As lithium carbonate prices dropped in early 2023, the electric vehicle industry, finally free from tight cost constraints, plunged into fierce competition.

For consumers, this meant an influx of high-value models. But for automakers, it’s a clash between the old guard and emerging players, with some quietly bowing out. Underneath this, investors continue to reshuffle their bets, fueling significant stock price swings.

So where does the EV market stand today? Are the numbers in the auto industry matching what we feel in the air? A recent report from BloombergNEF offers a closer look at this.

End of the boom years

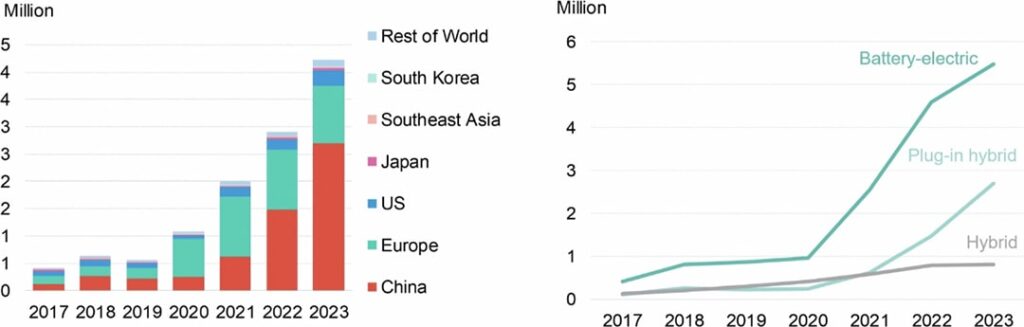

From 2020–2023, strong demand from China and ambitious electrification goals in Europe and the US drove global passenger EV sales to an astonishing growth rate of over 60%.

But as of 2023, automakers like Tesla, Mercedes-Benz, General Motors, and Ford have started scaling back their electrification plans. The main culprit? Profitability—producing electric cars is still much more expensive than their gasoline counterparts.

China’s domestic market remains hot, but with sales and penetration already high, a slowdown is looming. With pressures both at home and abroad, the explosive growth the global market saw in the last few years is set to slow.

