Late at night, Alice Jiang – a Chinese senior manager at a sports media company – has a hard time falling asleep. Whenever she cannot sleep, she turns on her favorite podcast app, QingTing FM, to listen to different audios about books, movies, and occasionally, travels. She says that listening to podcasts before sleeping calms her, distracts her from daily worries, and helps her to sleep.

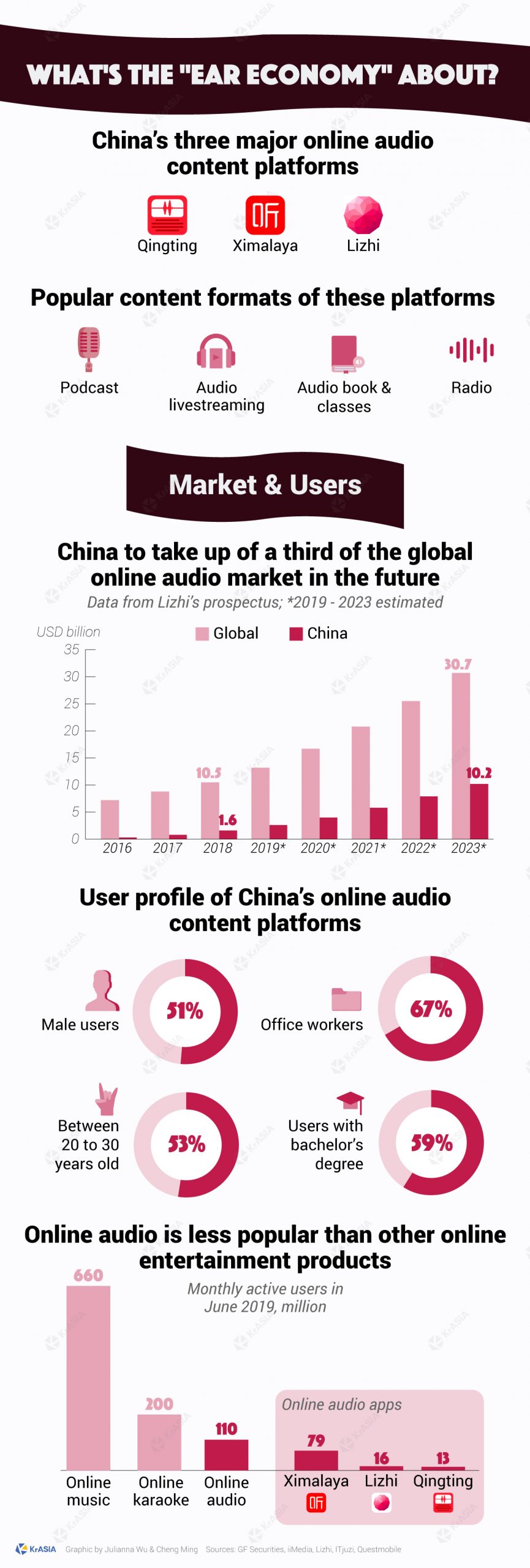

Alice is one of the estimated 542 million podcast users, part of the online audio industry, also called the “ear-economy,” in China, which includes podcasts, audiobooks, audio livestreaming, and other forms of online audio content. The market revenue of China’s online audio industry was RMB 17.58 billion (USD 2.5 billion) in 2019, with a solid year-on-year increase of 55.1% compared to 2018, and is estimated to hit RMB 27.2 billion (USD 3.8 billion) by 2020, according to iResearch.

Although a relatively new trend, podcasts are gaining momentum thanks to its essence: providing valuable information and letting listeners enjoy content while driving to work, completing house chores, or working out at the gym, for example. For others, like Alice, podcasts can provide companionship before going to sleep.

There are two main reasons to explain the rapid growth of the podcast industry in China. First, unlike in the West, where podcasts are mostly seen as a form of media and entertainment, in China, the podcast industry positions itself within the burgeoning paid knowledge sector.

