For many years, Alibaba (NYSE: BABA) and Tencent (HKEX: 0700) boasted the most formidable investment portfolios among China’s technology giants. The two biggest Chinese internet firms have long cultivated a diversified investment ecosystem to capture new opportunities in a broad range of markets.

However, there is a newcomer to the big stage.

Beijing-based content titan ByteDance, one of the most valuable startups out there, valued between USD 100 billion and USD 140 billion in private markets, has been aggressively pursuing expansion into a number of new arenas, leaving many thinking that Baidu (NASDAQ: BIDU) may have to relinquish its position in China’s BAT triumvirate (Baidu, Alibaba, Tencent).

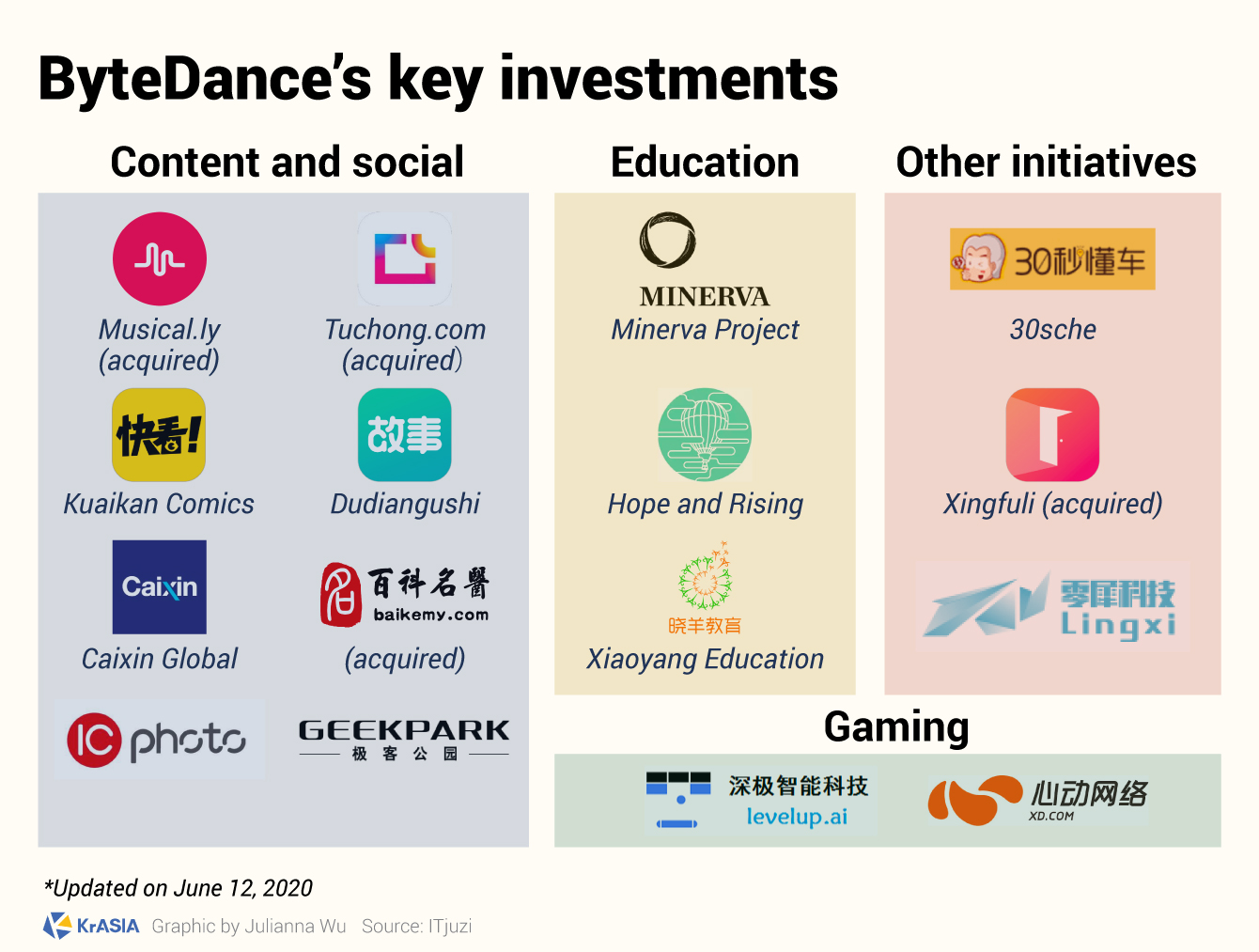

Not only has ByteDance been churning out new products across sectors, earning it the moniker of an “app factory”, but it has leveraged its robust revenue generation to assemble its own roster of promising investments in fields including content, education, gaming, and others.

Let’s explore ByteDance’s wide-ranging investment portfolio, consisting of over 80 deals, according to investment firm ITjuzi.

Content and social

ByteDance gained its popularity on the back of Jinri Toutiao, an AI-powered news aggregator, and short-video sensations TikTok and Douyin, so it is no surprise that the firm wants to further augment their position in content and social applications.

Following ByteDance’s landmark acquisition of Musical.ly in 2017, which would give rise to TikTok’s success, the firm is extending its empire to literature, photos, and other areas. The company invested in Tuchong.com back in December 2014, a photo database powered by over 800,000 photographers with an average 200,000 original images added daily, and IC Photo, in August 2016, another Chinese photo database.

ByteDance has also invested in online literature platform Dudiangushi amidst local growing demand for paid knowledge and content. The app, which relies on user-generated content (UGC), boasts a 4.9 rating from over 20,000 reviews on the iOS app store and has cultivated a strong user base among white-collar workers in China, with female users making up 71.3% of total users, and young users (between 25 and 30-year-old) accounting for nearly 40%.

