At the SoftBank Vision Fund, which has JPY 10 trillion (USD 96 billion) under management, 44-year-old Yosuke Sasaki is commonly known as the “chief of staff.” He is the behind-the-scenes force at the unique investment group, known for drawing funds from the Middle East and finding leading startup companies.

SoftBank Investment Advisers, based in London’s bustling Mayfair shopping district, is the company that manages the fund. Sasaki works with CEO Rajeev Misra under the official title of “head of CEO office,” but Misra introduces him to others as his chief of staff.

“My role is in two parts,” Sasaki said, “supporting Rajeev as CEO and connecting the Vision Fund to SoftBank Group and its wider ecosystem.” Misra and Masayoshi Son, chairman and CEO of SoftBank Group, speak on the phone five or six times per day to discuss the fund’s direction and select new investments. It is Sasaki’s job to relay the decisions made at the top to the people who will actually implement them.

“I would talk to the guys first to refine the way the proposal is structured,” he said of bringing external pitches to Misra. “Otherwise, Rajeev would never approve as is.” Sasaki does much of the front-end work, such as connecting Misra with people within the company and with investors, to ensure things run smoothly.

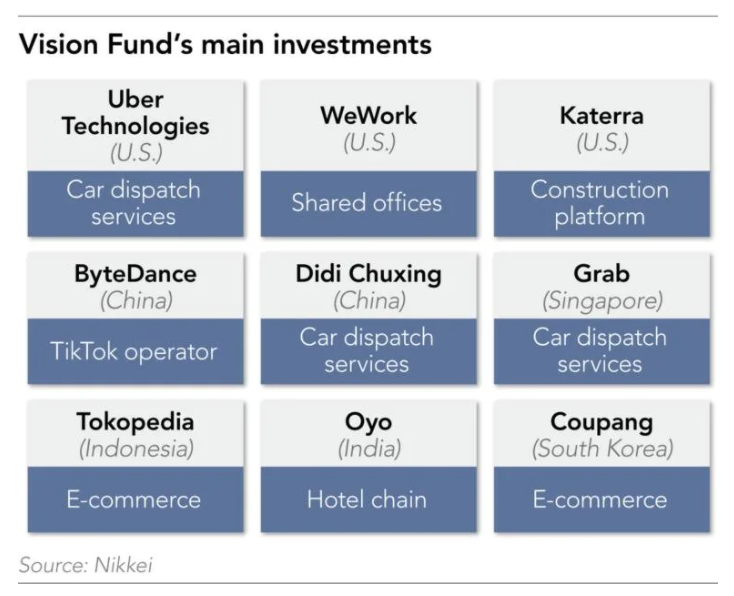

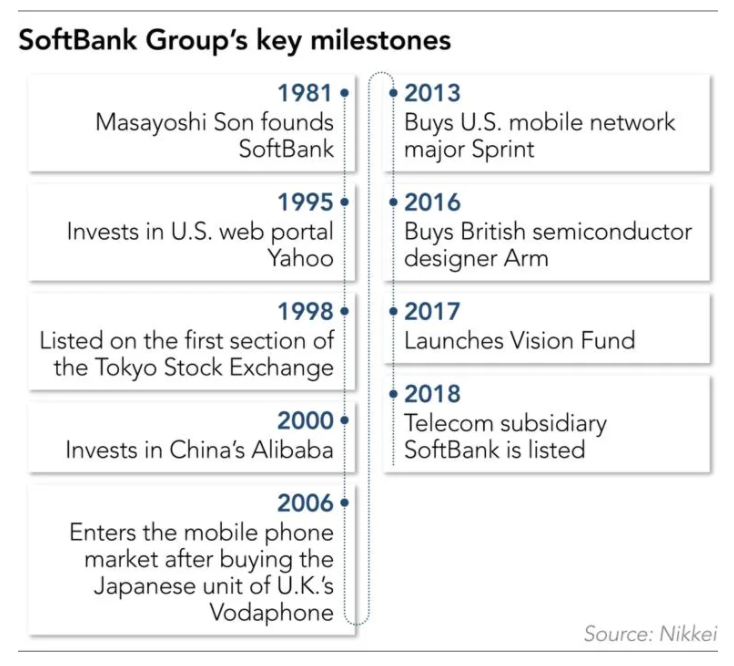

The Vision Fund looks for and invests in unicorns — unlisted companies with a corporate value of more than USD 1 billion — and other companies. Of the JPY 10 trillion under management by its first fund, 3 trillion came from SoftBank Group, and the remaining 7 trillion was provided by a Saudi Arabian sovereign wealth fund, a sovereign wealth fund of the United Arab Emirates, Apple, and others.

