Filling out personal data forms manually for various administrative needs can be frustrating and time-consuming, at least that is what Marshall Pribadi, co-founder and CEO of PrivyID, has experienced.

“Even in today’s digital age, we still need to fill in long forms to prove our personal data, including national ID numbers, tax numbers, and so forth. We also have to sign a lot of documents to prove their authentication. For me, this is quite annoying,” Pribadi told KrASIA in an interview.

“Back then, I always hoped that there was a customer-centric digital identity system, freeing me from having to repeat the same form-filling process while at the same time guaranteeing that the personal data I shared was legit and fully under my consent. Therefore, I created such a system,” he added.

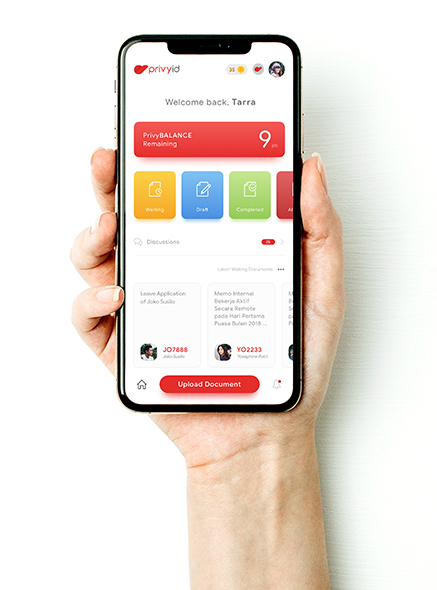

Founded in 2016 by Pribadi and his partner Guritno Adi Saputro, PrivyID has developed electronic identity verification technology that works on multiple platforms. Its main products are digital identities and electronic signatures. These use key infrastructure technology and asymmetric cryptography methods to verify the document’s integrity and signee’s identity.

PrivyID operates using an information security management system that has been officially acknowledged by the Indonesian government. It has obtained a certificate of authority which makes its digital signatures legally binding. Every signature made by PrivyID has a”padlock icon” that differentiates it from a regular signature.

Indonesian financial authority OJK now requires fintech lenders to adopt digital signatures, making them even more crucial today.

“The electronic signature doesn’t mean creating your signature on digital devices only, it must fulfill the handwritten signature function that cannot be falsified. It must represent the official identity of the signee, and it has to ensure that any changes made to documents after the signing process can be detected,” Pribadi said.

The company provides its services to corporate clients and individual users who are mostly freelancers or independent consultants.

All PrivyID accounts have undergone the government’s ID verification procedure and all digital signing processes require multi-factor authentication. Therefore, implementing PrivyId’s technology on a client’s platform helps them safeguard customer identity and their electronic transactions.

“Our clients use our services to verify the validity of their users as well as to sign any kind of electronic documents; from loan agreements in fintech startups to corporate internal memos,” he continued.

To date, PrivyID’s services have been utilized by more than 4.5 million individuals and 205 companies. Among PrivyId’s notable clients are state-owned banks Bank Mandiri and Bank BRI, private bank CIMB Niaga and multi finance company BCA Finance, as well as e-commerce platform Akulaku and fintech lender KoinWorks.

“Our digital signature enables up to 90% reduction in customer acquisition costs, capable of accelerating the registration process by 28 times. This is all within an end-to-end digital service that is 100% paperless. In short, we help businesses become more efficient and environmentally sustainable. Meanwhile, for individual users, our products allow them to conveniently authorize any digital documents and apply for various digital services wherever they are, whenever they want,” Pribadi continued.

The company has been acknowledged by Indonesia’s IT Ministry as both a certificate authority and certificate electronic signature provider. It is also listed as the only financial services innovation provider under the electronic know your customer (e-KYC) cluster at the OJK.

Moreover, PrivyID is registered at Bank Indonesia as an Assisting Provider for financial technology and it is an official partner for Indonesia’s Directorate General Population and Civil Registration under the Ministry of Homeland Affairs.

“There are several platforms that offer similar services today, but we can assure you that we’re the only one that fully operates in compliance with all local regulations,” Pribadi added.

The company recently raised Series A2 funding in September 2019 from Telkomsel Mitra Inovasi (TMI), the corporate venture capital arm of Indonesia’s largest mobile carrier Telkomsel. The startup did not disclose the details of its funding record.

According to Pribadi, the company will utilize its fresh investment to expand its team and develop products. The firm is currently looking for a chief financial officer and chief marketing officer to boost the company’s growth, he said.

Going forward, PrivyID wants to build partnerships with more banks, as well as IT and e-commerce companies. It aims to have 10 million individual users and 500 clients by the end of 2020.

The company wants to expand its business into international markets next year, including to Malaysia, Singapore, Thailand, and Australia. “I think customers in developed countries are generally more mature. They have a better understanding of what a digital signature is and the benefits that technology brings. They also have a higher rate of smartphone penetration, and their governments have already developed better personal data regulations and digital identity frameworks, which gives us opportunities to bring our services there,” Pribadi said.

This article is part of KrASIA’s “Startup Stories” series, where the writers of KrASIA speak with founders of tech companies in South and Southeast Asia.