Three decades ago, China’s automotive sector struggled to keep pace with the rest of the world. Locally manufactured cars were only just making their debut, and owning a car was a coveted status symbol in rural areas at that time.

As times changed, however, China’s industrialization propelled the progress of the domestic automobile industry. Chinese-made cars have not only gained popularity domestically but also embarked on a global export journey. Today, groundbreaking advancements in electric and new energy vehicles are positioning China at the forefront of the global automotive landscape.

Recent data reveals that in the first half of this year, China surpassed Germany and Japan to become the world’s largest exporter of automobiles.

Not long ago, at the recent IAA Mobility auto show in Germany, with a history spanning over a century, Chinese automakers almost stole the spotlight. Some attendees joked that while Germany sets the stage, it is China that steals the show. The chairman of the German Association of the Automotive Industry also said that “[Germany is] losing competitiveness.”

Stealing Germany’s show might be an overstatement, but Chinese automakers have, as a matter of fact, been performing well in Europe. SAIC Motor’s MG brand has been a bestseller in Europe for years, while Geely’s subsidiaries—Volvo and Smart—are gaining popularity. BYD is breaking into the European market as well, and Xpeng Motors has announced its entry into the German market by 2024.

However, this has been overshadowed by the EU’s recent announcement of an anti-subsidy investigation into electric cars imported from China. Announced on September 14 this year, this investigation could eventually result in the imposition of punitive tariffs of not less than 20% (currently at 10%).

In response, a spokesperson for China’s Ministry of Commerce stated that the EU’s initiation of this anti-subsidy investigation is based solely on subjective judgments regarding so-called subsidy programs and the perceived threat of harm, lacking sufficient evidence support and not in compliance with relevant WTO rules.

Nevertheless, unfavorable policies are adding uncertainty to the expansion plans of Chinese automotive companies abroad.

Leading in exports, with fastest growth in new energy vehicles

Chinese automobile exports are rapidly growing. In 2022, China became the world’s largest exporter of new energy vehicles. In the first half of 2023, China’s overall automobile exports exceeded Japan, making it the global leader.

While traditional fuel cars still dominate export numbers, the growth rate of new energy vehicles, serving as the technological backbone for international expansion, surpasses them. Looking at the export situation in the first half of this year, early adopters of new energy vehicles like SAIC and Geely export more, while BYD, with stronger technological capabilities, exhibits the fastest growth, showcasing the emerging technological potential of new players.

In the first half of this year, new energy vehicles played a significant role in generating export revenue. They constituted 32% of export volume, accounting for 42.5% of export value, proving to be a lucrative source of additional value for car manufacturers.

Tesla’s China factory remains a significant hurdle for other companies to overcome. According to the China Association of Automobile Manufacturers (CAAM), Tesla topped the export rankings last year, with SAIC and Geely in second and third place. In the current year, Tesla, SAIC, and BYD have been trading places in monthly export numbers, although Tesla has maintained a rather consistent lead. The exceptions were the months of March and August, when SAIC and BYD each temporarily clinched the top position respectively.

BYD has shown the fastest growth, becoming the top monthly exporter in August—a seemingly remarkable feat for a company in its second year of international exports. Traditional automakers still hold an advantage in export quantity. Established brands like Dongfeng Motor and Great Wall Motor (GWM) consistently export thousands of units each month. Among new players, only Nio maintains monthly exports in the thousands, whereas newer entrants like Weimar Motors have lower export numbers. In the first quarter of this year, Nio sold only 328 units in Europe, and Xpeng sold only 11 units.

For new energy vehicles, especially for new players, the quantity of exported cars is secondary. The focus is on technological prowess. In July, Volkswagen announced a USD 700 million investment in Xpeng Motors, acquiring a 4.99% stake and obtaining a seat on Xpeng’s board of directors. The collaboration includes a technology framework agreement to jointly develop two electric vehicles under the Volkswagen brand.

Xpeng’s technological advantage in autonomous driving is unique, making it one of only two companies globally with in-house full-stack autonomous driving capabilities, the other being Tesla.

Another Chinese automaker gaining favor from overseas investors is Nio. In June, Nio secured a strategic investment of USD 1.1 billion from a Middle Eastern institution, earmarked for expanding Nio’s international business.

As known, Nio is among the boldest in R&D spending among car companies, with R&D expenses reaching RMB 6.42 billion (USD 904.93 million) in the first half of this year—the highest among new players and the only one adopting a battery-swapping model.

