Taking a break from all the overwhelming news on COVID-19, stock market collapse, imminent funding drought and Trump tweets, my twitter feed is abuzz with the confirmed news of Facebook’s USD 5.7 billion investment in Jio Platforms Ltd. This may just be another masterstroke of an investment which will pay Facebook handsomely much like its acquisitions of WhatsApp and Instagram.

You can analyze this investment through different lenses. The most straightforward way is to start ascertaining the ‘data value’ of this investment. I’ll refrain from exploring this angle and strive to focus on other strategic implications for Facebook, especially WhatsApp, and for the consumer internet market in India.

Facebook’s USD 5.7 billion investment not only secures a 9.9% stake in Jio Platforms, the digital services arm of the Reliance group but also grants access to 388 million subscribers of Reliance Jio Infocomm Ltd, a fully-owned subsidiary of Jio Platforms. According to me, the most valuable piece of the deal is the corporate partnership between WhatsApp and Jio Platforms to create a WeChat-like “super-app” for India. This move was a long-time coming given Facebook’s recent investments into Indian startups and collaborations with domestic VCs to build startup incubators. On top of it all, Mark Zuckerberg had outlined his ‘WeChat plans’ earlier last year but couldn’t find the right market, the right infrastructure or the right partner to achieve his grand goals. In Jio, he has found all of the above.

Important strategic benefits for Facebook from the Jio investment:

- Facebook can now build well-integrated consumer & SMB payment platforms enabling P2P, B2C transactions as well as commerce through WhatsApp.

- Facebook can now better penetrate tier-2/3 India leveraging Jio’s reach, strengthen Facebook’s position in the Indian social media space and overcome the serious threat of ByteDance’s rapid emergence in the last 3–4 years.

- Facebook’s last big venture in India-‘Free Basics by Facebook’-didn’t fly due to regulatory hurdles. But now with a partner in Reliance, it can fulfill its ‘Free Basics’ dreams and more as it has also earned what we can call ‘Government Capital’.

What does the future hold for WhatsApp?

WhatsApp has primarily been a messaging platform serving over 400 million monthly active users in India with a dominant market share of 82% for close to a decade now.

Fun fact: Tencent was reportedly on the brink of purchasing WhatsApp in 2014 but an untimely surgery for CEO Pony Ma allowed Mark Zuckerberg to get in there first.

Despite its dominant market share, WhatsApp was slow to move on their payments product and didn’t capitalize on UPI as much as Google did with Tez/Google Pay. Despite its vast penetration and usage, WhatsApp let Google Pay take the FinTech game away thanks to Facebook’s data localization issues and Google Pay team’s masterful customer acquisition and retention strategies in India.

Another low-hanging fruit for WhatsApp was the growing demand and usage from India’s SMB sector. Realizing the opportunity, Facebook launched WhatsApp Business in 2018 but was only able to register five million out of the 60+ million micro and small businesses who were already using WhatsApp to conduct their businesses in some shape or form.

I have long believed that WhatsApp in India has a strong case to become the WeChat of India and now with all ingredients-infrastructure , partnership and regulatory clout- it can work towards realizing the following goals:-

