Political uncertainty in times leading up to major elections can affect the investment climate of a country. Major investment decisions often get put on hold.

Most experts, however, are confident Indonesia’s 2019 general elections will see local and foreign investment remain stable. Especially investments into the technology sector appear to be unaffected by a potential regime change and will, in fact, grow to make up an even larger chunk of overall foreign direct investments in the country.

“Normally there would be a slowdown in terms of deals and investment during the election year or even in the half year before the election,” Abadi Tisnadisastra, a corporate lawyer in the finance and investment space told KrASIA. “However, I don’t think there will be any dramatic changes this year.”

On April 17, citizens of the world’s third-largest democracy will cast their votes to elect the president and vice president, as well as the delegates of the consultative assembly. This year’s vote pits Joko Widodo -or Jokowi as he is fondly called- and Prabowo Subianto against each other, the same presidential candidates who already faced off in 2014. Accompanying Widodo in the race is cleric Ma’aruf Amin, while Prabowo is joined by businessman and former Jakarta vice governor Sandiaga Uno.

According to Tisnadisastra, concerns over the political and economic situation were actually more pronounced before the names of candidate pairs were announced.

“There were discussions about who would join the race. Would it be someone controversial? Would he bring totally different types of policy? But now since the presidential candidates are the same people from the previous election, the public and investors have anticipated what kind of programmes and approaches they’ll bring to the table.”

Tisnadisastra believes whether the current administration continues with a second tenure or it changes completely, there won’t be any major alterations in terms of policy and investment regulations. Moreover, he said that investment in the digital industry will continue to grow this year.

“Usually investors would wait and see even a year before the election and we were worried that investors would lose appetite for Indonesia. But it didn’t happen this time. Last year, we saw how big investors made an aggressive investment in Indonesia, including the major funding by Softbank in Tokopedia. ” Tisnadisastra said. “Indonesia’s digital economy has huge potential, so there is no resistance by investors, even when we’re facing political changes.”

Yansen Kamto, an investor and entrepreneur at startup ecosystem Kibar echoes this belief. “As long as a company/startup can prove that its product has high demand and value, then VC will invest without hesitation, despite the country’s political situation,” he told KrASIA.

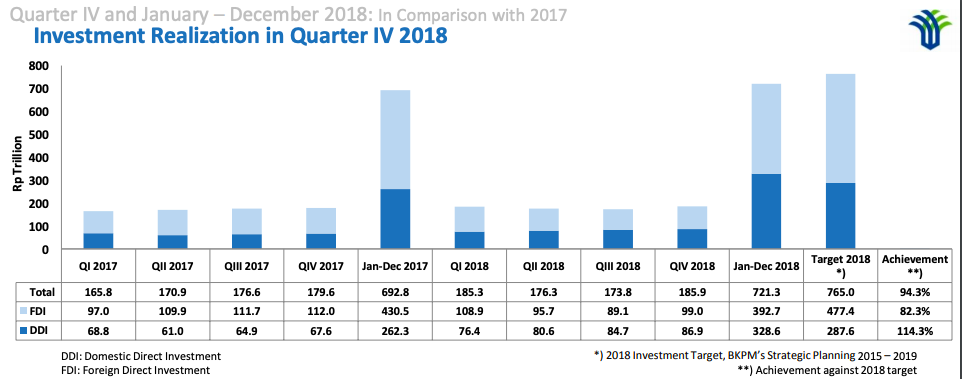

Indonesia’s Investment Coordinating Board expects direct investments totaling IDR 792 trillion (US$56.7 billion) this year, 9.8% higher than last year.

Domestic investment in 2018 reached IDR 328.6 trillion (US$23.5 billion), up by 25.3% compared to 2017. Foreign Direct Investment (FDI) in 2018 amounted to IDR 392.7 trillion (US$28.1 billion), but this represented an 8.8% drop compared to last year. According to the investment board, the decline was not caused by political uncertainties but is in line with a global downward trend in direct investment. “Our data is consistent with global trends where according to UNCTAD (The United Nations Conference on Trade and Development) international direct investment fell 20 percent compared to 2017,” the investment board’s chairman Thomas Lembong told local press.

Digital industry investments make up a growing chunk of FDI

Like Tisnadisastra, the investment board also assumes that global investors are unfazed by the 2019 presidential elections, no matter the outcome. The continuity and stability of a second Jokowi term might be slightly preferable, but Prabowo’s gestures also indicate that his administration will be pro-investment.

According to Lembong, e-commerce is one of the sectors that drive investments to Indonesia. E-commerce and the overall digital industry can make up 15 to 20% of the total foreign direct investment that enters Indonesia each year, “Foreign direct investment [in] e-commerce is growing at a time when global FDI is down, so the proportion is increased,” Lembong said. “Without the inflow to e-commerce and the digital sector, FDI in the last five years would have been down.”

Lembong sees that the trend will sustain and he even expects that there will be a little reconfiguration if the unicorn companies start to enter the stock market.

Some of Indonesia’s largest tech companies, like Tokopedia and Go-Jek, have each recently raised big funding rounds north of US$1 billion.

How Jokowi and Prabowo view digital economy policy

President Jokowi is known to be consistent in promoting Indonesia’s digital economy. One of the focus areas of Jokowi’s economic programme for the 2019-2024 term is to foster entrepreneurship, especially from the young generation or millennials, in order to face the 4.0 industrial revolution.

This target will be realised through a number of plans, including: the provision of entrepreneurial education and training facilities; guaranteeing ease of business and increasing co-working space facilities and establishing access to the internet in public places; facilitating startups advancement by developing incubators that are also supported by the business communities, state-owned companies, universities, and angel investors; and encouraging the development of export-oriented marketplaces.

The promise is de-regulation and support of entrepreneurial activities. At the World Economic Forum (WEF) in Davos, the Indonesian government represented by Thomas Lembong and IT Minister Rudiantara conveyed its intention further develop the country’s tech startups. “We are going to act less as a regulator and more as a facilitator and accelerator,” Rudiantara told Nikkei Asian Review.

Meanwhile, the challenger Prabowo also has several programmes for improving the country’s digital economy, although they are less specific. Prabowo’s rhetoric has been more nationalistic, stressing that he wants to encourage the growth of an innovation-based startup industry that will open up new jobs for the community. Prabowo also promised to improve the connectivity and security of IT and telecommunications infrastructure from the threat of cyber attacks.

It’s Prabowo’s running mate Sandiaga Uno, a former entrepreneur an investor, who is perhaps better known for his links to digital economy development programmes. Uno had served as vice-president of Small and Medium Enterprises at the Indonesian Chamber of Commerce from 2009 to 2010. Uno promised to focus on supporting the development of Micro, Small, and Medium Enterprises (MSME), a core element of which is to encourage MSMEs to “go digital” – ie, make smarter use of software, digital marketing, and e-commerce to grow their business.

In an uncertain global investment climate and with digital economy investments in Indonesia already accounting for up to 20% of all foreign direct investment, neither candidate pair is likely to introduce policies that would counteract this trend.

“I think that President Jokowi’s government has been very supportive of the development of the creative economy and the digital economy,” said Kamto. “The current administration is showing their support from every angle and whoever wins the election later, they need to continue this spirit, as technological advancement is an important key to economic development.”

Editor: Nadine Freischlad