Periscope is KrASIA’s new weekly content series that offers you a probe into China’s industries. We delve into a different space each Thursday, so sign up here to get each volume delivered to your inbox.

The growing demand for electric vehicles in recent years has undeniably caught the attention of investors. As leading companies such as NIO, Tesla, BYD, Song Guang Mini EV and more continue to gain public attention, one’s first natural inclination is to hope to get a seat at the table and invest through bullish stocks.

There are, however, other angles from which investors can perceive and join in the rise of the new energy market. The uptick in demand for industrial metals, sparked by China’s unexpected economic recovery and influx of demand for electric vehicles from both China and Europe, presents itself as another opportunity for investors.

Commodities’ Strong Comeback 📈

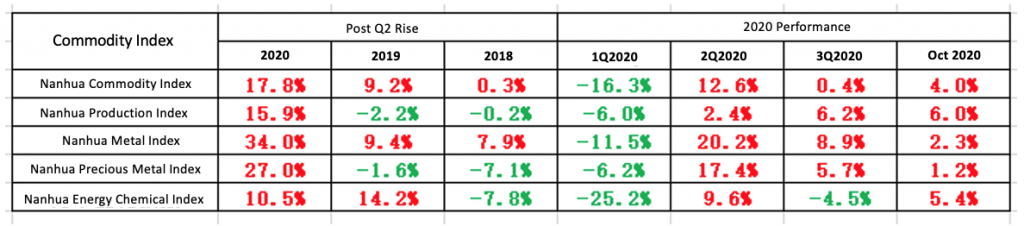

Commodities welcomed a strong rebound as China’s domestic market gradually stabilised in 2Q2020. According to the Nanhua Commodity Index, the market experienced a 17.8% growth from the period of 1 April to 22 October — a significant spike vis-a-vis the same period in the preceding years. The quarter-on-quarter growth was 9.2% in 2019 and 0.3% in 2018.

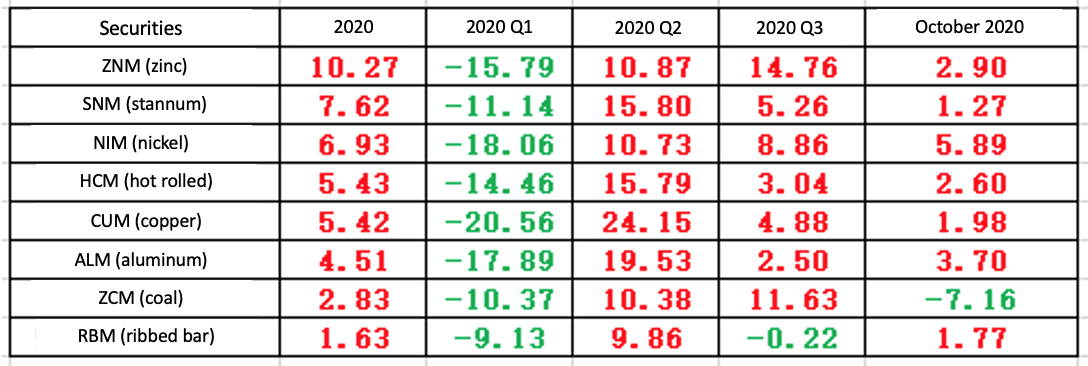

According to the research compiled by our research department, industrial metals and precious metals lead in performance:

Understanding the growth drivers behind commodities’ boosted performance 📊

1. The sooner-than-expected recovery of China’s domestic economy 🏗️ 🏭

The Covid-19 pandemic brought about a now well-known reality: global economic recession caused by necessary restrictions put in place across every country. As China’s domestic policy adapted quickly to the situation, implementing strict but effective measures, its economic recovery has taken lead over other countries This eventually gave rise to the sharp rebound in industrial metal prices.

Moreover, as the pandemic control measures relaxed, the resumption of work and production in the secondary industry was much faster that that of the tertiary industry. Additionally, compared with the rate of consumption, investment is more responsive to the lowered interest rate and fiscal expansion – real estate responds positively to the lowered interest rate, and the dominant source of capital for infrastructure is fiscal bond issuance.

