At the beginning of April, IM Motors, a subsidiary of SAIC Motor, announced a “quasi-900V ultra-fast charging solid-state battery,” triggering a frenzy of speculation in the secondary market. However, this excitement quickly turned into public criticism and skepticism, with many dismissing IM Motors’ claims as mere marketing hype.

In contrast to the speculative nature of the secondary market, patient capital in the primary market has been making long-term bets on solid-state batteries, sparking a new wave of investment enthusiasm. According to 36Kr, since March this year, several domestic solid-state battery technology companies, including GTC-Power, Ronggu New Materials, Yihua New Energy, Xingkeyuan, and CASOL, have secured new rounds of financing. Prominent investment institutions such as Hillhouse Capital, HongShan, Oriental Fortune Capital, and Innoangel Fund are actively investing in this field.

Shao Jiayu from Six Sigma Capital told 36Kr that a significant catalyst for this wave of investments was CATL’s recent announcement at the China International Battery Fair (CIBF) about its target to begin small-scale production of fully solid-state batteries by 2027.

“When the industry leader declares that solid-state batteries are the future and sets a clear timeline, venture capital institutions naturally have greater certainty in investing in solid-state batteries,” Shao said.

More certainty in solid-state batteries

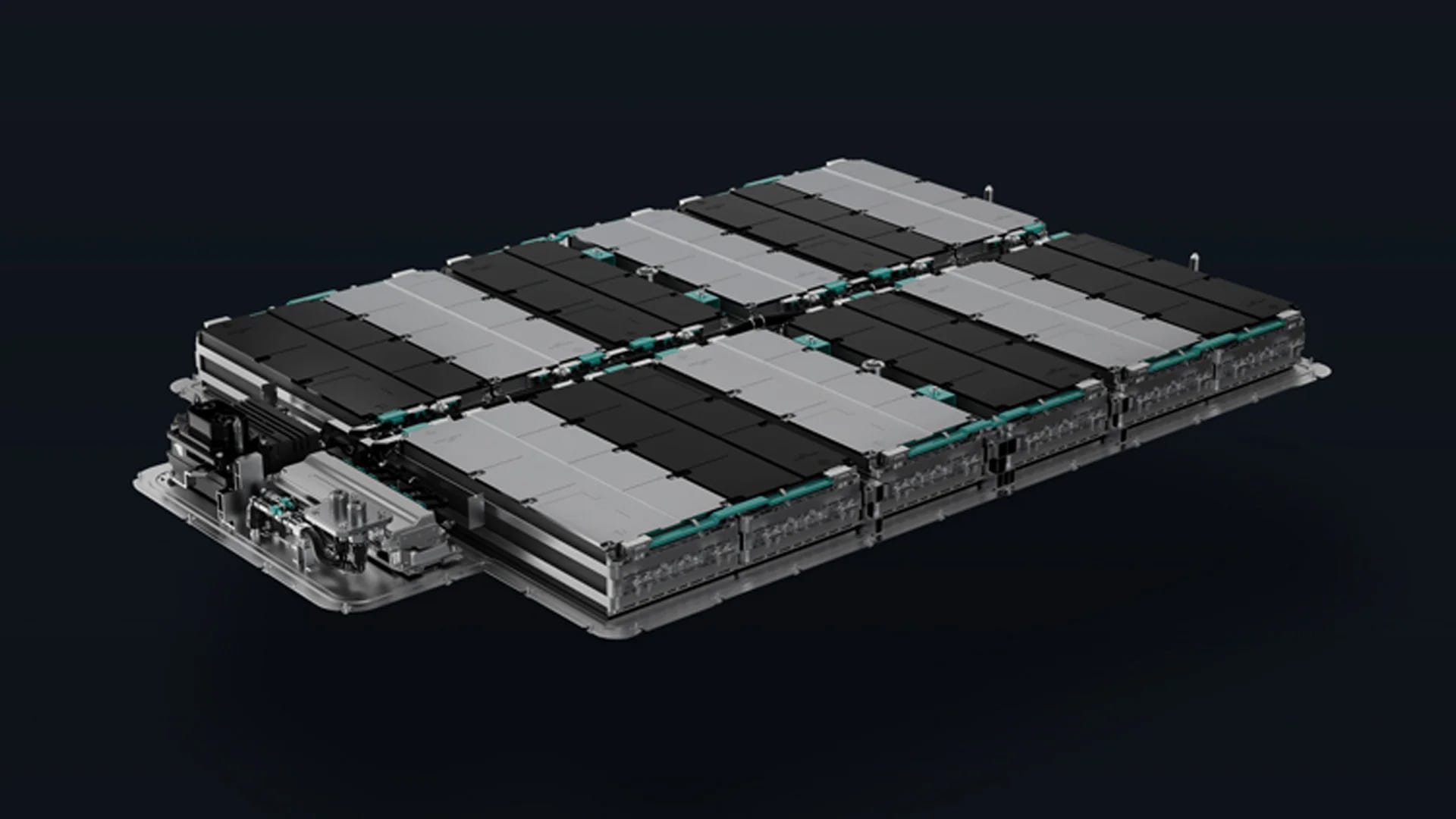

Solid-state batteries offer significant advantages over the current mainstream liquid batteries in terms of energy density, safety, charging rates, and cycle life. Their potential is so great that it is often said in the industry that the day solid-state batteries become widespread is the day fuel-powered cars exit the stage of history. As a result, technological advancements in solid-state batteries consistently capture the attention of capital markets and easily become the subject of speculation in the secondary market.

