For the largest-ever listing in the Indian corporate history, SoftBank- and Ant Financial-backed fintech decacorn Paytm’s debut on local bourses was tepid.

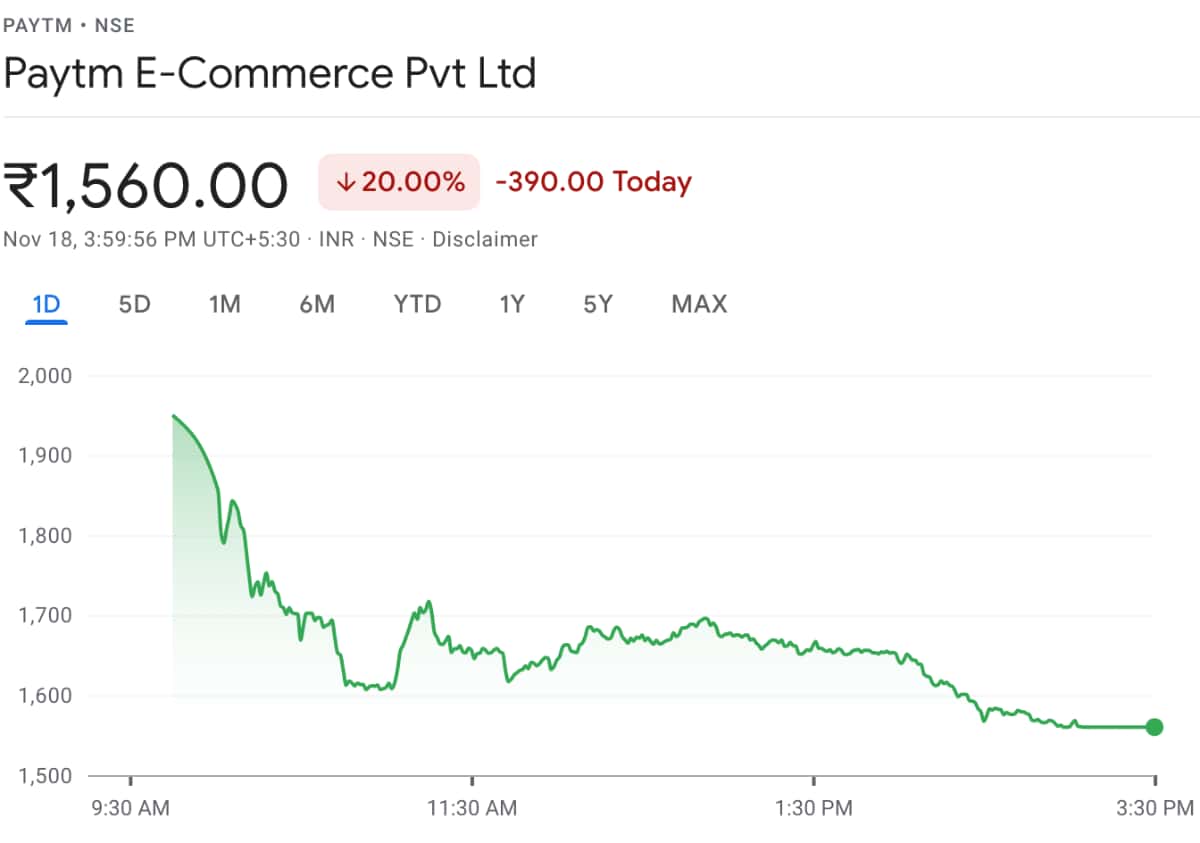

On Thursday, the Noida-headquartered company listed its shares on stock exchanges at a discount of over 9%. The fintech major’s shares opened for trading at INR 1,955 on BSE and INR 1,950 on NSE against the issue price of INR 2,150. Its stock price crashed almost 20% within the first 15 minutes of trading.

Paytm’s shares closed at an intraday low of INR 1,564 and INR 1,560 on BSE and NSE, respectively—dropping over 27% from the issue price.

However, given the massive size of the issue—85.1 million shares for which the company fixed the price band of USD 28–29 (INR 2,080–2,150) apiece—Paytm’s market capitalization still crossed INR 1.01 trillion (USD 13.6 billion) on the first day of trading. Although it meant the company’s valuation that reached USD 20 billion after its IPO last week, dropped by almost USD 6 billion.

