On a hot summer day of 2012, Cheng Wei, a 29-year-old Alibaba manager, missed his flight again because he could not hail a taxi in time to the airport from Beijing’s traffic-jammed and vehicle-jostled CBD area.

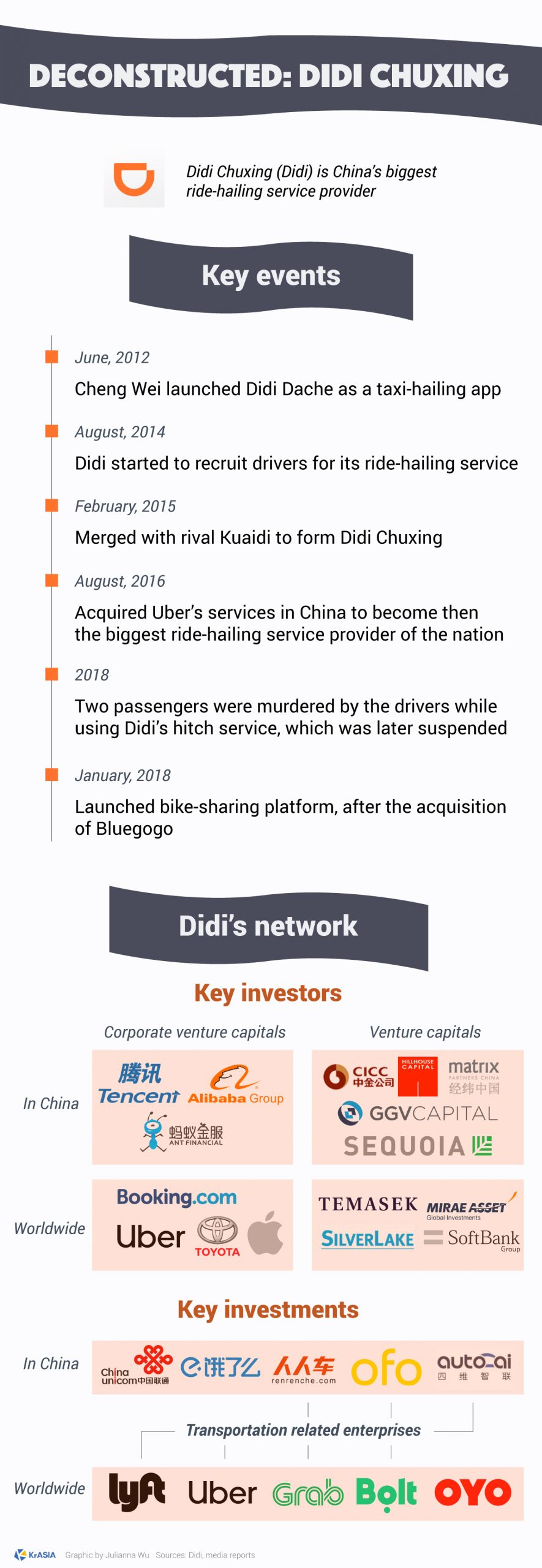

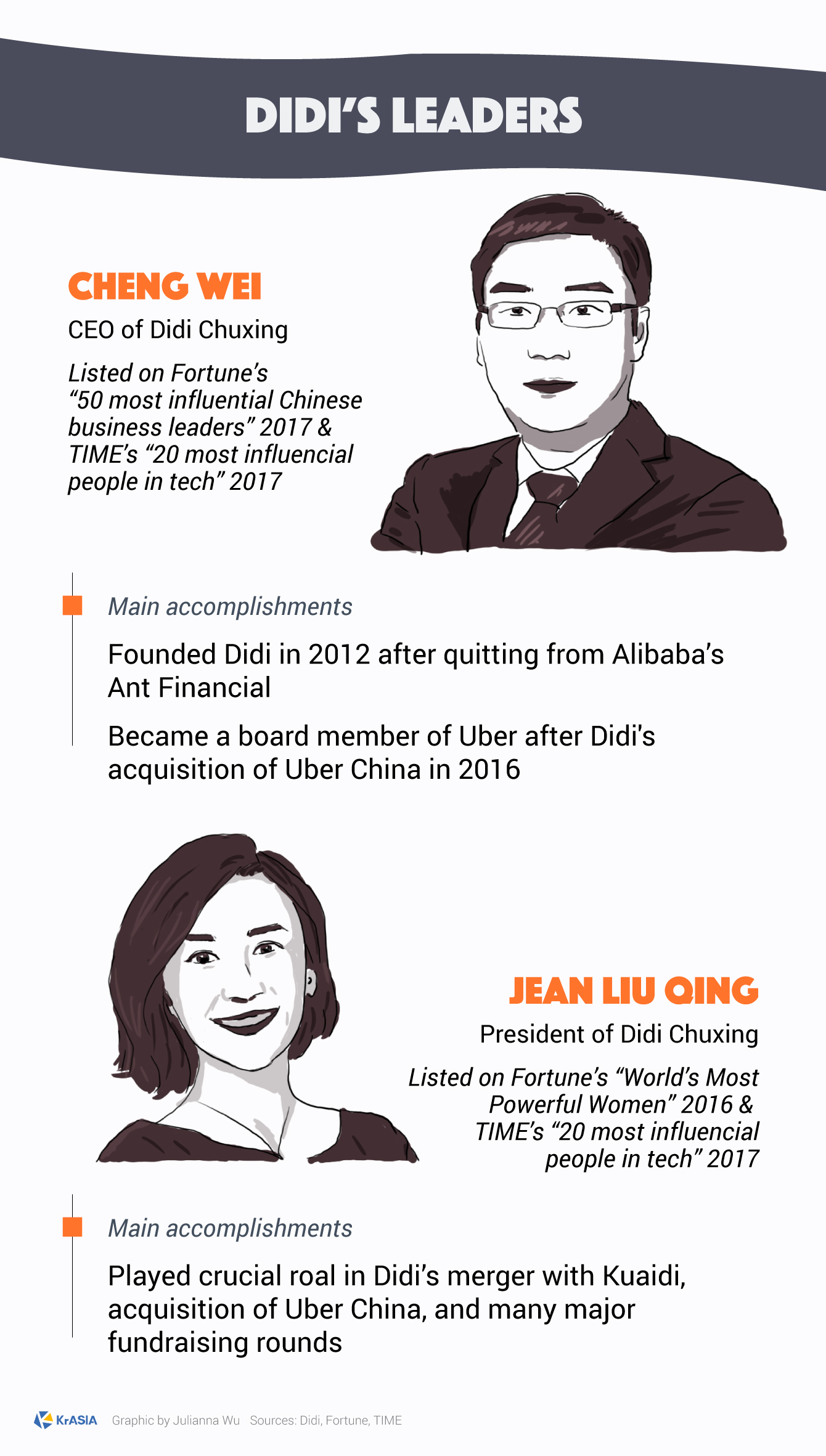

Just like many other cliche startup stories, Cheng’s personal encounter eventually led him to quit his promising career at Alibaba (NYSE: BABA; HKEX: 9988) to found a startup aiming at better matching cabbies and passengers. In 2014, Didi expanded its service from taxi booking to ride-hailing.

