A recent wave of failed P2P lending platforms in China has caused many investors to lose a lot of money. Some investors lost hundreds of thousands of dollars, which represented their entire retirement savings. What caused this to happen and should this trend in the world’s largest P2P lending market worry investors in Singapore?

What happened to China’s P2P lending industry?

China’s P2P lending industry, which is the world’s largest with total outstanding loans of approximately S$200 billion, experienced rapid growth in the past decade. In 2006, China’s first online P2P platform launched and there were 2,388 active platforms at the start of 2017. These companies allowed underserved borrowers to receive financing from large groups of individual investors, which helped those borrowers that had reached their credit card limit or did not qualify for bank loans. For this reason, crowdfunded loans have been particularly popular with low-income groups seeking home renovation, car, and education financing.

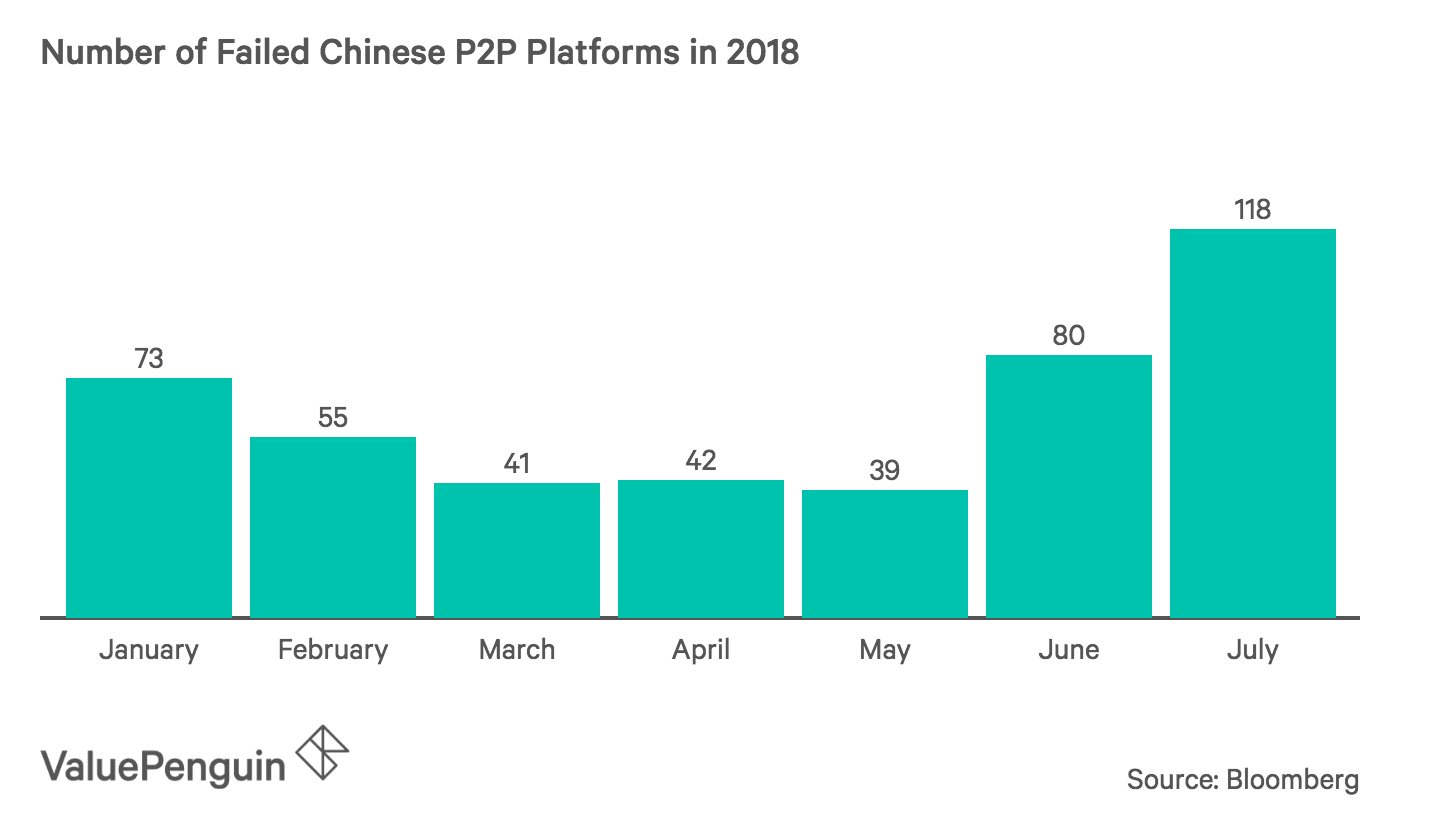

While these platforms provide crucial financing for many individuals and small businesses, some platforms conducted risky lending practices and one was even declared a Ponzi scheme by the Chinese government. This led the government to introduce stricter regulations on the industry. For example, platforms must now use a custodian bank to hold investor and borrower funds and are required to fully disclose their use of deposits. They were also required to register with local financial regulatory authorities by June of 2018. It appears that these restrictions and warnings from Chinese government have put pressure on P2P platforms and made investors nervous, especially of platforms with shady lending practices. As a result, P2P investors began a “bank run” on many of these platforms, many of whom faced extreme cash shortages and were forced to close as investors pulled out their funds.

Lessons for crowdfunding investors in Singapore

While the fallout of China’s P2P lending industry’s recent troubles has very unfortunate, investors in Singapore stand to learn a lot from these events. With proper due diligence and analysis, investors in Singapore can continue to invest using crowdfunding platforms with confidence.