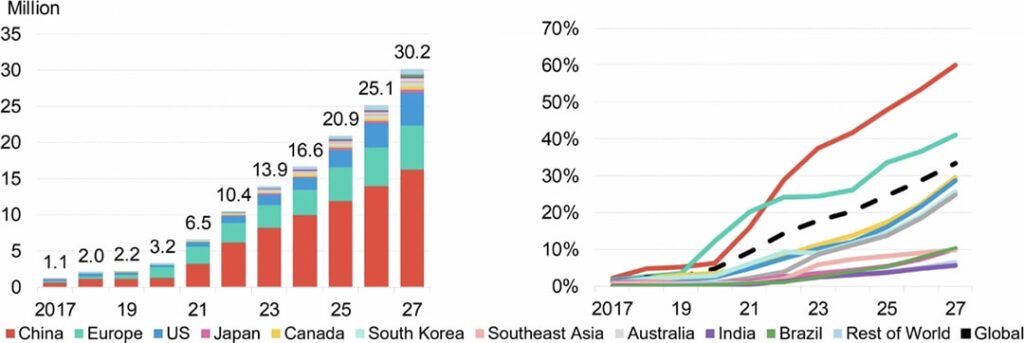

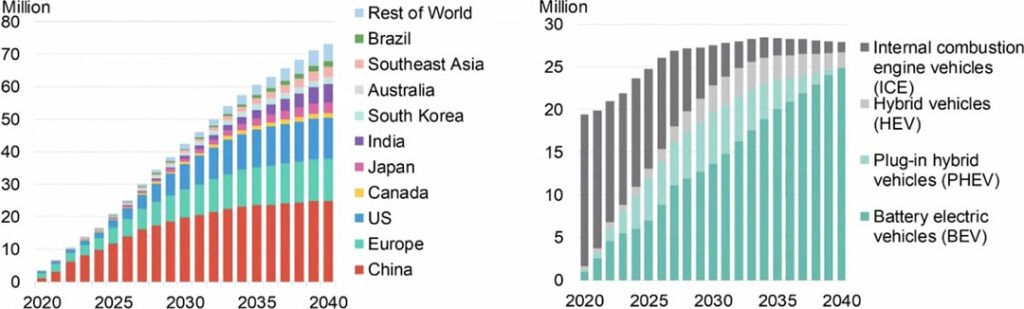

Based on current trends, BloombergNEF forecasts that, by 2027, annual global sales of passenger EVs will top 30 million, rising to 73 million by 2040. Penetration rates will hit 33% in 2027 and 73% by 2040. Between 2024–2027, the compound annual growth rate (CAGR) is expected to hover around 21%—a sharp drop from the 2020–2023 surge. EV stock will grow from 41 million at the end of 2023 to over 132 million by 2027.

Region by region, China and Europe are expected to remain the powerhouses of the global EV market, with penetration rates well above the global average. By 2027, China’s EV penetration will reach 60%, while Europe’s market will bounce back from its recent slump to top 40%. Among the Nordic countries, EVs will make up 90% of all passenger car sales, and in Germany, the UK, and France, the percentage is estimated to be over 40%.

Meanwhile, countries like the US, Canada, South Korea, and Australia will see faster growth, but by 2027, their penetration rates will still lag behind. The US is expected to hit 29%, while Japan remains cautious, showing only modest gains.

India and Brazil are slowly catching up, but their growing car markets mean EV sales in Brazil could grow fivefold by 2027, and triple in India.

In short, the EV market will keep expanding, but high base numbers and slowing goals in the West will temper global growth.

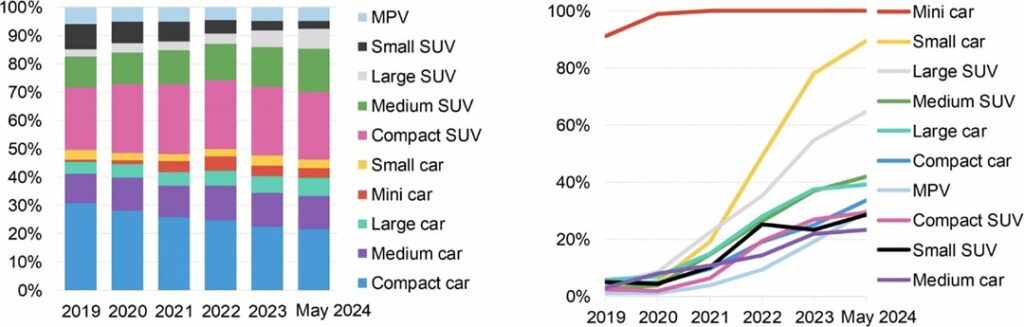

Late last year, Li Auto and Xpeng Motors rolled out new MPV models, and this year, Xiaomi introduced its first car: the SU7 coupe. Recent hits like the Denza Z9 GT, Neta S, and Stelato S9 are also all large sedans.

Automakers are gravitating toward the large passenger car segment, partly to boost brand power, but also because competition here is relatively light.

According to BloombergNEF, mini EVs have nearly hit 100% penetration, small cars hover around 90%, and large SUVs are over 60%. But compact sedans, compact SUVs, and MPVs are still in the 20–40% range, with plenty of room to grow. Mainstream family models like compact sedans and SUVs account for nearly 50% of total passenger car sales, making them a significant market. Small SUV penetration, though only around 20%, hasn’t shown much growth in recent years, and their market share is shrinking.

For automakers, this creates opportunities. Market share, low penetration rates, and upward trends are driving their product development decisions.

