Subscribe to our newsletter to read this first thing on Friday morning. This is the preview of what you will receive in your inbox.

One of the trends that have caught the eye of VCs in India is direct-to-consumers (D2C) beauty and personal care brands gaining popularity among India’s Gen Z and millennials, who make up 51% of India’s 1.3 billion population.

With COVID-19 making it difficult to move around for almost one and half years, companies like Nykaa, Sugar, Mamaearth, Wow Skin Science, MyGlamm, Skinkraft, and Plum connected with a larger consumers base through innovative digital content marketing, charming them with their personalized and customized offerings.

Of all these D2C platforms, Nykaa is the largest and most established player in the online beauty and personal care space. Founded in 2012 by Falguni Nayar, a former investment banker who bootstrapped her own startup at the age of 50, Nykaa entered the unicorn club last year and became profitable in the financial year ended in March 2021—a rare feat for a consumer internet startup in India.

Nykaa opened up its IPO on October 28. In this week’s big read, we looked at how it turned out, what it signifies, the company’s journey so far, and its future plans.

The Big Read

Nykaa raises USD 715 million in India’s first D2C startup IPO

Lifestyle omnichannel retail startup Nykaa—the first Indian women-led unicorn to debut on public markets—opened its USD 715 million initial public offering (IPO) this week, which made it the first D2C platform in the country to go public.

On day one of the subscription, it saw decent demand from retail individual investors with its retail portion getting fully booked within an hour of opening. Overall, the public issuance was subscribed 1.55 times on the first day.

Nykaa IPO comprises fresh issuance of equity shares worth INR 6.3 billion and an offer for sale (OFS) of INR 47.2 billion by the existing shareholders. The company has fixed the price band of INR 1,085–1,125 apiece for the IPO, which will conclude on November 1. With the listing, the Mumbai-based company—which so far has raised USD 100 million in equity—is eyeing a valuation of over USD 7.1 billion.

Many industry experts feel Nykaa has been overly valued, but attribute it to its market-dominant position—it currently has over 35% share in the country’s USD 125 million online BPC market, which constitutes about 8% of India’s overall USD 15 billion BPC industry.

Nykaa will utilize the IPO proceeds for setting up new retail stores and warehouses, debt repayment, and marketing. Aside from that, the company also plans to expand internationally.

The Weekly Buzz

1. Reliance and Google to launch co-developed low-cost smartphone in India during Diwali. Jointly developed by the two giants and customized for Indian users, JioPhone Next will be powered by Pragati OS—a mobile operating system based on Google-owned Android OS. These devices will be assembled at facilities operated by Neolync, a two-year-old electronics manufacturing startup, in which Reliance invested INR 200 million (USD 2.6 million) in August 2021.

2. India’s edtech market is set to grow 5x to reach USD 3.5 billion by 2022 as per a new report shared exclusively with us by BLinC Invest. The country boasts over 9000 education technology startups, of which about 750 firms have raised a total of USD 8.5 billion to date. At about USD 3.8 billion, total edtech funding between January and August 2021 had already surpassed capital inflow in the sector in the entire 2020, the report noted.

3. Tata Group to invest USD 2 billion in soon-to-be-launched super app. Dubbed TataNeu, the one-stop-shop for its consumer services, including healthcare and e-pharmacy, food and grocery, fashion and jewelry, hotel bookings, consumer electronics, payments, and financial services is likely to be rolled out early next year. Tata may later raise an additional USD 5 billion by selling minority stakes in its digital arm, Tata Digital—which is spearheading the super app initiative.

4. Indian cloud kitchen firm Rebel Foods to ramp up presence in Southeast Asia through its partnership with food and grocery delivery platform Foodpanda. The decade-old company—just turned into a unicorn earlier this month—will bring its in-house brands to countries and regions like Singapore, Hong Kong, Thailand, Malaysia, Pakistan, Taiwan, the Philippines, and Bangladesh, and jointly create brands with Foodpanda for several of these Asian markets.

