An important tenant of China’s new antitrust regulation takes aim at large marketplace platforms that force exploitative exclusivity agreements onto merchants. The rules are designed to protect local businesses, which were disproportionately impacted by the country’s COVID-19 lockdowns in early 2020. While marketplace platforms play a crucial role in the development of China’s internet sector, the COVID-19 pandemic alerted regulators to the fact that these companies and their services are now indispensable to modern society.

Just as Amazon’s business became the backbone of the US pandemic economy, Alibaba’s e-commerce and on-demand services were vital to minimizing disruption to Chinese society—except even more so, with Alibaba accounting for nearly 20% of retail sales in China compared to Amazon’s 5% in the US.

Marketplace platforms play an outsized role in China’s digital economy, and the new regulation threatens to ban the use of coercive exclusivity agreements by sector leaders to improve competitive equity, foster new innovation, and protect the interests of small and medium-sized businesses that rely on marketplace platforms as vital sales channels.

“The recently drafted guideline is a signal from regulators that the country will start to pay attention to illegal monopolistic practices in the platform economy and curb its brutal growth,” Xue Kepeng, professor of economics and competition law at the China University of Political Science and Law, said to KrASIA.

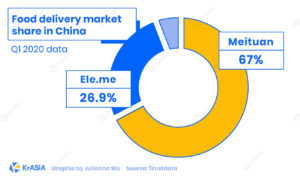

Beijing-based on-demand service platform Meituan has enjoyed a rapid rise to the top echelon of China’s tech giants, thanks to its omni-platform strategy that hosts third-party services like food delivery, hotel bookings, transportation, and entertainment. The company is firmly entrenched in the lives of many people in China, especially among younger, middle-class consumers.

The government’s new antitrust rules aim to create an environment for the healthy development of internet platform companies while ensuring that the rights and interests of merchants and consumers are not overlooked in the name of growth.

The power of exclusivity

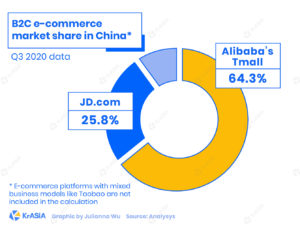

To retain their dominant positions, Alibaba’s Tmall and Meituan have employed the widespread use of exclusivity agreements with merchants to not only secure services and products for their own platforms, but also simultaneously cripple rivals.

“In recent years, there has been less and less innovation in the internet field, which is caused by the monopolistic behavior of certain companies,” Xue said.

Despite Alibaba’s best efforts, the Hangzhou-based internet conglomerate’s stranglehold on China’s e-commerce space has loosened in recent years, thanks to the growth of group-buying sensation Pinduoduo and encroachment from short-video players Douyin and Kuaishou, whose social e-commerce functions hold appeal for many younger consumers. Exclusivity agreements with merchants serve as a handy way to directly confront a competitor.

In May 2019, brands like Supor, Midea, and Joyoung shuttered their flagship stores on Pinduoduo due to fears of being blacklisted from Alibaba’s market-leading user base on Tmall and Taobao. Guangzhou-based home appliance company Galanz, which did not do the same, found out what can happen the hard way: after the company reached an agreement with Pinduoduo the following month, it noticed that its products were not appearing in Tmall’s search results.

Alibaba’s closest competitor in the e-commerce space, JD.com, has levied lawsuits against Alibaba to stop alleged monopolistic practices.

Impact on merchants and consumers

Food delivery leader Meituan has already encountered some pushback after locking in some merchants with exploitative commission contracts. The company only takes a 16% commission rate from restaurants that list solely on its platform, compared to 21% for those that dare leverage other takeout channels like Alibaba’s Ele.me.

In April, as China’s restaurant sector felt the pinch from COVID-19 lockdowns, a number of trade associations asked Meituan to remove “monopoly clauses” in its agreements and to lower commission fees by at least 5% for its member companies.

Xue explained that while this type of predatory pattern is not new to the Chinese economy, it never reached the scale of platforms like Meituan or Alibaba’s e-commerce ecosystems. “Many behaviors of internet platforms have long violated the anti-monopoly law,” he said. “They did not reach the scale or form the commercial behavior that was worth attention before.”

Meituan’s founder and CEO Wang Xing agreed in the company’s recent third-quarter earnings call, saying, “As internet platforms become bigger and more important to the economy, regulatory frameworks will also evolve.”

Meituan had 476.5 million users as of the end of November, while Alibaba reported 881 million mobile active users across its marketplaces up to the same period.

Meanwhile, the restaurant industry has only grown more reliant on delivery platforms like Meituan in the wake of the COVID-19 pandemic, leaving restaurants even more vulnerable to accepting Meituan’s reduced take rate in return for exclusivity. Meituan processed an average of 34.9 million food delivery orders every day in the third quarter of 2020, up 30.1% year-on-year.

The new regulation banning such discriminatory commission structures comes as Meituan consolidates its leading position in China’s massive food delivery sector. While penalties for violations can vary, they are not to be ignored.

“There are several penalties for violating monopoly law in China, including the termination of exclusivity agreements and a fine of between 1% and 10% of annual turnover,” Xue said.

For a company like Meituan, which booked RMB 97.5 billion in sales in 2019, potential fines for antitrust violations are significant.

While exclusivity agreements and “monopoly clauses” are a cheap ploy to help industry leaders retain a dominant position, adherence to the new policy would force marketplace platform companies to innovate their core services, rather than rely on merchant exclusivity for differentiation. By encouraging more organic innovation and product diversity, China’s new antitrust policies will benefit consumers by providing more choices and enhancing users’ experience.

Besides e-commerce and food delivery, marketplace platforms in China must weigh how the policies will impact business in sectors like short video, automotive services, and travel bookings. Although platform businesses have made a great contribution to China’s economic growth in recent times, the time to regulate the market has come. “The country will gradually standardize the business behavior of the platform economy, and crack down on illegal behaviors,” Xue said. “Antitrust is only the first step.”