Many Chinese podcasters sell their products as self-improvement tools. Lu Lu – a master’s degree student at Peking University, told KrASIA that out of her 57 paid subscriptions on Ximalaya FM, one of China’s major podcast apps, 32 are educational audio content about business and finance, nine are audiobooks, while the rest are lifestyle advice.

Second, while podcasts in the West are almost completely free or advertisement-supported, Chinese podcast hosts are already monetizing via paid subscriptions. “Free apps are very limited and mostly uninteresting,” says Alice.

By charging anywhere from RMB 20 (USD 2.85) to RMB 30 (USD 4.28) for subscriptions, many Chinese podcasters are generating revenue through these platforms, even with small audiences composed of less than 2,000 subscribers.

A combination of social and technological factors has led Chinese society to jump on the podcast wagon. While technological factors include affordable smartphones, the ease of paying for subscriptions via mobile payment methods, and affordable data plans, social factors include city dwellers’ long commutes and busy lifestyles. Also, the competitive job market has led many youngsters to seek continuous input of new information to stay updated, and podcasts are a great way to do so while multitasking.

Major players in China’s podcast industry

There are various podcast platforms in China, but Ximalaya FM, QingTing FM, and Lizhi FM are leading the industry in terms of paid subscriptions, and have been recognized as the main “the big three” players by China’s state media China Daily.

Ximalaya FM

Shanghai-based Ximalaya FM manages the Ximalaya app, which provides audiobooks, music, a variety of entertainment programs, news, and other audio content. Only a year after its launch, in 2013, the Ximalaya app reached 10 million subscribers, while today it counts over 79 million monthly active users (MAU), according to iiMedia’s report.

The company differentiates itself from competitors by the vast variety of audiobooks provided on its platform, which currently holds authorization for 70% of China’s audiobook copyright holders, according to Daxue Consulting.

