Hendra Kwik, founder and CEO of fintech platform Payfazz, was born and raised in the Sumatran city of Jambi, Indonesia, where the level of urban development is far below Jakarta and other major cities on Java. While becoming a successful entrepreneur, he noticed first hand some of the daily problems of rural communities, such as the lack of banking access.

Kwik went to Bandung Institute of Technology (ITB) to pursue a degree in chemical engineering, and shortly after his graduation, he got the opportunity to work at a global oil and energy company in Brazil.

During his time on the American continent, Kwik, who always had a special interest in the tech industry, visited many global tech centers including Silicon Valley and the Massachusetts Institute of Technology in the US, while also visiting other Latin American countries to see the development of their startup ecosystems.

He realized the huge inequality of financial access and tech mediated services between first-tier cities and local communities, and among developed countries versus emerging markets, and wanted to do something about it.

“When I returned to Indonesia, I had several job proposals from different companies, including one from Kudo (now GrabKios by Kudo), whose founder was my senior at ITB,” Kwik told KrASIA in a recent interview.

“I come from a village so I wanted to work in a company that contributes well to the underserved communities. I was inspired by Kudo’s mission to let anyone participate in e-commerce, even those who don’t have access to the internet,” he continued.

At Kudo, Kwik was responsible for business development and growth strategy. His position required him to visit many rural towns and villages in Java, which reminded him of some of the daily challenges he had to face while growing up in his hometown in Jambi.

“People in the village had had very little connection to financial services so they couldn’t upgrade their lives. Many of them came to me to ask me how to get a loan for their business and how to easily transfer money to their families, showing how much they needed access to financial products,” Kwik said.

The growing demand and his personal background drove Kwik to build his own fintech startup, Payfazz, which he launched in 2016, together with two partners: Ricky Winata and Jefriyanto. From the beginning, Payfazz’s mission was to provide digital financial access for rural communities, Kwik said.

An agency-based approach

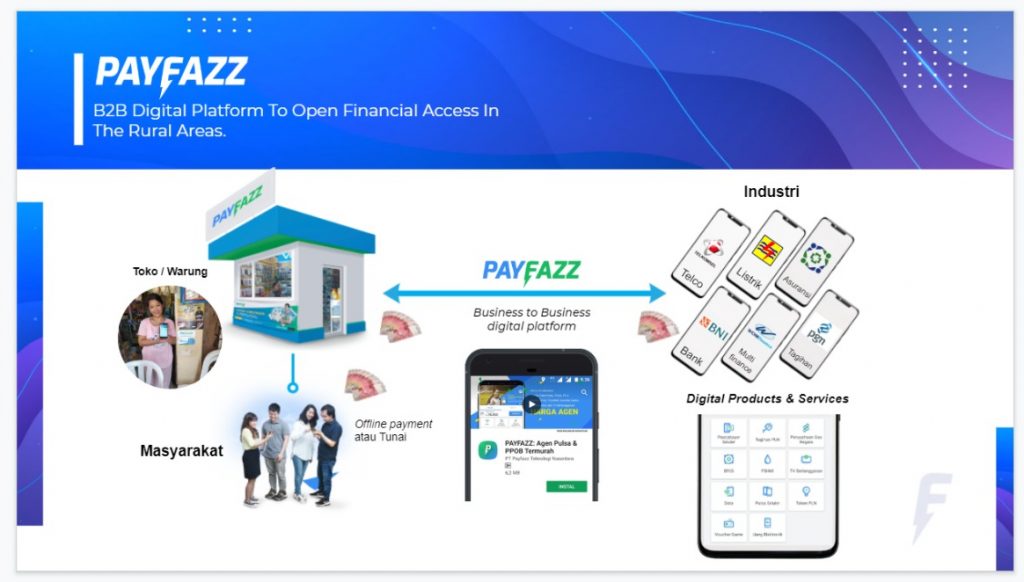

Payfazz is a digital platform that enables online payment points in different physical locations. The firm works with a network of agents across the country in charge of helping customers to execute transactions including paying utility bills, topping up phone credit, transferring money, and more. Citizens that don’t own bank accounts can go to Payfazz agents and pay them in cash for the services they need, while agents will make the transactions online through the Payfazz app.

