SoftBank, the world’s largest investor, which has been besieged with criticisms over its shoddy governance, investment missteps, and grim prospects, is still at it, or at least so in China.

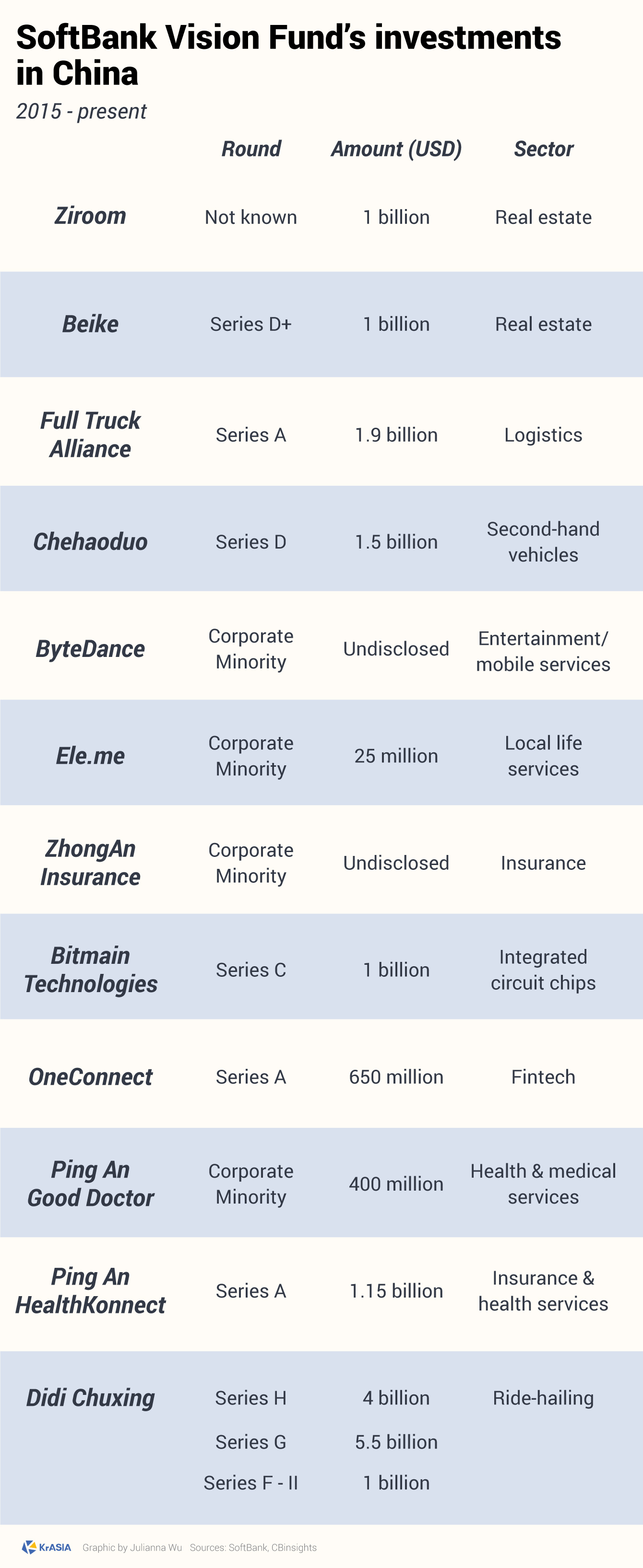

The Japanese investor has reportedly made two new heavy bets in China’s frothy property market late last year, with two billion-dollar investments through its Vision Fund. The cheques were written right before the coronavirus outbreak partially paralyzed the country’s already slowing economy.

SoftBank poured USD 1 billion each into Chinese apartment rental platform Ziroom, and Beike, a real estate brokerage house that uses an online portal to connect sellers, buyers, and agents. The Ziroom deal, which valued the startup at USD 6.6 billion, was made half in direct capital injection, and half in stake acquisition from its founding team.

Both Ziroom and Beike fall under the wings of HomeLink Real Estate Agency Co., also known as Lianjia domestically, one of China’s top traditional estate agents.

Ziroom differs itself from traditional long-term rental operators in the way it acquires properties. Traditional operators either build their own properties for rent from scratch, or rent a whole property from a developer to refurbish and sublet.

But Ziroom chooses to draw on China’s abundant supply of individual landlords, cumulating their vacant apartments, renovating them to the same Ziroom standards and style before subletting. Various value-added services such as house maintenance and cleaning are also provided.

With this “retailing model”, Ziroom has been growing quickly from the outset. It now serves over 2 million tenants across nine Chinese cities: Beijing, Shanghai, Shenzhen, Hangzhou, Nanjing, Guangzhou, Chengdu, Tianjin, and Wuhan.

The Beike deal, led by SoftBank’s 1 billion investment, was joined by a group of investors including Hillhouse, Tencent, and Sequoia. Beike raised a total of USD 2.4 billion in its Series D+ round.

According to the Hurun Global Unicorn List 2019, Beike and Ziroom are the top two Chinese real estate unicorns.