Hillhouse Capital saw three of its healthcare investments went public on the same day, as China’s biggest private oncology healthcare hospital group Hygeia Health (HKEX:6078), insulin maker Ganlee (603087), and surgical instrument developer Kangji Medical (HKEX: 09997) all went public June 29.

Hygeia opened its first trading day with a 23.2% jump in its stock price, resulting in a market cap of USD 2.05 billion. At the same time, Kangji saw its stock price almost double from its listing price of HKD 13.88 (USD 1.79) to HKD 25.9 (USD 3.34), hitting a market cap of USD 4.8 billion at the end of Tuesday.

Notably, Hygeia and Kangji also sealed their pre-IPO fundraising on the same day, June 16, at which time Hillhouse joined Lake Bleu Capital to become a common investor of the two companies.

Meanwhile, Shanghai-listed Ganlee is one of Hillhouse Capital’s earliest investments in healthcare, as the venture capital firm backed Ganlee with an undisclosed strategic investment in 2015.

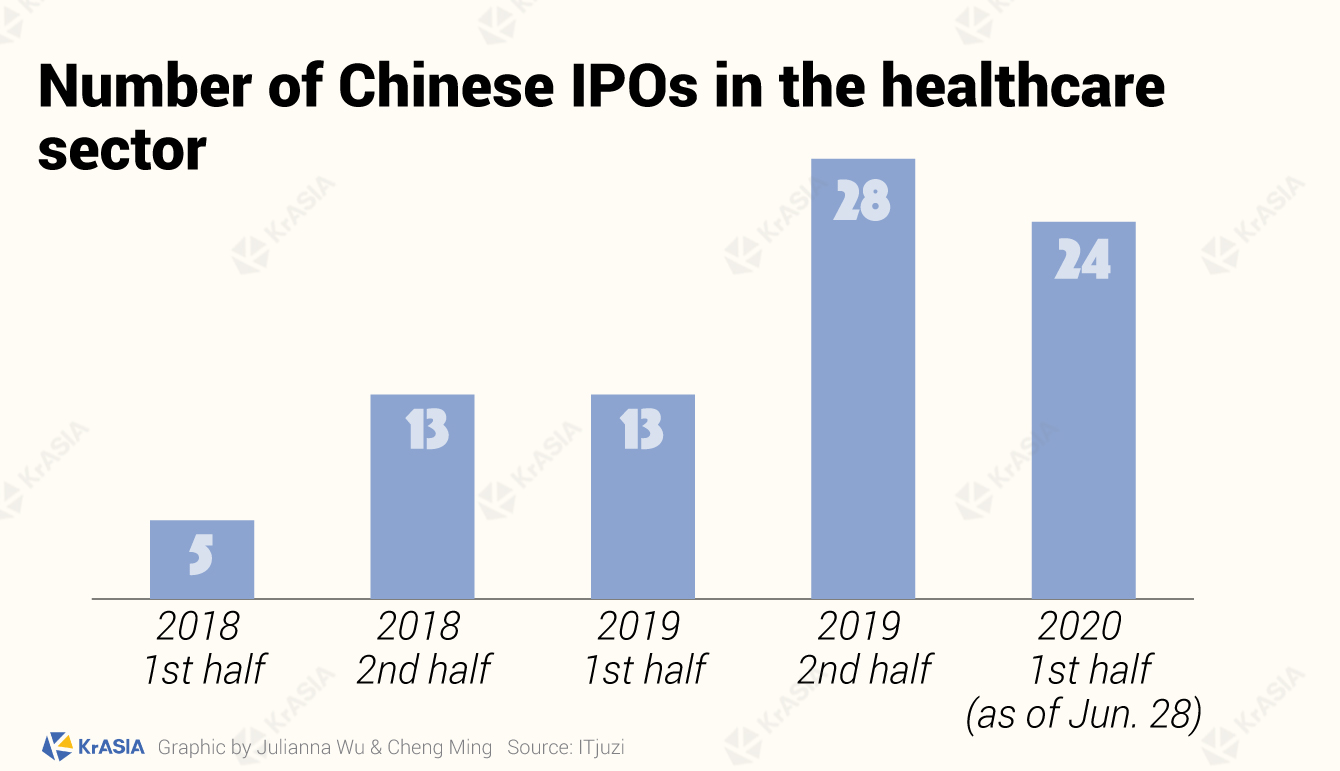

Driven by the COVID-19 pandemic, both the primary and secondary market has demonstrated strong interests in healthcare. As of June 28, 24 Chinese medical & health businesses went public amid volatile global capital markets.

