An increasing number of Indian family offices are eyeing a bigger stake in the burgeoning local startup ecosystem—the third-largest in the world, enticed by the high returns startups have given to their backers since last year.

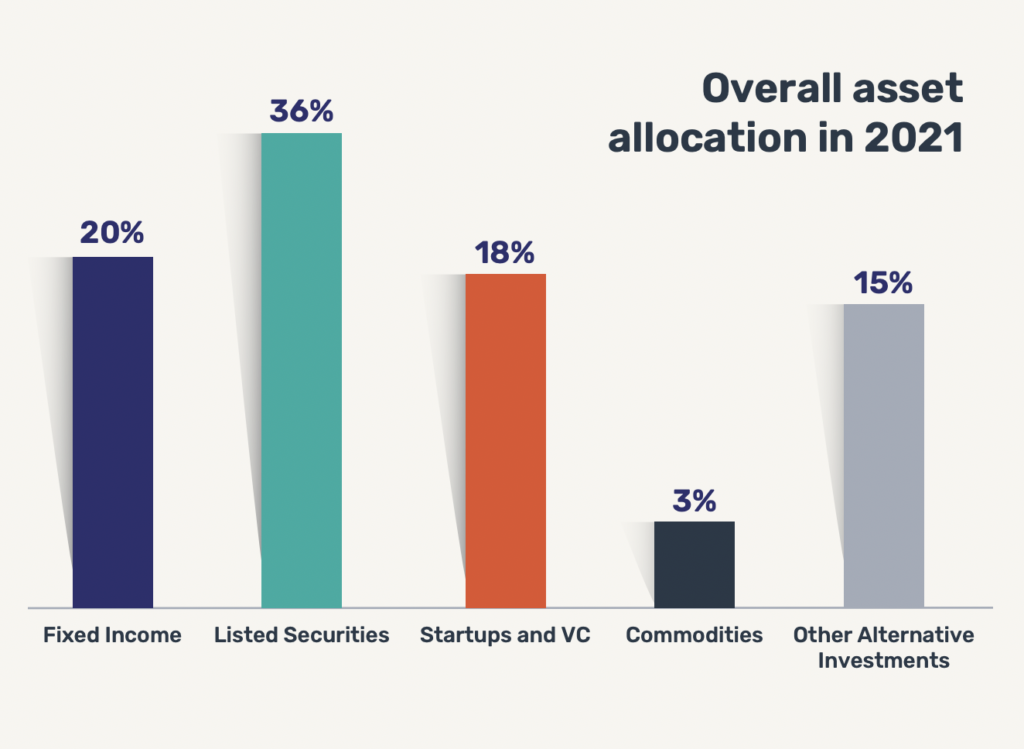

This class of investors is now allocating up to 18% of their wealth for private market investment—in startups and VC funds, found a new report by trica, AZB & Partners, and EY. Titled “The Private Market Monitor,” the report surveyed over 100 family offices and ultra-high net worth individuals (UHNIs)—those with wealth over USD 30 million—between July and October 2021.

Family offices invest in assets to preserve and grow money for the rich. A family office can be a single-family office that is established in-house by ultra-rich families, or a multi-family office, set up by professional wealth managers who serve various rich clients.

“Private market investments remain the alternative investment of choice comprising 18% of the overall pie,” the report noted. “This is quite aggressive when compared to a 15% allocation to other alternatives (real estate, infrastructure, art, etc.), 20% allocated to fixed income, and 36% to listed equities.”

This means private market investments are now half of the public market investments in listed companies that have been the preferred investment option for business families for almost two decades.

