Online healthcare service operator WeDoctor is eyeing a Hong Kong IPO in the third quarter of 2020 with an aim to raise between USD 700 and 900 million, reported Caixin. The Hangzhou-based startup is now valued at USD 5.5 billion.

The Tencent-backed unicorn has been preparing for a public listing since May 2018, when it completed China’s biggest healthtech pre-IPO fundraising by collecting USD 500 million from private funds.

It is unclear why the IPO has been delayed for more than two years, but media reports suspected that intense market competition and the lack of a profitable business model may have contributed to the sluggishness.

Compared with rival Ping An Good Doctor (HKEX:1833)’s 315 million registered users and DXY’s 2 million registered doctors, WeDoctor’s 210 million users and 310,000 doctors don’t have an advantage.

Meanwhile, most digital health startups in China currently depend on the sales of medicine to make a profit, while their telemedicine services keep struggling to generate revenue as customers hesitate to pay for remote consultation services when it comes to disease diagnoses, said industry practitioner interviewed by IFnews.

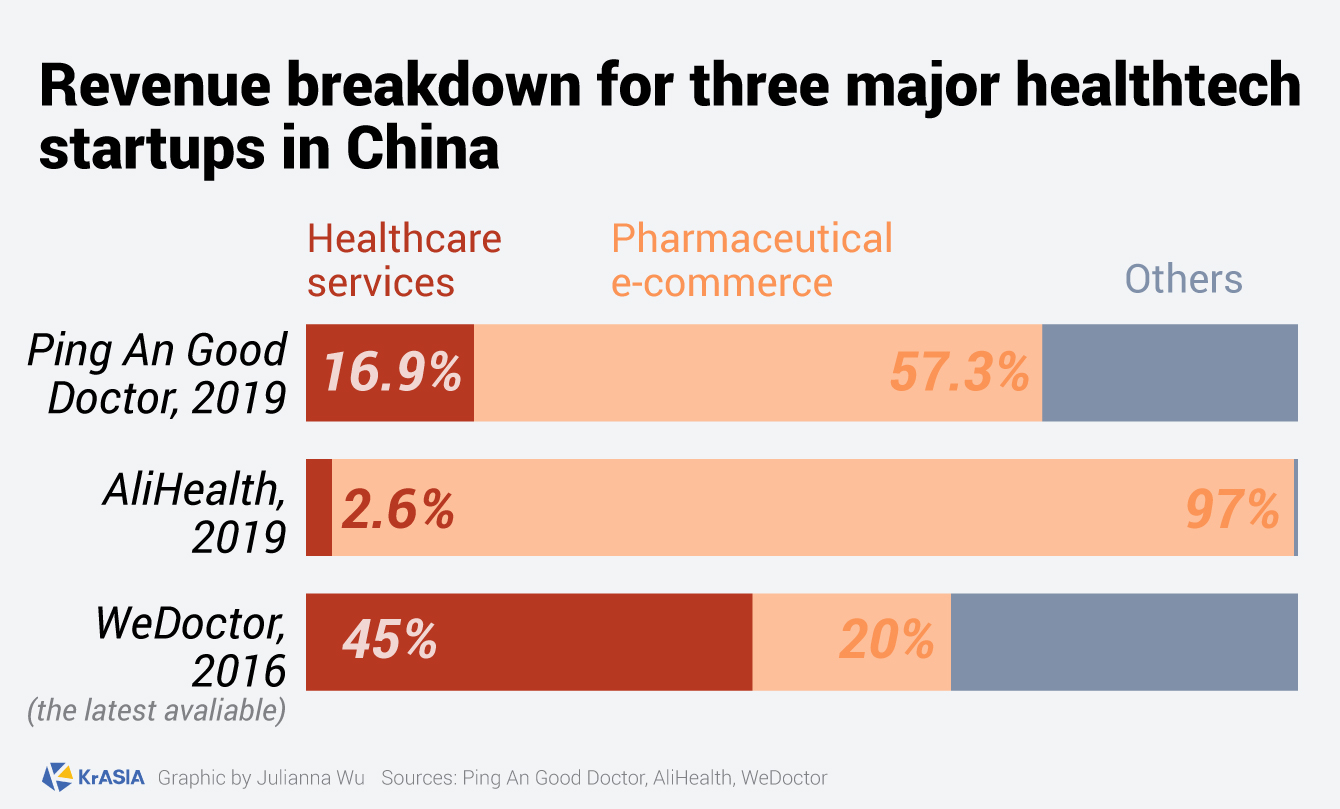

Competitors Ping An Good Doctor and AliHealth (HKEX: 0241) generated 57% and 97% of their total 2019 revenue from online medicine e-commerce, respectively, according to their earnings reports.

Though WeDoctor’s IPO has been delayed for more than two years, the online healthcare sector continues to be favored by investors in Q1 2020 in China, as millions of citizens and institutes benefit from online healthcare services that have taken off after the COVID-19 pandemic.