Travel is the only thing you buy that makes you richer. However, it has been tough for online travel companies in India to make money. In fact, for most online businesses in India, balancing growth and profitability is the hardest decision. This is partly because most companies are willing to lose millions of dollars every year to try and grow faster than the market, given there is still so much growth left to tap into.

Profitability and growth are like the two ends of a see-saw in a children’s playground. It is simple to tip anyone’s end by exerting a little more pressure, however, it is extremely hard to balance the two ends in a way that everyone on it is happy with the equilibrium so achieved. What we do know with enough external evidence is that “Growth for Growth’s Sake” and “Profits for Profits’ Sake” are both wrong approaches—they impact culture and lead to extreme choices that destroy long-term value. Recent events have brought profitability back in focus in the startup discourse, so we thought we’d share our own experience with the see-saw.

They say “Statistics hide more than they reveal”. At ixigo, our fiscal year (FY) 19 audited revenue numbers were telling us something. On one hand, we were proud that we grew our daily active users to over three million users per day and total revenue to INR 118 crores (USD 16.5 million) from INR 69 crores (USD 9.7 million) last year, a 71% increase. On the other hand, we had controlled our losses to INR 40 crores (USD 5.6 million) which were lower than last year’s, but we were still spending quite a bit of money. What the statistics were clearly telling us is that at this scale, with some more effort and pain, there was a real chance to turn around our business and keep growing without burning as much.

