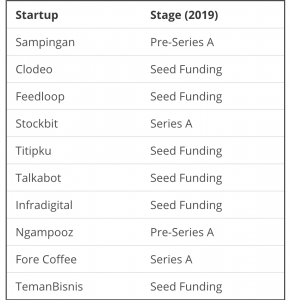

According to data compiled by Daily Social, there were 113 startups in Indonesia that received funding in 2019 and released the information to the public. Among those investments, only ten involved angel investors.

Angel investors are individuals who pour money into startup from their own pockets. Most of them are involved in pre-seed, seed, or pre-Series A funding stages. There are some who take part in Series A funding rounds through venture capital firms.

Helping startups launch

In a startup’s early phase, financial profit is often ruled out. Founders typically approach investors to ask for capital assistance, in order to accelerate their plans.

Not all business plans can run smoothly, especially under founders who lack good judgement. While some technology products might be very sophisticated, if they are not needed by the market, then no one will use the products, let alone pay for them. Investors usually examine these risks before actually channeling funds into a startup.

“Angel investors are entrepreneurs who dare to take risks by investing in new startups. Angel investors usually provide capital, but also non-capital,” Ideosource’s managing partner Andi Boediman said once.

The sums of funds invested vary and depend on the startups’ needs. However, we’ve been informed that the average amount is mostly a few hundred million rupiah (at least USD 6,000). In Indonesia, angel investors are usually successful entrepreneurs. Therefore, it is true that sometimes angels can provide non-capital assistance as mentors for the founder.

Profit after growth

Startups that have turned into major players in Indonesia with help from angel investors during their seed phase include Gojek and Tokopedia.

“I learned about the concept to build a business with capital from angel investors and venture capital. I didn’t know any venture capitalists, so I turned to the only conglomerate I knew, my boss at the time,” Tokopedia’s co-founder and CEO William Tanuwijaya told local media outlet Swa when discussing the early phase of his company.

There are several aspects that might affect angel investors’ considerations when investing in a startup. Private investor Michael Tampi told Daily Social that trust in the founder has been his main anchor. In addition to that, other things such as market opportunities, business plans, and intellectual property are also considerations.

These are some things that angel investors look for in a founding team:

- Whether they have passion and experience in related fields.

- Whether they have the right team composition.

- Their business vision.

Even though investing in a startup is a high-risk business, angel investors might reap profits once the startup succeeds in achieving growth, such as raising larger sums in subsequent funding rounds—then, the angel investors’ shares become more valuable.

“The advantage of being an angel investor is that if a startup succeeds in funding Series A, B, or later, we can see a significant increase in the value of a seed investment. However, the success of one startup is uncertain, and most companies usually shut down before reaching the next funding rounds,” said GDP Venture’s chief marketing officer Danny Oei Wirianto.

Wirianto is an angel investor for more than 30 startups.

As a catalyst for the startup ecosystem

Daily Social has been monitoring the launches of new startups every month. These companies intend to offer solutions to specific problems in all sectors. Sometimes, the innovation they offer is quite advanced, such as developing artificial intelligence for a specific purpose.

Another challenge for founders is convincing venture capitalists to invest in them. Some of them have been lucky enough to meet people with similar visions. An article from e27 mentioned that angel investors also invest to fulfill their desires. It’s either because they are really into a specific business sector, captivated by the developed technology, or they see a future in the service.

Angel investors have a crucial role in developing the startup ecosystem. They accompany founders who are building sustainable businesses. The Indonesian market is projected to be a hub in Southeast Asia. Lots of young people dream of building a successful startup—already, we see tight business competition between digital startups.

The mechanisms of angel investments

Unlike venture capitalists who clearly identify as investors, angel investors may simply be entrepreneurs who are running their own businesses. In order to locate them, founders must widen their business networks, either through offline meetings or through online channels such as LinkedIn, AngelList, and other sites.

However, some of Daily Social’s sources revealed that it is no easy feat to locate angel investors, go through negotiations, ensure that visions align, and then close funding. But if you succeed, it could be a way for your startup to grow.

Regarding investment mechanisms, there are two popular models: equity stakes or convertible notes. In terms of shares, investors will exchange the cash they provide for ownership in the company. The amount will depend on agreements between investors and founders. The calculation can be as simple as this: if the startup is worth USD 1 million, the angel will invest USD 200,000 for a 20% stake.

However, calculations that cover the company value or valuation can become complicated. A convertible note is often the preferred choice. It allows both parties to determine the value of the company, usually keeping it valid until the next round of investment. The note is made as a loan to the company, and it has a deadline for repayment.

The process goes, for example, if the angel investors agree on a note by including a capital fund of USD 200,000, it turns into the company’s debt. However, when due, investors can choose whether to get their money back along with interest or convert the money into company stock.

Once approved, the next process is for the investors or the startup itself to make a term sheet. The document is a sign of business ties, and outlines every detail related to the agreement. Usually, a legal team needs to be involved.

–Original article in Indonesian. Translation by Kristin Siagian.