Most emerging technologies hold great promise and potential, but not without their own share of challenges. The same applies to the field of blockchain technology. Cybercriminals are exploiting this new territory, pilfering funds and manipulating the decentralized finance space. According to a report by Merkle Science, around USD 3.9 billion worth of cryptocurrencies were lost to hacks in 2022, 47.4% higher than the previous year.

Merkle Science aims to address this. Founded in 2018 and headquartered in Singapore, the crypto risk mitigation, compliance, and forensics platform works with various organizations including crypto and Web3 companies, retailers, financial institutions, and government agencies to combat and prevent cybercrimes. The venture capital-backed company utilizes a mix of artificial intelligence and blockchain technology.

One of Merkle Science’s solutions takes the form of Tracker.

Tracker is the company’s investigation forensics tool currently used by financial intelligence units, cyber firms, Web3 projects, and law enforcement agencies, amongst others. The tool tracks and analyzes data on blockchains to trace the criminal movement of funds in real-time.

Tracker was designed with the aim of creating a secure, transparent, and compliant digital asset ecosystem, even for those with minimal experience in the blockchain field.

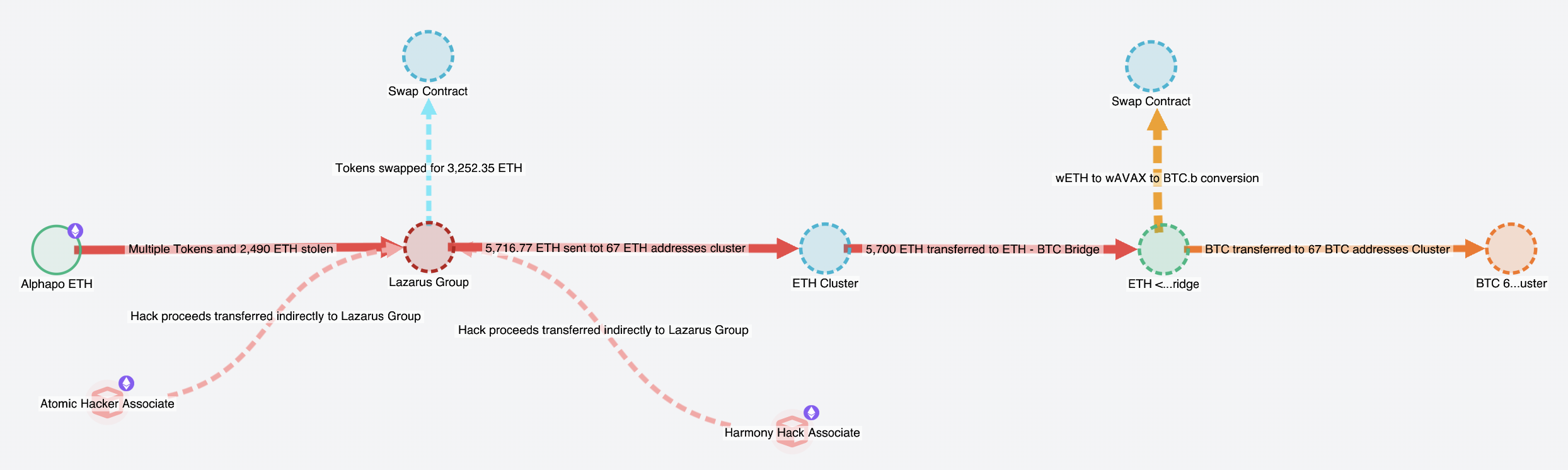

Users can access an array of analytics and visualization capabilities through its intuitive interface to track fund flows and cryptocurrency transactions in real-time. They can also use Tracker to analyze transaction behavior and patterns to identify potential illicit activities, trace stolen funds, and conduct detailed DeFi-related investigations and forensics.

Tracker is also equipped with advanced graph database technology, enabling investigators to automatically generate maps of incoming and outgoing entities linked to a wallet address.

The evolving role of blockchain forensics in crime prevention

Merkle Science’s Tracker is part of a new generation of investigation tools, serving use cases related to crypto forensics and investigations. Through their capabilities, including enhanced coverage for EVM-compatible chains, multi-chain investigations, and decoding of smart contract transactions, tools like Tracker offer viable solutions to the complex challenges faced in the crypto landscape.

“Over the past year, the demand for tracking crime involving mixers, decentralized finance (DeFi), and non-fungible tokens (NFTs) has skyrocketed. Crypto crime, once synonymous with Bitcoin, now finds its epicenter in DeFi, rendering traditional blockchain investigation tools obsolete,” said Mriganka Pattnaik, co-founder and CEO of Merkle Science.

Blockchain forensics and crypto crime investigation tools like Tracker are essential to mitigate the rise of criminal activities in the crypto industry. With losses in 2023 already amounting to USD 656 million thus far, they hold increasing importance in preventing further escalation. With access to such tools, investigators could find it difficult to analyze transaction data, trace people involved in illegal activities, and uncover emerging criminal trends in the digital asset space.

Key use cases and value

Financial institutions and crypto businesses managing a multitude of crypto fraud claims require cutting-edge solutions to assess claim legitimacy, which can be a critical factor that influences their bottom line. Merkle Science’s engagement with TokoCrypto, a leading cryptocurrency exchange in Indonesia, exemplifies this need. By implementing Merkle Science’s predictive risk intelligence solution, TokoCrypto managed to streamline its transaction monitoring process, not only surpassing regulatory standards but also improving its risk-based approach. As a result, the Indonesian Financial Transaction Reports and Analysis Center (PPATK) acknowledged Merkle Science for its crucial role in promoting a secure and compliant crypto ecosystem.

The Alphapo payment provider hack is also an illustrative case highlighting the importance of investigative tools developed by companies like Merkle Science. While the losses in the alleged hack was estimated to be over USD 60 million worth of crypto, Merkle Science was able to track the case using its proprietary Tracker, identifying the additional losses and potentially the Lazarus Group as the responsible party.

The importance of such tools extends to law enforcement and government agencies as well. Accurate, easy-to-use tools with independently verifiable data and visualizations are vital, especially in legal contexts such as subpoenas. Reflecting on Merkle Science’s collaborations with law enforcement agencies, Nirmal AK, CTO of Merkle Science, emphasized the significance of accessible investigation tools and on-demand support in incident response.

Through Tracker and its various solutions, Merkle Science is spearheading a transformation in how businesses and regulators approach security, transparency, and compliance in the dynamic world of cryptocurrencies. With capabilities ranging from crime investigation to regulatory compliance, its impact is profound, moving stakeholders closer to a safer digital asset ecosystem. The value it offers transcends mere functionality—it symbolizes a more secure future in the realm of digital currencies.