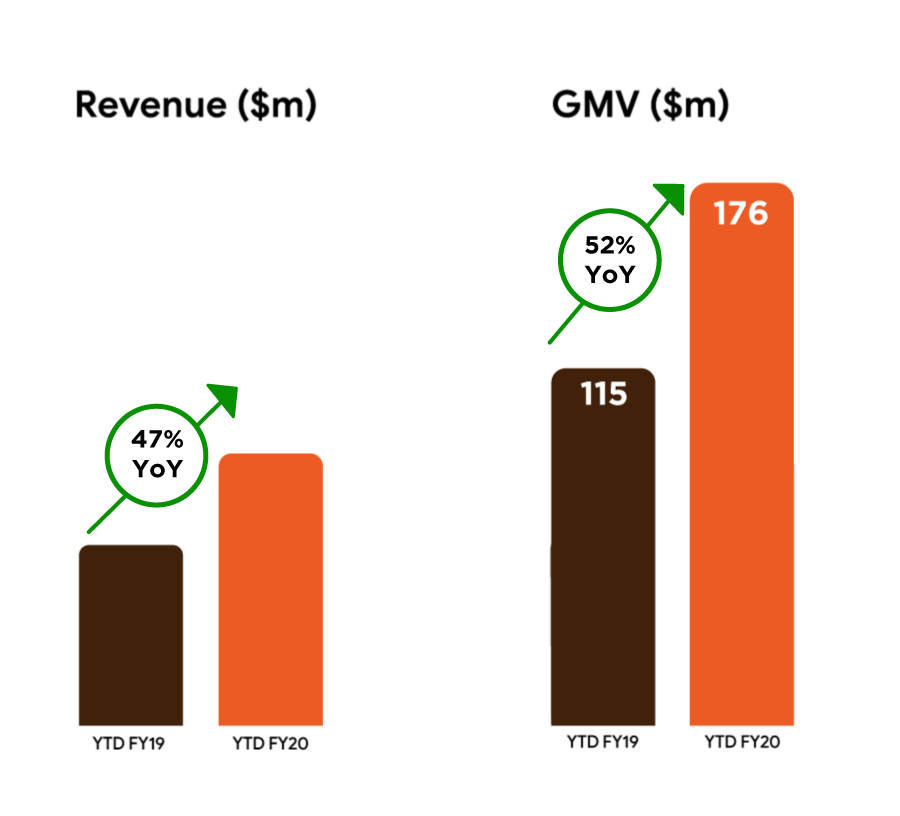

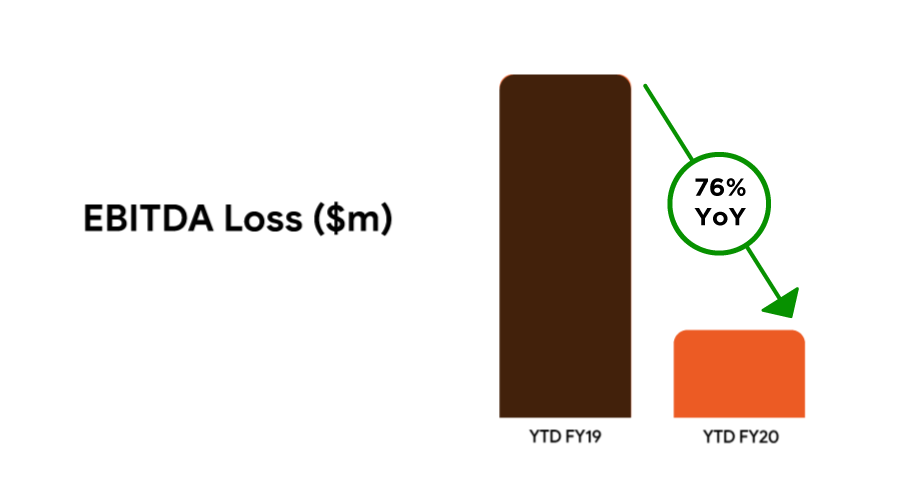

So, at the beginning of FY20, we set out on an audacious goal of trying to turn profitable before the end of this fiscal, without compromising much on growth. We started working proactively on improving the margins in our business by controlling our spends and maximizing our revenue. The results of some of our actions over the last several months on all these areas: A 52% growth in GMV YoY, a 47% growth in Revenue YoY, and a 76% reduction in losses YoY for the April to October period! There is now a fair chance that we can turn fully profitable within the next two to three quarters.

This is the back story of how we achieved this turnaround.

