A more connected world means a common, greater ability to transact between territories. In light of this transition, companies are turning their gaze toward less-tapped markets for new opportunities, turning cross-border digital commerce into a catalyst that spurs the growth of the world’s emerging economies.

The trio of Latin America (LATAM), Africa, and India exemplifies this paradigm shift, showcasing not just the scale of their rising spending power, but also the profound willingness of their populace to transact.

To understand the current state of cross-border digital commerce in these rising markets and gain an overview of their payments landscape, KrASIA had the privilege of speaking with Wei Duan, vice president of APAC at EBANX, a Curitiba-headquartered payments solution provider serving businesses and merchants globally across 29 countries in three regions: LATAM, Africa, and Asia.

Rising markets exhibit strong impetus to transact

In the sprawling expanse of the LATAM region, the population’s inclination for transactions is as notable as the enormity of its land area. Latin Americans typically exhibit a strong impetus to transact—a behavior that implies not just their spending power and the scale of their disposable income, but also their propensity to consume that’s rooted in culture.

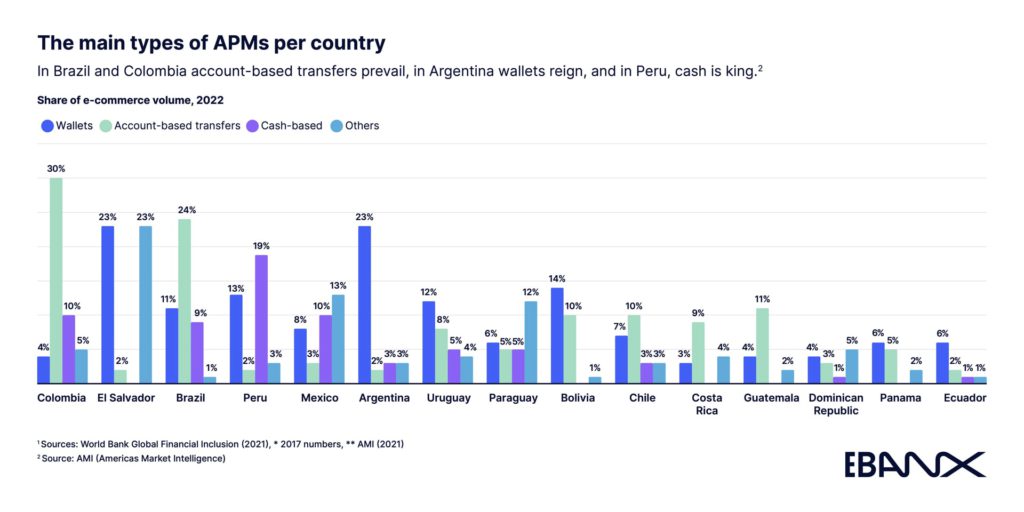

More importantly, consumers in LATAM prefer to conduct their transactions using alternative payment methods (APMs). In this context, APMs refer to any mode of payment other than credit or debit cards, including online purchases made with cash-based vouchers (also known as boleto bancario in Brazil) and digitized, real-time payments such as digital wallets, account-based transfers, and more.

“LATAM is a diversified region with a huge consumption willingness. This isn’t just about people having high disposable incomes—it’s also about their willingness to access products and services, and to spend, and that’s why alternative payment methods and installments are so popular in the region,” Wei said.

Meanwhile, India, the second largest online market in the world, has merely scratched the surface with 32% of its population engaged in online shopping, leaving plenty of room for growth. Initiatives like Digital India underscore the nation’s commitment to unlocking this market’s full potential. The online retail vertical alone is set to double to USD 173 billion by 2027, from USD 87 billion in 2022. Cross-border transactions only account for 8% of this industry in India so far.

The continent of Africa, with its rapidly growing population of young consumers wielding substantial spending power, is on the verge of hosting a billion adults by 2030, surpassing the demographics of India and China by 2032. By introducing a strategic mix of products, payment solutions, and enhanced connectivity, nations in Africa, particularly South Africa, Kenya, and Nigeria, have the potential to lead a digital renaissance capable of transforming the entire continent into an economic powerhouse. Notably, the GDP of sub-Saharan Africa is projected to grow at a CAGR of 7.3% through 2027, surpassing the 5% global average.

Graphic source: Beyond Borders 2023–2024 (Special Edition: India) by EBANX.

Integrations: A common ingredient for growth

Although LATAM, Africa, and India are in different stages of digital maturity, the common thread binding these regions lies in the integration of global commerce with locally preferred payment methods. Contrary to past understandings, credit access was found to not be a significant barrier, with APMs helping to fill this gap adequately. Instead, the main challenge involves bridging these APMs with global brands.

Reflecting on the exponential growth of China’s digital economy also provides valuable insights for companies eyeing LATAM or other rising markets like Africa and India. The Chinese experience, characterized by a surge in e-commerce during the 2000s, highlights the transformative potential of APMs.

Alipay, WeChat Pay, and other domestic APM providers have been exploring integrations for years with the goal of providing Chinese consumers access to seamless and cost-effective APMs like digital wallets. This enabled users to conveniently pay for a variety of digitally delivered products, including popular online-to-offline (O2O) services such as ride-sharing and food delivery, which continue to thrive. These companies played a pivotal role in expanding China’s digital economy, transforming it into the powerhouse it is today.

While China’s lessons may not directly translate to other markets, there are evident parallels in growth potential. Fragmented landscapes, characterized by diverse tech players and financial institutions, suggest that, akin to China, integrations will be similarly crucial in these regions.