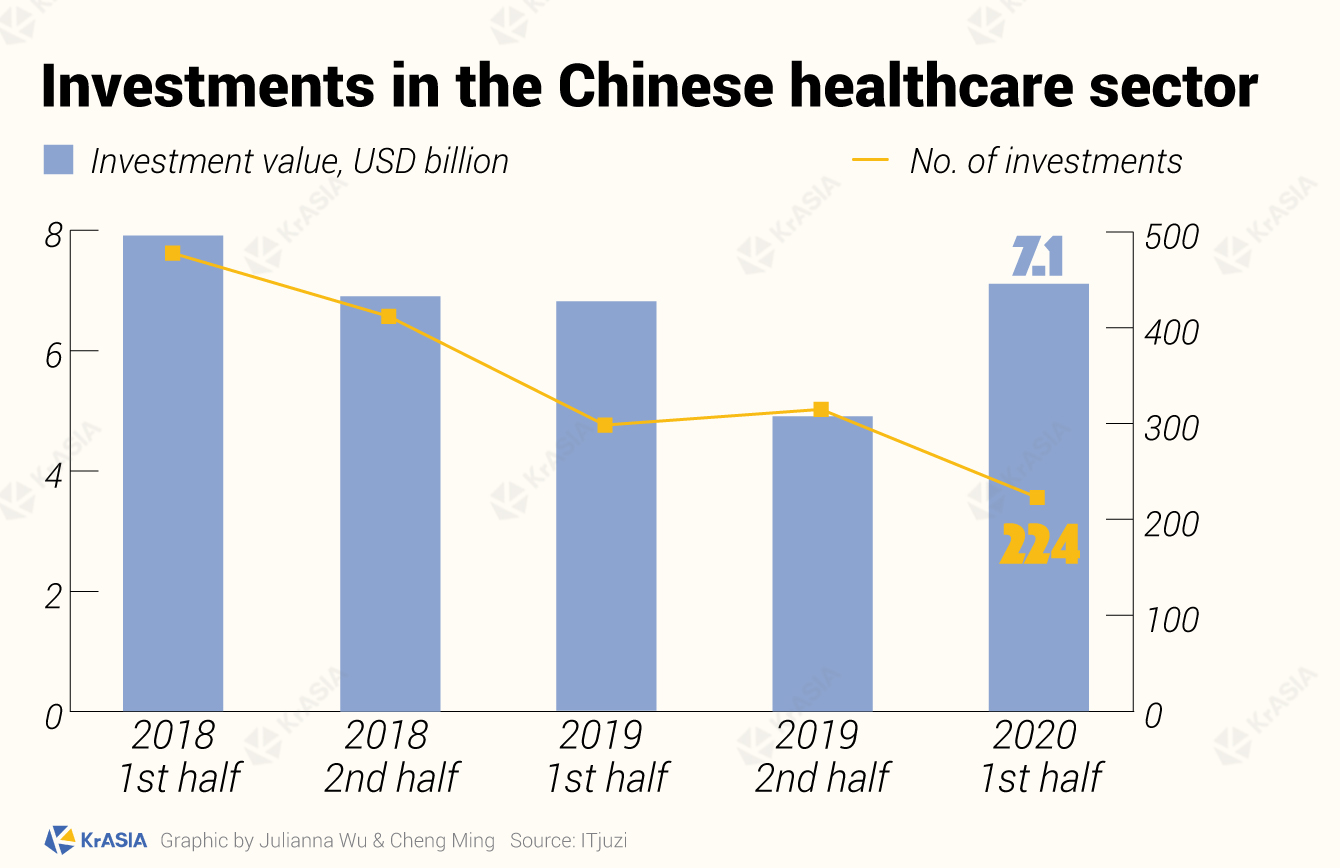

In the first half of 2020, healthcare financing accounted for 16% of the total fundraising value across all sectors in China, a record high.

The 224 cases, though short of the 300 investments that took place from January-June 2019, recorded a 46% increase in total investment value, as data from ITjuzi showed.

Widely known as one of the earliest backers of internet giants like Tencent (HKG: 0700) and JD.com (NASDAQ: JD), Hillhouse Capital has shown great interest in the healthcare sector over the years.

With a total capital of USD 575 million spread across in 57 ventures, healthcare is Hillhouse’s favorite sector to bet on, as KrASIA discovered by analyzing its historical investments.