The recovery of real estate investment, infrastructure construction and industrial production became the combined driving force behind China’s economic recovery. As the rate of recovery for real estate, infrastructure and industrial production is highly dependent on the availability of industrial metals, its demand rose. Naturally, the prices of industrial metals rose as well.

2. The increase in global liquidity 🏦

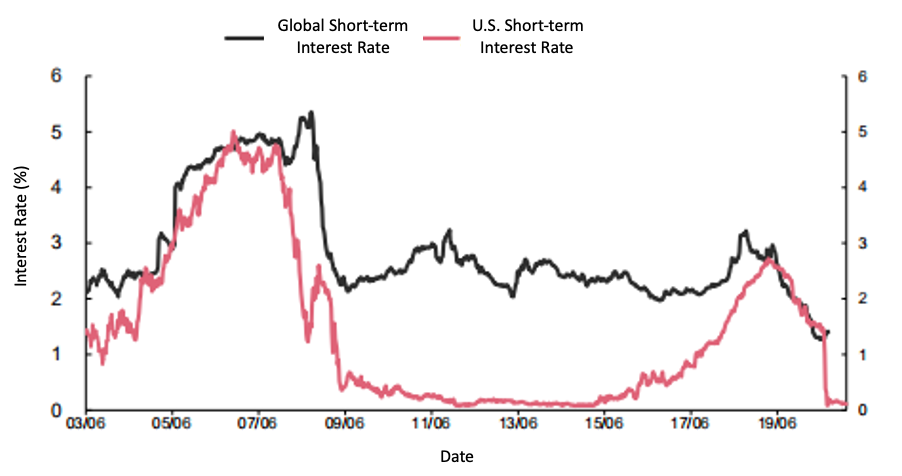

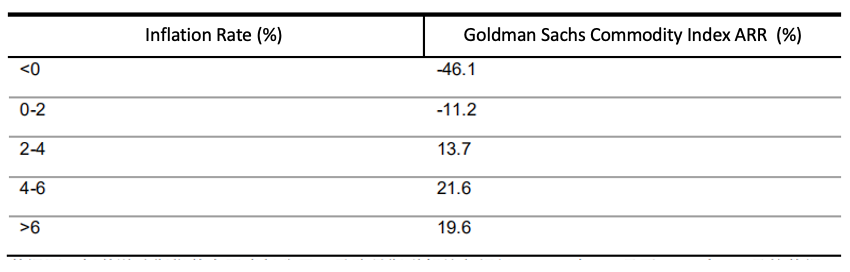

In addition to domestic drivers, surge in global liquidity too played an important role in supporting the prices of industrial metals. Commodities have both physical and financial characteristics, making it a little more resistant to inflation when compared with other investment instruments.

Since the earlier half of the year, the United States Federal Reserve have introduced several expansionary monetary policies, to flood markets with liquidity, in an attempt to stimulate the economy. In the short-term, increased liquidity provides better recovery support for the population in the bottom tiers of the socioeconomic pyramid. In the long-term however, it can trigger a higher rate of inflation. The market’s anticipation of future inflation then, to a certain extent, triggers the demand for inflation-resistant commodities, driving up its prices.

Future Outlook 🌐

The investment outlook continues to remain positive in the midst of 4Q2020. There are two driving factors that have led to this scenario:

