China’s first e-cigarette stock Smoore International (HKG: 6969) listed on the Hong Kong Stock Exchange last Friday, and its share price climbed 106%, raising a total of USD 890 million which could rise to USD 1.02 billion if the overallotment rights are exercised, according to the company’s announcement.

Oversubscribed 116 times in the local Hong Kong market and 18.8 times internationally before its first trading day, Smoore hit a valuation as high as USD 18.9 billion on July 10, as IPO Zaozhidao reported.

Competing against nearly 1,200 different atomizer makers globally, Shenzhen-based Smoore is the world’s largest manufacturer of atomizers for vaping devices by revenue in 2019 with a total market share of 16.5%, the company revealed citing Frost & Sullivan’s research.

Its customers include tobacco companies like Japan Tobacco, British American Tobacco, Reynolds, and e-cig brands like NJOY in the US, and RELX, the biggest of its kind in China, as per its prospectus.

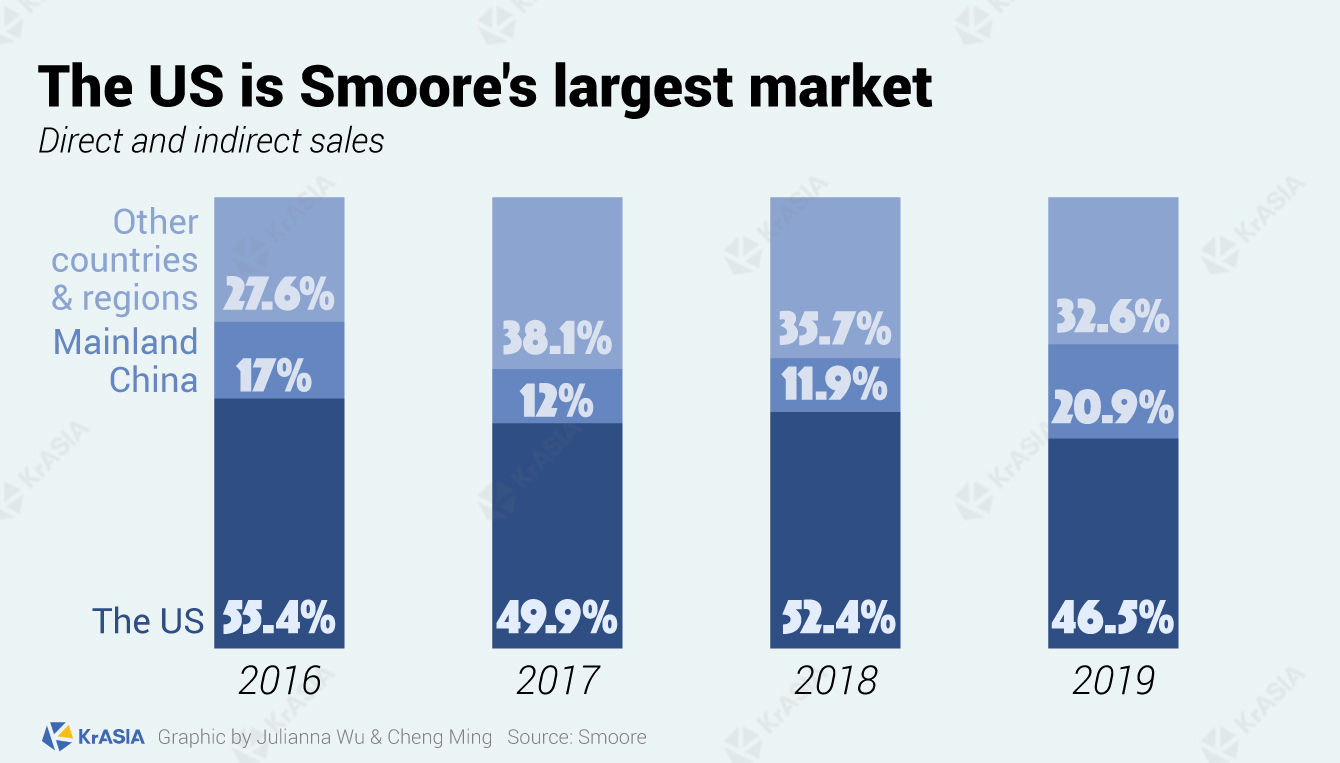

As of November 2019, China made 90% of the world’s vaping equipment, mostly in Shenzhen. The US is the biggest market for Smoore, as data revealed on its prospectus showed, while overseas markets accounted for nearly 80% of its sales in 2019.

2019 was a tough year for global manufacturers and sellers of e-cigs, as health concerns as well as rampant teenage vaping pushed governments to tighten the regulations on the industry, which was once a hotspot for investment in China. A total of 13 fundraising deals collected nearly RMB 1.3 billion (USD 180 million) in the first half of 2019, as per China Venture.

Last September, US vaping giant Juul pulled its products off the shelves of Taobao and Tmall, China’s two biggest e-retailers, after the US government banned flavored e-cigarettes due to a handful of deaths and potentially hundreds of lung illnesses tied to vaping, KrASIA reported.

Later the same year, China’s State Administration for Market Regulation and State Tobacco Monopoly Administration jointly issued a circular to ban the online sales of all electronic cigarettes to protect teenagers from harm, leaving local brands to access the country’s 300 million smokers only through offline channels.

In 2019, Smoore generated revenue of USD 1.08 billion, while net profit was USD 310 million.