Invest with regulated platforms

First of all, it is important to invest with a reputable platform that is registered with the government. Many of the failing lending platforms in China were never registered with regulators, thus making their practices less transparent to consumers. In Singapore, there are a number of platforms that are approved by the government, including Funding Societies. If you are curious, you can search through the Monetary Authority of Singapore’s (MAS) directory to determine whether or not the platform you are interested in is registered.

Beware of opportunities that are too good to be true

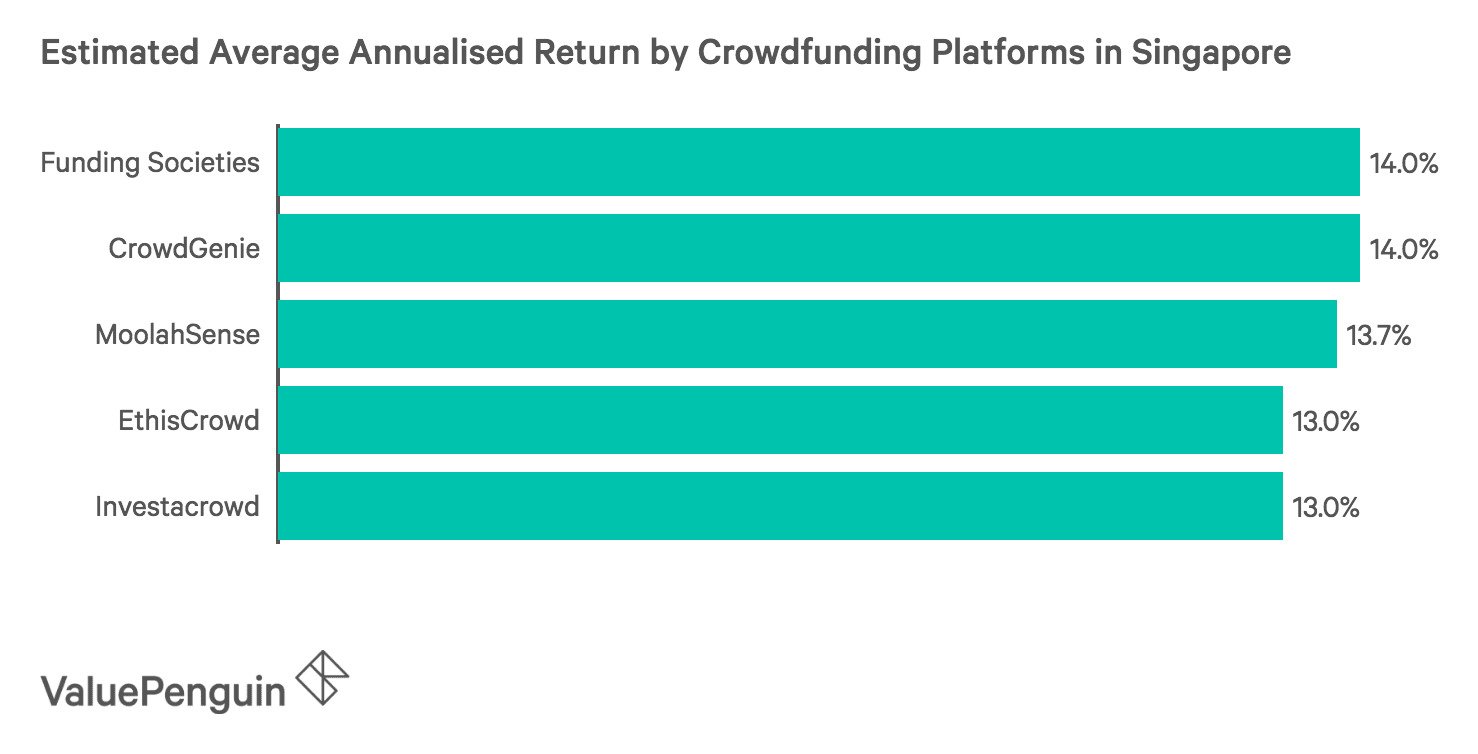

Aside from investing with platforms that were not well-regulated, some Chinese investors fell prey to platforms that promised returns that were too good to be true. You should be wary of any investment that promises dramatically higher returns than comparable opportunities. For example, we estimate that the average annualised return of many of Singapore’s crowdlending platforms is all very similar. An easy way to avoid the pitfall of choosing a crowdfunding platform that makes unrealistic claims is to thoroughly research various platforms in order to understand reasonable returns based on the characteristics of your investment, including size, duration and risk.

Even after you’ve found few platforms you want to try, it is even more important to assess each investment opportunity’s risk profile. For example, when comparing crowdfunding lending opportunities, you will ultimately need to assess how likely the borrower is to repay your loan. To determine this probability, it is helpful to consider their current and future income sources as well as their borrowing history and borrowing purpose.

Don’t forget to diversify

Focusing on the highest possible returns may have also led investors to discount the importance of diversification. It is important to diversify your risk when investing in crowdfunding campaigns, as well as with other opportunities. A few Chinese investors had their entire retirement savings invested in one P2P platform, which completely exposed them to the default risk of the platform and its campaigns. Whether you are investing through crowdfunding sites, online brokerages or any other investing platforms, it is important to carefully review each opportunity to understand its risk profile in order to find a level of diversification that works for you. For example, the literature on this matter generally suggests having at least 10 to 20 stocks in your investment portfolio; following a similar philosophy when it comes to crowdfunding investment opportunities could be a decent place to start.

Originally appeared in ValuePenguin written by William Hoffmann. William is a Senior Research Analyst at ValuePenguin Singapore, focusing on banking and SMEs. He previously was an Economic Consultant at Industrial Economics Inc.