For Muslim investors, the desire to remain faithful to religious principles in financial endeavors has led to the accelerating growth of a niche market for shariah-compliant products and halal investment.

The halal industry has caught the eye of major private equity institutions like Gobi Partners, and is expected to continue growing rapidly as the world’s Muslim population, and the customer base for such services, will increase by 35% by 2030, especially in Africa and Asia.

Even though one of the largest IPOS ever—for Saudi Aramco—adhered to Islamic law and was given the nod by the kingdom’s Grand Mufti, few people outside regions where Islamic finance plays a crucial economic role realize what this industry entails. Here are five things to know about the market for halal investment, and why investors are getting on board.

1. What is halal investment?

Halal investment, more accurately known as shariah-compliant investment, involves investing in compliance with the principles of Islamic law. Requirements for shariah compliance are comprehensive and subject to constant debate in theological and practitioner circles.

Yet, there are three key principles that are generally agreed upon.

Transactions cannot involve riba

Riba refers to gaining interest from loans or deposits, even if the interest charged is not in excess of market rates. The general idea is that charging interest is tantamount to usury and involves inequitable exploitation of resources.

For instance, creditors with collateral and cash flow benefit from “unearned income,” while debtors need to expend more labor to generate profit from these loans, making the division of profit inequitable between parties.

Investment in “haram” industries is prohibited

Haram is the opposite of the word “halal,” and refers to things that are unlawful according to Islamic law. Some examples of haram industries are military equipment, pork products, alcoholic beverages, gambling, and certain sectors of the entertainment industry like pornography.

Investing based on gharar (uncertainty) and maysir (gambling) are off the table

Gharar refers to highly uncertain transactions or transactions that run contrary to the idea of certainty and transparency in business.

Most derivative financial products, such as futures, options, and forwards are prohibited. In a similar vein, maysir refers to the acquisition of wealth due to chance without the expenditure of effort.

2. What is driving the growth of shariah-compliant products?

The heavy requirements of shariah-compliant investment tend to confound those who structure mainstream financial products.

Islamic business financing

Interest rates are a central instrument in regulating both private and public finance transactions. They enable credit, which is the lifeblood of business.

To work around this, new models of risk-reward sharing have cropped up, such as generating profit-sharing rates where creditors act as partners in a particular investment together with their debtors.

This is arguably a more responsible way of harnessing capital for businesses—creditors are no longer guaranteed a return (based on interest fees), and instead, have to exercise oversight of how the capital is used in order to secure their revenue streams.

Takaful: Shariah-compliant insurance

Another example of a niche financial product is takaful, or shariah-compliant versions of conventional insurance. According to AIG, takaful accounted for around 2% of the USD 1.8 trillion Islamic finance market as of 2017.

Conventional insurance is a model based on risk transfer, as risk is shifted from the insured to the insurer at the outset, and potentially moved back should premiums be unpaid on schedule. Takaful, on the other hand, is a risk-sharing model, where premiums received from multiple members are pooled into a fund, with members mutually guaranteeing each other.

Sukuk: Halal portfolio ownership

Lastly, one big fish is sukuk, which are Islamic financial certificates that represent ownership in a portfolio of eligible existing or future assets. These have sprung up due to the prohibition on interest, which excludes conventional bond issuances.

Like conventional bonds, sukuk are viewed as having lower risk profiles compared to equity, while unlike conventional bonds, investors receive both partial ownership of the asset as well as profit payments generated over time, rather than a stream of interest payments.

3. Which institutions are turning to halal investment?

Sovereign issuers of sukuk arguably kick-started the growth of the Islamic finance market, by using their influence and financial weight to provide the principles, expertise, and funds to shape the market.

Malaysia issued the first sovereign sukuk in 2002. Since then, a slew of countries have followed suit. In particular, the UK was the first non-Muslim country to issue a sukuk, at GBP 200 million (USD 257 million) in 2014. This set a precedent for the western world and was heavily oversubscribed, attracting orders of GBP 2.3 billion (USD 2.95 billion).

Historically, sovereigns have taken the lion’s share of the world’s sukuk market. However, both public and private corporates have started to take a leaf out of this book too.

Aside from sukuk, banks offer a wide swath of general Islamic banking facilities for everyday consumers. This constitutes the largest share of shariah-compliant assets, especially in Malaysia and Indonesia, countries with two of the largest Islamic populations worldwide.

To cater to the mass market, indexes are also getting on board—and not just in Islamic countries. As early as 1996, the Dow Jones Islamic Market Index [DJIMSM] was the first attempt by any global index provider to create a measurement tool for shariah-compliant investors. In recent years, the trend has accelerated. In 2018, Singapore launched the FTSE ST Singapore Shariah Index to reflect the stock performance of companies in the Asia Pacific Region whose businesses comply with shariah.