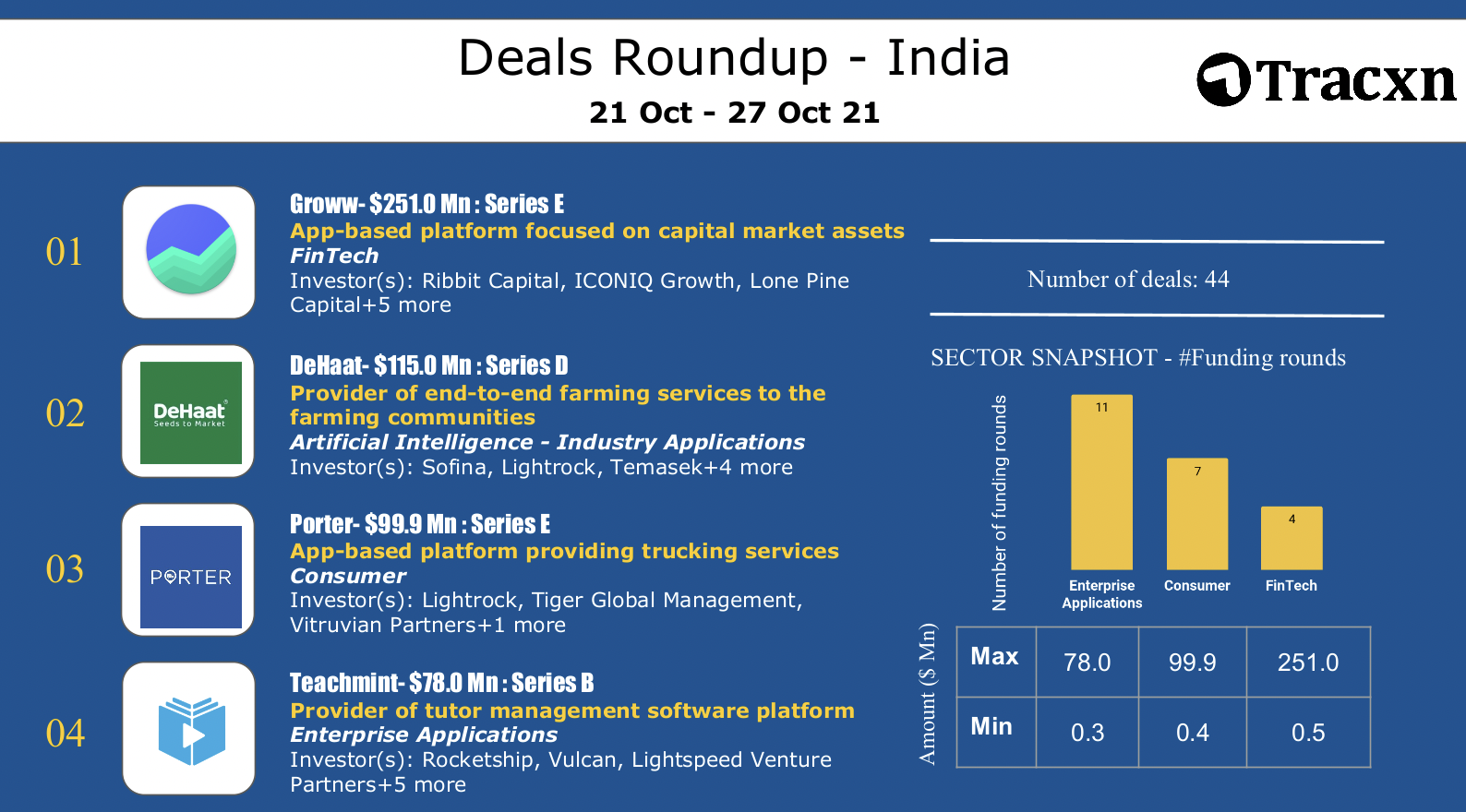

Top Deals This Week

The Spoiler

Tune in next week to take a closer look at India’s niche NFT gaming space.