There’s a fair number of mobile wallets in Indonesia, but two stand out: Go-Jek’s Go-Pay and Grab’s Ovo. (In Indonesia, Grab chose to partner with a third-party solution rather than develop a localized version of the GrabPay wallet it operates in most other countries.)

These two arguably have the largest transaction ecosystem for mobile money in Indonesia right now.

Both platforms let you pay for rides, food, and other services ordered through the app from your wallet balance. And a growing number of offline merchants also accept this payment method. Funds are transferred by simply scanning a QR code.

Private companies can be really tight-lipped about the volume and value of transactions that run through their networks. That said, by most estimates, Go-Pay is seen as the leader in mobile money transactions in Indonesia right now.

We can approximate the number of transactions form some figures Go-Jek mentioned on various occasions. For example, a recent article by Nikkei mentions Go-Jek counts 100 million monthly transactions, 50% of which are through Go-Pay. That would make for more than 1.5 million daily transactions.

The same article says that Ovo has 250,000 transactions per day, citing an anonymous source. Whether these figures are accurate is hard to tell. A difference in volume between Go-Pay and Ovo is not that surprising, because Go-Pay had about a year-long head start. GrabPay, after its Indonesia launch, ran into some regulatory hurdles (link behind paywall) and could only begin to offer a full suite of mobile wallet features after it partnered with Ovo.

That doesn’t mean Go-Jek can rest on its laurels. Mobile money is a phenomenon that’s just starting to take off, which makes the situation dynamic. Millions of mobile users who have yet to join either platform and existing users might be swayed to try out other wallets if one has a superior user experience, better discounts, or more features.

Upate: An Ovo spokesperson later reached out to say that the figure of 250,000 transactions per day for Ovo is “outdated by several quarters.” Ovo says it’s “the #1 platform in Indonesia in terms of Total Payments Volume (TPV)”, which it attributes to its strong presence across offline retail, as well as online-to-offline with Grab and Kudo.

How do Ovo and Go-Pay differ in their user experience? Here’s a side-by-side comparison.

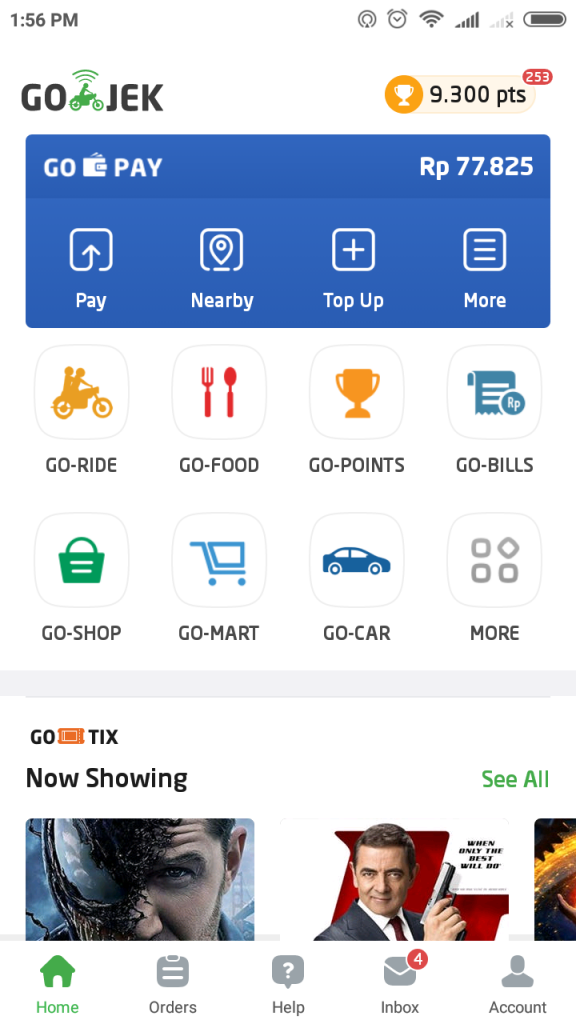

Go-Pay user experience

If you have a balance in your Go-Pay wallet, funds will be deducted from there per default for rides, food, or other services you book through the app. You can always choose to pay in cash if you prefer.

In addition, there are four main functions of Go-Pay.

With ‘Pay’, users can pay at partnering offline merchants by scanning a QR code. Go-Pay also offers to transfer funds to another Go-Pay user here. But to do that, you have to upgrade your wallet first. More on that later.

