JD.com, China’s second-largest e-shop by transaction volume in 2019, booked a better-than-expected Q1 2020 financial results at a time when COVID-19 sinks the global economy.

The Beijing-based company (NASDAQ: JD) recorded USD 20.6 billion revenue and USD 200 million net profit in the first three months ended March 31, 2020, both exceeding analysts’ estimations polled by Bloomberg.

While China’s e-commerce sector was hampered by a partially halted supply chain and logistics system, JD.com maintained a strong user growth as it benefited from its proprietary logistics network and a successful strategy to woo users from lower-tier cities.

Logistics

Most delivery services were suspended amid the coronavirus outbreak, and JD Logistics, together with China Post, SF Express, and Sunning Logistics, were the only four courier operators that remained normal business, according to 36Kr.

Though the quarantine has created obstacles for logistics services in many areas thus pushed the costs high, the flush of orders brought down per order cost which was at an all-time low for JD Logistics, said CFO Sidney Huang in the conference call after releasing the latest financial results.

In the quarter past, JD Logistics and other services generated a revenue of USD 930 million, 53.6% higher year-on-year.

Users

As China’s urban market saturates in recent years, the relatively underdeveloped lower-tier cities have been a battleground for China’s e-commerce sector.

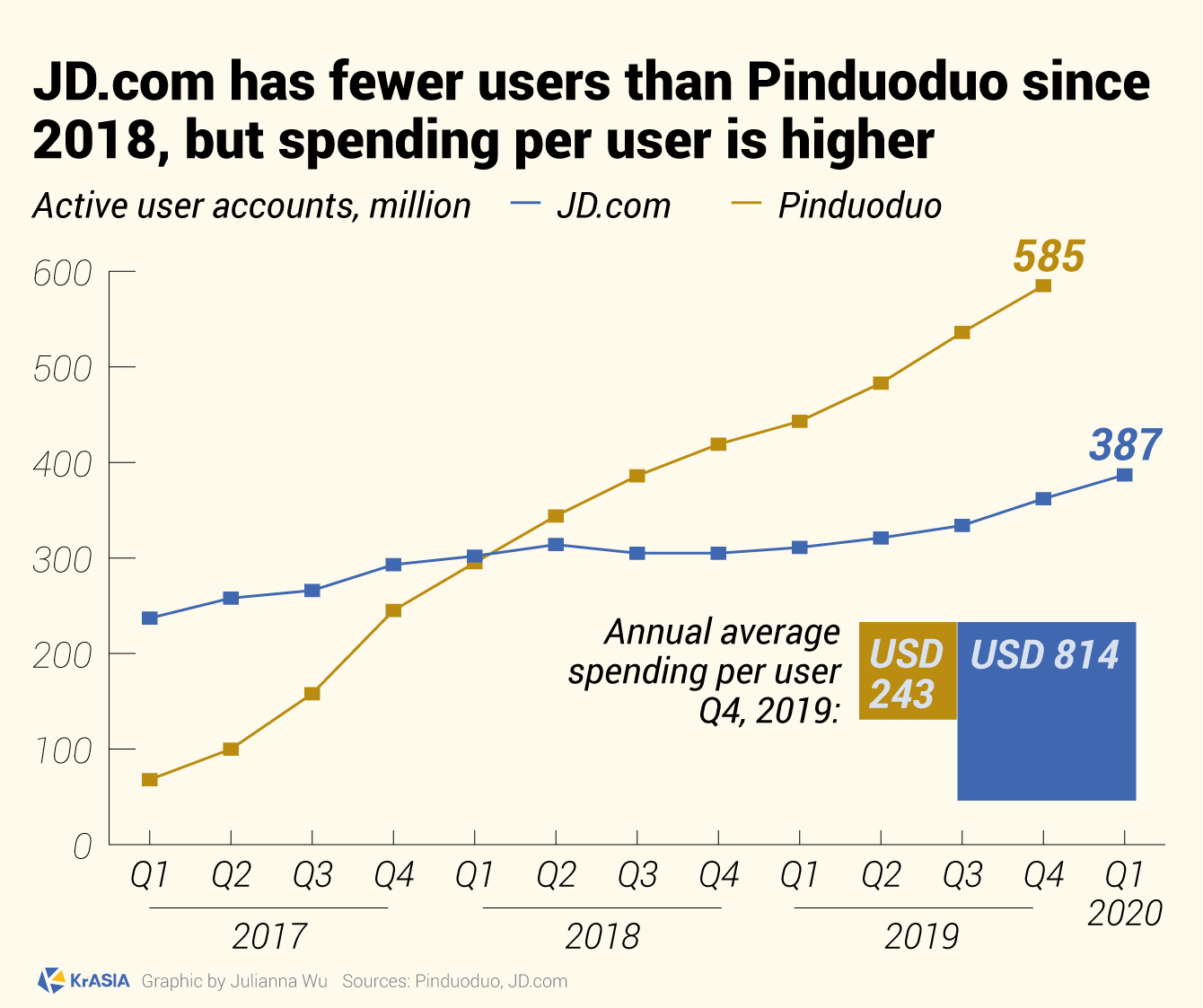

In early 2018, JD.com saw rival Pinduoduo (NASDAQ: PDD), an online store rose as a preferable group-purchase choice among users in the lower-tier cities, surpassed its number of monthly active buyers.

Pinduoduo’s rapid rise pushed JD.com to begin its own pursuit of gaining the lower-tier city market.

“Similar to Q4 last year, over 70% of new customers in Q1 came from the lower-tier cities,” said CFO Huang: “The lower-tier city customers contributed over 50% of our fulfilled GMV in Q1, which sets a new record.”

Thanks to its lower-tier cities strategy, JD.com managed to grow its users even amid the global pandemic. The strategy also helped JD step out of a sloppy 2018-2019 period.

The number of annual active user accounts for JD.com now stood at 387 million, 25% higher than the end of 2019, though still lags behind Pinduoduo.