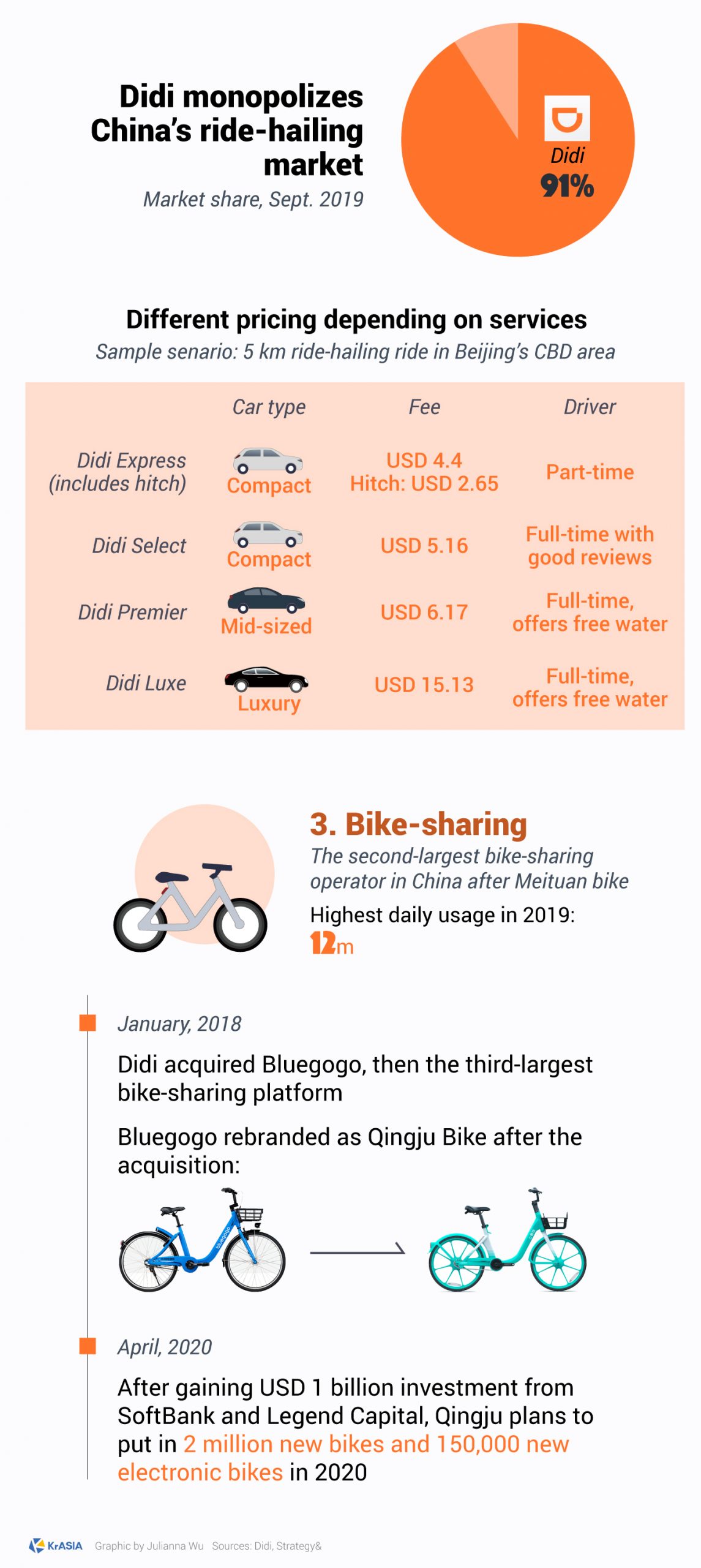

Didi wasn’t the sole player in the market. There were other formidable players as well, from a local startup Kuaidi and global giant Uber. Didi fought a good fight, which ended up with it merging rival Kuaidi and Uber’s China operation in 2016, consolidating its status as the largest ride-hailing service in China.

The impediments on the company’s drive to success are not just competition. In 2018, the killings of two female passengers by their Didi carpool service drivers in two separate cases put the company’s reputation and business on the line. Didi had to suspend its carpool service, which was lucrative, and pledge big investments to improve the safety standards of its services.

Currently, as the third-largest unicorn in China with a valuation of around USD 70 billion, Didi has driven to a critical crossroads with lots of uncertainties awaiting ahead. Market-wise, in 2019, Didi’s US counterparts Uber and Lyft both experienced valuation dive after their public listings, making investors concern about Didi’s prospects. Business-wise, the Beijing-based startup is seeking other possibilities overseas while the domestic Chinese market saturates.

Didi claimed profitability, without disclosing the actual figure, right before the COVID-19 outbreak hit the world and dented global ride-hailing businesses as city lockdowns around the globe sagged demand. Now even as China is slowly opening its economy and getaround demands are coming back, the rebound won’t be on pace with the growth without a pandemic. Last week, it had to deny a rumor that it’d be merged into local service giant Meituan (HKEX: 3690), further reflecting industry observers’ concern over its sustainability as an independent business.

In April, Didi launched its 3-year plan codenamed “0188” with each digit representing a goal: zero safety incidents, 100 million services per day, 8% revenue in the mobility industry, and 800 million monthly active users globally.