China — Plant-based faux meat makers in Asia are seeing sales soar as consumers seek safe and healthy alternatives in the wake of the coronavirus outbreak.

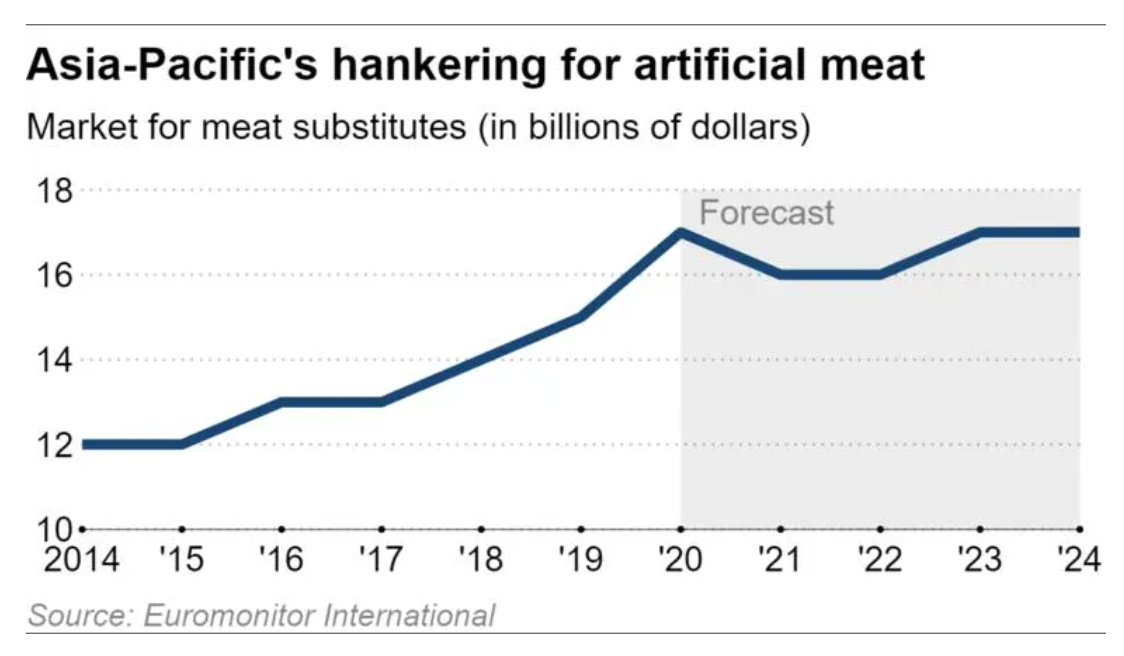

Even before the pandemic, Euromonitor International reported that the substitute meat market in the Asia-Pacific region was worth USD 15.3 billion in 2019, up 4.75% from the previous year. But COVID-19 has accelerated that growth, with the market forecast to expand 11.6% to USD 17.1 billion in 2020, the UK-based market researcher says.

Experts and industry insiders cite increasing consumer health awareness as well as anxiety over food safety triggered by the coronavirus as incentives pushing companies to seek business opportunities in plant-based meat.

“More consumers have interest in alternative meat after the coronavirus outbreak as they increasingly see concerns over food safety,” said Seiichi Kizuki, a research director at the Mitsubishi Research Institute. He said that some reports claiming the source of the virus was a food market selling bats in the Chinese city of Wuhan, where the outbreak was first discovered, is a key reason behind the worries

In Japan, Marukome, a major manufacturer of miso paste, saw May sales of its meat substitute products made from soybeans soar 96% above target. A company spokesperson told the Nikkei Asian Review that “(consumers) wanted to maintain their health and immune system through utilizing healthy food materials.”

Mie Matsubara, a Tokyo resident and mother of two, is one consumer who started purchasing soybean-based meat for a healthier diet even before the pandemic struck. Now, though, her husband has asked her to cook dishes he hopes will boost their immunity to help steel them against possible infection.

Matsubara, however, acknowledges that getting used to the food is a challenge.

“When you start to eat it, the texture and taste are comparable to meat,” she said. “But as you continue, the aroma of soybeans becomes concerning.” She added, however, that the odor is less noticeable when she cooks soy-based fried chicken thanks to the addition of a seasoning mix.

Many consumers rushed to stock up on longer lasting foods such as canned items, in particular, during the early stage of the spread of the coronavirus in Japan. While animal-based meat has a short storage life, Marukome stresses that its soybean-based version will not go bad for 12 months.

But the company says other factors point to continued strong demand for such products even after the coronavirus crisis ends, citing increasing awareness regarding environmental sustainability, including calls for greenhouse emissions from cattle farms.