Meta -> Marketplace -> OTA

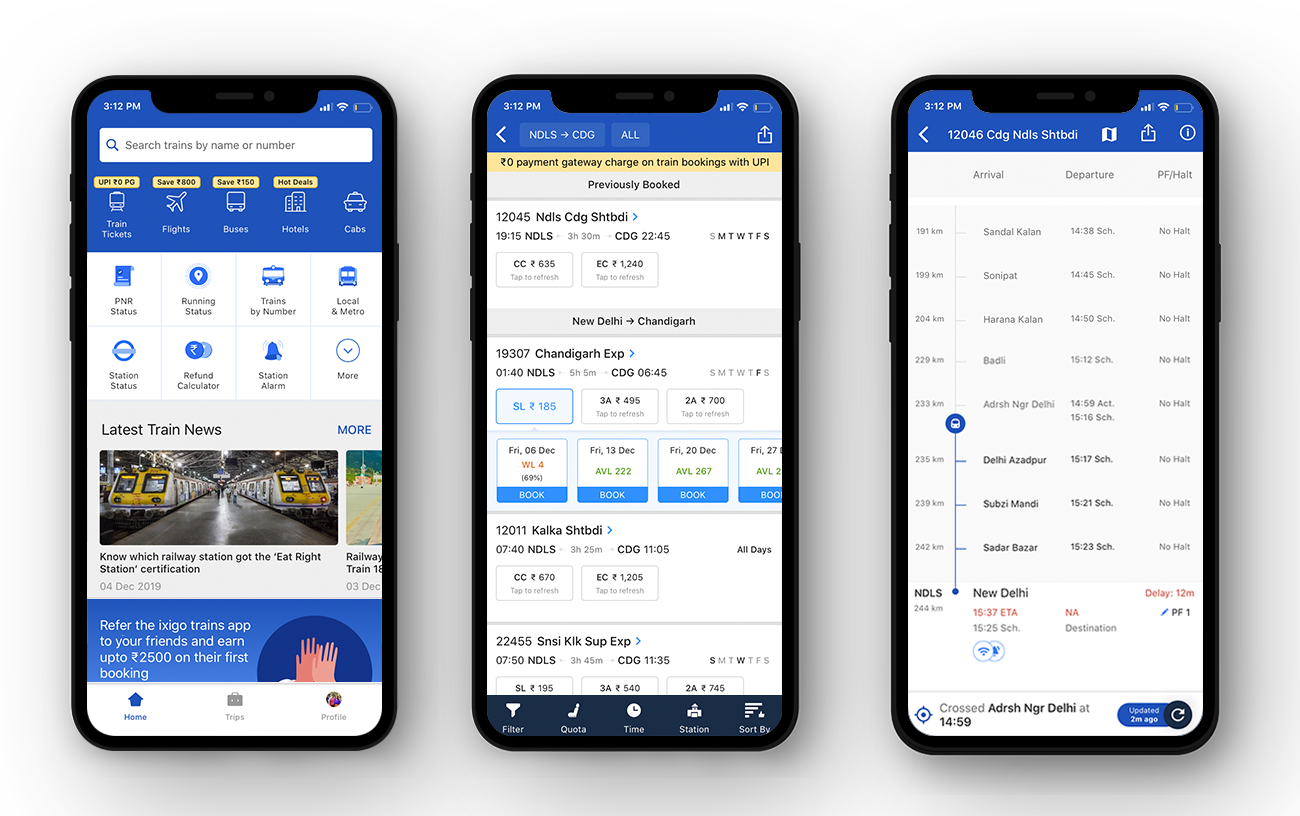

Meta-search (or the business of aggregating travel sellers and building a vertical search engine that leads consumers to other booking sites) was how ixigo began in 2007. After scaling rapidly on the web, by 2015, it became apparent that mobile was the future, and the meta experience was sub-optimal on mobile since many of our partners had complex and slow mobile experiences, so we moved to a marketplace model. This allowed us to have greater control on the transaction flow as the transaction could consummate inside our app, however, the user would still pay the OTA directly and would be able to see who they were buying from, and OTAs /airlines would deal with all the post-booking experience. Being transactional allowed us to enter the train booking segment too where we were already the number one train utility app, but could now close the loop on transactions for all modes of transport. We even built our own loyalty program ixigo money that worked across OTAs to allow our users to earn and use 100% of their loyalty rewards on their next booking. And to deal with the additional hand-holding required, we started working on our email/chat/voice-bot named TARA and won the Phocuswright Launch Runner-Up Award in 2017. These features improved our retention and repeat usage significantly — our transactions per user per year went up by over 60%.