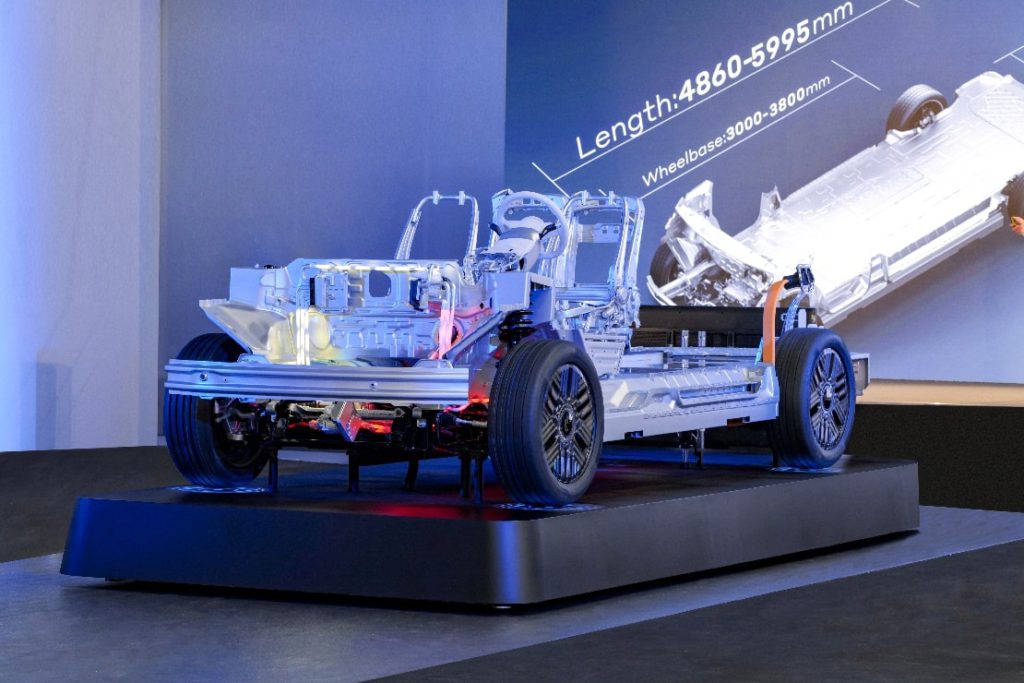

Chinese automakers have not only emerged as new players but have also attained global leadership in technical capabilities across various domains, including battery technology, hybrid systems, electric powertrains, and vehicle design.

This year, new energy vehicles, solar cells, and lithium batteries have become China’s “three new treasures” for export. According to China’s General Administration of Customs, in the first quarter of this year, the combined export growth of these products reached 66.9%, with a year-on-year increase of over RMB 100 billion, contributing to a 2% overall increase in exports.

Emerging global impact, Southeast Asia as a new battleground

The automotive industry exemplifies economies of scale, and after SAIC’s European sales exceeded 100,000 units, Yu De, the general manager of its international business division, said that “SAIC’s overseas business has achieved profitable scale and has become a significant source of profits for its listed companies.”

SAIC is considering building a factory in Europe.

In 2022, the European market sold a total of 2.38 million new energy vehicles, with 549,000 originating from China. This means that for every four new energy vehicles sold in Europe, one is from China.

Europe stands as the second-largest market globally for new energy vehicles. In 2021, its penetration rate for such vehicles reached 21%, outpacing China by a year. As highlighted earlier, SAIC’s MG4 EV surpassed rival models, including the Volkswagen ID.3 and the Tesla Model 3, in sales in the UK from January to May.

Thus, it is apparent that Europe has become a hub for Chinese automakers, attracting both new and established players for their first international foray.

However, the growth rate in Europe is slowing down. The growth rates in 2020 and 2021 were 142% and 66%, respectively, while in 2022, the growth rate for new energy vehicles dropped to 14%. Simultaneously, Southeast Asia is becoming an emerging market for automotive companies.

Southeast Asia has become another focal point for the export of Chinese new energy vehicles. Factors such as economic development, proximity to China, and limited presence of Japanese, Korean, European, and American car manufacturers provide significant advantages for Chinese new energy vehicles in local sales.

The largest new energy vehicle market in Southeast Asia is in Thailand, where BYD and Nio almost dominate the market. BYD’s Atto 3 (overseas version of the Yuan Plus) has been the top-selling pure EV in Thailand for eight consecutive months, selling a total of 11,167 vehicles in the first half of this year, capturing 35% of the market share in Thailand. Hozon Auto is in second place, with its Neta V series selling 5,955 units and holding 18.8% of the market share.

While these sales figures might not compare to domestic figures, they are significant in the context of the local automotive consumption market. According to the Thailand Automotive Institute, in 2022, the sales of pure EVs in Thailand reached 13,454 units.

BYD has also begun establishing overseas factories. Initially, BYD’s overseas factories were focused on developing the local market for new energy buses and building battery factories. Now, with the rapid development of pure electric passenger cars, BYD is preparing to build factories in Thailand, Hungary, Brazil, and other places to cover Southeast Asia, Europe, South America, and other regions.

On July 6, BYD established three factories in Brazil, with a total investment of BRL 3 billion (USD 612.61 million), which are expected to start production in the second half of next year.

It’s not only new energy vehicle manufacturers that are venturing into investments in overseas factories; traditional fuel vehicle manufacturers are also entering the fray with investments in international production facilities.