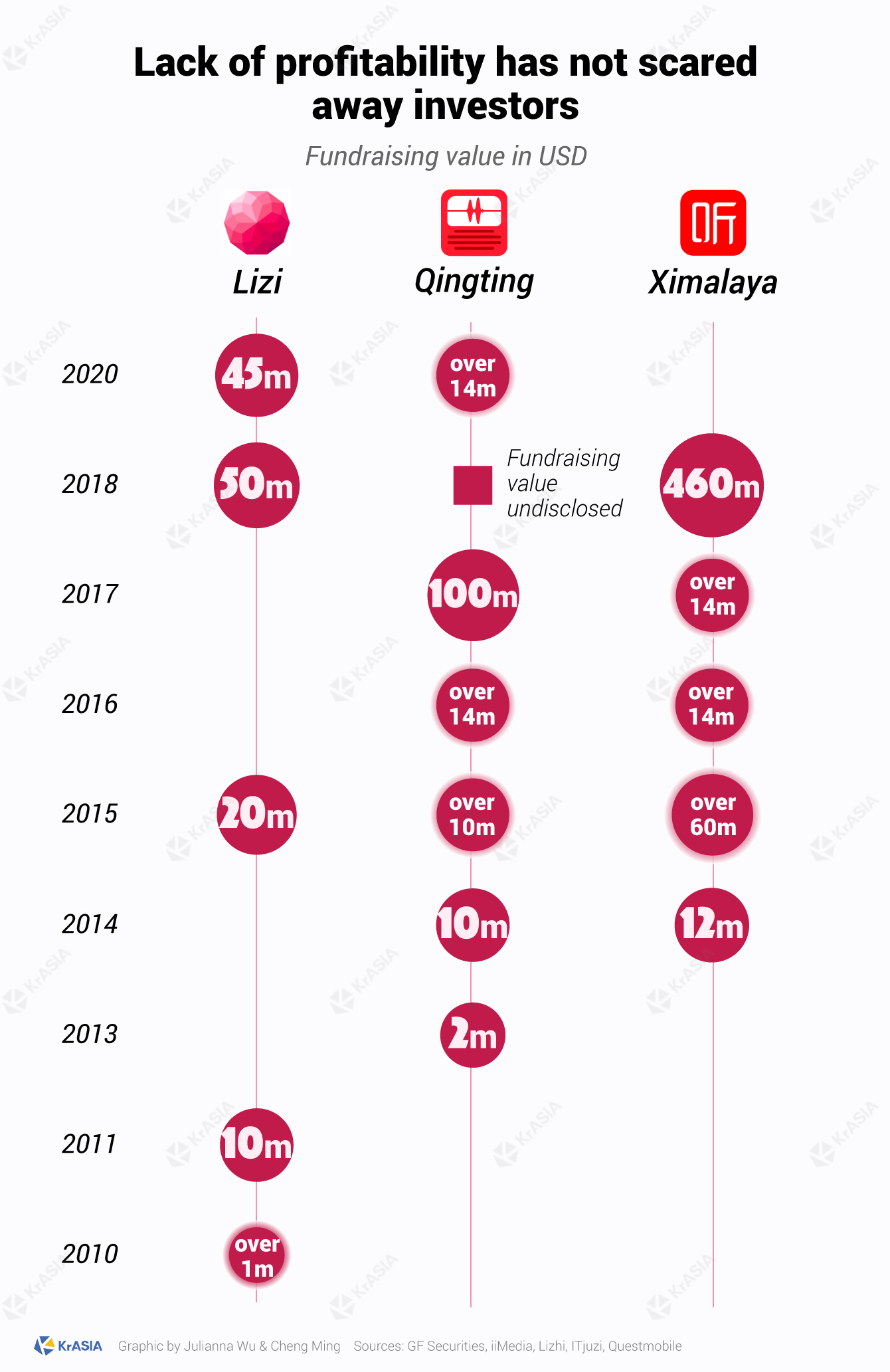

The firm has raised a total of USD 123.1 million in funding over seven funding rounds, the most recent of which was a Series D round led by Whales Capital in 2017.

QingTing FM

Founded in 2011, QingTing FM is also a Shanghai-based online radio service provider. The platform pulls together a variety of audio content, including broadcasts from global radio stations, audiobooks, magazines, and newspapers, as well as some original programming featuring life stories.

The platform enables users to upload their own content to build personal radio channels, also offering features to promote their content and attract users.

QingTing FM has raised a total of USD 182.6 million in funding over five rounds, completing its most recent Series E round in 2017.

In 2015, the company was voted as the best mobile radio and podcast app in mainland China by BRS Media’s survey. It also ranked third in the same poll globally, while competitor Lizhi FM ranked fourth.

Lizhi FM

Launched in 2013, Nasdaq-listed Lizhi FM (LIZI) targets young audiences, mostly under the age of 24. With the motto of ‘Everybody can be a podcaster,’ Lizhi focuses on individuals’ podcasts compared to Ximalaya and QingTing.

The platform offers podcasts about music, news, poetry, talk shows, and foreign languages. Also, like in QingTing FM, Lizhi users can create their own podcast shows.

The company primarily generates revenues by selling virtual items through its live, interactive audio sessions, while the contribution from user subscriptions and advertising remains relatively small.

Lizhi FM is the first Chinese podcast platform that went public. The company concluded its IPO in January this year, raising USD 45 million.

With over 46.6 million (MAUs), Lizhi FM is China’s second most popular podcasting platform after Ximalaya FM. However, the firm does not consider Ximalaya FM as its biggest competitor due to their platform’s differences, according to its CEO Lai Yilong. Lizhi’s content is primarily user-generated, but Ximalaya FM, in contrast, hosts more professionally generated audio content, he explained to tech media 36Kr.

A growing market

The COVID-19 outbreak has helped to accelerate podcast platforms’ rising popularity.