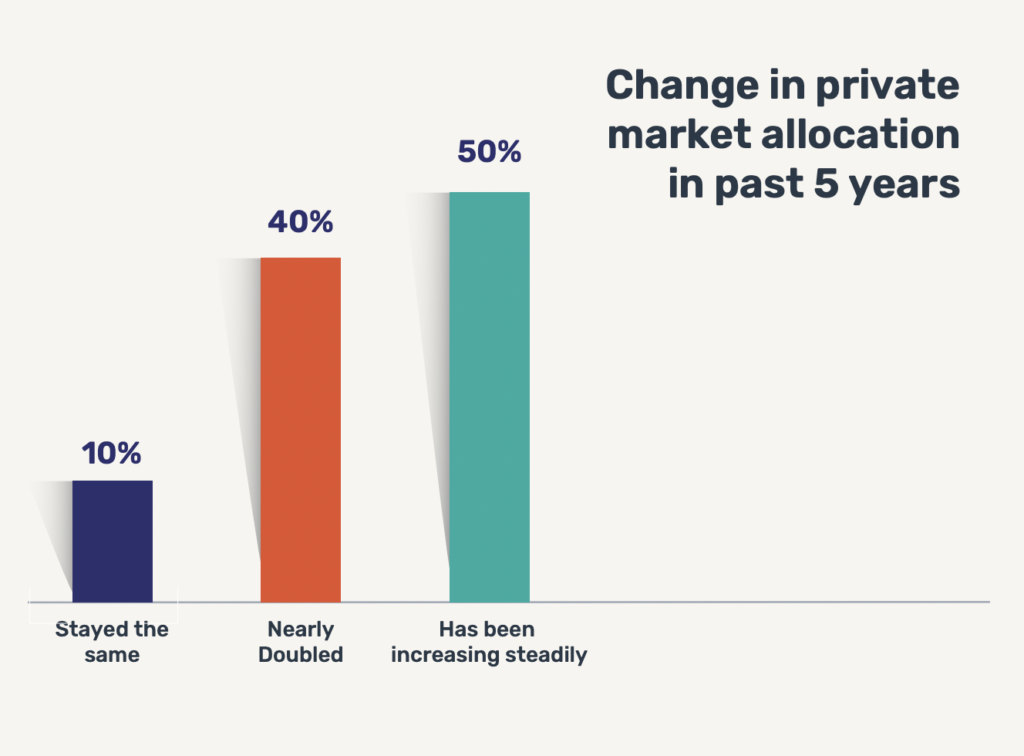

Since 2016, over 40% of family offices have doubled their allocation to private markets, which used to range between 5–10% of their overall asset distribution. Overall, 50% of the family offices have stepped up investments in startups and VCs, the report added.

Family offices are beefing up investments in the startup ecosystem, given local startups’ disproportionately high growth and high returns to their backers, believes Nimesh Kampani, CEO and co-founder of trica, which helps family offices and UHNIs invest in startups.

“The entire startup ecosystem has exponentially grown over the last two years. The COVID-19 pandemic changed consumer behavior and now they are used to ordering online with a click of a button, which is fuelling the growth of consumer internet startups,” Kampani told KrASIA. “Still, only 140 million or about 10% of Indians are buying things online. There is huge potential to grow due to the massive untapped market.”

The interest of family offices and UHNIs in startup investing has also piqued because a lot of wealth has been created due to startup IPOs this year, he added. A string of startups, including food delivery giant Zomato and omnichannel beauty retailer Nykaa, made bumper market debuts and generated high returns for their investors earlier this year. The report noted 36% of family offices are optimistic about exit opportunities in the startup ecosystem.

Emerging trends shaping family office investments

As family offices emerge as an active investor segment in the startup ecosystem, they are keen to come onboard startups’ cap table directly, rather than backing them by investing in VC funds. This is evident from the fact that the biggest chunk of money that family offices set aside for investing in the private market goes directly to startups.

The private market portfolio of the family offices comprised 47% direct startup investments, while 32% went to VC and PE funds and 11% to venture debt funds, the report found. Furthermore, in the next three to five years, 75% of family offices are likely to make direct startup investments alongside Indian public market equities, it added.

“The family office ecosystem has matured. They have professional teams with fund managers. The younger generation—which has more exposure to startups—has also come to the fore,” said Kampani. “When you become an LP (limited partner) to a fund, there is always a cost involved. Since family offices have knowledge and expertise in-house now, they are turning to direct startup investments, looking for companies where they can find adjacencies and synergies to their family’s core business.”

About half of the family offices surveyed preferred the seed to series A stage to enter a startup investment. They also showed an inclination to enter at growth stages through secondary transactions—buying stakes from existing backers—while keeping a higher allocation for early-stage primary transactions, as per the report. Over 40% of family offices said they favor late to pre-IPO transactions, as they like to back soon-to-be public companies.

“The inclination of family offices to opt for direct startup investments is a sign of increased acceptance of the asset class, given more liquidity and access (to startups),” the report added.

Notably, more and more business families from smaller cities, with over INR 1 billion of annual turnover are opening their purse strings for startups investments, driven by the next generation which is better educated and more in tune with current startup trends.

“We are onboarding many tier 2, tier 3 business families which want to invest in startups. But they are behind the curve at the moment compared to ultra-rich families in bigger cities,” said Kampani.

In addition, a new category of first-generation UHNIs has been created with startup founders and entrepreneurs making fortunes with acquisitions and public offerings. These individuals are now are proactively exploring the family office route of managing their wealth and re-investing into startups.

“Over the next decade, wealth creation will happen in the private market, and Indian family offices are well prepared for that,” added Kampani.

Earlier in June, a report by 256 Network and Praxis Global Alliance India, projected that Indian family offices will invest USD 30 billion in local startups by 2025—constituting 30% of the USD 100 billion capital Indian startups are likely to raise over the next four years.