Qubu is a Chinese fitness app that starts users off with a simple task: walk 4,000 steps a day for 45 days. If they manage to stay active in that month and a half, they receive 15 “candies”—Qubu’s in-app virtual currency.

Candies can be traded in to unlock more complex tasks that carry higher rewards or even exchanged for real-world cash. In documents seen by KrASIA, Qubu’s candies were marketed as wealth management instruments that carry up to 36.8% return on investment over 60 days. It is also strongly suggested that anyone who uses the app should recruit a downline. You could earn passive income without putting in any extra work, the logic went.

But if something sounds too good to be true, then it probably is.

The fleece: Where fitness meets crypto

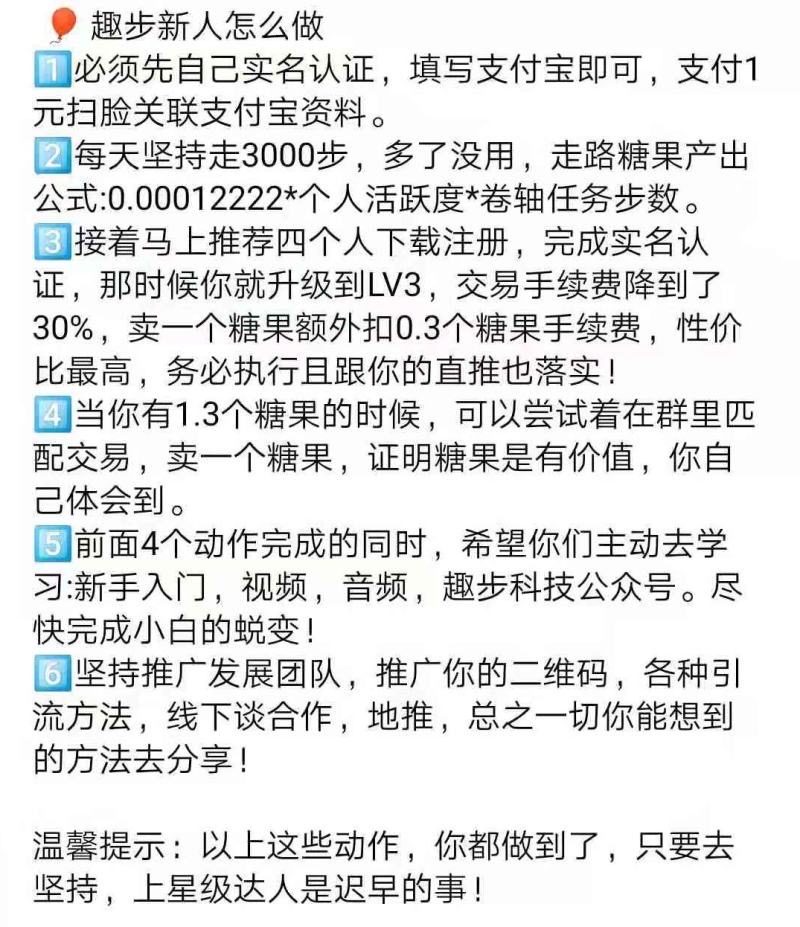

Signing up was easy. Registration is practically free; the app only prompts you for your name, ID card number, and Alipay account information. Qubu would charge you one yuan to verify the information that you have keyed in. There is no initial investment, it says. All you have to do is take regular walks.

But the hard selling would come quickly.

Qubu’s app has a trading center where anyone can buy bundles of its virtual currency from other users using actual cash. The app takes 25–50% of the transaction value as a processing charge, with higher level users paying lower fees. By December this year, Qubu claimed to have 95 million registered users. If its claim is true, then nearly one in ten mobile users in China has registered on the app—an unlikely scenario. Qubu said it has issued 1 billion candies, with a significant portion of its users pitching in to spend millions of renminbi to buy candies.

Yan, a Qubu user who spoke with KrASIA under a pseudo name, thought of the RMB 15,000 (USD 2,150) he spent in Qubu as an investment. Yan bought hundreds of candies not long after he was introduced to the walking app earlier this year. He liked that candies could be exchanged for Qubu’s own cryptocurrency called GHT, and he had faith that blockchain-based assets would yield a solid return.

Call it a grand miscalculation. Yan is now in limbo after Qubu was placed under investigation for illegal fundraising practices and financial fraud by the market regulator in Changsha, capital of central China’s Hunan province, where the company was based. Qubu has since claimed to have relocated to the southwest municipality of Chongqing.