Paytm’s USD 2.4 billion IPO—the country’s biggest so far—comprised a fresh issue of INR 830 billion and an offer for sale (OFS) by existing shareholders worth INR 100 billion. The three-day IPO, concluded on November 10, was subscribed 1.89 times, with the retail portion being booked 1.6 times. Prior to the issue opening, Paytm garnered interest from 122 institutional investors in the anchor round, who bought more than 38.3 million shares for a total of USD 1.11 billion.

Investment banking experts believe Paytm’s expensive valuation, lack of clarity on the path to profitability, and cutthroat competition to be the key reasons behind its weak debut.

According to Neil Bahal, managing director of Negen Capital, a Mumbai-based investment management firm, the listing at the discount of 25% over the issue price is justified.

“Paytm listed as we expected. First, it was extremely expensive for a loss-making company at 49 times of revenue,” Bahal told KrASIA. “Secondly, huge losses do not help. And lastly, investors do not have the confidence whether the company can achieve profitability or not.”

Bahal believes the investor’s focus will shift to Paytm’s business evolution, and the company will need to chart a path to profitability.

“They have been living in a bubble of revenue growth, heavy losses, and cheap funding,” he said. “Soon, they will realize that the stock market only cares about profitability.”

Sonam Srivastava, founder of Wright Research, who manages a smallcase (portfolios of stocks or exchange-traded fund under one common theme or strategy) related to the innovation theme at investment platform smallcase, said while Paytm has added INR 1 trillion in market cap to the Indian market with its listing, it has had a disappointing start on the public markets, with many questioning its business model and sky-high valuation.

“Public markets are a place that focuses more on profitability and less on prospects. There have been concerns about Paytm losing market share in its biggest business, which is payments, and not having a vision for its other financial services business,” she said. “These concerns are justified and immediate, and the vision of the company to tackle them will speak of its prospects.”

Notably, Paytm had a 12.86% market share in UPI transactions—which stood at 4.21 billion in October 2021—against PhonePe’s 46% and Google Pay’s 34.4% market shares, respectively.

However, she said she remains bullish on the prospect of fintech in the long term, and if Paytm can tackle its inefficiencies, it could be a good long-term investment.

Tepid fintech IPOs

In a recent note, Sydney-headquartered investment banking and financial services firm Macquarie said Paytm’s business model “lacks focus and direction” and that the company is a “cash guzzler.”

Analysts at Macquarie believe achieving scale with profitability is a big challenge for Paytm aside from regulations and competition, and gave the company an underperforming rating.

“Dabbling in multiple business lines inhibits Paytm from being a category leader in any business except wallets, which are becoming inconsequential with the meteoric rise in UPI (Unified Payments Interface) payments,” it said in a note. “Competition and regulation will drive down unit economics and growth prospects in the medium term, in our view. Unless Paytm lends, it can’t make significant money by merely being a distributor.”

Interestingly, Paytm’s biggest rival PhonePe, in a statement made one day ahead of Paytm’s market debut, said it clocked more than 2 billion transactions across payment channels in October, doubling the numbers which stood at 1 billion in February 2021. Since last December PhonePe has topped the ranking of UPI monthly transactions in India.

Paytm is the third fintech company to go public this month. PB Fintech, the parent company of insurance platform Policybazaar and credit marketplace Paisabazaar, went public on November 15, listing its shares at a 17% premium on the issue price of INR 980. The stock closed at a 22.74% premium over its IPO price, which valued the company at USD 7.27 billion, making Policybazaar the world’s most valuable insurance marketplace.

However, PB Fintech’s performance paled in comparison with Zomato and Nykaa, the two high-profile startups that went public over the last few months. While Zomato was listed at a premium of over 52%, Nykaa made its public debut at a premium of 78%. Both Zomato and Nykaa crossed the market capitalization of INR 1 trillion on their debut day.

Similarly, Fino Payments Bank, a Mumbai-based digital banking firm that made its stock market debut on November 12, listed at a discount of over 5% compared to its IPO issue price of INR 577 apiece.

Experts believe Paytm’s tepid listing may serve as a lesson for other internet companies that are eyeing public markets over the next several months.

“This poor Paytm IPO will force the next set of tech companies to come at reasonable valuations. In a way, this is good for investors in the long run,” said Bahal. “Investors should not lose hope. Technology is the future, and a lot of wealth will be made in tech and internet stocks.”