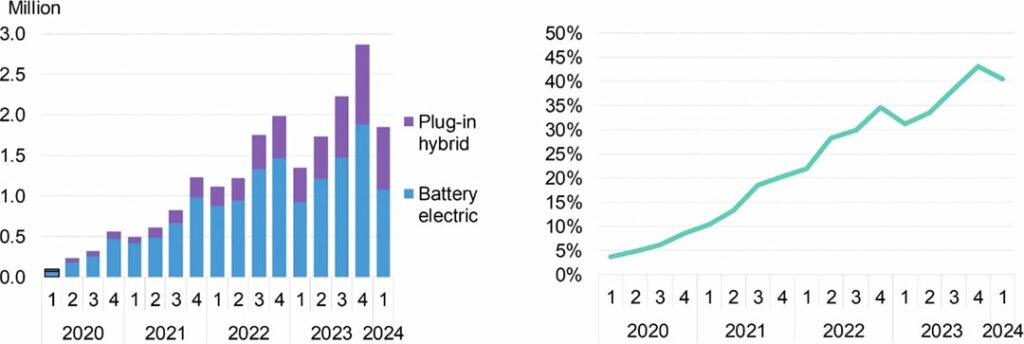

Between 2023–2024, plug-in hybrid electric vehicles (PHEVs) and extended-range electric vehicles (EREVs) have emerged as the market’s dark horses. In the first quarter of 2024, PHEVs accounted for around 40% of sales.

Why the sudden surge in PHEVs in China? Two reasons: first, prices for these vehicles, once high, have been steadily falling. Coupled with rising gasoline prices, the total cost of owning a PHEV is now much lower than that of gasoline and fully electric vehicles. Second, the electric-only range of PHEVs has been increasing. BloombergNEF estimates that, in 2023, the average electric-only range of PHEVs hit 80 kilometers, with some domestic models exceeding 100 kilometers—further winning over consumers.

Interestingly, the PHEV boom is mostly limited to China. China drives most of the growth in global PHEV sales, while Europe, though still a strong market for PHEVs, has seen their market share drop since 2020.

The reason for this divergence could be cost. BloombergNEF points out that European and US PHEVs generally have smaller battery packs for economic reasons, while Chinese PHEVs use nearly twice as much battery capacity. This leads to different ranges. Plus, usage habits differ. In Europe, PHEVs used as company cars run in electric mode only 11–24% of the time, compared to 26–54% for private car owners.

In China, BloombergNEF predicts that PHEV sales will keep climbing in 2024 and 2025, but in the long run, fully electric vehicles will become the dominant choice.

The rapid rise of PHEVs is also reshaping the supply and demand for power batteries.

For example, BloombergNEF estimates that, in 2023, global power battery production capacity was nearly double the demand, with China’s capacity exceeding demand by over threefold. Because PHEVs use smaller battery packs, their rising market share is reducing overall demand for batteries, intensifying competition among battery makers.

Price wars: Vehicles under RMB 200,000 suffer greatest hit

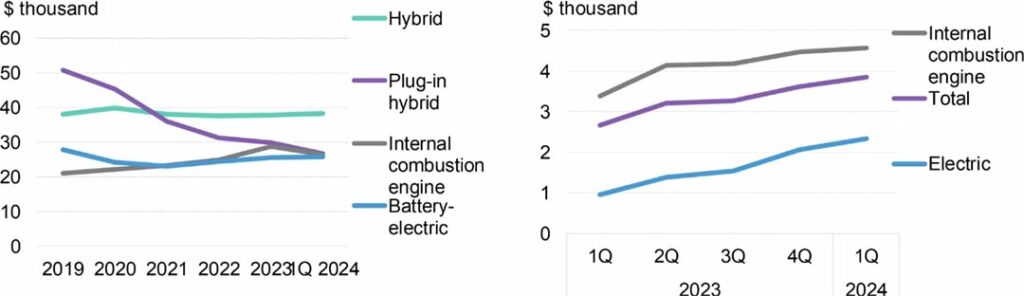

This year’s price wars in the automotive industry have been fierce, and BloombergNEF provides some macro-level data to illustrate the impact.