1. Economic recovery in China and the US 🇨🇳 🇺🇲

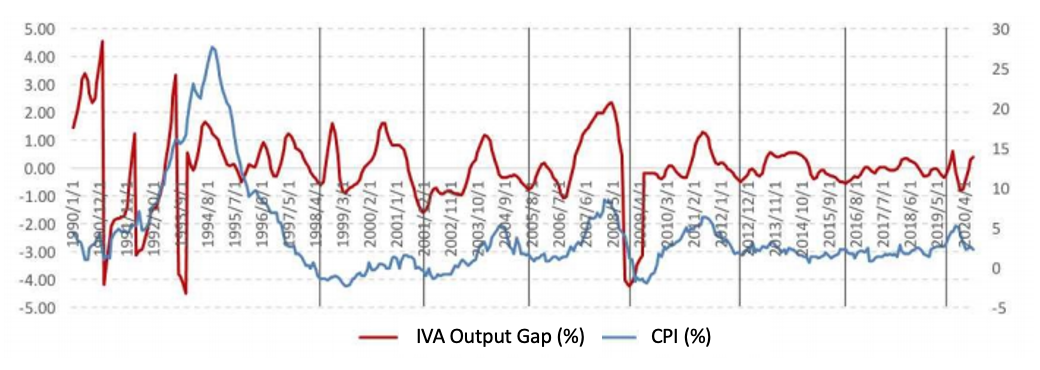

As mentioned earlier, China’s economic recovery pulled ahead of other countries, and in fact has seen an accelerated rate of recovery since August. In reference to the Caixin Securities’ Output Gap index — which measures the difference between the actual and potential output to determine the effectiveness of resource utilisation — performance for the current economic cycle (October 2019 – October 2020) fell short of expectations, due to the brief recession in 1Q2020. Nonetheless, China has been experiencing an accelerated rate of recovery since August. The economic powerhouse has bounced back from the slowdown, brought upon by the global pandemic, faster than any country worldwide.

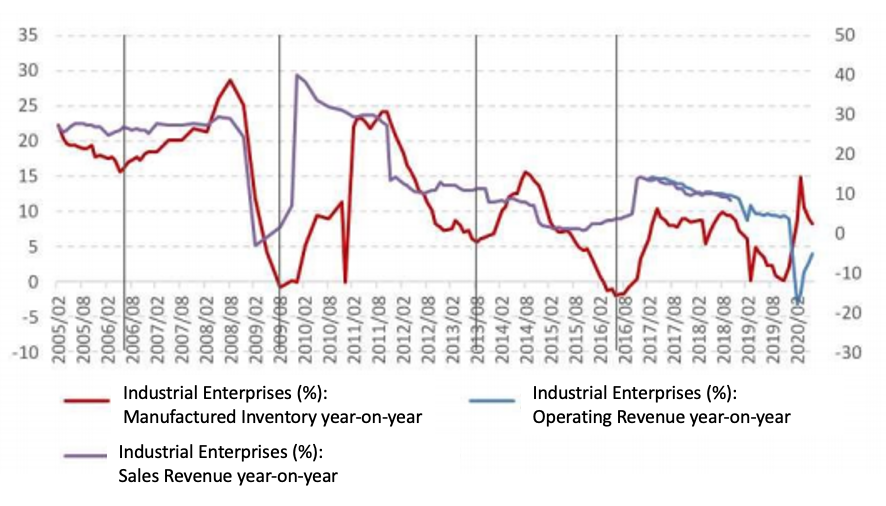

The national reserves, entered the passive destocking stage in May, before reaching an inflection point in August, indicating that the domestic inventory cycle may be in the transitory stage of “passive destocking – active replenishment”. On the whole, China’s reserves is synchronous with the output gap index, indicating that China’s economy is expected to transition from recovery stage to expansion stage after the fourth quarter.