“LATAM has a lot of potential for growth, but some of its industries remain less developed than Asia. Using the digital economy as an example, a country like China offers capabilities that LATAM could use more of. Naturally, these two regions complement each other,” said Wei, drawing a strategic connection between China and emerging markets like LATAM.

Ultimately, what is apparent in rising economies, is that modern consumers are less concerned about the origin of their goods, as long as the offerings are competitive in quality and price, and payment services they utilize are safe, transparent, and seamless. In particular, software-as-a-service, cloud computing, and other digital verticals like gaming and social media, are expected to hold the highest potential for international expansion into these regions. The accessibility of financial infrastructure in these markets, coupled with reduced entry barriers, stands out as key drivers propelling this trend.

The payments landscape in LATAM, Africa, and India

Navigating the payments landscape in emerging markets unveils a mosaic of challenges and opportunities that lie within. In LATAM, alternative payments account for a substantial 39% of all digital commerce transactions, with Colombia and Brazil leading the charge at 50% and 44% respectively. Beyond the lack of credit and debit card access, APMs thrive in LATAM due to cultural preferences—allowing Latin Americans to pay in ways that resonate with their lifestyle.

According to Juliana Etcheverry, global director of strategic payments partnerships at EBANX, technology plays a critical role in driving APM adoption. “New technology is increasing the use of APMs and enabling more digital ways to boost financial inclusion in the region,” Etcheverry said.

For global companies, understanding and refining their offerings based on local cultural preferences is paramount to developing a new customer base in rising markets like LATAM. According to research conducted by EBANX, the ability to adapt can not only reduce costs, but also help build trust and enhance order values.

Among the latest trends to emerge in these markets include:

- Instant payment methods are on the rise, including Pix in Brazil and Pagos Seguros en Línea (PSE) in Colombia, among others, mirroring a global shift toward seamless, rapid transactions. A similar trend has already been unfolding in India, with its Unified Payments Interface (UPI) adopted by 344 million citizens. UPI was used to process over 70 billion transactions in 2022, accounting for one-third of India’s GDP, and over 270 million merchants now accept the payment method. In sub-Saharan Africa, digital payments penetration surged from 23% to 46% from 2014 to 2022, with APMs, particularly mobile money, playing a huge role in driving this growth.

Graphic source: Beyond Borders 2023–2024 (Special Edition: Africa) by EBANX.

- While buy now, pay later (BNPL) services have not yet penetrated LATAM as they have in Asia and Africa, the popularity of installments, integrated with APMs, has offered a unique alternative. For example, Brazilian fintech company Koin found success by catering to consumer preferences, offering interest-free installments payable with locally preferred payment methods such as Pix or boleto bancario.

- Cash may no longer be king, but will play a complementary role to digital payments. For example, consumers could continue to manage their digital wallet balances using cash, rather than go entirely cashless. Currently, cash-based methods still account for 19% of digital commerce in Peru, while cash continues to hold a significant 10% share of transaction volumes in Brazil and Mexico, where APMs are prevalent.

Navigating rising markets with EBANX

In this dynamic landscape, EBANX has emerged as a linchpin, seamlessly orchestrating payments across LATAM, Africa, and Asia. Processing more than two million transactions daily across 29 countries, EBANX connects over 1,600 merchants from Asia, North America, and Europe with over a billion potential customers.

Operating with teams located in 16 countries worldwide, EBANX stands out among global payment service providers, specializing in addressing the intricacies of 17 LATAM economies. These range from major ones such as Brazil, Mexico, and Colombia to fast-growing markets like Peru, Chile, Paraguay, as well as Central American and Caribbean nations like Costa Rica, Panama, Dominican Republic, Jamaica, and Bahamas.

Beyond LATAM, EBANX recently ventured into Africa, and is now operating in 11 African countries including South Africa, Kenya, Nigeria, Egypt, and Morocco, among others. In Asia, India serves as EBANX’s operational entry point into the broader Asian market.

Since it was founded in 2012, EBANX has excelled in delivering a comprehensive, cloud-based, and API-driven platform adept at addressing diverse payment requirements. It collaborates with over 20 strategic partners, including Stripe, Recurly, TokenEx, and more, amplifying its capacity to offer merchants a wide range of billing, payment, and commerce solutions.

Wei, who played a key role in introducing EBANX to merchants in China and Asia, shed light on the company’s expansion approach. “The first step we take is always exactly the same: finding the best experts who understand the market well, and understand the challenges from a comprehensive perspective—including aspects like taxes, consumer behavior, regulatory frameworks, and more. Having a local eye is key,” Wei said.

Another notable aspect of EBANX is its knowledge-sharing initiatives, underscoring its role as a representative of LATAM, Africa, and India. Having found success in navigating multifaceted markets, the company actively shares market-specific insights with merchants, instilling confidence while offering support and an actionable blueprint for effective market entry.

“We did plenty of knowledge sharing with some of the big names that are dominating in LATAM right now. From day one, they are getting to know LATAM through us, EBANX, as a representative of the region, the continent, and its culture, and I think that instills a lot of confidence in that market among our merchants,” Wei said.

While rising markets like LATAM, Africa, and India present a tapestry of opportunities, their landscapes are diverse, suggesting that success hinges on companies’ ability to appreciate and navigate each market’s unique contours.

Instead of seeking a one-size-fits-all solution, EBANX’s story underscores the value of working in harmony with each market’s local culture and preferences. By extension, entering an emerging market becomes a nuanced dance that, at its zenith, prioritizes the shrewd application of innovation, adaptation, and collaboration.

This article was written in partnership with EBANX.