A plan for its second fund was revealed in summer 2019, and together with the first fund the Vision Fund would have raised JPY 21 trillion, the largest pool of venture capital in the world. At the time, it would have accounted for about 30% of the world’s managed venture capital assets, and it was described as a “giant whale jumping into a pond.” Vision Fund 2 is now up and running, but so far only with funding from SoftBank Group. Because of its huge size, the Vision Fund received mixed reactions in Silicon Valley and in the finance sector, which could lose some influence to the behemoth.

This investment titan is laden with risk. If the investment targets grow steadily and go public, it can lead to profits, but failures can lead to big losses. In September 2019, US-based WeWork, one of SoftBank’s investment targets, ran into difficulties when its public listing was postponed over issues with corporate governance and profitability. In part because of this, SoftBank Group posted a net loss of JPY 1.4 trillion in the January-March period of 2020, the largest ever for a Japanese company.

SoftBank Group had to sell or convert more than JPY 4.5 trillion in assets to cash as its stock price plummeted because of the poor performance of its portfolio companies like WeWork, and because of the novel coronavirus pandemic. Son had said he intended to create several large-scale funds, but at a May 2020 news conference he admitted that fundraising from the Middle East and other countries was stagnant and said, “Naturally we won’t attract investment funding if [the first fund’s] performance is poor.”

In June 2020, it was revealed that the Vision Fund would cut 15% of its 500 employees. The fund, which had grown rapidly over three years from nearly 10 people, including Sasaki, saw its fortunes reversed for the first time.

Currently the second fund continues to discover companies and manage them with SoftBank Group’s own funds, and one of its portfolio companies, China-based online real estate brokerage KE Holdings, listed on the US market in August. On Dec. 9, DoorDash, the largest food delivery service in the US and an investee of the first fund, also went public. Home delivery services are expected to do well during the coronavirus pandemic, and the company’s market capitalization has exceeded USD 50 billion. The Vision Fund holds more than 20% of the company’s shares, and SoftBank Group’s unrealized profit is now about JPY 1 trillion.

The Vision Fund has attracted attention for the enormous amount of money it has raised from countries in the Middle East. In a 2016 meeting at the State Guest House in Tokyo, Son persuaded the crown prince of Saudi Arabia that “data is next, after oil,” and secured a USD 45 billion investment. Misra was key to the birth of this mega-fund, known for its investments in leading technology companies like Uber Technologies.

Sasaki first met Misra in 2006. At that time, Sasaki was in charge of raising funds to acquire Vodaphone’s Japan unit for SoftBank, and he was struggling to come up with JPY 2 trillion. Mizuho Bank and Deutsche Bank were both advisers in the fundraising process, and Misra was the head of the Deutsche Bank team. “I thought, ‘Oh, he’s unusual, and his voice is very loud,'” Sasaki recalled with a laugh. “I was amazed that he and Masa (Masayoshi Son) spoke in a very informal manner.” He had no idea then that Misra would go on to join SoftBank Group.

Sasaki earned an MBA from the Wharton business school at the University of Pennsylvania in 2015. After that, Yoshimitsu Goto, currently the chief financial officer of SoftBank Group, told him to meet with Misra in London.

The two met at Harry’s Bar, a popular Italian restaurant in Mayfair near the office. Misra told Sasaki to ask him anything. “Why did you join SoftBank in the first place?” Sasaki asked.

“I’m interested in technology. I’m extremely interested in investing in technology,” Misra replied without averting his gaze in the slightest. “When it comes to investments in technology, I believe Masa is the best in the world.” Misra conveyed his approval to Goto, and Sasaki was put in charge of Misra’s affairs.

Misra was in charge of strategic finance for all of SoftBank at that time. At Sprint, a major US cellphone company it acquired in 2013, he pushed for and realized financing ideas like securitization of network base stations and the wave spectrum, using connections at Deutsche Bank, his old employer.

The idea of a massive fund like the Vision Fund was born in the mind of this “idea man.” The combination of Misra’s connections with Middle East investors in Saudi Arabia, the UAE, and elsewhere — connections he had cultivated during his time at Deutsche Bank — could prove a potent combination with Son’s discerning eye. “Masa had also thought about it for a long time,” Sasaki said of the idea that would become the Vision Fund. “Something that hadn’t been realized has been realized.”