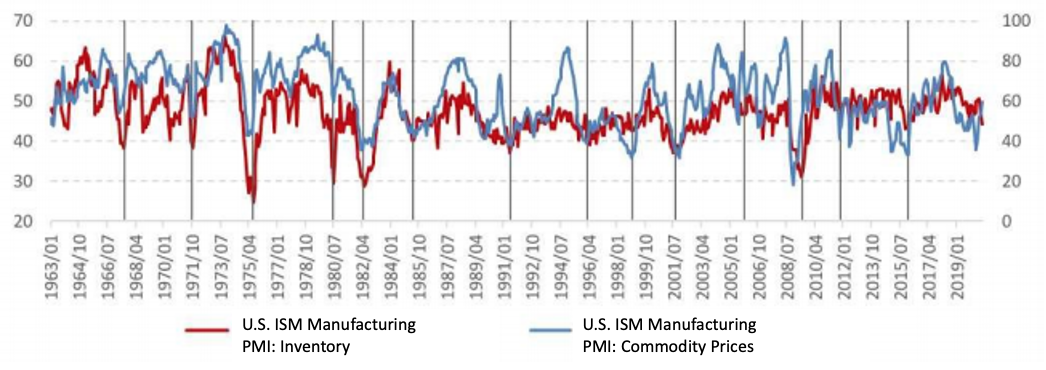

Comparatively, the US has yet to demonstrate the same fervent recovery as China. As shown in the figure below, in February 2020, the U.S. economy fell into recession, ending the steady growth the economy had been experiencing since the last financial crisis. Demand levels started to normalise after May and the US inventory cycle consequently entered the passive destocking stage of price increase and volume decrease.

However, since June, the second wave of the pandemic extended the duration of passive destocking. It is expected that with the election in November, the US would introduce more stimulus policies, thus accelerating the recovery of demand, and inventory would bounce back, starting the tail end of 2020, after hitting record lows.

2. The soaring demand for electric vehicles 🚗 🔌

According to Goldman Sachs, an extraordinary advancement in the implementation of favourable new energy policies in China and Europe proliferated industrial metal prices.

This year also had the European Commission pass a key regulation; a landmark decision surrounding the most stringent law governing carbon emission. Concurrently 24 out of the 27 EU countries have introduced policies with new energy vehicle incentives. Consequently, Europe’s new energy vehicle market grew rapidly, surpassing China in the first half of the year to become the world’s largest new energy vehicle market.

According provided by the European Automobile Manufacturing Association (AECA), the September 2020 total sales volume of electric vehicles in Germany, Britain, France, Norway, Sweden, Portugal, Italy, Switzerland and Spain will total about 133,000; up 195% year-on-year. However, the overall market penetration rate of electric vehicles is still at a low level of 12%.

In China, as consumption levels recovered in July and August, the automobile industry rebounded rapidly. Ultimately setting a new D2C sales record in September — 138,000 electric vehicles were sold that month, presenting a year-on-year increase of 67.7%. The wholesale sector too saw a big spike, with sales volume exceeding 125,000; a year-on-year increase of 99.6%. Moreover, the upward turn persists despite the reduction of government subsidies, indicating strength in consumers’ demand for electric vehicles.

With favourable policies and the evolving consumer preferences, it is expected that the new energy automobile industry will continue to flourish in both China and Europe. Thus setting a precedent for the exponential growth of copper and other industrial metals needed in new energy manufacturing.

From a geo-political perspective, depending on the outcome of the US elections in November, the US may strengthen its “green infrastructure” policies, which is then expected to further boost the rise of industrial metal prices.

Note-worthy New Energy Startups💡

H2-Bang Technology (氢邦科技): Founded in 2019, funded by angel investment 🔋

Xin Bang Technology is a new energy company focused on developing and manufacturing its proprietary Solid Oxide Fuel Cell (SOFC) batteries. The SOFC battery is considered as a new subversive power generation technology after hydropower, thermal power and atomic power generation. SOFC is an exceptionally versatile energy source due to its high power generation efficiency, long lifespan, low cost and high fuel adaptability. As such, it can be used for distributed power generation and cogeneration, in extended range vehicles, unmanned aerial vehicles, ships and other fields.

KEnergy (克能新能源): Founded in 2020, Series A 🛵

KEnergy is a light power lithium battery manufacturer; its core product is a novel lithium manganate soft pack battery. This battery Balances cost efficiencies and performance and boasts a long lifespan and is safe for use. It has passed the nail generation test — a global industry standard — both both at home and abroad, and is positioned for the low-speed vehicle market.

ENWISE (倍奇能源) : Founded in 2019, funded by angel investment ♻️

ENWISE provides energy solutions that efficiently repurposes organic waste into new energy sources. Through the combination of dry anaerobic fermentation technology, and remote management and control system, the company provides a holistic suite of solutions: implementation of equipment, system operations and after-sales services. ENWISE’s current equipment unit has the capacity to process up to 100 tons of organic waste each day. Each ton of organic waste produces 40kg of solid fertiliser and the biogas yielded in the process can be utilised for electricity generation, heating and more.