In 2020, GWM acquired General Motors’ factory in Thailand. In early 2022, GWM acquired Daimler’s factory in Brazil and plans to invest USD 1.9 billion locally to produce new energy vehicles. Under this influence, the proportion of GWM’s overseas market sales to the overall sales volume has increased from 6% to 11% in the past three years.

Selling cars is just the first step, and the next step is the globalization of the value chain.

From export plans to the ultimate delivery of cars to consumers, automakers still need a massive sales network. In China, BYD relies on nearly 3,000 dealers to sell cars across the country. Internationally, almost all automakers need to build their sales networks from scratch.

In June, BYD reached a cooperation agreement with overseas automobile dealer ATL Automotive Group. The plan entails offering comprehensive sales and after-sales services for new energy passenger cars across ten countries and regions in the Caribbean.

China’s automotive globalization has transitioned from mere product output to a value chain output model encompassing “research-production-sales.” Nevertheless, automakers with scale effects, embarking on the establishment of factories abroad, remain a minority.

To restructure the global automotive industry, what challenges remain?

The automotive industry chain extends upward to include steel, rubber, electronics, and textiles, and downward to involve insurance, finance, and maintenance. This chain is exceptionally long. Whether car companies are going global or transitioning to new energy vehicles, they need to collaborate with partners worldwide to learn from each other and complement their strengths and weaknesses.

Some domestic car companies, such as SAIC, Geely, and BYD, have successfully expanded abroad within the value chain. Taking Geely as an example, its new energy and intelligent technology platform, space-oriented architecture (SOA), released on LEVC Tech Day, is a comprehensive application in overseas household and commercial compound scenarios. It represents a shift from product output to technology output. Dai Qing, senior vice president of Geely, also stated that the future strategic goal is continuous and uninterrupted technology output.

However, the globalization of the value chain is not without challenges and risks and should not be underestimated. The EU’s anti-subsidy investigation into Chinese car companies is a crucial confirmation of the difficulties and challenges faced by the globalization of the automotive industry.

Subsidies are a crucial means of supporting the development of local industries, and the global development of new energy vehicles depends on subsidies. Changes in subsidy policies worldwide also impact the global layout of Chinese car companies.

On the one hand, subsidy policies differ significantly. For example, Nordic countries implement tax exemption policies, reducing taxes such as tariffs and consumption taxes on new energy vehicles by 20% compared to fuel vehicles. Western European countries directly provide cash subsidies. For instance, subsidies in France and Germany are relatively high, reaching over EUR 7,000 (USD 7,660). Southern European countries provide fewer subsidies, around EUR 5,000 (USD 5,470).

At the same time, these subsidies may face potential reduction, with Southern European countries imposing various restrictive conditions due to financial difficulties. Subsidies in Germany and France have also dropped to around EUR 5,000 (USD 5,470), and European countries are considering limiting subsidies for new energy vehicles, leading to a decline in the overall growth rate of new energy vehicles in Europe.

The attractiveness of the European market is diminishing. This has less impact on early entrants to the Southeast Asian market, such as BYD, Great Wall, and Nio. However, for companies relying more on the European market, like SAIC, Geely, Nio, and Xpeng, the situation is more unfavorable.

Furthermore, most countries have canceled subsidies for plug-in hybrid electric vehicles (PHEVs). For BYD, which excels in hybrid technology, this means a shift toward pure EV models to penetrate the European market.

Simultaneously, many European countries are considering canceling or reducing subsidies for EVs produced outside their borders. For companies with significant exports, such as SAIC, Geely, and BYD, subsidy policies become a crucial factor in considering whether to build factories in Europe as soon as possible.

On the other hand, consumer behavior in Europe differs significantly from that in mainland China. For example, younger people in Europe prefer used cars, while new car buyers tend to be older, typically over 40. Their purchase decisions are often influenced by comprehensive evaluations from traditional print and automotive media rather than emerging vertical media. Therefore, selling cars in Europe requires advertising through traditional media channels, targeting the older consumer demographic for better results.

In addition, there are significant differences in purchasing habits. European users prefer to use cars through leasing and similar arrangements rather than direct ownership. For example, many Dutch companies purchase cars to lease them to employees. In Germany and Denmark, over half of new users use operational leasing or financing leasing to obtain the right to use a car instead of owning it. This is why Nio adopted a “subscription model” to sell cars, allowing owners to “lease” the car in the medium to long term and supporting a buyout at the end of the term.

In the process of China’s automotive globalization, local policies, user habits, market characteristics, and other factors test the strategic planning capabilities of car companies. Europe is the first stop for most of China’s new energy vehicles to go abroad. Success in this battle will affect the global layout of many car companies.

This article was adapted based on a feature originally written by and published on Shizhibang (WeChat ID: shizhibang2021). KrASIA is authorized to translate, adapt, and publish its contents.