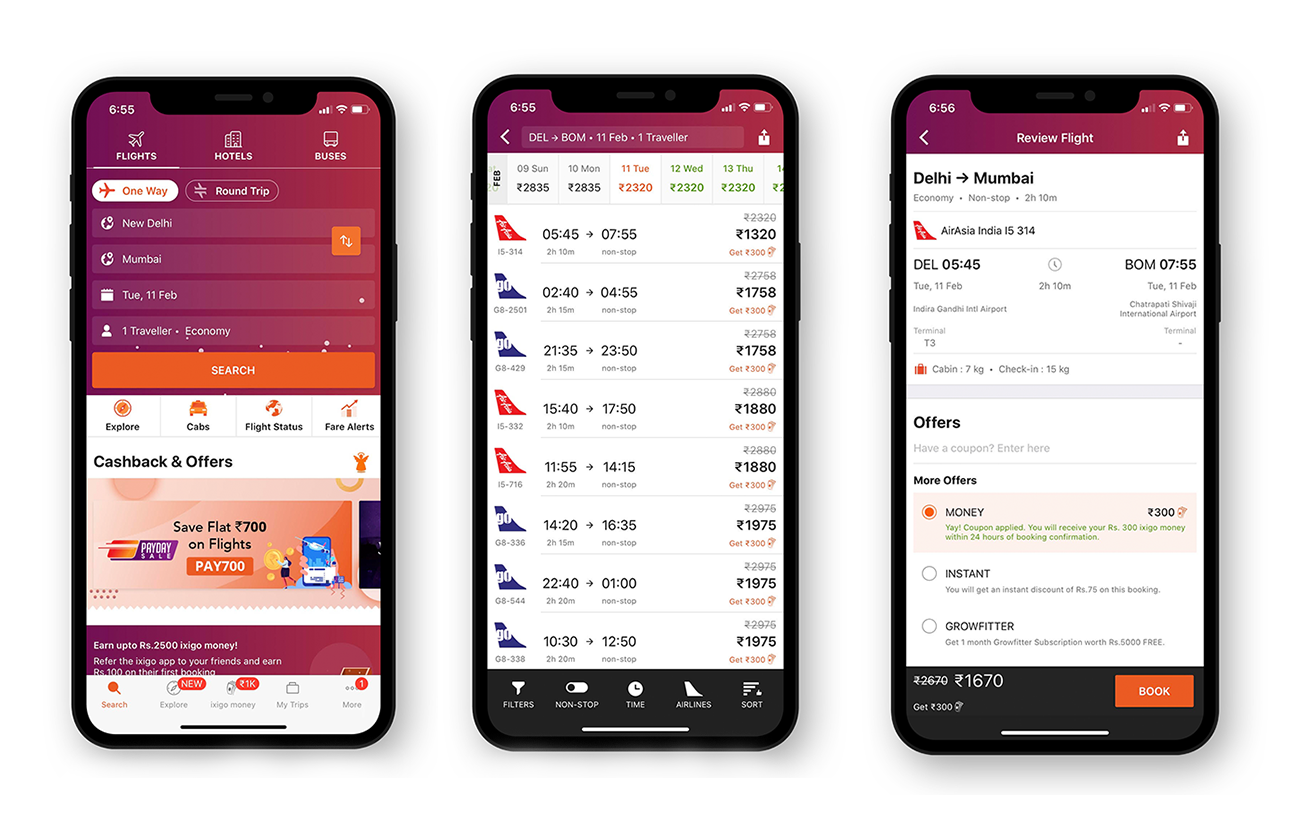

Last year, we observed that though people knew they were buying from our partners on ixigo, they would still hold ixigo responsible for any let-downs in experience or customer service issues from any of the partners. Also, since we had no control of the payments or last-mile customer experience, we wouldn’t get real-time data related to transactions and hence couldn’t solve many common customer pain points including issues with payments, with fare changes, with refunds, and with modifications. Despite OTAs having been around for more than a decade, many of these problems seemed to hamper the experience and growth of the category without ixigo being able to change or control it. In the middle of 2019, we took a call to attempt to solve these problems by going more full-stack ourselves—by becoming an OTA.

We believe the secret to building a long-term viable OTA business is to ensure that you provide the very best customer experience and while doing that you maintain a healthy take rate, keep marketing spends low, and run with a small team of smart, motivated people. Let’s examine these a bit.

- Revenue / Take Rate: As you scale your business and build deeper relationships with your supply partners and advertisers, your ability to negotiate better deals increases, and you are able to operate at better take-rates. However, there is a natural limit to the take-rate increase due to the market and competition. At ixigo, we believe we are already operating at fairly decent takes in the key categories of flights, trains, and buses, but still have some headroom left on ancillaries such as advertising, insurance, food, local transportation as well as in cross-sell categories such as hotels, activities, and packages to travelers who book using us. A large part of this will be enabled by better onboarding, better user experience, more contextual targeting of our own users, and deeper partnerships with relevant players in each category.

- Marketing Spend: OTAs are intermediaries between consumers and suppliers, and the higher they need to spend on their own customer acquisition, the more broken their unit economics get, and the less profitable their business becomes. At ixigo, we get almost 90% of our traffic organically. We’ve spent almost nothing on brand marketing for quite some time now. And even when we do paid marketing, our CAC is one of the lowest in the entire category. We do spend money on product improvements, customer experience enhancement, and some content marketing videos that go viral from time to time! Loyalty spend on ixigo money is our other major spend item, but we have been cognizant to never give back more than what we earn as a cardinal rule. We’ve made money on every transaction that happens on ixigo for nearly three years now—“contribution margin positive”. Also, our focus is on building the best customer experience as an OTA that has more empathy in dealing with travelers. This improves our NPS, repeat user rate and generates immense word of mouth for our business. We’ve made money on every transaction that happens on ixigo for nearly three years now.

- Operating Expenses: A decade ago when most OTAs built their business, the approach was to throw people at problems, and many OTAs ended up looking like offline travel agents, with thousands of employees and contractors. Where ixigo’s meta-search vintage has helped us is in building a more frugal and engineering-driven mindset when it comes to solving problems; we tend to solve problems with technology first, rather than with expanded operations and headcount. So, with less than 170 people on our rolls, we are doing over a million tickets per month and running a tight ship that’s an order of magnitude smaller in people ops than what one would expect it to be from the outside.

Will we succeed in our mission of getting to profitability soon? Will we continue growing at more than double the pace of the overall market growth? What’s the right balance between the two?

Growth vs. Profitability is a tough see-saw that every company has to ride and balance. Which side one tilts on depends on the market, the company’s circumstances, and the immediate objectives of the business and its shareholders. In the end, all businesses, no matter what scale they attain, need to start making money.

At ixigo, we will continue our endeavor to build the travel app with the most amazing customer experience, and try to keep the see-saw balanced.