China’s internet sector is no short of legends about self-made founders bootstrapping successful businesses or newly-minted startups pulling off miracle growth. E-commerce up-and-comer Pinduoduo (NASDAQ: PDD), falls under the second category.

With its rapid-fire expansion, the Shanghai-based company has won over users, impressed investors, and caught its competitors off guard.

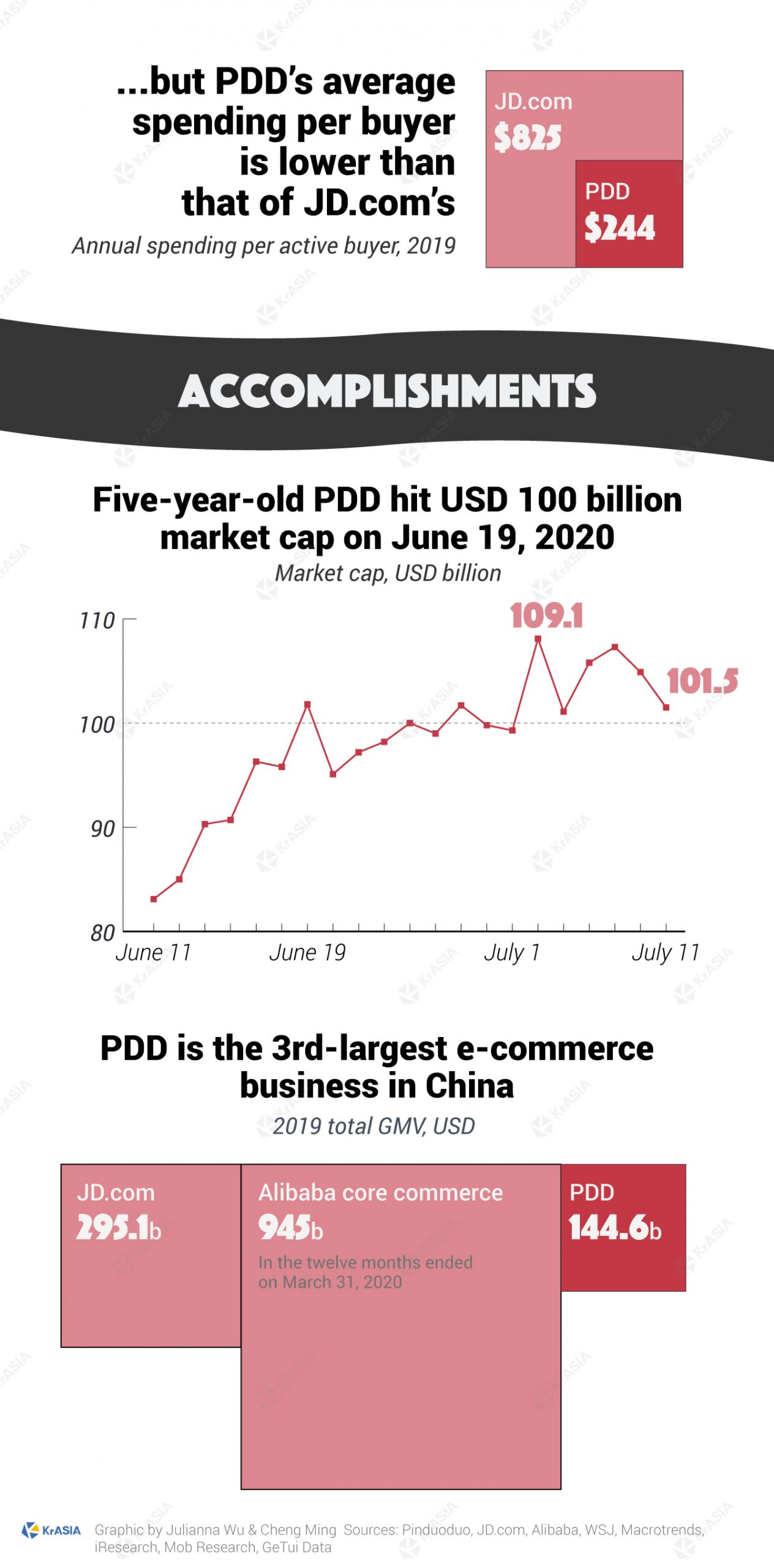

It took Pinduoduo less than five years to hit a trillion yuan sales benchmark, half as long when compared to the ten-plus years spent by Alibaba (NYSE: BABA; HKEX: 9988), and JD.com (NASDAQ: JD; HKEX: 9618), the other two major e-shop operators in the country.