a) Build a consumer and SMB commerce layer

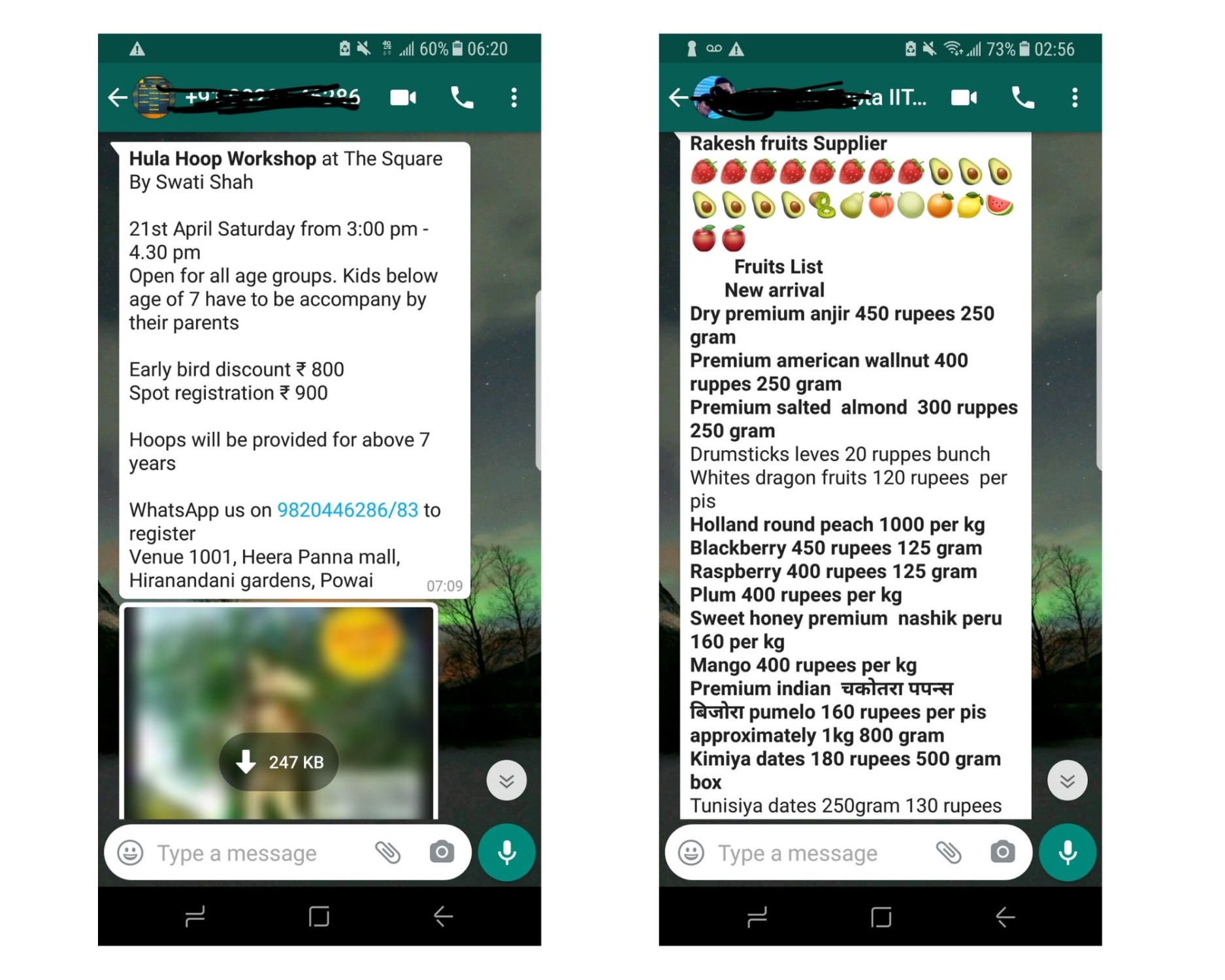

India has over 60 million micro, small and medium businesses and most of these businesses are currently conducting their business, be it communication, transactions, delivery, on WhatsApp. As shown in the picture below, one such example is a fruit vendor in Powai (Mumbai) who advertises the produce, collects orders and coordinates delivery to his regular customers — all on WhatsApp. There are nearly 30 million such micro and small business users who can be empowered by JioMart and WhatsApp. Facebook’s investment in social commerce platform Meesho also ties in well with this goal.

b) Improve adoption of WhatsApp Pay and explore non-payment use cases

WhatsApp Pay has tremendous network effects for P2P payments. Yet owing to the slow roll-out it hasn’t been able to garner the appropriate level of adoption compared to the first movers such as Paytm and Google Pay. Coming to B2C payments, WhatsApp Pay has almost zero foot print. This can be attributed to the aggressive merchant acquisition strategies of Paytm and Google Pay and the consequent large-scale adoption of these payment systems by online & offline merchants.

