- Funding for seed capital running dry amidst risk averse investors.

- Asia dominance in mega deals.

- AI investments on the rise.

Increased funding over lesser deals in the US market; Asia reflecting the trend

PwC and CB Insights just published the latest of their joint-effort MoneyTree report for Q1 2018, and according to the report, US financing trend again displayed the inverse relationship between investments size and deal activity over the last quarter, which is an alarming sign for early stage startups investments.

It means that investors are placing larger bets over less deals, as reflected by a decline of 2% in deal activities as investments inched up by 4%.

The finding is in line with a global trend – especially in the U.S. and China – that investors are becoming increasingly risk-averse. They’d rather empty their pockets for a late stage investment – typically most costly and less rewarding but safer – than betting on early stage startups that have a much higher chance to close up the shop.

Asia pulls back after a stellar Q4’17 with a fall of 17% in funding with a mere 5% decline in deals. Global investments too fell marginally to $46.5 B despite less deals over the last quarter.

This speaks to the fact that smaller and newer startups are facing higher constraints to raise funds to stay afloat amidst risk adverse investors going for sustainable returns.

Asia dominates mega deals; Alibaba lags behind archrival in corporate investments

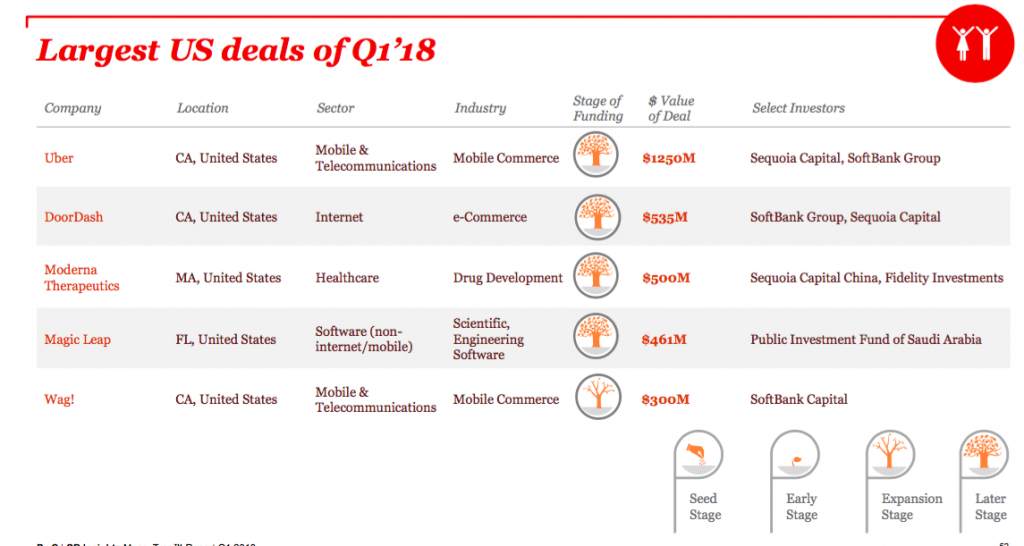

As private investments chase after later stage companies, let’s look at global mega deals over the last quarter.

Only Uber among the top mega deals in the US is part of the top 5 global mega deal. Asia’s clear dominance could signal the rapid rise of unicorns in the region. Among the 4 mega deals in Asia, Tencent invested in EasyHome, Go-Jek and Mobike, while fierce competitor Alibaba only funded EasyHome.

As opposed to traditional VC investors in North America, greater number of large corporates invest in startups in Asia. Citing from data in PwC/CB Insights, Asia’s large corporates contribute up to approximately 10% more funding when compared with North America and Europe. Stronger growth in early-deal size in Asia over the last quarter could signal higher potential for innovation and continued momentum in the startup space in the region.

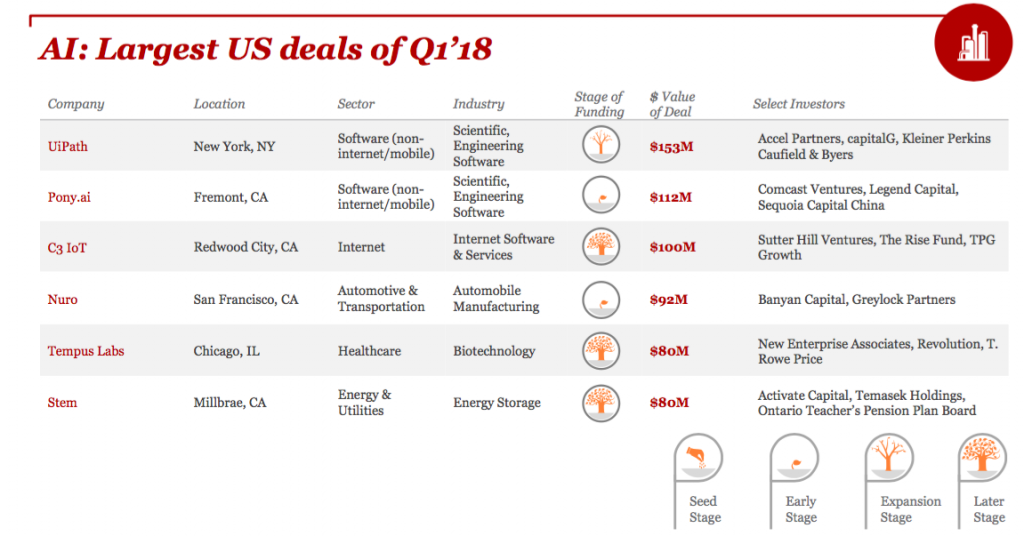

Leading Artificial Intelligence investments pave the way for autonomous cars and facial recognition

Artificial Intelligence investments in US established a new record of $1.9 B in Q1’18 across 116 deals. Total investment sizes across top 6 investments across US hit $617 million. However, Alibaba alone funded $600 million to China’s leading AI Developer SenseTime. Both regions are heavily investing in tapping into AI heading towards robotic process automation, driverless cars and facial recognition.

The Rise of the e-Commerce Giants

E-commerce giant DoorDash accounted for the second largest deal in the US over the last quarter. Meituan’s growing dominance in China after taking over Mobike and the expansion of Deliveroo’s buying of assets might be the new push for omnichannel experience in the e-commerce market.

To conclude, US and Asia markets keep reflecting the same trends in funding patterns and areas of growth. Asia is playing more and more important role in the global startup space, having a good start dominating the mega deals in the first quarter of 2018.

Editor: Ben Jiang