduo has still maintained a pace faster than its peers.

Against the backdrop of increasingly cautious operations, Pinduoduo’s natural growth space for its domestic business affords it time and budget for international expansion. Consequently, despite maintaining a high growth rate, the impact of international business on its profit and loss statement has been very limited so far.

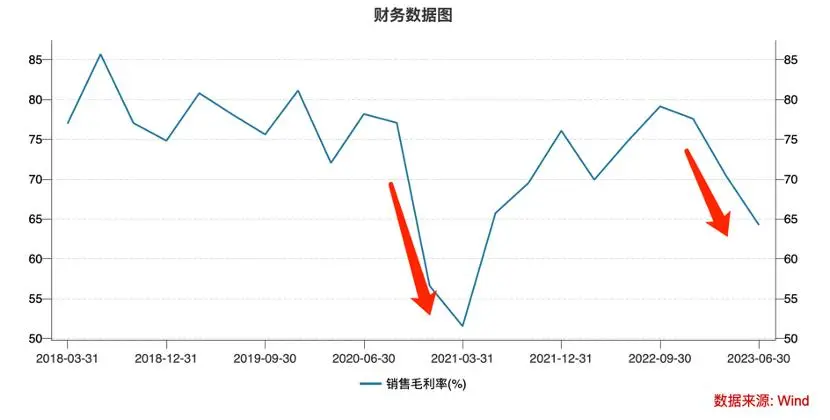

A high gross profit margin has always been a major characteristic of platform e-commerce (with costs primarily being labor and server costs). In the chart above, we can see that Pinduoduo maintained a very high gross profit margin for most of the time, except for a noticeable decline around 2021 and this year.

The first decline is easy to interpret. At that time, to compensate for the deficiency of quality stock keeping units (SKUs), Pinduoduo introduced its self-operated business. Since this was only meant to enrich the shopping experience of users and had no profit motive, it largely diluted the overall gross profit margin of the company.

The current downward pressure on the gross profit margin is mainly due to Temu. In the earlier discussion, we briefly introduced the main operating logic of Temu’s fully managed model, where the platform purchases goods from merchants, takes care of order fulfillment, pricing, marketing, and other work, including logistics, warehousing, and other aspects. What’s more important is that, to improve customer acquisition efficiency, the platform strengthened its cost-effectiveness. When high costs meet low price differences, the gross profit margin for the international business cannot be too high. As the business grows, it ultimately dilutes the overall gross profit margin level.

We have already discussed how the special cycle of the domestic business provides a valuable time window for the international business. The contraction of market expenses and the improvement in marketing revenue also counteracted the unfavorable factors of the gross profit margin decline. As of now, Pinduoduo’s operating profit margin seems relatively stable.

However, with the continued expansion of Temu’s scale, Pinduoduo is at a crossroads:

- It can continue to maintain its investments and pursue high cost-effectiveness, which will dilute its gross profit margin. When cost-effectiveness exceeds the limit that its market expenses can compress, Pinduoduo’s overall operating profit margin will be impacted.

- As Temu’s user base stabilizes and is able to invest more significantly in overseas operations, its overall losses will also decrease. From a financial perspective, Temu will become more proactive.

According to Huatai Securities, Temu may formulate gross profit-focused strategies by controlling its product and logistics costs according to market demand and category-based product competition. For example, it could reduce discounts or raise prices in relatively mature markets like the US to enhance its profitability.

Intuitively speaking, the biggest takeaway from this analysis is the “prudent” operation of Pinduoduo. Going international is a major “cash burn” endeavor, yet it has still managed to keep its finances stable while improving its operational efficiency. This is very rare among Chinese companies.

On the contrary, some Chinese management teams, when venturing into new businesses, tend to become overzealous and end up with nothing after burning too much money.

This is perhaps the most significant inspiration Pinduoduo can give to other Chinese enterprises.

This article was adapted based on a feature originally written by Tong Zhibin and published on Rethinking Finance (WeChat ID: rethinking_finance). KrASIA is authorized to translate, adapt, and publish its contents.