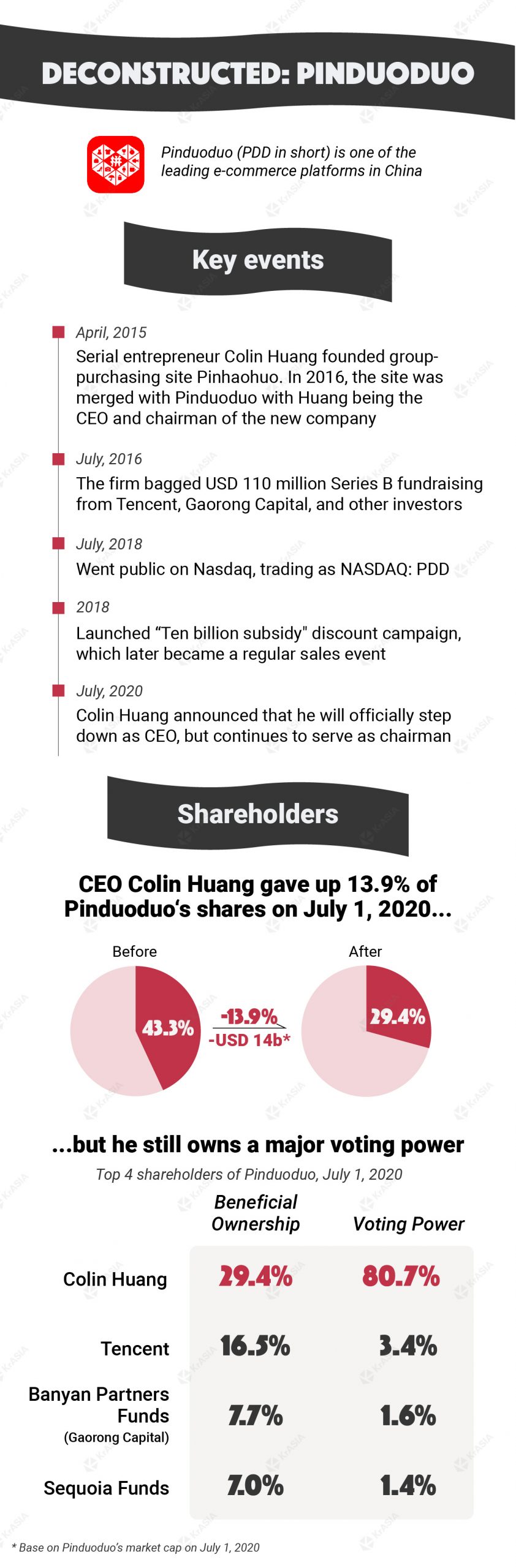

Moreover, Pinduoduo became the fourth Chinese internet company, after Alibaba, Tencent (HKG: 0700), and Meituan Dianping (HKEX: 3690) to join the USD 100 billion market cap club this June, one step ahead of its major rival JD.com.

Many have attributed Pinduoduo’s success to its strategy of social e-commerce: users get discounts if they share product links with their friends on WeChat or QQ, inviting them to take part in a group purchase. WeChat and QQ are China’s two most popular social messaging apps owned by Pinduoduo’s investor Tencent.

The social and somewhat entertaining online shopping experience, together with cheap prices, helped Pinduoduo gain quick popularity among China’s price-sensitive users who live in lower-tier cities and towns and had been left out in Alibaba and JD.com’s fought for the top-tier city market.

Read more: Why does Pinduoduo call itself a ‘Costco+Disney’ concept?

