JD.com (NASDAQ: JD), China’s second-largest e-commerce site by transaction volume, is reportedly planning for a secondary public listing on the Hong Kong Stock Exchange to raise around USD 3.4 billion by selling at most 5% of its shares, according to Reuters and 36Kr.

After experiencing an exceptionally sluggish first quarter as the COVID-19 outbreak halted global financial activities, Hong Kong is set to welcome its biggest IPO of the year as soon as June.

The Beijing-based e-commerce company’s fundraising move comes at a time when US-listed Chinese stocks face increased scrutiny as some companies, including coffee chain store Luckin (NASDAQ:LK) and edtech GSX (NASDAQ:GSX), were embroiled in fraud allegations this year.

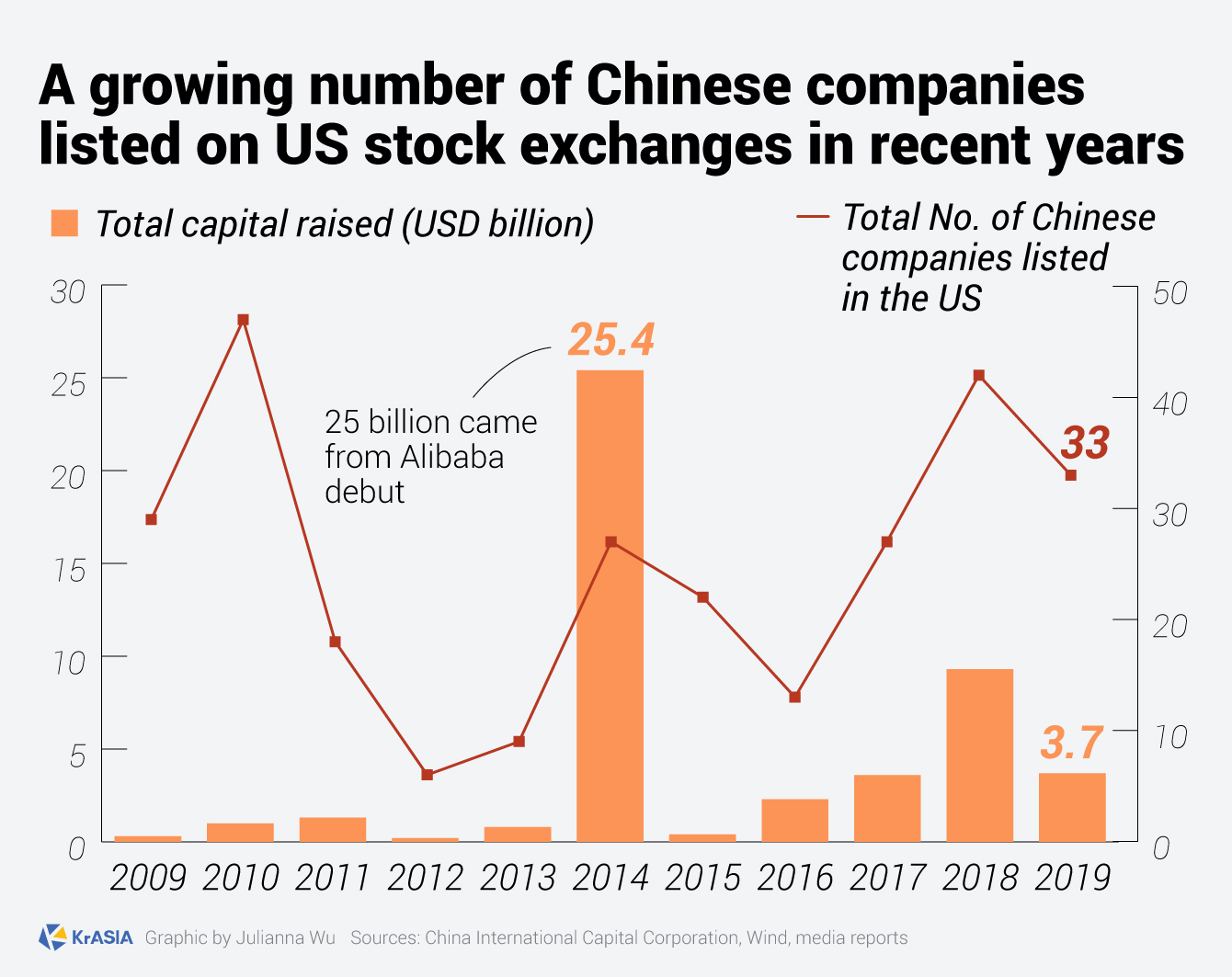

To optimize their fundraising channels, many growing Chinese internet companies filed IPOs abroad over the years, resulting in nearly 200 Chinese companies currently listed on the New York Stock Exchange and the Nasdaq combined.

However, many US-listed Chinese corporations are considering a return to domestic capital exchanges, as they face obstacles in adapting to foreign trading and regulatory systems, said Haitong Securities in their recent report seen by KrASIA.

Recent corporate malfeasance scandals have undoubtedly caused international investor confidence to waver, catalyzing the process, said the report.

Last November, Alibaba (NYSE: BABA; HKEX: 9988), JD.com’s major competitor in e-commerce, secured USD 13 billion through a secondary public offering in Hong Kong.