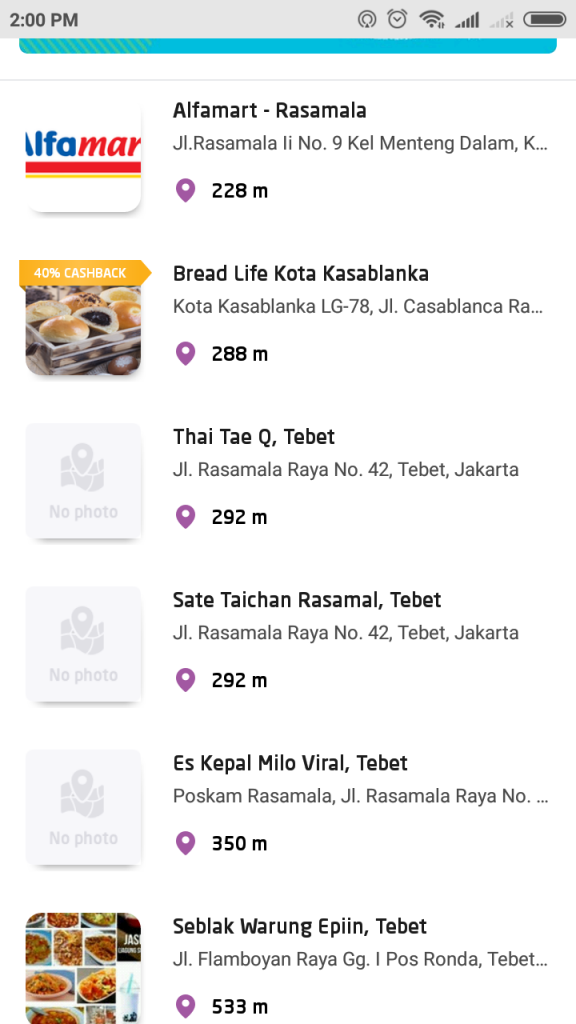

‘Nearby’ shows a list of Go-Pay merchants around you. That seems to be a mix of minimarts, restaurant chains, and food stalls. It’ll also come in handy if you need to find out in advance if a particular place you are about to go to accepts Go-Pay.

‘Top Up’ offers you various ways to add credit to your wallet balance. It’s like a mini bank account. If you earn money through Go-Pay, for example, if you’re a driver, you can theoretically save up Go-Pay balance and expense it from there without ever having to go through a real bank account. This won’t replace formal banking but can form an alternative ecosystem that exists alongside banks for certain types of transactions.

You can do this by giving a Go-Jek driver the amount in cash and the driver will credit it to your Go-Pay account. Go-Jek introduced this easy top-up method from the start and it helped onboard people who were unfamiliar with the concept of mobile wallets before.

Top ups can also be made through Alfamart outlets. Alfamart is a convenience store chain with thousands of outlets across the archipelago. Go-Pay also offers top ups through bank and ATM transfers for various banks.

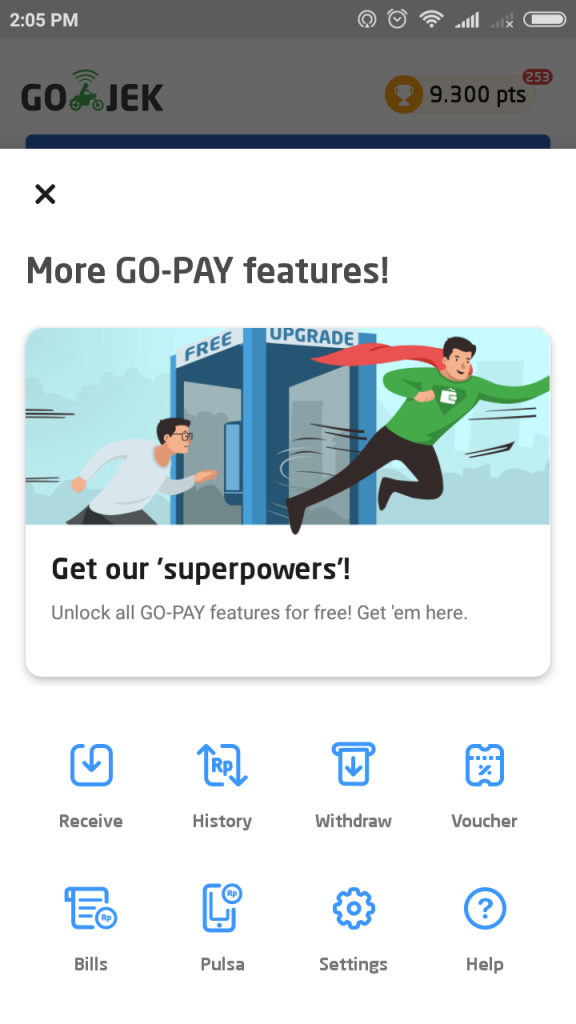

The tab ‘More’ brings you to a screen with additional features, such requesting money from another user and withdrawing your wallet balance to a bank account. But to be able to access these functions, Go-Pay asks you to upgrade your account. You photograph your local ID, driver’s license, or passport. You also have to take a photo of yourself holding the ID document, and a photo of your signature. Then you must enter a local address and your current job title. The approval takes up to 24 hours.

