Subscribe to our newsletter to read this first thing on Friday morning. This is the preview of what you will receive in your inbox.

Since late last year, we have been noticing something very interesting brewing up in India’s startup ecosystem. VC money flowing into Indian startups has been on the rise every year since 2018 with last year as the only exception due to the pandemic. However, despite a slight dip in 2020, investors have started putting in higher than the usual amounts in single rounds across all stages.

For instance, early-stage startups looking to raise seed rounds are able to get four to five times higher investments. Similarly, other rounds of funding are seeing double the usual investment. We spoke with the people in the industry to understand why this is happening if it’s sustainable for the long term, and what does it mean for the local ecosystem.

The Big Read

Checks get fatter for India’s early-stage startups

What Happened

Venture capital funding made in the first half of this year is one billion US dollars more than the lump sum India’s startups raised during the entirety of last year. A Venture Intelligence report said in the first half of this year, Indian startups raised a whopping USD 12.1 billion across 382 deals—exactly half of the 764 deals VCs participated in to distribute USD 11.1 billion in 2020. These numbers suggest that the check sizes are going up.

Going against the norm, VCs have begun writing hefty checks for early-stage companies. Until last year, a seed round used to range between USD 500,000 and USD 1 million. Currently, it can easily reach USD 4 to 6 million, and in some cases even more. Series A rounds have doubled from USD 5–6 million to anywhere between USD 10 and USD 12 million. Meanwhile, Series B rounds have shot up in the range of USD 25–30 million from USD 12–15 million, according to investors KrASIA spoke to.

Last week, healthcare platform Eka.Care landed a USD 4.5 million seed check from early-stage investors and a clutch of seasoned serial entrepreneurs. Last month, Elevation Capital led Series A round of USD 38 million—one of the largest Series A rounds in the country—in a teen-focused fintech startup FamPay.

What Does It Mean

“Startups’ pace of raising money has also increased. Many startups are going for frequent funding rounds despite being well-capitalized,” said Arun Natarajan, founder of Venture Intelligence, a Bengaluru-based research firm.

For instance, edtech startup Teachmint raised around USD 17 million in May and another USD 20 million in July. Likewise, Chargebee, a subscription billing and revenue management platform, raised USD 125 million in April 2021, just six months after closing a USD 55 million round.

Although founders are happy with the rise in check sizes as well as higher valuations, this could be a litmus test for them. Anil Joshi, managing partner of Unicorn India Ventures, told KrASIA that if entrepreneurs cannot utilize the fund to scale the company and justify their high valuations, they might find it difficult to raise money in the future at the same valuation.

“That will make things worse for the startups,” he said. “They may have to go for a down round, which will dilute the value of stakes for the existing investors, resulting in their losses.

”There is enough capital in the market chasing companies with resilient founders who have a good business sense and a strong team, Vinay Singh, a partner at Fireside Ventures, told KrASIA in a recent interview. He added, “Valuations are thus going up in the private market. It is the reflection of demand and supply of money in the market. We have seen the bull cycle before in 2012–15 and 2004–08. I think we are in the middle of that.”

The Weekly Buzz

1. Indian ride-hailing unicorn Ola to enter used car retailing business. Dubbed as Ola Cars, the new business will be complementary to its core business of cab-hailing, local media Entrackr reported. If the plans materialize, Ola will be directly competing with used car startups like Spinny, CarDekho, CarWale, Cars24, and Droom. Since last year, the pre-owned vehicles segment has been witnessing accelerated growth, with many consumers opting to buy used cars instead of taking cabs due to fear of catching the deadly virus.

2. India’s quick commerce market to reach USD 5 billion by 2025, a report says. Bengaluru-based research agency RedSeer said the market of quick commerce, which has an addressable size of 20 million households, is estimated to reach USD 300 million by the end of this year. Companies such as Google-backed Dunzo and food delivery major Swiggy, which got into hyperlocal deliveries of groceries and other products in 2020, are the leaders in this category, according to the RedSeer report.