Three key trends stand out:

- Average price reductions for both gasoline and new energy vehicles (NEVs) have increased each quarter, but gasoline cars have seen much steeper drops than EVs.

- Before 2023, gasoline vehicle prices were rising, but after 2023, prices began to fall sharply. Meanwhile, PHEV prices have been on a steady decline since 2019.

- In 2023, the average price of PHEVs reached parity with gasoline cars, while gasoline vehicle prices started to fall, and prices of fully electric vehicles rose slightly. This implies that PHEVs and gasoline cars are in direct competition.

From early 2023 to the first quarter of 2024, price competition was particularly intense in the low- to mid-end hybrid segment. According to CICC data, sales of vehicles priced above RMB 300,000 (USD 42,276) have stayed relatively stable, but models in the RMB 200,000-300,000 (USD 28,184–42,276) range are moving into the RMB 100,000–200,000 (USD 14,092–28,184) category, and vehicles priced under RMB 100,000 are losing market share.

In the EV market, both high-end and low-end models are converging into the middle price range. This trend of product upgrades and price competition is reflected in the data: the market share for vehicles priced below RMB 100,000 and those in the RMB 300,000–400,000 range has declined, while the share of RMB 100,000–200,000 vehicles has increased slightly, and RMB 200,000–300,000 vehicles have seen a significant rise.

Overall, hybrid vehicles priced under RMB 300,000 and fully electric vehicles priced between RMB 300,000–400,000 (USD 42,276–56,368) are the hardest hit in this round of competition. Hybrids priced above RMB 300,000 and fully electric models above RMB 400,000 have been less affected.

Battery Electric Vehicles (BEVs):

| Price Range (RMB) | Type | 2022 | 2023 | 5M24 |

|---|---|---|---|---|

| Below 100,000 | SUV | 4.17% | 2.21% | 1.33% |

| Below 100,000 | Sedan | 25.54% | 21.98% | 22.40% |

| Below 100,000 | MPV | 0.00% | 0.01% | 0.00% |

| Below 100,000 | Other | 0.14% | 0.07% | 0.07% |

| 100,000–200,000 | SUV | 12.74% | 15.30% | 17.12% |

| 100,000–200,000 | Sedan | 24.08% | 25.41% | 22.95% |

| 100,000–200,000 | MPV | 1.51% | 0.62% | 0.64% |

| 100,000–200,000 | Other | 0.29% | 0.16% | 0.18% |

| 200,000–300,000 | SUV | 4.76% | 15.14% | 14.42% |

| 200,000–300,000 | Sedan | 9.68% | 9.85% | 11.41% |

| 200,000–300,000 | MPV | 0.08% | 0.12% | 0.08% |

| 300,000–400,000 | SUV | 10.05% | 3.47% | 3.52% |

| 300,000–400,000 | Sedan | 3.55% | 2.47% | 1.65% |

| 300,000–400,000 | MPV | 0.10% | 0.25% | 1.01% |

| Above 400,000 | SUV | 2.28% | 1.76% | 1.72% |

| Above 400,000 | Sedan | 0.99% | 0.63% | 0.84% |

| Above 400,000 | MPV | 0.03% | 0.54% | 0.67% |

Plug-in Hybrid Electric Vehicles (PHEVs):