Upgrading the wallet with this identification procedure also means you can now store up to IDR 10 million (US$659) in your wallet balance. With the regular account, you may only have up to IDR 1 million (US$66). After this upgrade, you can use the peer-to-peer fund transfer feature, where you can send and request money from other Go-Pay users.

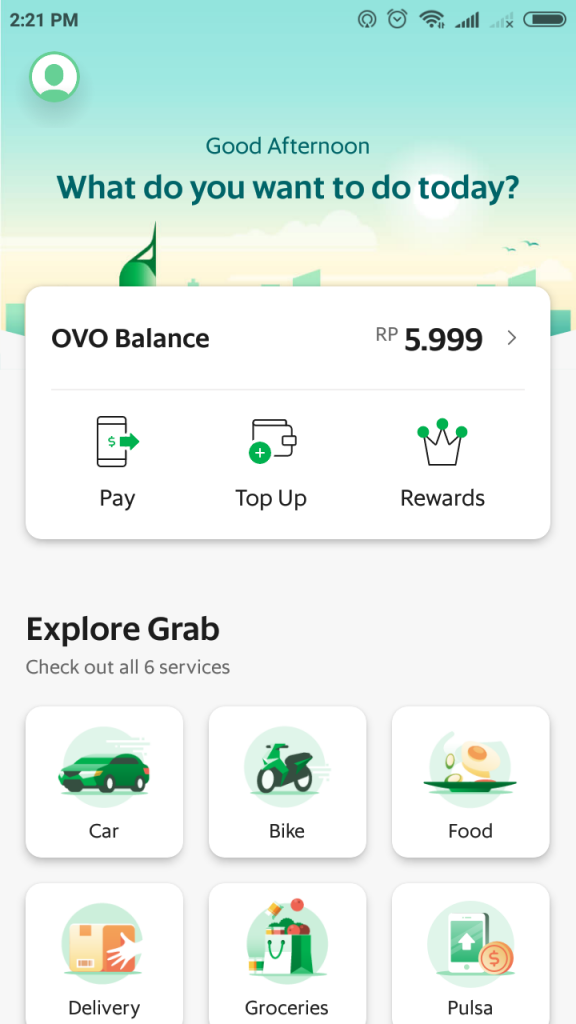

Ovo user experience

Unlike Go-Pay, Ovo is a standalone app. It’s seamlessly integrated with Grab’s app though. Any top up that occurs through Grab shows up in the standalone wallet, as well as vice versa.

Once you have Ovo balance, Grab deducts fees for rides and deliveries from there by default unless you opt to pay in cash. Beyond that, the Ovo wallet within Grab offers options for payments, tops ups, and rewards.

Under ‘Pay’, you can scan a QR code at a partner merchant to transfer funds from your Ovo balance. Unlike at Go-Pay, there’s no option to transfer to other users here.

‘Top Up’ is similar to Go-Pay, it has options for top up through drivers using cash, various ATM and bank transfer options, and the same convenience store network Alfamart.

One difference to Go-Pay is that Grab’s Ovo allows you to link up your debit card and another wallet, Doku. This doesn’t work for all debit cards though, in the fine print, you can see that those from BCA (the largest private Indonesian bank) are not included. Others, such as Bank Mandiri’s cards, are.

Ovo caps the maximum balance you can have in the wallet at IDR 2 million (US$132). To get to the maximum of IDR 10 million (US$659), you have to upgrade your wallet, which is similar to how Go-Pay works. The registration process is not purely digital though, Ovo lets you upload a photo of your ID but then asks you to see one of their agents to complete the registration.

In the ‘Rewards’ section, you can see the loyalty points you earned from using Grab services or spending Ovo from your balance. The points can be turned into vouchers that can be redeemed at various merchants. This rewards system resembles Go-Jek’s token and deals system, the difference is that Go-Jek doesn’t present it as part of the wallet user experience.

Summary

Both wallets are under constantly under development and frequent changes occur, so this comparison represents a snapshot of their current state. Key differences are that Grab’s Ovo does not allow for peer-to-peer transfers from Grab user to Grab user within Grab’s app. (Ovo itself, the standalone app, does offer this feature between Ovo users, after ID verification.)

Unlike at Go-Jek, Grab users can link debit cards in their Ovo wallets, which saves them the hassle of having to top up the balance each time it runs low. It only works for some banks.

Go-Pay seems to be leading in terms of transaction volume, but Go-Pay only works in Go-Jek’s own ecosystem of services and merchants. In contrast, the balance in Grab’s Ovo wallet can also be used it in the networks of other Ovo partners outside of Grab’s reach. Ovo was developed by PT Visionet, a subsidiary of retail and property conglomerate Lippo Group. This has helped Ovo spread its acceptance points to many shops and retail stores.

Editor: Ben Jiang

* The article was updated on October 8 with additional information from an Ovo spokesperson.