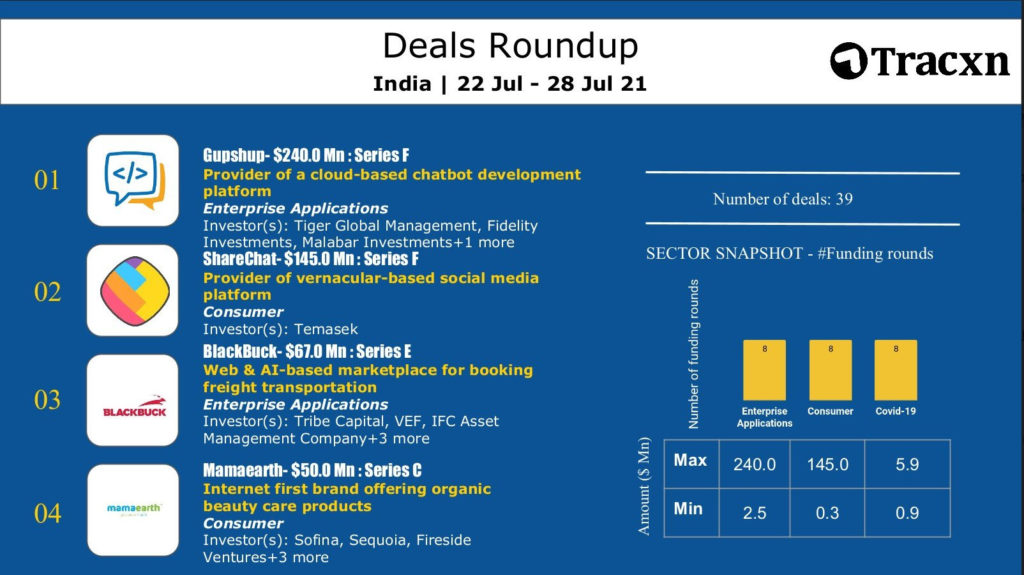

3. Tiger-backed ShareChat and Moj conclude its USD 650 million Series F round with a recent USD 145 million check. The deal values the company at USD 2.88 billion. The most recent funding takes the total amount raised by the six-year-old startup to over USD 911 million. It plans to use this capital to accelerate user growth, attract and incentivize a diverse creator base, and create better AI feeds for its platforms.

4. Zomato makes stellar debut on bourse, its market cap hits INR 1 trillion. Indian food delivery startup made its bumper debut on Indian stock exchanges last Friday, becoming the first internet unicorn in the country to go public. It listed its shares on the BSE at INR 115, a 51.32% premium over the issue price of INR 76, while on the NSE, it began trading at INR 116, surging by INR 40 or 52.63%.

5. Byju’s buys US-based edtech startup Epic for USD 500 million. The acquisition will help Byju’s enhance its presence in the US market as Epic provides access to its two million teachers and 50 million user base. This comes two months after the USD 16.5-billion edtech giant announced the global launch of its live online learning platform targeting countries like the USA, UK, Australia, Brazil, Indonesia, and Mexico to begin with.

Startup of The Week

Aspiring job applicants in India tune in to Khabri

After New Delhi-based software engineer Pulkit Sharma developed a fondness for podcasts a few years ago, he developed his own audio app in 2017. In its early days, Khabri used to broadcast news snippets in one of India’s most widely spoken languages, Hindi.

When the team spoke with its users, they realized there was a commonality they had not expected: Khabri’s listeners were using it as a way to study for public service entrance exams. Once the company learned why the majority of its users were frequenting the app, it decided to address that problem directly.

In 2018, Khabri transitioned to audio-format education and started recruiting teachers to join the platform and cover different subjects, like history, geography, and economics. Khabri’s user-generated content includes tips and tricks to ace exams, as well as courses to expand one’s vocabulary.

Deals This Week

What We Are Reading

As India’s apex bank RBI recently said it’s working on a digital currency, this is the right time to read up on what CBDCs are and how it’s going to change the future of money. Anirudha Basak, a product manager at a fintech startup Raise, explains why a country needs a digital currency, and how it’s different from real-time payments such as UPI in India. In an easy-to-understand language, Basak explains how digital currencies affect banks and your account.

The Spoiler

Tune in next week to read what the founder of Leher, India’s answer to Clubhouse, has to say about the audio-only social media sector.