China Evergrande Group has gone from narrowly avoiding a cash crunch in September to being able to pay back a USD 2 billion bond early — but that does not mean all is once again well at Asia’s largest private sector debtor.

Last year Evergrande rang alarm bells far beyond China when a letter purportedly from the property-focused company warned of a looming liquidity crisis without help from local government. Such a scenario — for a company that at the time owed USD 130 billion to banks, shadow lenders and holders of domestic and offshore bonds — risked being devastating for China’s USD 50 trillion financial system, sending debt problems cascading from the highly leveraged property sector into potential cross-defaults on loans from banks and trusts.

Yet next Wednesday (Feb. 10) Evergrande will have enough cash on hand to redeem HKD 16.1 billion (USD 2.1 billion) of bonds early, after raising equity and spinning off its property management arm.

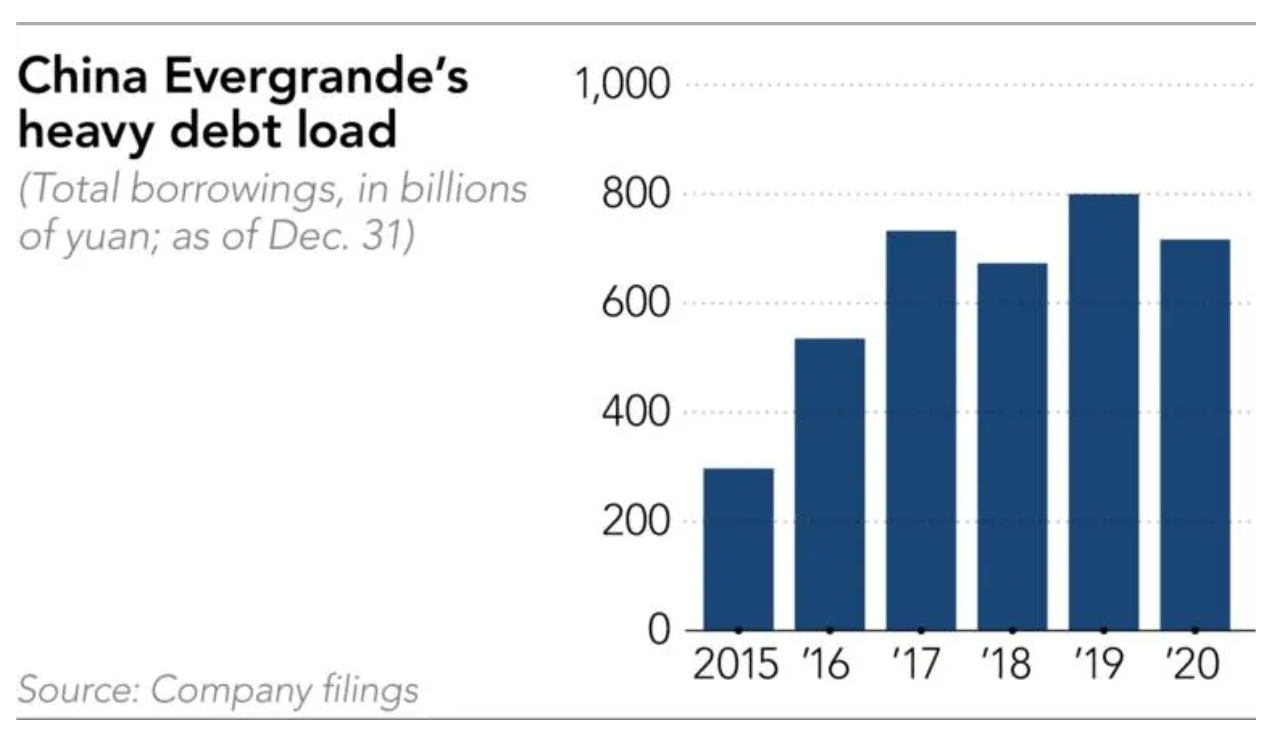

Evergrande also said on Jan. 5 that it boosted 2020 property sales by 20% and cut its outstanding debt as of Dec. 31 to RMB 717 billion (USD 111 billion). Its shares have had their best start to a year since 2012.

For all the signs of stabilization, the company is not out of the woods. Evergrande and its billionaire founder and chairman Xu Jiayin, a former steel factory technician, will need to further boost sales and sell assets to achieve their goal of slashing debt to half of peak levels by the end of 2022.