The original plan for the Vision Fund actually called for a USD 30 billion fund, but Son shook his head when he heard the amount. “There’s no time in life for small thinking,” he said, and the planned amount was increased to USD 100 billion.

Sasaki’s journey did not start at SoftBank. He joined Bank of Tokyo-Mitsubishi (now MUFG Bank) in 1999 and moved to SoftBank in 2003. He joined the finance unit, which consisted of just 10 or so people and worked out of a small office in central Tokyo.

Sasaki placed his fate in the hands of a company much smaller than the megabank. He saw the company grow as it acquired Vodaphone’s Japan unit, Sprint and then Arm Holdings, a major British semiconductor company. As a member of the finance team, Sasaki worked tirelessly to realize these transactions, worth trillions of yen.

In the midst of all of this, there was one lesson he never forgot. It was a phrase used by the late Kazuhiko Kasai, the man who previously controlled SoftBank’s finances and provided the support for Son’s ideas.

Sasaki moved to Fukuoka Prefecture in 2008 to take charge of business management of the Fukuoka SoftBank Hawks, a professional baseball team. He was in charge of all of the team’s business operations, including business planning and budgeting. At the same time, he was chief of staff to Kasai, who was then president of the team.

Kasai, who also had a background in banking, was known as a major proponent of the acquisition strategy. When SoftBank considered delisting after the Lehman shock in 2008, Kasai stopped Son, telling him “absolutely not” to do it. He always sat next to Son at the earnings news conferences.

As SoftBank’s CFO, Kasai was based in Tokyo. However, he was known as an unrivaled baseball fan who played catcher as a student, and he was passionate about managing the Hawks. He frequently made his thoughts on the team’s planning and budgeting known, and it was Sasaki’s job to act on these detailed instructions. Managing a professional baseball team is an on-the-ground business, with money from fans — the customers — coming in on a daily basis. It provided Sasaki with a glimpse of real day-to-day business operations, as opposed to the more detached work of the finance sector. He also got to experience the Hawks’ 2011 victory in the Japan Series championship. Although reluctant at first, Sasaki found himself drawn by the joy of the baseball business.

“Do work that can endure the results.” That was Kasai’s favorite phrase. Sasaki interpreted that to mean not to focus on just producing results, but to ensure that one can always own up to them by doing his best and avoiding compromises.

Kasai, who was the heart of the finance unit, passed away suddenly in 2013. Son had trusted Kasai, 20 years his senior, completely in all matters. “For me, he was the all-time greatest catcher,” Son said at a ceremony for Kasai held by SoftBank.

Goto is now the one who carries on Kasai’s ambitions. He advocates for “aggressive finance” to support investments through fundraising, and he now sits at Son’s side during news conferences. His titles are exactly the same as Kasai’s — CFO of SoftBank and president of the Hawks.

For Sasaki, there is one scene that he will never forget from late 2005, shortly before the acquisition of Vodaphone’s Japan unit. He and Kasai were waiting for a meeting with Son in the president’s office on the 26th floor of the company headquarters in Tokyo. The company had just come out of the red, and Kasai was not positive about the Vodaphone deal.

Just then, Son entered the room 10 minutes early, uncharacteristic of the top executive. He began to talk about SoftBank’s history, from its founding in the 1980s to its acquisitions of the Comdex computer trade show and Japan Telecom. The internet was going to shift from computers to mobile devices. Everything had been leading up to this day. After hearing Son’s impassioned speech, Kasai grabbed his hand and shouted: “All right then. Let’s do it!”

Fifteen years have passed since that meeting. Sasaki now supports Misra as his chief of staff. Fundraising for the second fund has not gone as initially planned, and the situation is further complicated by the coronavirus pandemic. But investment in companies that will change existing industries through artificial intelligence continues. “Masa earnestly believes in the Information Revolution,” said Sasaki. “There is no change in his investment philosophy for the age of technology.”

Digitization around the world is advancing at a dizzying pace, and entrepreneurs who will change the world with technology are rising to power. In this new world, quick investment decision-making is key. Whenever he is at a loss or hits a wall, Sasaki now asks himself, “Am I giving my best so that I can ‘endure’ whatever the results?”

This article first appeared on Nikkei Asia. It’s republished here as part of 36Kr’s ongoing partnership with Nikkei.