Earlier this year, the three big players launched special audio columns related to the pandemic, China Daily reported. Users can listen to these columns to get prevention tips and household hygiene tips, receive the latest news, and stories about medical staff and others working behind the scenes. Also, these platforms have set up livestreaming audio broadcast columns allowing users to consult medical experts for free on both epidemiological and mental health issues.

According to iiMedia’s study, people are reducing outdoor time due to the contagion, which, to some extent, has boosted the user growth and general development of the podcasting sector. The firm estimated that the average MAU for podcasts will increase by over 50% year-on-year in the first quarter of 2020.

Meanwhile, iResearch’s report underlines that the current user penetration rates for online music, games, and videos have reached 89%, 82%, and 74%, respectively. In comparison, the penetration rate of online audio is only 45.5%, suggesting great potential for further market penetration.

The future of the industry looks promising, yet, challenges remain in terms of boosting revenues. One of the main problems is retaining paying users. For educational and self-improvement podcasts, users’ enthusiasm tends to fade quickly. For instance, some platforms have been criticized by netizens for “selling anxiety” as much of their content is touted for making people “more prosperous”. At the same time, advertising strategies tend to make people feel unsatisfied with their current lives.

Another challenge is expanding the user base. The industry at the current stage does not appeal to the majority of users, but only to a specific niche. According to PodFest’s survey, 68.2% of podcast users live in China’s top 20 cities, with Beijing, Shanghai, Guangzhou, Shenzhen, and Hangzhou being the top five cities. Moreover, 88.5% of respondents are under age 35, while 86.4% hold a bachelor’s degree or above.

Perhaps one of the biggest challenges is profitability. Regardless of the high number of subscriptions, most of the podcast’s platforms are yet to become profitable. While hosts are already making some sort of income, platforms are not generating enough revenues to cover all expenses on research, development, and content licensing, among others.

Take a look at Lizhi for instance. The company has yet to turn its fanfare into profits on its balance sheet, which explains why its public debut wasn’t very well-received among American investors. Since its second trading day on January 18, 2020, its share price had fallen below the IPO price of USD 11 and has not recovered.

After its listing, Lizhi’s CEO Lai Yilong told media outlets that the company would be able to earn a profit in 2020. Yet, the reality is harsh, as, in the first quarter of 2020, the company booked a USD 29 million net loss, almost doubling its 2019 performance in the first three quarters, when it collected losses for USD 15 million.

That said, the lack of immediate profitability has not stopped venture capital firms and tech giants from joining the competition in this narrow sector, which has caught the attention of other major tech players.

Tencent’s music subsidiary, Tencent Music Entertainment (NYSE: TME), for example, has introduced an Audible-style audiobook and podcast app in April 2019. The move allows the company to expand into the Chinese audio streaming market on the back of its huge pool of listeners and its partnership with online literature company China Literature, KrASIA reported.

Baidu (NASDAQ: BIDU) has also invested in the podcast industry, injecting USD 50 million into Kaishu Story’s Series C round in July 2019. Kaishu Story is a podcast content production company focusing on children’s bedtime stories. The podcast studio has produced more than 9,000 stories since its inception and attracted more than 30 million listeners.

To stay ahead of the others, Ximalaya FM relies on its vast library of authorized content, while Lizhi FM is predilecting original content creation, to become an “individual’s podcast” source where amateur and young podcasters can design their own shows. QingTing FM, meanwhile, is focusing on professional podcasting and international content.

To increase revenue, podcasts companies are also looking for new business cooperations. Qingting FM and Ximalaya FM are partnering with smartphone companies like Huawei, Vivo, and Xiaomi to provide audio content on mobile and wearable devices, in addition to smart home appliances.

According to the same estimates by iResearch, the Chinese audio online market industry is set to grow almost 55% in 2020, 46.4% in 2021, and 36.1% in 2021 to reach a market revenue of RMB 54.3 billion (USD 7.8 billion). Audio platforms have plenty of room to grow, while constantly innovating to lure more users.