To become an agent, applicants need to sign up and register through the Payfazz app. Once verified, they are able to open a balance on the app, connected to one of Payfazz’s bank partners. Agents can use the deposit on their Payfazz’s balance to pay for their customers’ needs, receiving cash in exchange from their clients. Payfazz cooperates with a number of major banks in Indonesia, including BRI, BNI, Bank Mandiri, and BCA.

Besides facilitating payments, Payfazz also offers point-of-sales service for merchants to help them manage inventories and bookkeeping. Furthermore, the startup provides small loans for SME agents in partnership with multi finance companies and peer-to-peer (P2P) lender Modal Rakyat.

According to Kwik, anyone can become a Payfazz agent, able to operate in neighborhood kiosks or warungs, eateries, telco stores, or even from their own homes.

“Most people in rural areas work in the informal sector or operate traditional kiosks. By becoming Payfazz agents, they will get an additional channel of income and expand their network or customer base. In addition, micro and small business owners will be able to establish a digital financial identity through Payfazz. This opens up opportunities to get funding to grow their business,” Kwik continued.

On average, agents can increase their income through Payfazz by at least 20%, depending on their effort, Kwik said. Payfazz currently has 250,000 agents who facilitate payment services for around 10 million users, he added.

Priority on financial literacy

Another problem in rural towns of developing countries is the low rate of financial literacy, which is often caused by limited access to information and proper financial education. This has brought various challenges for Payfazz in Indonesia, including the risk of frauds under the guise of Payfazz agents.

“I ensure that all Payfazz agents are trustworthy, but there have been several incidents of fraud using social engineering methods. There were irresponsible people who claimed to be Payfazz agents to get money from customers. There’s always risk like this for startups focusing on rural communities because their financial literacy is usually lower than those who live in the cities,” said Kwik.

He believes that agents are currently playing an important role in educating local communities about finances, which will continue to be one of the focuses of the company, especially after raising fresh investment.

Payfazz educates agents through social media posts and articles on its website, as well as via regular updates on its app, Kwik explained. On the offline side, Payfazz’ sales team routinely train agents on how to utilize the platform as a vehicle to get extra income and as a bridge for the unbanked communities around them.

Moreover, agents are encouraged to teach their customers about how to use fintech services in a secure manner so they can avoid any possible fraud.

In early June, Payfazz bagged USD 53 million from B Capital Group, Insignia Ventures Partners, and BRI Ventures. To date, Payfazz has raised a total of USD 74.1 million in four funding rounds, according to Crunchbase.

“We hope to be able to increase our agent and user base up to 20 times eventually. To drive this growth, we’ll allocate a lot of funds and resources to strengthen our R&D and tech capabilities, as well as community education outreach via agents,” said Kwik.

According to Kwik, Payfazz’s revenue comes from two core business models. The firm takes a 0.5% to 1% commission on every transaction, while agents can set their own margins to charge users, usually between 5% to 9%.

For its lending service, Payfazz serves as a platform to connect borrowers with lenders, such as multi finance corporations and fintech firms. Payfazz gets a variable commission of between 4% and 10% per year from lending partners using this service.

Kwik recognized that as the COVID-19 pandemic has hurt rural economies, Payfazz’s transaction volume has been stable but the amount per transaction has slightly declined. However, the firm’s transaction volume has been growing by around three to four times per year, and it now processes more than IDR 1 trillion (USD 68 million) in transactions per month, Kwik said.

There is also surging demand for loans although the firm has managed to keep the rate of non-performing loans (NPL) steady. He hopes this crisis can further increase public awareness about the importance of financial planning.

Going forward, Kwik plans to work with new fintech lenders to meet the high demand for small loans from MSME agents. Moreover, the company will continue to maintain a healthy growth to reach profitability soon, Kwik affirmed.

“We already have a positive cashflow, but we want to improve our profitability metrics. We want to allocate new funding to boost business growth. That way, we hope to accelerate our mission and reach as many communities as possible,” he said.

This article is part of KrASIA’s “Startup Stories” series, where the writers of KrASIA speak with founders of tech companies in South and Southeast Asia.