Lastly, the asset management industry is also a major player, with Asia being the next frontier. In 2017, 106 out of 137 new global Islamic funds were launched from Asia. This has in part been driven by liberalization, deepening capital markets, and rising private wealth in the region.

4. Why are institutional investors looking at this market?

Firstly, traditional ways of debt financing through conventional bonds are excluded for large Islamic sovereign and corporate entities. Sukuk, however, is instrumental for large Islamic issuers who need to raise massive amounts of funds to finance national or corporate projects.

Even secular issuers are looking to sukuk. In 2009, General Electric became the first global multinational corporate to issue a sukuk (USD 500 million), in an attempt to diversify its funding base to non-Western sources.

Secondly, mass market products are needed to cater to increasing demand from consumers themselves. Stringent requirements for shariah-compliant financial products generate a product gap in the market. This creates a need to expand and deepen the variety of shariah-compliant assets.

According to PWC, the global Islamic population is expected to grow by 35% by 2030, especially in Africa and Asia, which is home to over 95% of the world’s Islamic population.

Demographic momentum in these regions is further spurring mass market shariah-compliant financial products as well. For instance, servicing the large unbanked market in many countries within these areas is a pivotal point of entry.

A rising middle class also generates demand for wealth management products with shariah-compliant characteristics. A growing number of older folk in these markets further spurs a call to retirement products such as Islamic pensions and asset management products.

Thirdly, due to its concordance with general environmental, social, and corporate governance (ESG) principles, there have also been attempts to generate more synergies between both tracks of investment. For instance, in February 2018, the Indonesian government launched a USD 1.25 billion sovereign green sukuk, the world’s first.

5. How do halal investment affect entrepreneurship circles?

The race for the shariah investment verticals has also bitten the entrepreneurship world. According to a report by the International Market Analysis Research and Consulting (IMARC) Group, the global halal economy is projected to reach USD 2.6 trillion by 2023.

On the entrepreneurship side, the robust growth of this market segment has led to the development of halal-focused startups. These tackle incumbent competitors head-on by offering better, and specifically shariah-compliant, products or services in industries that are ripe for disruption.

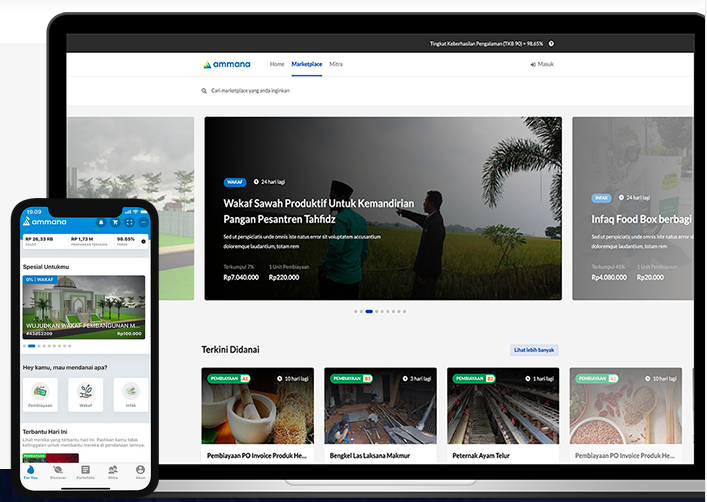

Examples include fintech companies such as Wahed, which describes itself as the world’s first automated Islamic investment platform, and Alami, a P2P service matching micro, small, and medium-sized enterprises (MSMEs) with funders.

Read more: 10 Halal-focused startups to watch in 2020

On the financing side, mudarabah (profit-sharing contracts) and musharakah (capital contribution partnerships) are two specific modes of Islamic private equity (PE) and venture capital (VC) that are slightly different from conventional PE and VC structures.

Such investors may select from prevailing methods for valuation, investment, and exit insofar as this is shariah-compliant. Shariah advisors are also appointed, as shariah compliance is a unique form of risk that needs to be handled delicately.

All Islamic financial products, including services provided by fintech companies, must comply with the regulations or standards set by the Shariah Board. Muslim majority countries like Indonesia and Malaysia have national shariah boards that have the overall authority on the frameworks and policies related to shariah governance.

In May 2020, Halal Angel Network, the world’s first organized group of halal angel investors, launched as well, with the aim of connecting angel investors with shariah-compliant startups.

Aside from PE/VC firms and angel investors that specialize in this niche market, even generally secular deal-makers have sought to cater to the market as well. This is generally by presenting shariah-compliant funding tracks to cater to demand from limited partners and entrepreneurs alike.

One example is Gobi Partners, which has coined the term “taqwa tech,” referring to Muslim entrepreneurs or startups focusing on technology to serve the demands of the Islamic economy.

With these exciting developments lined up, the halal investment economy is one that should not be overlooked in the years ahead.