Around the time of the domestic crackdown on Qubu, the scheme started to spread into the Southeast Asian market. A video clip seen by KrASIA shows a group of about dozen Qubu users wearing branded yellow T-shirts and yellow caps gathered in a restaurant/bar in Johor Bahru, a Malaysian city with a major Chinese community.”We are in Johor Bahru, Malaysia,” these users said in the 10-second video clip, waving their smartphones. Screenshots of Malaysian Qubu users’ candy transactions posted on social media also suggest that the app has been operating in the country.

Qubu’s massive following underscores a dilemma faced by regulators in China—the central government is actively promoting the blockchain, to the point that president Xi Jinping told his fellow politburo members that the technology is an “important breakthrough” where the country must be a global leader in its development and application. Yet blockchain is sometimes associated with Ponzi schemes, particularly via dubious initial coin offerings and cryptocurrencies.

“The Qubu scheme is very deceptive,” said Martin, a tech blogger who has been writing about how to make money online since 2015. Qubu merged the concepts of “blockchain” and “fitness” to formulate its selling points. Many of its users were misled to believe that they were taking part in a cutting-edge health initiative that collected data from their smartphones to mine some sort of virtual coin, he observed.

The tasks, which Qubu assigned to new users, function as cryptocurrency mining machines, he said. The higher the tasks’ levels are, the greater their processing power, and the more candies they then generate—at least, that’s what users were led to believe. Users felt like their pots of candies weren’t growing fast enough, so they would click “buy” over and over again to unlock tasks with bigger payouts.

Like most Ponzi schemes, Qubu also relied on its users to bring new people on board. The platform heavily emphasized the importance of recruitment, and divided its subscribers into five tiers. The more people you signed up, the more commission you earned (via a percentage of your downline’s candy output), and the faster you moved up the pyramid.

False fronts and real consequences

In a video shared among Qubu users, a woman who appears to be a team leader tells other users that she can earn as much as RMB 180,000 (USD 25,700) a year by investing in the platform’s candies and recruiting new users. It’s a familiar sales pitch.

Du Xiang, who leads a grassroots team that exposes pyramid schemes across the country, said the danger of Qubu and similar online scams is that they tend to have low investment entry points and a large target population. “Plus, they’ve created an illusion that it’s cutting-edge and following the social trend of [adopting blockchain technology],” he said.

Against the backdrop of Qubu’s rapid rise is a top-down push to embrace blockchain technology.

China’s most recent Five-Year Plan, the policy blueprint that sets out the government’s vision for the country’s social and economic development in half-decade blocks, was released in 2016. It listed blockchain as a critical “strategic frontier technology” and called for more research in the technology. Governments at all levels have rushed out policies covering how blockchain can be utilized in local and industrial developments.

The Changsha Economic and Technological Development Zone, where Qubu’s former headquarters were located until the app ran into trouble this summer, had an RMB 3 billion fund to lure in blockchain companies. Eligible firms were also promised free rent for up to three years and RMB 2 million in subsidies.

Though Qubu bills itself as living on the blockchain, industry observers said it has little to do with the tamper-proof digital ledger. Kang Li, assistant director at the Blockchain Research Center of China at Chengdu’s Southwestern University of Finance and Economics, said the company was likely only using the buzzword to attract people’s attention without implementing the technology at all.

Scammers oftentimes tailor their pyramid schemes to ride the latest trends, said Du Xiang. In the past few years, he has noticed that it is increasingly common to see the blockchain appropriated in pyramid schemes.

Court records appear to back up Du’s observations. In 2016, only one court judgment in China mentioned blockchain. That number shot up to 171 last year, and then more than 400 entries even before this year’s end.

Despite the removal of the now-disgraced Qubu app on the Apple App Store and various Android app stores in China, there were no fewer than two dozen similar blockchain-based fitness apps available for download in China as of the end of November.

“We have developed many similar systems. Some reward users for walking, others for answering questions or planting virtual trees,” said a programmer in Guangzhou who has worked on several outsourced coding projects for Qubu copycats. It usually costs less than RMB 100,000 to develop the app and its in-app trading system. The programmer wished to remain anonymous given the sensitivity of the topic.

Most of the Qubu users who were approached for this story didn’t speak to KrASIA on the record as they hoped to retrieve their investments after the scandal subsides.

“Blockchain is only the convenient concept that they use to scam money,” said Zheng Xiaofei, an editor at Shenzhen-based anti-fraud consultancy Feifan Fenghuotai, while commenting on Qubu and its copycats.

Echoing Zheng’s point, tech blogger Martin said the fact that many people have only a vague comprehension of blockchain leaves scammers with opportunities to misrepresent their pyramid schemes as real, meaningful applications.

Kang Li, the blockchain expert, warned that scams that are dressed up as blockchain-powered operations could undermine the digital ledger’s true development. “Some people might choose to stay away from the technology because they get spooked by it,” he said.