On the morning of June 30th, when Shivani Kapila discovered that she could no longer access TikTok, it felt like a personal loss.

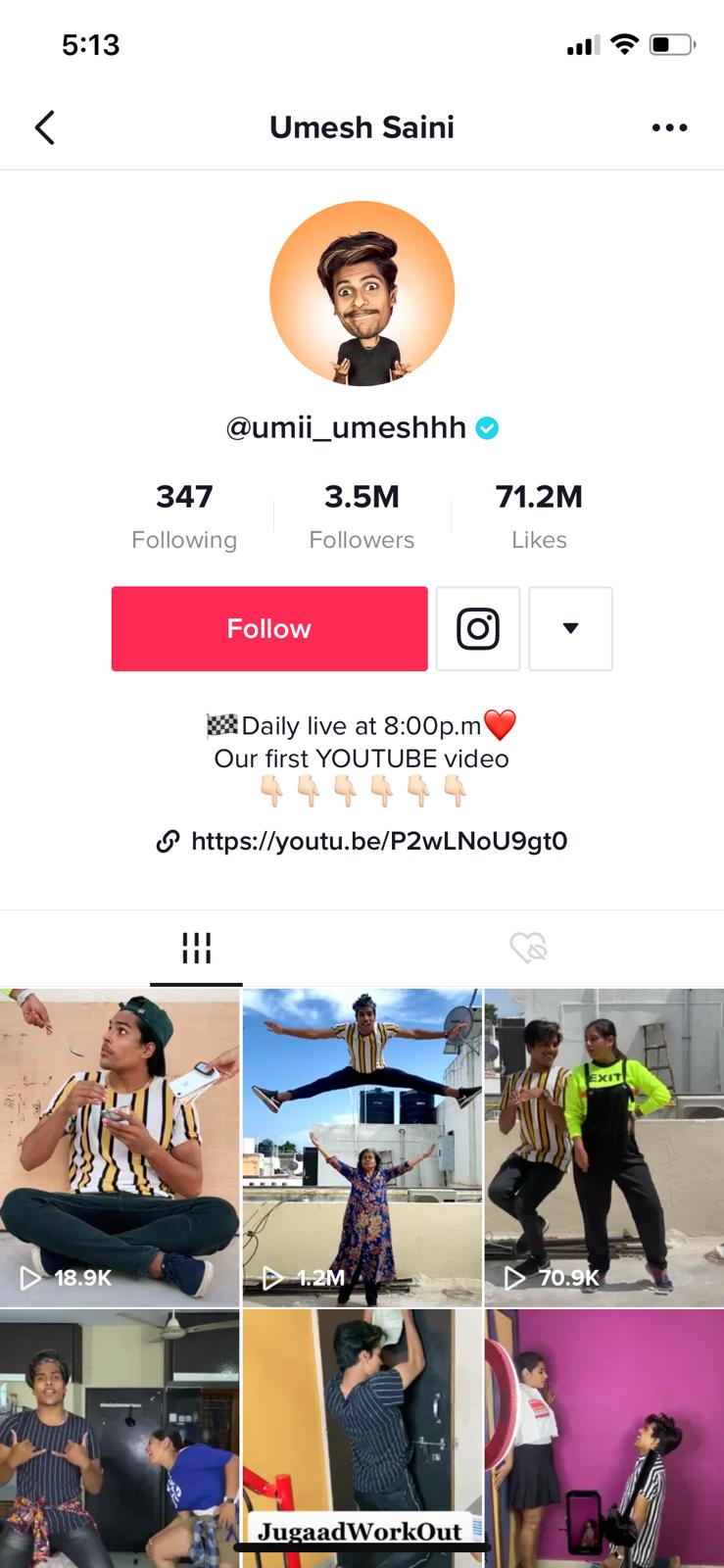

Only a few months back, Kapila, who is in her mid-20s, had moved from Mumbai, the commercial capital of India, to her home-town in Surat, a city in the western state of Gujarat, leaving her full-time job which saw her in role of a HR professional. As a TikTok influencer Kapila had nearly 10 million followers, and the motivational videos which also featured her mother-in-law and Kapila’s friend, Umesh Saini, had become quite a hit. Saini too had moved cities to be a part of this trio.

“TikTok gave me a new identity. All of a sudden two years of my life were wiped out of existence,” says Kapila.