The task is all the more challenging given that the company has had to offer steep discounts on homes to lure buyers, according to sales agents, and faces an anticipated slowdown in the property market amid a regulatory crackdown.

“Evergrande is symptomatic of the broader China story where companies lower down the credit curve are falling out of favor,” said Warut Promboon, managing partner of Hong Kong-based research company Bondcritic, referring to investor appetite for bonds issued by companies with too much debt.

Evergrande is a prime example of the debt-fueled expansion espoused by Chinese companies as the economy grew. Nonfinancial corporate debt climbed to 159.1% of gross domestic product in the first quarter of 2020 from 152.2% a year earlier, according to the Institute of International Finance. The ratio is the world’s second highest behind Hong Kong.

But as the economy slows and regulators move to curb risk, corporate defaults have scaled new heights. Evergrande’s travails were discussed by China’s cabinet and its financial stability committee, chaired by Vice Premier Liu He, Bloomberg reported in September. But they didn’t make a decision on whether to intervene, the report said.

Last March Evergrande’s debt peaked at RMB 875 billion — the highest among developers globally.

As it tries to meet its 2022 goal, the company also wants to list its electric vehicle unit in Shanghai to raise equity — benefiting from growing interest in Chinese EVs. China Evergrande New Energy Vehicle Group, already listed in Hong Kong, has surged 490% since the end of 2019 and is valued at USD 53 billion — or more than double its parent. Evergrande, which owns 75% of the EV subsidiary, plans to invest almost USD 5 billion to produce as many as a million electric vehicles annually within three to five years.

But while a listing in Shanghai could raise as much as USD 5 billion, people familiar with the plans have said, the effect on Evergrande’s own finances would be limited. Most funds raised would flow toward expansion rather than the parent company’s books.

Evergrande in an e-mail said that since September it has redeemed bonds worth HKD 47.7 billion early.

“The early repayment within a short period of time has fully demonstrated the cash strength and sound financial management ability of the company. The company is confident that it will accomplish its goal of reducing interest-bearing indebtedness by RMB 150 billion in 2021,” it said.

Watch this: Video | Will real estate giant Evergrande succeed in the EV industry?

Evergrande’s goal is part of a plan to regain investor and client trust. “We have stopped partnering [with] Evergrande since late last year,” Zhang Chenghe, a Shanghai-based salesman with Lianjia, a unit of New York real estate agent listed Ke.com. “It has far too much debt and it still owes our company a lot of money.” Lianjia is one of China’s largest real estate brokerages.

Cutting debt is also imperative for Evergrande to meet Beijing’s tough new leverage policy for property developers.