However, recent developments in the domestic solid-state battery industry suggest changes beyond secondary market speculation—manufacturers are beginning to announce clear mass production timelines for solid-state batteries. GAC Group was the first domestic manufacturer to provide a clear mass production timeline for fully solid-state batteries. On April 12, GAC unveiled its fully solid-state battery technology, announcing that it would achieve mass production in 2026, initially applying it to its Hyper vehicle models.

CATL followed suit not long after. On April 28, Wu Kai, CATL’s chief scientist, stated during CIBF 2024 that the company aims to achieve small-scale production of fully solid-state batteries by 2027. Wu mentioned that, based on a scale of 1–9 for technological and manufacturing maturity, CATL’s solid-state battery development is currently rated around 4, with an expectation to reach 7 or 8 by 2027, enabling small-scale production.

On May 17, Gotion High-tech also released its Jinshi battery, which utilizes fully solid-state battery technology. Pan Ruijun, the chief engineer of the project, told 36Kr that Gotion plans to conduct small-scale vehicle trials of fully solid-state batteries in 2027. If tests go smoothly, mass production is expected to be achieved by 2030 as the industrial chain gradually establishes.

Accelerated timelines and industry catalysts

Why are battery manufacturers and automakers concentrating their announcements of small-scale solid-state battery production timelines around 2026 and 2027? A solid-state battery R&D head at a lithium battery plant told 36Kr that Japanese and Korean companies have thus far been ahead in solid-state battery development. At this year’s Beijing Auto Show, some Japanese automakers announced plans to mass produce solid-state batteries by 2026, prompting China to accelerate its efforts. China’s Ministry of Industry and Information Technology is planning industrial policies for solid-state batteries, preparing to provide tens of billions of RMB to support multiple companies’ investments.

“I believe that with such substantial funding, coupled with corporate support and external capital inflows, we can expedite the development of fully solid-state batteries in China. Achieving mass production by 2030 is a conservative estimate,” the R&D head said. This momentum generated by leading manufacturers will naturally drive demand for solid electrolytes, cathodes, and anodes across the supply chain. Investment institutions aware of these developments have completed new rounds of investments before lithium battery manufacturers announced their production timelines.

According to 36Kr, just in March, four solid-state battery supply chain projects completed new rounds of financing, including both new projects receiving initial funding and existing projects securing continued investment, marking a mini investment boom.

Challenges to industrialization

The acceleration by industry giants and policy support will undoubtedly hasten the development of the domestic solid-state battery industry. However, the exact timing for mass production remains uncertain. Producing small solid-state batteries in a lab is not difficult. In the 1990s, the Oak Ridge National Laboratory in the US discovered a suitable solid electrolyte in the lab, and thin-film batteries based on this electrolyte achieved energy densities exceeding 700 Wh/kg, 2.5 times that of current liquid lithium batteries.

But transitioning solid-state batteries from the lab to industrialization presents significant engineering and technical challenges. Toyota, which holds the most global patents in the solid-state battery field, has experimented with tens of thousands of electrolytes over the past 30 years. However, Toyota has yet to achieve mass production, with previously announced production timelines repeatedly delayed.

An investor specializing in the lithium battery field told 36Kr that for solid-state batteries to be commercialized, they must meet six key performance criteria: safety, energy density, cycle life, charging rate, temperature resistance, and battery management system (BMS) control. At a conference in January, professor and academician Ouyang Minggao also pointed out that “the industrialization of fully solid-state batteries still faces a series of scientific challenges that need to be addressed at different levels, including key materials, interfaces, composite electrodes, and single cells.”

“The fact that solid-state batteries, which emerged in the 1990s, have not been mass-produced in 30 years fully illustrates the difficulty in this field,” the investor said. “Although the development pace is accelerating, we are still far from achieving large-scale commercial use.” In his view, for investors with ample funds, it is understandable to broadly invest in the solid-state battery supply chain. However, in terms of technological progress and industrialization, solid-state batteries have not yet reached a breakthrough point and cannot achieve technical transformation in the short term.

In other words, solid-state battery projects should still be regarded as typical venture investments that pose considerable risk. Nevertheless, faced with the new trillion-RMB investment trend in solid-state batteries, few institutions are willing to miss the opportunity to bet on what could foreseeably be the makings of the next CATL.

According to incomplete statistics by Hangbang Investment, there were 22 financing events in the domestic primary market in the solid-state battery sector in both 2022 and 2023. Leading companies in the sector, such as Qingtao Energy, WeLion New Energy, and ProLogium Technology, have grown into unicorns with valuations exceeding RMB 10 billion.

Notably, the industrialization of solid-state batteries involves not only competition among enterprises but also among nations. For example, South Korea plans to invest KRW 3.066 trillion from 2023–2028 to achieve early commercialization of solid-state and lithium metal batteries.

KrASIA Connection features translated and adapted content that was originally published by 36Kr. This article was written by Wang Fangyu for 36Kr.