Read more: From Uber to TikTok: Liu Zhen, the woman behind ByteDance’s rise

Kuaikan Comics, an online comic and cartoon platform, also received an investment from ByteDance in January of 2017, during the company’s Series C fundraising round.

Baikemy, one of China’s largest and only nationally authorized medical information portals, was also acquired by ByteDance for an undisclosed price in May, bolstering the company’s position in the healthcare space. Founded in 2010, Baikemy produces professionally generated content (PCG) on various medical topics.

Beijing-based ByteDance has also invested in English-language Chinese media Caixin Global, as well as tech-media Geek Park.

As ByteDance consolidates its dominance in the online entertainment, the company’s strategic investment in information platforms directly encroaches on the Chinese search incumbent Baidu, which ByteDance surpassed in terms of advertising revenue share in 2019.

Toutiao, ByteDance’s flagship news aggregator, launched a Toutiao Search in August 2019, following up with a standalone app for Android this February, as if ByteDance’s intentions to replace Baidu as the B in the BAT group were not clear enough.

Education

Zhang Yiming, ByteDance’s founder and CEO, singled out education as a crucial sector in an open letter on the company’s eighth anniversary in March, having previously highlighted in 2017 his vision that the intersection between education and technology is inevitable. The edtech market in China is estimated to rise to RMB 453.8 billion (USD 63.6 billion) in 2020, according to an iiMedia report.

ByteDance led a USD 57 million Series C fundraising round in the San Francisco-based edtech firm Minerva Project, while Zhang Yiming was awarded a seat on the board of the American company. The Minerva Project operates a catalog of education applications with a focus on customization, a similar theme that powered ByteDance’s Toutiao to such prominence.

Read more: More than short-video apps, ByteDance eyes education sector in 2020

In 2019 ByteDance invested in Xiaoyang Education, an edtech firm providing cloud services to primary and secondary schools while specializing in processing big data to improve education management and scholastic outcomes.

The company also invested RMB 420,000 in parenting educational service provider Hope and Rising which focuses on early child development from infancy to eight years old with the support of AI.

ByteDance has also released a slew of its own education products including, GuaGua English, Dali Classroom, Haohao Xuexi, and others, showcasing its commitment to innovation in the sector.

Gaming

Having dominated mobile entertainment, ByteDance is expanding its influence into China’s massive mobile gaming sector with hopes of creating a mobile mega-ecosystem. In 2019, the company deployed game development teams in Beijing, Shanghai, Guangzhou, Shenzhen, and Hangzhou.

Building upon the company’s release of mini-games within Douyin in 2019, ByteDance appointed Yan Shou as head of its gaming business in February, and received its first game license from the Chinese National Radio and Television Administration (CNRTA) in March, paving the way for future releases.

Read more: Opinion | Five reasons why ByteDance might become the next gaming giant

This advance has not gone unnoticed, as gaming leader Tencent took note, blocking ByteDance’s enterprise platform Lark’s links from working with WeChat, while a Tianjin court ruled that Douyin could not recommend friends using their WeChat or QQ (both Tencent products) photos.

The competition is set to intensify between the two, as ByteDance is reportedly building a team of 1,000 to head its gaming division.

Meanwhile, a ByteDance international gaming title Combat of Hero rose to popularity in the Japanese market this March, again showcasing the Beijing-based firm’s ability to succeed outside of China. The game was released by ByteDance-owned Ohayoo studio based in Miyazaki, Japan, while the Chinese content giant has also snapped up game developers including Pangu Game Global and Shanghai Mokun Digital Technology.

ByteDance even proved they could compete directly against Tencent, with the release of their title Xiaomei Fights the Landlord, which is based on traditional poker and rose to popularity in early 2020. Meanwhile, Tencent already had a similar game, Happy Poker, proving that ByteDance could succeed in the mobile gaming market.

The company leveraged its powerful social channels like Douyin and Toutiao to market the game, with Chinese gaming media reporting that Xiaomei Fights the Landlord released 1,388 different videos on Douyin, racking up more than 160 million views.

Perhaps ByteDance’s most notable move in the gaming industry is its acquisition of LevelupAI in January. The gaming startup, also based in Beijing, applies big data, machine learning, and artificial intelligence to create, play, and test games. The firm is also researching Procedural Content Generation (PCG) algorithms to automatically create content for video games.

Other initiatives

TikTok’s parent company also made an adventurous foray into other areas, such as the internet of vehicles (IoV) sector. In May, it announced the development of an IoV division to optimize their apps targetting in-car experiences. The move builds upon their investment in 30sche, an auto trading, content, and information platform, which features multimedia including livestreams for its community of car-enthusiasts.

ByteDance also wants to apply its strengths in artificial intelligence and big data to fintech, as the firm led a Series A fundraising round for Beijing-based Lingxi, a company applying machine learning to financial services.

Access to financial products and services in China has long been mainly accessible to those in urban areas, but fintech products have the potential to democratize access to financing for individuals and small businesses throughout China’s rural regions.

While many of ByteDance’s successful products are content discovery platforms, the firm has also acquired Xingfuli, a real-estate app that helps users find properties for sale or rent, complete with ByteDance’s trademark recommendation engine.

ByteDance’s investment strategy aims to replicate its successful formula of leveraging machine learning and artificial intelligence to power content discovery platforms across industries.

Like rising tech titans before them, ByteDance’s aggressive horizontal expansion signifies the firm’s ambition, and will likely cause friction with many sector incumbents. However, given ByteDance’s strong record of monetization, and overseas success, its ecosystem may yet grow to be one of the most influential in global tech.