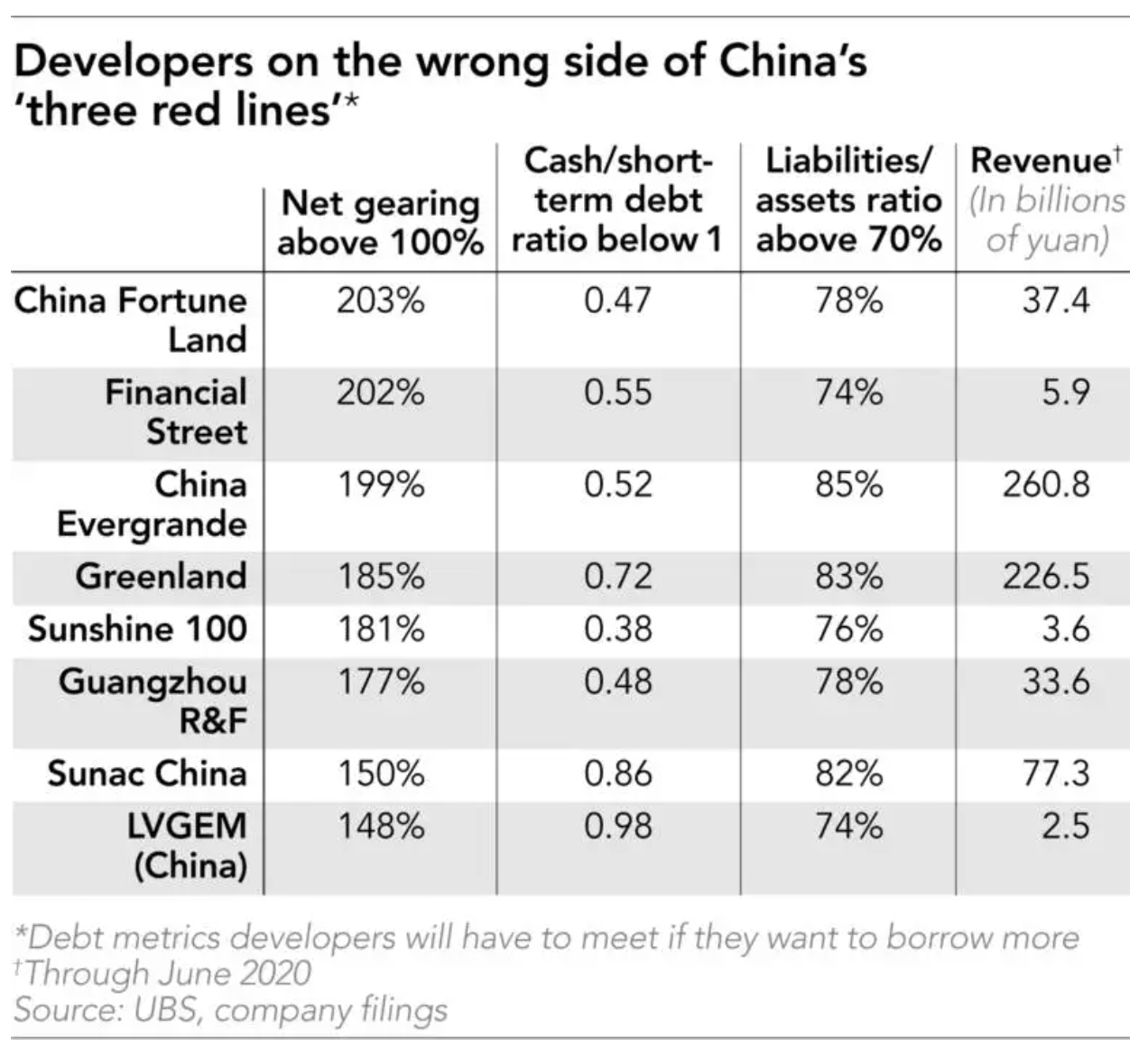

Concerned by the stress building up in the sector, authorities have laid down markers known as the “three red lines” measuring ratios of financial strength which developers must meet to borrow further. Companies are scored on a four-color system from green to red.

Not meeting any of the criteria, Evergrande is in the red category across the board and would in effect be shut out from borrowing — impacting its ability to acquire land and invest in new businesses.

Banks’ will also have to limit their exposure to mortgages and the property sector, reducing a source of funding for developers such as Evergrande. The limits come on the heels of measures aimed at snuffing out risks in the bubble-prone sector. China’s home prices have risen every month since mid-2015, with loose monetary policy amid the coronavirus pandemic adding fuel.

With China’s economy emerging strongly from the pandemic, Beijing is eager to rein in economic stimulus and curb debt, which has soared past 300% of GDP. Last month action by the central bank sent overnight interbank borrowing costs to their highest in almost six years.

Of the 59 developers with a high-yield rating as of Dec. 31, 11 had weak liquidity, Moody’s Investors Service estimates. Two hundred bonds issued by China developers defaulted in 2020 up from 150 in 2019 and as many as 499 real estate companies went bankrupt last year, according to a report dated Jan. 28 by Daiwa analysts Cynthia Chan and Jonas Kan.

Reminders of their problems continue to surface. China Fortune Land, another company that fails to meet all “three red lines” criteria, said this week it had overdue loans worth RMB 5.26 billion due to a liquidity shortage but promised it will not avoid repayment obligations. The company has more than USD 6 billion of onshore and offshore bonds maturing this year.

Analysts expect Evergrande, the largest by sales in China, and its competitors to struggle with slowing growth amid tighter credit conditions.

Xu, whose net worth is estimated to be USD 27.7 billion by Forbes, built Evergrande after a debt-fueled binge that created China’s largest land bank — over 300 million square meters. It was to be the foundation for a wave of construction. At the moment, Evergrande is selling 1,300 projects in more than 280 cities across the country. It has assets of RMB 2.3 trillion spanning theme parks and sports stadiums to electric vehicles.