For Saini, breaking the news of TikTok ban to his parents was like telling them about his job loss. “When I told my family that TikTok was shut in India, for a day there was an absolute gloom in my family,” recalls Saini.

Citing cyber security issues, that India claimed put its sovereignty at stake, the Union Ministry of Electronics and IT, on June 29th, banned 59 Chinese apps, including TikTok, Likee, Kwai, Helo, NewsDog, Bigo Live, and others.

The news came as a shocker for over 1.2 million TikTok creators in India, including a substantial number of youngsters from semi-urban areas who had found stable earning opportunities through the app. For them, TikTok was like a magic wand for fame and money in 15 seconds. Earnings ranged from barter deals for clothing and fashion accessories to as much as INR 200,000 (USD 2,687) per video.

On an average, by making TikTok videos, Kapila could earn almost twice her previous salary as a corporate professional.

Indian apps eyeing the TikTok pie

India is TikTok’s biggest overseas market, accounting for almost 611 million or about third of the total worldwide downloads with over 200 million users in the country.

The rush to fill the void left by TikTok is now the next big thing in the Indian app market.

Several homegrown apps like Roposo, Chingari, Mitron Tv, Bolo Indya, and others are now eyeing the market. Immediately after the ban, Indian broadcaster Zee5 announced the launch of a new content creation app called HiPi. Another Indian social media platform, Sharechat, debuted its own short video app, Moj, a few days after the ban was announced.

Then there are foreign, non-Chinese apps such as US-based Triller and Germany-based Dubsmash, that appear to be promising candidates to replace TikTok. However, the foreign apps don’t touch the Indian heartland the way TikTok did through its regional overtures.

In a languid job market hit by COVID-19, the homegrown firms are found frantically searching for app developers, UI/UX designers, and social media marketers. In the last few days, Roposo hired about 100 freelancers, apart from 20 full-time employees. It plans to hire 100 full-time employees in the next few days, Mayank Bhangadia, founder, Roposo, told KrASIA.

Within hours of the TikTok ban, these apps saw phenomenal surge in traffic, sending servers crashing in some cases.

So far, Roposo, the oldest Indian app in the category, which started in 2014, leads the pack with about 75 million downloads, of which around 15 million downloads were in the last few days. Bhangadia is aiming at 100 million downloads in the next week.

However, more than app downloads, what is important for these apps is the ability to retain users. With its highly addictive, short-videos that were easy to consume, TikTok created a new business model, entwining a web of brands, public relation professionals, and content creators. Brand endorsement was a big source of earning for content creators.

Hence, the challenge for the Indian platforms is to get and retain users, generate volumes, and attract brand partnerships.

“The user base of TikTok was so high that brands followed. New players would take time to establish themselves,” says Paras Tomar, a TikTok influencer from New Delhi with more than three million followers.

The Indian apps are also working on finding earning avenues for content creators. For example, on Roposo, if a video has 100,000 views, the creator earns a similar number of Roposo coins, which in actual money value would be INR 100 (USD 1.34). The company did not comment on how many brands are on board for endorsements.

Similarly, Bolo Indya has created a private learning room where content creators share their knowledge and can earn money.

“We will ensure that social traction converts into financial independence,” Varun Saxena, co-founder and CEO of Bolo Indya, told KrASIA.

Too many bugs

The alternatives to TikTok are still evolving, and many users complain that they are bugged with errors. It would take at least two to three weeks for homegrown apps to provide a seamless user experience.

ByteDance-owned TikTok has been in the market since 2017 and over the years it has invested heavily to ensure its UI and UX are top-notch. In 2018, ByteDance invested USD 100 million in India, while last year it said it would invest USD 1 billion in the country over the next three years.

Tomar believes local short-video apps are not even close to TikTok and they need to work a lot more on their platforms.

These apps don’t give the comfort which TikTok gave. TikTok grew with time. Everyday they were coming up with a new feature,” he says.

“Indian apps have so many bugs that it is difficult to upload videos. There is always one error or another,” says Amit Bachi, a TikTok influencer with nearly two million followers.

The scathing reviews of the apps on Google Play store also tell a story. Almost all the reviews talk about low speed, problems in uploading videos, and cheap interface. Unprecedented traffic surge in apps was something which they were not prepared to handle.

“There are issues that arise out of sudden scaling. Against about 700,000 installs in the month of May, we were getting 600,000 installs an hour after TikTok ban. Most of the features are now working smoothly, except for one or two. Also, it takes time for people to understand the new features,” says Bhangadia.

