Chinese gaming publisher NetEase (NASDAQ: NTES)’s secondary listing in Hong Kong is 74 times oversubscribed in the first two days of its public offering since Tuesday, as reported by Hong Kong Economic Times.

20 years after its Nasdaq debut, the gaming giant will begin trading on the Hong Kong Stock Exchange on June 11 under the stock code (HK:9999), aiming to raise up to USD 2.8 billion, KrASIA reported.

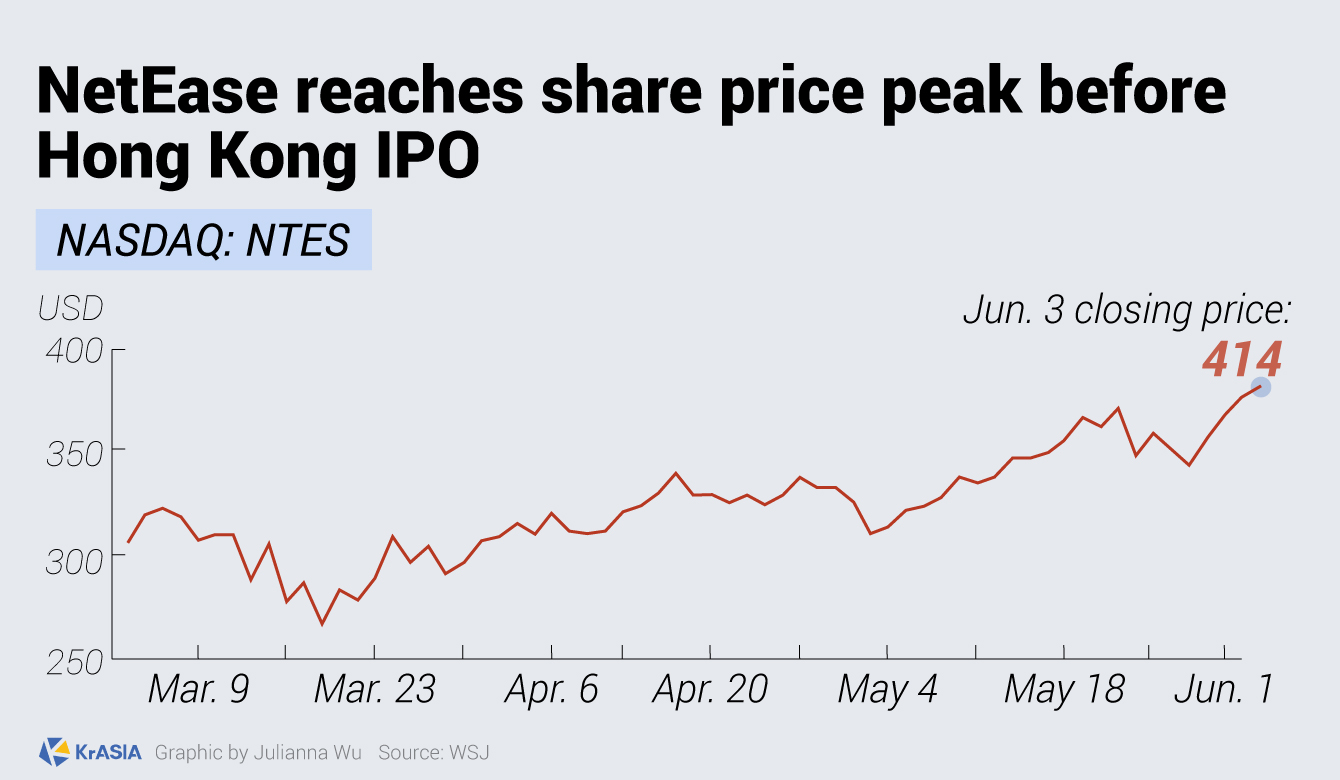

Boosted by investors’ enthusiasm, NetEase’s Nasdaq stock price hit an all-time peak on Wednesday local time, resulting in the latest market value at USD 53.5 billion.

NetEase’s domestic public offering comes at a time when US-listed Chinese companies are facing escalating pressure in overseas capital markets after a series of financial scandals, short attacks, and more stringent regulation.

Last month, the US Senate passed a bill to ban foreign companies from public listings or raising money from American investors unless they comply with US accounting practices to provide greater transparency.

JD.com (NASDAQ: JD), China’s second-largest e-commerce player by market cap, is the next to list in Hong Kong following NetEase, KrASIA reported earlier, with a fundraising target of USD 3 billion.

Group-purchasing e-commerce platform Pinduoduo has also been rumored to be seeking a Hong Kong IPO with China International Capital Corporation as its underwriter, but later the company’s spokesperson denied the reports to 36Kr.

Last year, e-commerce magnate Alibaba (NYSE: BABA; HKEX: 9988) made global headlines as it launched a USD 13 billion IPO, the second-largest in 2019 globally, through a secondary listing in Hong Kong.

Though the COVID-19 outbreak dragged down the IPO value of new listings on Hong Kong’s stock market this year, investors’ enthusiasm was not watered down: 95% of 2020 Q1 IPOs were oversubscribed, and 49% of them were oversubscribed by more than 20 times, as per Deloitte’s report.