As debt mounted and investors grew nervous Xu last year unveiled a strategy summarized as “grow sales, control scale and reduce leverage,” though he struggled to convince investors. Evergrande’s bonds fell to as low as 58% of face value in March — though Xu insisted investors should “relax” and said the company had never defaulted and would not do so.

But Evergrande and investors knew the clock was ticking on one potentially huge cost — the RMB 130 billion raised from borrowers in 2017 with the promise of converting the debt into equity by listing its Hengda unit on a mainland exchange within three years. If that were not achieved, Evergrande would have had to repay the money.

With a Hengda listing being held up by regulators, in September a social media post purported to show a letter written by Evergrande to the provincial government of Guangdong warning of a potential default and financial crisis if the listing could not go ahead. Evergrande’s shares and bonds slumped again.

While it denied it wrote the letter, Evergrande quickly moved to convince investors not to demand repayment. In November it scrapped the listing plan and said more than 90% of the investors had agreed to become equity holders.

While it was putting out that fire, the company sought USD 1.1 billion in an equity sale in October. It only raised half that amount, underscoring investor skepticism. However Evergrande did secure a further USD 900 million by spinning off its property management arm in Hong Kong.

Entering 2021, the next hurdle for Evergrande seemed to be the maturity of the HKD 16.1 billion bond on Feb. 14. The bond was, theoretically, convertible into Evergrande equity — but at a price far above its depressed share price.

As speculation swirled on how Evergrande would meet the redemptions, it surprised with the pledge to repay and cancel the bonds on Feb. 10. Its shares soared 16% on Jan. 18.

Evergrande’s confidence appears to be growing. In January it said it would shed a further RMB 150 billion yuan in debt in 2021, supported by cash collection from sales, proceeds from the property management spinoff and reduced land purchases.

“We expect Evergrande’s net gearing to improve markedly to about 130% at end-2020 on the back of proactive measures taken in the past few months,” said CGS-CIMB analyst Raymond Cheng.

Evergrande is still in the red category under the “three red line” policies, he pointed out. “However, we think it could improve to at least orange, if not yellow, in 2021,” Cheng said.

Evergrande’s gearing, which is measured by dividing the total debt by shareholders’ equity, stood at 199% in 2019 and is estimated to have dropped to 170% at the end of 2020.

Meeting the debt reduction target for this year will put Evergrande within striking distance of halving its borrowing from last March. But the market has not yet seen exactly how Evergrande has achieved its goals, beyond the company’s own “report card” in January. It is due to report 2020 earnings on March 29.

“We’ll have to wait and see how Evergrande has managed its recent debt reduction,” said Nigel Stevenson, an analyst at accounting investigation company GMT Research in Hong Kong. “Contracted sales increased substantially in 2020. However, we’ve yet to see a clear picture on how this has impacted profitability… they’ve prioritized cash collection potentially at the expense of profitability.”

Last month UBS analysts cut Evergrande’s rating from “neutral” to “sell” and gave it a year-end price target of HKD 6 a share, expecting sales growth to slow and margins to fall. Evergrande property sale prices fell by 10% to 15% based on monthly sales data in the 12 months to June 2020 and UBS’ own project-level price checks, they said.

And wider fears over state support for struggling companies could complicate Xu’s strategy. In the past, investors flocked to bonds and stocks issued by the likes of Evergrande in the belief that such companies were too big to fail and would be bailed out by authorities.

But that confidence has been dented by a series of defaults by state-run companies including coal miner Yongcheng Coal & Electricity Holding Group and chipmaker Tsinghua Unigroup late last year. That has prompted companies to hasten their deleveraging plans.

Evergrande can still meet its goals if it quickly sells off part of its land bank, its homes under construction and reduces the pace of land acquisition, said Phillip Zhong, an analyst at Morningstar in Hong Kong. Reducing its stake in subsidiaries such as property management and electric vehicles could accelerate the plans, he said.

The challenge is the “ambitious sales targets, which may be difficult to achieve in a slowing market, and the threat of investors re-evaluating the valuation of units such as automobiles,” he said.

Bondcritic’s Promboon said that, given the influence Evergrande has on the economy and the implicit support it has enjoyed, the company still has a chance to execute its turnaround — but suggested there could be more twists for its investors.

“For now, its securities are not for those who cannot stomach volatility,” he said.

This article first appeared on Nikkei Asia. It’s republished here as part of 36Kr’s ongoing partnership with Nikkei.