| Price Range (RMB) | Type | 2022 | 2023 | 5M24 |

|---|---|---|---|---|

| Below 100,000 | SUV | 0.10% | 0.01% | 0.05% |

| Below 100,000 | Sedan | 0.07% | 4.21% | 11.71% |

| Below 100,000 | MPV | 0.00% | 0.00% | 0.02% |

| 100,000–200,000 | SUV | 33.98% | 29.96% | 29.85% |

| 100,000–200,000 | Sedan | 20.34% | 17.57% | 17.31% |

| 100,000–200,000 | MPV | 0.94% | 0.34% | 0.05% |

| 200,000–300,000 | SUV | 14.71% | 12.22% | 12.82% |

| 200,000–300,000 | Sedan | 9.24% | 6.24% | 2.64% |

| 200,000–300,000 | MPV | 0.00% | 0.17% | 0.99% |

| 300,000–400,000 | SUV | 11.03% | 15.73% | 13.69% |

| 300,000–400,000 | Sedan | 1.40% | 0.33% | 0.00% |

| 300,000–400,000 | MPV | 0.53% | 4.75% | 2.93% |

| Above 400,000 | SUV | 3.60% | 5.30% | 6.23% |

| Above 400,000 | Sedan | 3.63% | 1.72% | 0.26% |

| Above 400,000 | MPV | 0.44% | 1.46% | 1.45% |

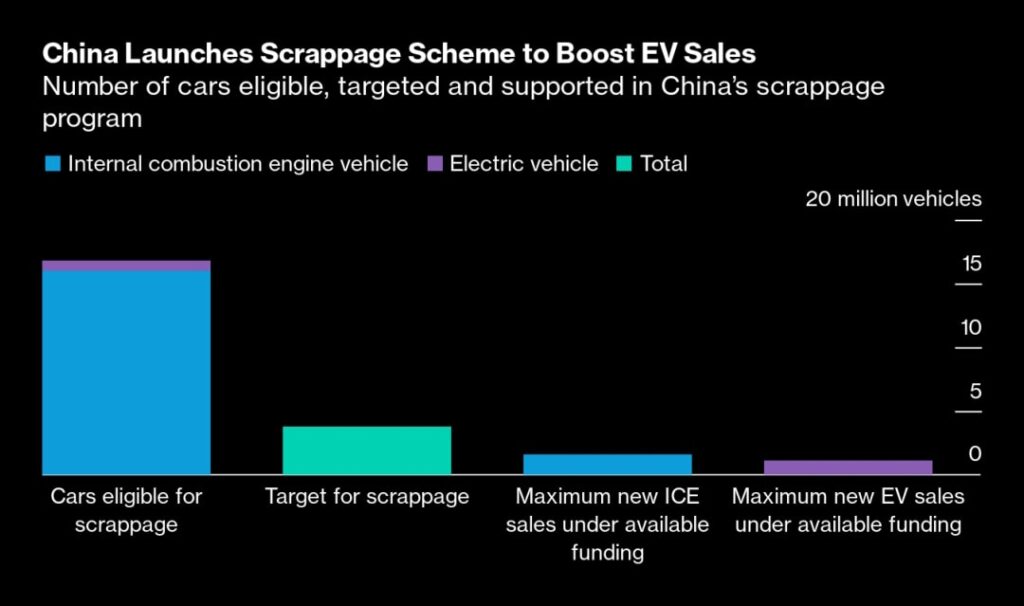

Impact of trade-in policies

On July 25, China doubled the subsidies for its trade-in program, first introduced in April, in a bid to boost domestic car demand. Consumers who scrap high-emission older vehicles and purchase EVs can receive RMB 20,000 (USD 2,818), while those opting for more fuel-efficient gasoline cars are eligible for RMB 15,000 (USD 2,113).

BloombergNEF notes that the initial program didn’t gain much traction, as consumers hesitated to act. But with subsidies now doubled and the program set to expire at the end of 2024, sales could see a significant uptick.

Around 16.8 million vehicles are eligible for the trade-in program. The original RMB 11.2 billion (USD 1.6 billion) budget, set by China’s Ministry of Finance in May 2024, was expected to support the replacement of about 1.6 million vehicles with gasoline cars or 1.1 million with EVs under the old subsidy standards.

While the updated budget hasn’t been revealed, BloombergNEF estimates that the number of vehicles replaced will stay close to the original target. As a result, the program could still add 1.1 million EVs in local sales, generating USD 26 billion in revenue and pushing total EV sales past 10 million units this year.

KrASIA Connection features translated and adapted content that was originally published by 36Kr. This article was written by Fan Liang for 36Kr.