The emergence of the coronavirus, however, is clearly seen as the main factor pushing a growing number of consumers to seek alternatives to meat. Major meat processor Itoham Yonekyu Holdings in March launched Japanese-style Hamburg steak and fried chicken derived from soybeans and plans to expand its sales channels after it saw increasing demand due to the pandemic.

The trend can also be seen elsewhere in the region. In Hong Kong, social enterprise Green Monday, which makes plant-based meat brand OmniPork, saw its retail sales jump 120% in April, when the coronavirus outbreak peaked in the city, compared to January “as many more people became conscious of the risk and problems associated with the meat and livestock industry,” a Green Monday spokesperson told Nikkei.

“[The] coronavirus exposes the public health and sustainability risk of our meat-reliant food system, which represents a window of opportunity for the plant-based sector,” said the spokesperson.

Nozomi Hariya, an analyst at Euromonitor International, agreed, saying “consumers’ hesitation about consuming animal-based product” is increasing on “concerns that the coronavirus originated in animals [and that] has made some consumers choose meat-less options.”

So-called mock meat is making its way into Asian fast-food chains as well.

“We see great potential for the plant-based meat market in China,” Joey Wat, CEO of major Chinese restaurant operator Yum China Holdings, said in a news release published June 1.

In early June, Yum China introduced offerings using mock meat at three brands it operates in the country — KFC, Pizza Hut and Taco Bell — by teaming up with US producer Beyond Meat.

Starbucks, another big brand in China, announced in April that it was partnering with Beyond Meat to add plant-based meat to its food menu.

Japanese hamburger chain Mos Food Services, meanwhile, has already introduced a plant-based burger in Singapore and Taiwan and began sales in its home market at the end of May. Mos sold 30 burgers on average per each restaurant on the first day of a pre-launch campaign in March in large cities such as Tokyo.

Its “Mos plant-based green burger” uses shiitake mushrooms and konjac for patties and sells for JPY 538 (USD 5.05).

The expanding market has even attracted companies from other industries.

Ibiden, a Japanese maker of printed circuit boards, has started production of a soybean-based meat substitute. The company utilizes mold technology used to shape and manufacture automobile parts, to make soybean-based Japanese hamburger steak.

The company plans to commence test sales at major retailers from July to September in the greater Tokyo area before starting full production.

In Thailand, meanwhile, local conglomerate Charoen Pokphand Group has started research and development for plant-based food.

“Although plant-based food is not so popular in Thailand, we will continue to develop it as it is a [global] trend,” Wisade Wisidwinyoo, president of CPRAM, a subsidiary of Charoen Pokphand Foods, told Nikkei.

Not only big conglomerate CPF, but also emerging Thai start-ups are trying to take advantage of the shift toward plant-based meat as they realize that several instances of animal-sourced pandemics over the past decade have raised concerns among meat lovers and encouraged them to become vegetarians or switch to plant-based meats.

Thai FoodTech, which launched plant-based food product More Meat early this year, says it has received a warm welcome from local clients.

Vorakan Tanachotevorapong, a co-creator of More Meat, said his company earned higher-than-expected sales of THB 500,000 (USD 16,189) in the first quarter of this year, well above the around THB 100,000 expected when he launched the product in January 2020.

Swiss giant Nestle will invest more than CHF 100 million (USD 94 million) to produce plant-based meat in China by the end of the year, betting consumers will embrace alternative meat as pork imports from overseas decreased due to the pandemic.

The world’s largest food company will expand existing facilities in Tianjin for artificial-meat production, its first such attempt in Asia.

After major US meat plants closed due to confirmed coronavirus cases among workers, concerns arose among meat suppliers in Asia about their supply chains. Mitsubishi’s Kizuki, however, said plant-based meat has a low procurement risk as it can easily adapt to the vagaries of supply and demand. For example, raising cattle from breeding to fattening takes several years. And climate change can cause large fluctuations in the harvest and price of food grains needed to feed animals.

Also, unlike animal meat, advocates say plant-based varieties produced in hygiene-controlled facilities avoid the risk of losses resulting from animal illnesses such as outbreaks of avian influenza, foot-and-mouth disease, and the African swine fever that decimated Chinese pork stocks in 2018.

“Alternative meat will draw more interest” in the wake of food company supply chain anxiety caused by the coronavirus pandemic, Kizuki added.

This article first appeared on Nikkei Asian Review. It’s republished here as part of 36Kr’s ongoing partnership with Nikkei. 36Kr is KrASIA’s parent company.