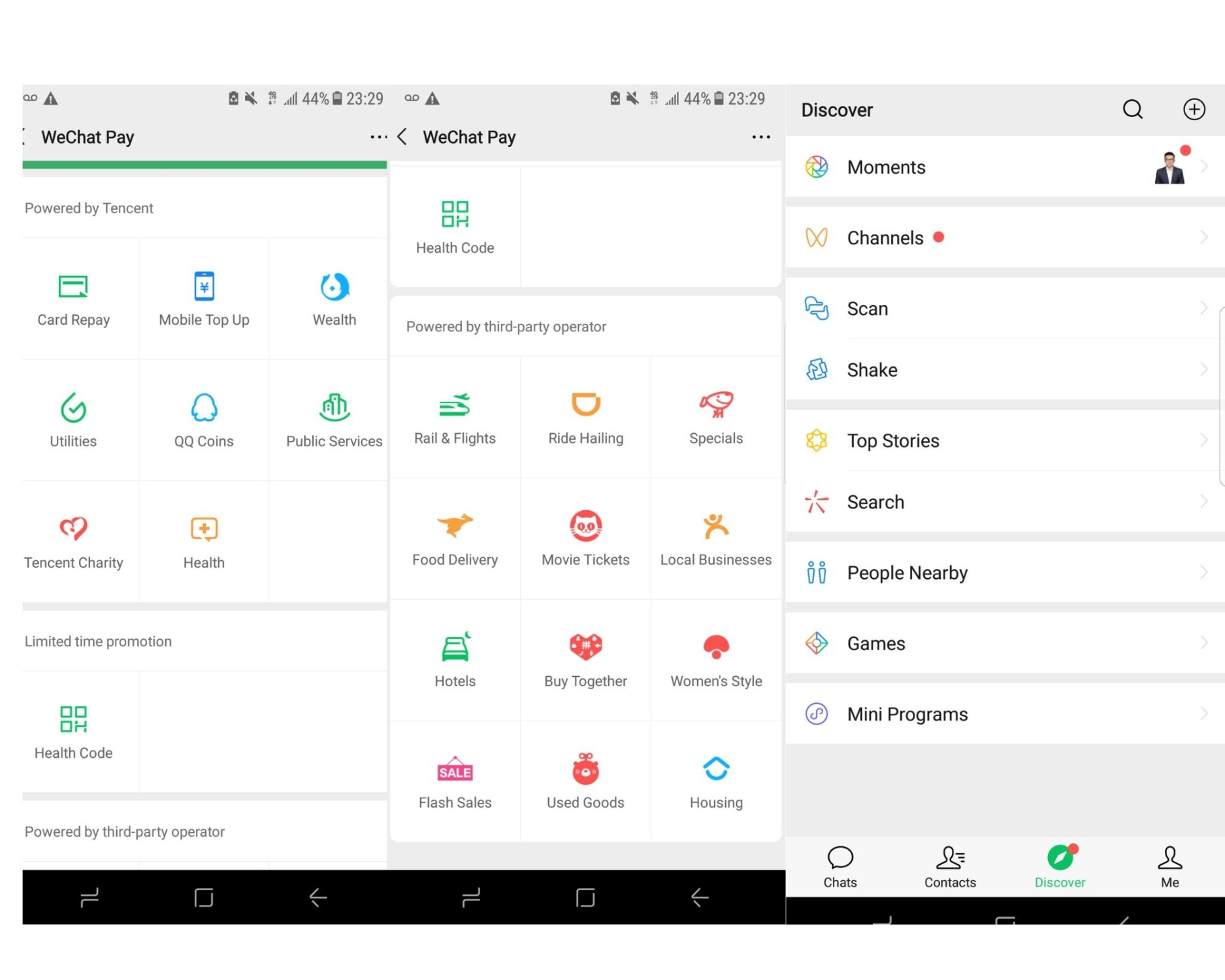

On a comparative note, WeChat’s payment system WeChat Pay or Weixin Pay has a market penetration of 84%. And WhatsApp can now hope to achieve that level of penetration and adoption through the vast network of JioMart, Jio Retail and Jio Pay.

I believe payments is just the first step. As can be seen in the following screenshots of the WeChat Pay application, WhatsApp Pay can start expanding its platform beyond payments and start incorporating wealth management and micro lending, among other things.

c) Explore monetizing WhatsApp through ads

Facebook’s bread and butter has been ‘ad revenue’ — which consistently grew at a double-digit rate till now but Facebook hasn’t yet had a chance to monetize WhatsApp. This is Facebook’s chance to explore introducing contextual ads into WhatsApp.

Below are the screenshots of ‘Official Accounts’ feature in WeChat. This feature serves primarily as a list of ‘subscriptions’ for a) News, b) Updates and c) Advertisements. WhatsApp can introduce a similar feature in India and start providing highly contextual information, advertisements and deals. In the figure below, the left most figure shows advertisements and personalize deals from the retail brand Uniqlo and the right most figure shows news and updates from an educational institution (Peking University).