Saxena of Bolo Indya agrees that it would take about two weeks for it to set the best filters in place.

YouTube and Instagram keep the show running

YouTube and Instagram remain the top immediate alternatives to TikTok to keep the show running. Even though they don’t offer the ease of a video-editing app, they offer a sense of dependability.

However, unlike TikTok, which was a stable source of employment for many youngsters, earning a living out of YouTube and Instagram is much more competitive. The videos compete with a variety of content. TikTok is only about small shots of entertainment. Content creation on YouTube and Instagram is more tedious, requiring lengthy videos with real background.

“As of now I am focusing only on YouTube and Instagram. However, the earning is not much. It is very difficult to get followers on these platforms as search engines are different. Also, the features which TikTok provided, like stabilization, photograding, filters and ease of shooting videos are all absent,” says Vendy Yaduwanshi, who had four million followers on TikTok. He has so far managed about 16,000 followers on Instagram.

“I haven’t explored any other alternative to TikTok. As of now, we will be on Instagram and YouTube only. It has its problems, but there is no other alternative,” says Saini. He, along with his co-stars recently started a YouTube channel called Little Gloves, which so far has got about 24,000 subscribers. However, earnings remain elusive, he says.

TikTok had touched the Indian heartland, and its deep penetration was its forte, something which YouTube and Instagram lack. However, Instagram is secretly testing its own short-video platform, Reels, in India. While Instagram has kept its India plans for Reels under wraps, similar to TikTok it is likely to be a 15-second video platform.

“In rural areas and villages people don’t know how to use YouTube or Instagram. It is difficult to get regional audiences to move to these platforms,” says Yaduwanshi.

Read this: Indians spent 5.5 billion hours on TikTok: App Annie

One factor which can act as a brownie point for Indian TikTok substitutes is the wave of anti-China sentiment. Coupled with this, Prime Minister Narendra Modis’ repeated calls for ‘Atmanirbhar Bharat’ or self-reliant India has struck a chord among people. More recently, Modi called for an ‘Aatmanirbhar Bharat App Innovation Challenge,’ a move to encourage Indian app developers to produce world-class products.

Content creators too have latent support for this movement.

“I believe India’s decision to ban TikTok was good. I would like to be on an Indian app as we want to use our own products. In fact, for the last one month, ever since this India-China dispute started, I was producing less content for TikTok,” says Amit Bachi, a TikTok influencer with nearly two million followers. In two weeks, Bachi has gained some 37,000 followers on Instagram.

Tomar too, agrees that for the last two months anti-China sentiments were already palpable on TikTok. Many had already started uploading more content on YouTube and Instagram.

Untapped potential

The Indian app market is one of the fastest growing markets in the world, and the sheer volume give any global player a reason to invest in the country.

According to data from analytics and market intelligence firm App Annie’s State of Mobile 2020, India has emerged as the fastest growing app market in the world. It recorded a total of 19 billion downloads from app store (Google Play Store, iOS combined) in 2019, up from 6.55 billion in 2016, the report says.

However, Indian short video platforms that quickly want to claim this market after the unceremonious exit of TikTok, Helo, and others, urgently need funding. Just a day after the ban, Bengaluru-based Mitron Tv raised INR two crore (USD 4.6 million) from 3One4 Capital and Lets Venture Angel.

VCs have also taken a cognizance of this and are actively seeking such opportunities. On the day of the ban, Prayank Swaroop, partner at Accel, asked founders to get in touch with him if they are “building apps that replace these apps in India.”

According to Nitin Menon, a senior banker dealing with Media and Entertainment vertical in a private bank, to compete with global giants like Facebook, YouTube, and Instagram, Indian apps will need creativity, a subscriber base and adequate doses of funding.

“While China funding is cut off, there is an opportunity for the existing Indian VC/PE ecosystem, supported by the global and Indian capital stimulus to provide the financial impetus to support and grow select entertainment led platforms in the future,” says Menon.

Clearly, the disruptions brought about by the hasty exit of TikTok from India has already piqued the interest of venture capitalists in the Indian market.

According to Bhangadia, a lot of investors are now enquiring about funding opportunities in the Indian app market for video streaming market.

Saxena says, Bolo Indya will soon announce a fresh round of funding.

The next few weeks are expected to be action-packed for the Indian social media startups. And their success would depend on the verdict of millions of users in the Indian heartland.