2019 has been yet another exciting year for e-sports fans in China: in November, the country’s team took home the World Championship of League of Legends crown for the second consecutive year.

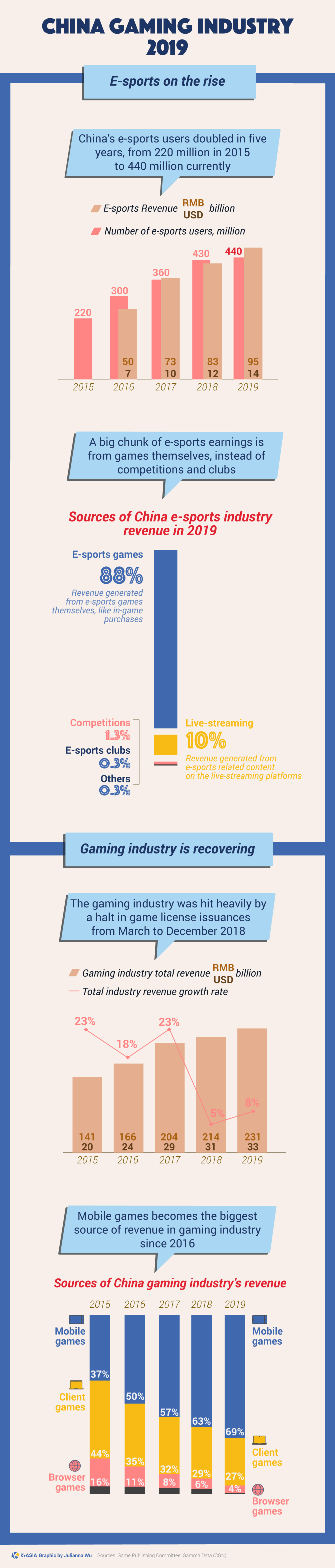

Victory brings in money; the e-sports industry in China generated a revenue of USD 14 billion (RMB 95 billion) in the past year. This was a 13.5% increase from 2018, according to the Game Publishing Committee, the government body in charge of issuing game licenses in China. The Committee released the annual China Gaming Industry Report on December 19th.

Nearly all of the revenue came from e-sports games’ in-game spending, up to 88%, while live-streaming took 10%, and competitions 1.3%, among others, said research company Gamma Data.

“If the e-sports industry wants future development, midstream enterprises (meaning clubs and competition organizers, who work between game makers and content distributors) need to promote their monetization ability,” said Gamma Data in their 2019 report.

Outside of the electronic battle arenas, 2018’s halt on issuing game licenses had made this a tough year for many game makers. While the industry still managed to increase its revenue from the year before, 2018 saw a sharp drop in growth rate: from 23% in 2017 to 5.3% in 2018, as the same report showed.

Since the government restarted the approval process for games at the end of 2018, China’s gaming industry is recovering, with a small but steady 7.7% growth in total revenue in 2019, according to the report.

Another noteworthy trend highlighted in the report is how the mobile phone has become the dominant platform for both casual gaming and e-sports in China. Taking up nearly 70% of the gaming revenues, mobile online games have pushed browsers, console, and standalone games to the edge, leaving less than 30% of the earnings to client PC games.

Mobile e-sports games maintained a 25.8% aggressive growth in revenues, bringing in USD 8 billion (RMB 58 billion) in 2019, while client PC games, to which League of Legends, the world’s biggest PC game by player numbers, belongs, saw a second consecutive year decrease to USD 5 billion (RMB 37 billion).

Chinese game publishers have earned a total of USD 12 billion (RMB 83 billion) from overseas markets in the past year, with the US being the top market with 30.9%, followed by Japan with 22.4%, and South Korea with 14.3%, the report said.