Subscribe to our newsletter to read this first thing on Friday morning. This is the preview of what you will receive in your inbox.

As hundreds of millions of Indians embraced online shopping amid the COVID-19 pandemic over the course of this year, e-commerce companies—which were already growing robustly before the healthcare crisis—saw their traction and sales soar.

Investors saw that too and pumped USD 9.1 billion into e-retail firms in the first 11 months of 2021, almost 300% more than the USD 2.3 billion they invested in the entire 2020, as per the data collated by research firm Venture Intelligence. This has made e-commerce the most funded sector this year.

The massive growth in online shopping in India was reflected pretty well in this year’s annual festive sales held by major e-commerce players in October for over a month leading up to Diwali. According to a new report by local conversation media platform Bobble AI, the active user base for Flipkart and Amazon—India’s top two e-retailers—rose 83% and 72% in 2021 Diwali sales over last year.

More interestingly, transactions from tier 2 cities like Jaipur, Guwahati, Lucknow, Kochi, Mysore, and Bhubaneswar reached an all-time high with an 82% increase over the previous year. This implies consumers from smaller cities and towns are now fuelling the growth of e-commerce in the world’s second-most populous country.

For this week’s big read, we looked into the Indian festive season sales results, and how differently e-commerce players fared.

The Big Read

Walmart-owned Flipkart maintains lead in Indian festive sales despite heightened competition

Indian e-commerce giant Flipkart, which was acquired by Walmart in 2018, grabbed a 60% market share during this year’s Diwali sales, maintaining a clear lead in Indian festive season online sales of 2021.

However, it lost some ground to its archrival Amazon and other smaller players like Snapdeal and Meesho, which primarily focus on the lower-tier cities at a time when more growth is expected to come from those markets.

Amazon came in second with a 32% market share. As per PGA Labs’ data, despite a clear lead, Flipkart’s Diwali market share dipped by 5% from last year’s 65%. On the other hand, Amazon India climbed up by 7% from 25% in 2020.

Other players like smaller rival Snapdeal, social commerce firms Meesho and DealShare, Reliance’s fashion portal Ajio, and Tata Group’s online platform for electronics, fashion, and accessories Tata Cliq, among others, shared 8% of the market share in terms of the gross merchandise value (GMV), compared with 10% a year ago.

Overall, during this year’s festive season sales, e-commerce firms clocked USD 9.2 billion in GMV, compared to USD 8.3 billion in 2020, an increase of almost 11%.

The Weekly Buzz

1. Meta is betting big on WhatsApp Pay in India. The company said its chat platform WhatsApp has kicked off a pilot program to enable people in 500 villages across the states of Karnataka and Maharashtra to pay through WhatsApp. The initiative is a part of the company’s mission to onboard the next 500 million people to the digital payments ecosystem. WhatsApp will make “significant investments” in WhatsApp Pay over the next six months to fuel its adoption across India.

2. Microsoft is in talks with India’s Tata Group for strategic investment. After roping in a couple of strategic investors, the USD 103 billion salt-to-software conglomerate will reportedly look to kick off a fundraising drive for Tata Digital—which is spearheading its ambitious super app initiative—similar to Reliance’s USD 20 billion-plus fundraising spree for its digital arm Jio Platforms last year. Tata’s super app is likely to be rolled out in March 2022, after being delayed multiple times already.

3. Flipkart and Walmart lead India’s biggest agritech funding with a USD 145 million check for Ninjacart to step up their e-grocery play. The development comes at a time when India’s quick commerce space is heating up with a slew of online grocery and hyperlocal startups announcing aggressive plans to expedite their deliveries. The investment in Ninjacart, which sources fresh produce from farmers for retailers, will strengthen Walmart-owned Flipkart’s supply chain for fresh fruits and vegetables, which constitutes a crucial part of groceries.

Q&A Of The Week

4 observations on India’s fintech space from Jupiter’s Jitendra Gupta

Jitendra Gupta is a former investment banker and a serial fintech entrepreneur. He founded one of the first Indian digital payments solutions companies, Citrus, in 2010. Six years later, it was acquired by Naspers-owned PayU, which Gupta joined as managing director for India.

While at PayU, Gupta spearheaded its alternate lending business, Lazypay, which introduced the “buy now, pay later” concept in India in 2017. Two years after that, he left PayU to build a neobank, Jupiter.

Gupta launched his neobanking platform in June 2021 on an invite-only basis. It now has more than 250,000 users. Through partnerships with banks, the two-year-old company gives users new ways to open accounts, apply for debit cards, and perform expenditure analysis—currently sees 5,000 to 6,000 new users signing up each day.

As Jupiter gets ready to add lending to its portfolio of services, Gupta expects the neobank to reach nearly 2 million users by December 2022, he told KrASIA in an interview.

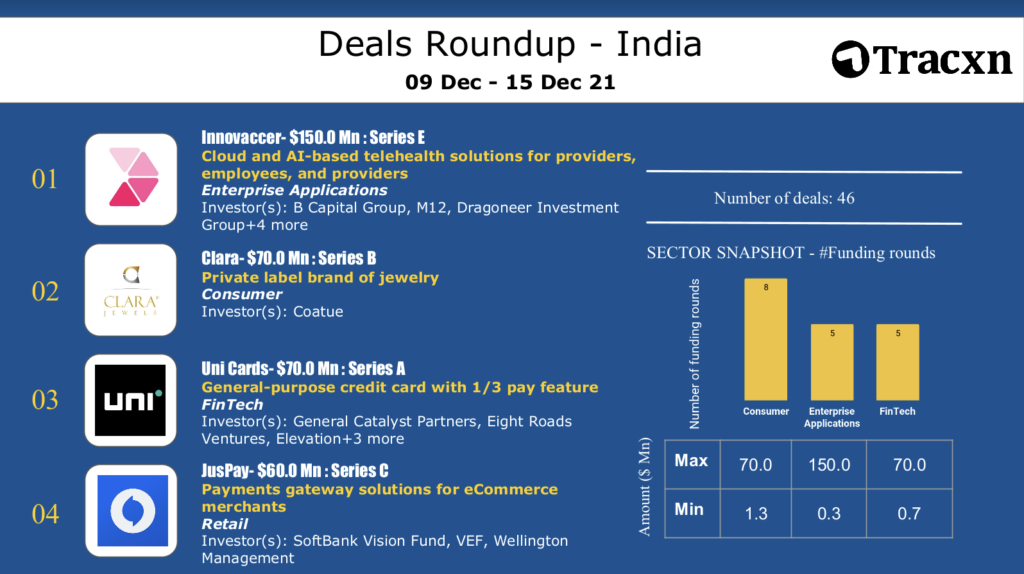

Top Deals This Week