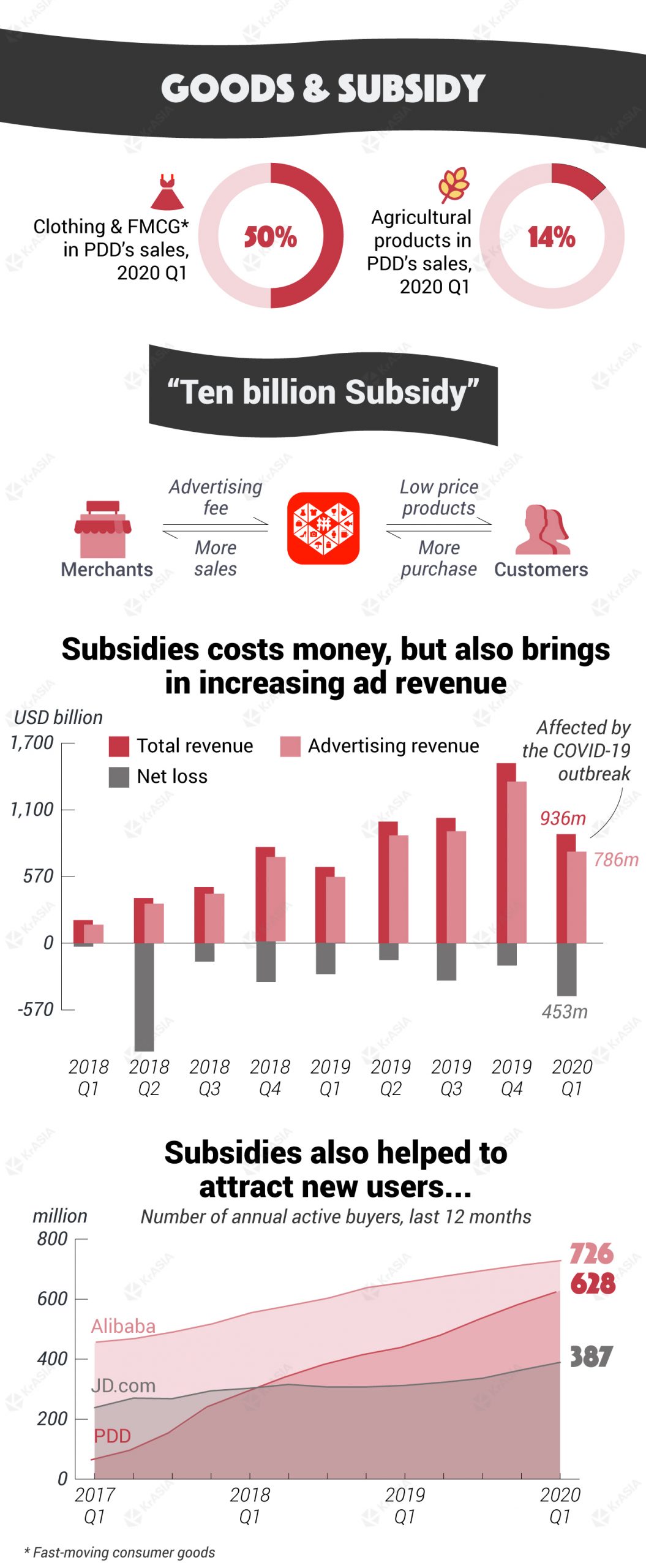

The social element is an important pillar underpinning Pinduoduo’s quick rise, but there is more than meets the eye. Its “Ten Billion Yuan Subsidy” program also played a critical part in gaining new small city bargain hunters while retaining existing customers.

In June 2019, Pinduoduo said it would, together with merchants on the platform, provide a total of RMB 10 billion (USD 1.4 billion) to lower 5-50% the prices of certain clothing, cosmetics, and 3C products. The campaign has helped Pinduoduo secure an average 9% quarter-to-quarter user increase.

Subsidies are like a double-edged sword. Though Pinduoduo’s revenue, mostly from advertising, has been increasing over the past few quarters, it still can’t make a profit due to its high marketing and subsidy expenses. In the quarter past, as affected by the COVID-19 outbreak, the company saw the worst net loss of USD 450 million since 2018.

Alibaba and JD.com followed suit, rolling out their versions of the “Ten Billion Yuan Subsidy” campaign in 2019.

While Alibaba and JD are trying to explore markets downwardly, Pinduoduo is looking to venture up into the top-tier market. Since earlier this year, the e-commerce platform has also started subsidizing high-end products like iPhones and Chinese spirits like Maotai.