Didi Chuxing, China’s largest ride-hailing company, announced it has acquired 99, the Brazilian taxi and car-hailing company, potentially adding more firepower to its competition with Uber in one of the world’s largest market for car booking.

This move comes as part of the company’s plan to expand its presence in the global market. As Cheng Wei, founder and chief executive of Didi, puts it,

“Globalisation is a top strategic priority for Didi.”

Didi’s Globalization:

The Chinese market is believed to be very much stabilized. Cheng told media outlet Caijing that reaching out to 7 billion global users would be the solution to the company’s potential bottleneck in China.

In the light of that, Didi has invested globally in ride-hailing regional leaders, including Singapore-based Grab, U.S.-headquartered Lyft, India’s Ola, Taxify in central and eastern Europe and Careem in the Middle East. These companies are also Uber’s regional rivals.

The latest acquisition of 99 is Didi’s first overseas acquisition to date. Actually, the relationship between Didi and 99 has been long in the offing. A year ago, Didi led the $100 million investment in 99. The two also sealed a partnership to help 99 expand in the region.

Latin America: a new battleground

Brazil, with over 200 million inhabitants, is Uber’s second largest market outside the US. The ride-hailing company has 17 million users and 500,000 drivers in the country, while its local rival 99 has 14 million users and 300,000 drivers.

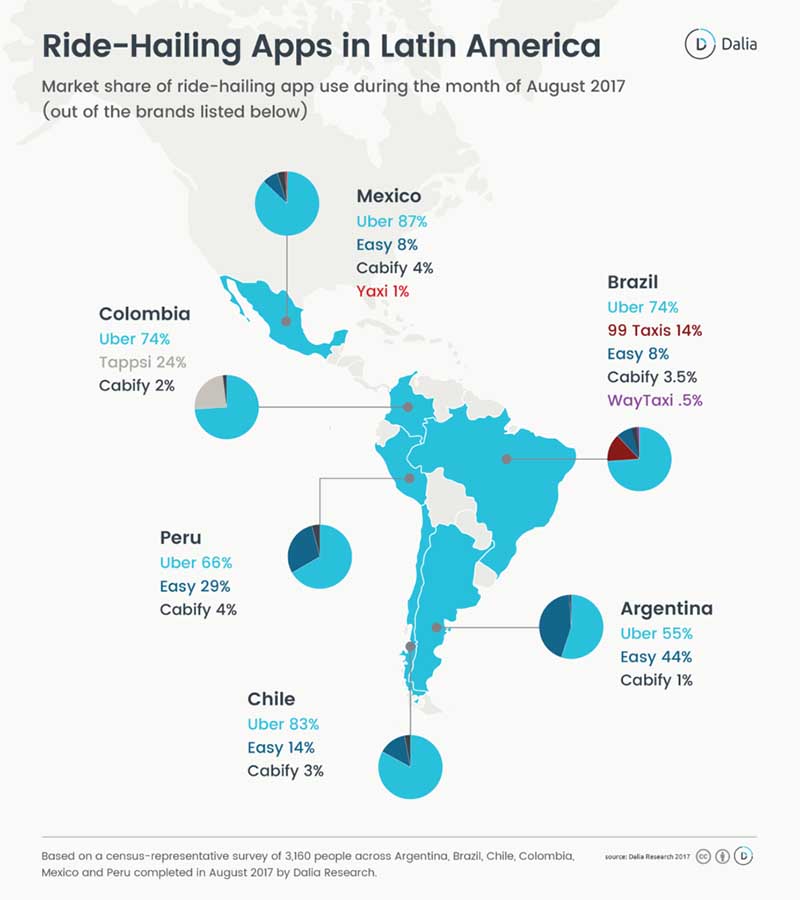

For the embattled players in the ride-hailing industry, Latin America as a whole is the fastest-growing region, while Uber has established a stronghold there.

The US ride-hailing company’s market share dwarfs local rivals by a large percent. As the scale is vital to attracting both drivers and passengers, among the embattled ride-hailing players, Uber has obviously seized the opportunities to dominate the Latin American market.

Outside Brazil, the rivalry between Uber and Didi is likely to escalate as well. The first battleground is probably Mexico.

Uber has amassed seven million users across 45 cities in the country. Besides, Mexico City has become Uber’s third-largest market in the world by rides, after the Brazilian cities, Sao Paulo and Rio Janeiro.

As for Didi, even before acquiring 99, the Chinese company was reported expanding into the Mexican market, launching its ride-hailing service in the first quarter of 2018.

Cash reserves vs. dominant market share

When facing the increasingly fierce competition, Didi seems to be fearless.

“Didi is just as good as Uber, if not better, in terms of technology, innovation, and operation,” said Cheng to Caijing, “Besides, we have more than $10 billion cash reserves to back the company’s strategy, much more than our rival Uber.”

With such an abundant cash reserves, Didi is able to buy in more cars and rent them to local drivers, which according to Cheng, is the way to scale up in regions where most people don’t have a car.

As of Uber, it has undergone a difficult time in 2017, grappling with lawsuits and personnel changes. Its market value shrank roughly 30% to $48 billion following its recent stake sale to SoftBank.

In 2016, Uber lost its battleground in China, selling its China operations to Didi. Although Back then, the US company was believed to be stronger than its Chinese counterpart.

Will Didi be able to take a large chunk of the Latin American market from its current dominator Uber? We should all probably wait and see.