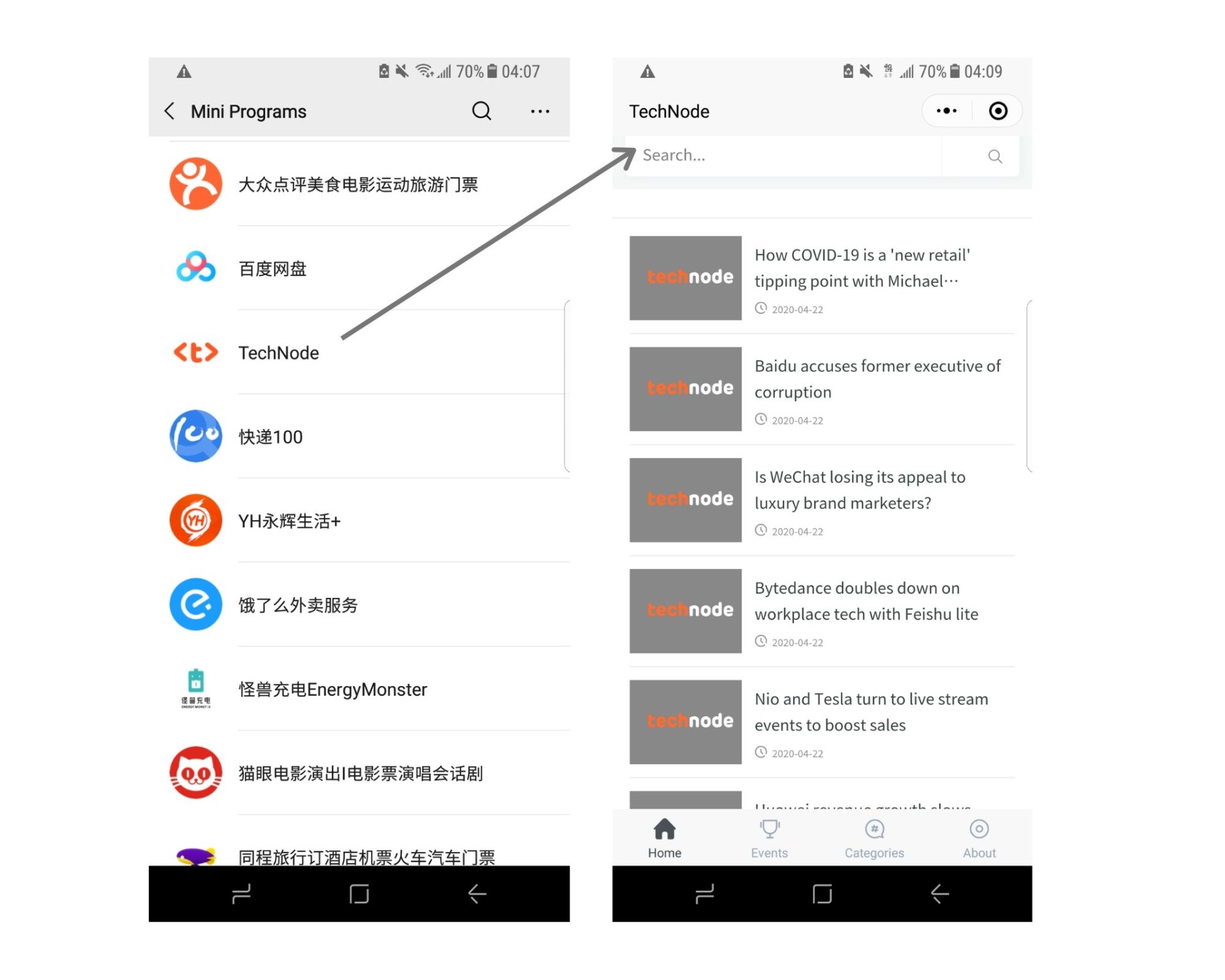

d) Become the ‘Super’ app to access other ‘mini-programs’ and services

In the following screenshot, you can see all the third-party applications I have accessed through WeChat in the form of ‘mini-programs’. Mini-programs essentially provide a native user experience while the user is accessing a third party’s application without leaving the WeChat ecosystem. Through the ‘mini-programs’ feature, businesses can build deep integrations with WeChat and WeChat Pay so as to gain access to and serve clients easily. The incentive for the user to use mini-is that she/he doesn’t need to install multiple applications or maintain multiple accounts or struggle with any payment friction.

WhatsApp can potentially offer a music mini-program (through JioSaavn), a learning mini-program (through Jio’s Embibe or Facebook’s investment in Unacademy), a video streaming mini-program (through Voot) as well as a news mini-program (leveraging Network18). Take a moment to observe all the offerings under Jio Digital Services (which are strikingly similar to WeChat’s mini-programs) and how they can readily tie into the WhatsApp universe.

What are the risks?

a) The execution risk remains a major cause of concern based on Facebook’s prior actions. In the past Facebook hasn’t been quick to leverage favorable infrastructure and policy shifts. It also hasn’t shown great agility and speed in incorporating India specific features which can guarantee quicker adoption.

b) Another strategic concern would be whether the increased adoption of WhatsApp may cannibalize the growth of Facebook’s other assets in India. This risk could potentially be mitigated by building inter-linkages between apps and deeper integrations.

c) I foresee challenges emerging from differences in work culture and business practices given Facebook is a Valley-based tech firm while Jio (as part of Reliance) was built under a traditional Indian conglomerate.

d) Potential anti-trust regulations may emerge if Facebook and Jio’s collaboration results in a monopolistic share of the market.

What is the future for Facebook-Jio?

The collaboration between Facebook and Jio presents a unique opportunity in India to build a true software-hardware closed-loop ecosystem capturing both online and offline user behaviors.

Facebook has the largest communication and social media platform in India while Jio on the other hand brings together a huge existing user base, a retail network, a media network, along with hardware in the form of its smartphones. This enables deeper integrations, the kind which have not been possible by either party or any other market player till now. China has seen Alibaba and Tencent create large multi-product closed-ecosystems and I strongly believe that its time for a similar innovation to take shape in India.

Dhanasree Molugu is an MBA candidate at University of Chicago Booth School of Business & interns with Foundation Capital. This article first appeared on Medium.