Two weeks ago, online retail giant Amazon kicked off food delivery pilot for its employees in select localities of Bengaluru, to grab a piece of the pie in India’s food-tech market, which will soon be worth more than USD 17 billion.

With the new addition in its portfolio of services, Amazon is now present across e-commerce, e-grocery, food-delivery, payments, credit card, travel, movie ticket bookings, insurance, education, e-books, on-demand video, music streaming, and cloud computing in the world’s second-most populous country.

The popular perception is that Amazon is gearing towards becoming India’s first super app, leaving behind payment services such as SoftBank-backed Paytm and Walmart-owned PhonePe. But when you look closely, not all Amazon services are bundled together, which is the core principle of a super app.

It has a separate e-grocery app, Prime Now; subscription video-on-demand app, Prime Video; on-demand music streaming app, Amazon Music; and educational app, JEE Ready that it launched just last year for students who are preparing for the entrance exam of the country’s premier engineering college, Indian Institute of Technology.

Industry experts believe Amazon is aiming to be much more than a super app.

“Amazon wouldn’t want to call itself a super app. For them, super app is sort of a mediocre term invented by analysts and media,” Jayanth Kolla, founder and partner of Bengaluru based business consultancy firm Convergence Catalyst, told KrASIA.

Amazon’s core strategy, Kolla explained, “is to have a hand in the pie of anything that sells online.”

“Some of these new things that you’re seeing on Amazon, like movie tickets, booking flights, and insurance products are a combination of two things,” Kolla said. “One, experimentation. Second, it is essentially capturing the flavor of the season and the market.”

Satish Meena, an analyst at research firm Forrester, believes that the American e-tailer is carefully creating an ecosystem of services in the country.

“One thing that Amazon realizes is that India is not ready for the super app kind of concept. There are apps (which are taking a shot at becoming super app), but customers use them for one or two activities,” he said. “That is why Amazon is creating platforms for various use cases that are digital.”

“But the underlying factor is the Amazon ecosystem. They are trying to cater to the customers who trust Amazon as a brand name or as an ecosystem via these different apps as of now,” Meena explained.

Prabhu Ram, Head – Industry Intelligence Group at CyberMedia Research, noted, by building “an array of services around its core business,” and integrating high-frequency use cases such as education and entertainment, “Amazon can leverage its users digital footprint to provide targeted services and bring more value and loyalty amongst its user base.”

For Amazon, Meena said, India is the biggest bet as it doesn’t just present a huge opportunity in retail, but other sectors as well which are going digital.

According to a mid-2019 analyst note by Canadian investment bank RBC Capital Markets, India is expected to emerge as one of Amazon’s biggest international markets by 2023, generating USD 32 billion in gross sales and accounting for 4% of the e-tailers’ global revenue.

Dave Fildes – Director, Investor Relations, at Amazon, in the earnings calls this January, said they are looking at a lot of “innovation, ideas, investment,” in India and coming up with “some interesting and new services and features,” that are specific to the region. True enough, while the company shut its restaurant food delivery in the US last year due to the fierce competition, it saw it as an opportunity in India.

Given that Amazon hasn’t been able to establish a significant presence elsewhere in the Asian peninsula due to local competition, India has indeed become a vital market for the US-based e-tailer. It’s no surprise that Amazon has poured in over USD 6.5 billion in the South Asian nation since its entry six years ago.

In Southeast Asia, Amazon is present only in Singapore and Vietnam. Mid last year, it was in talks with Indonesian super app Gojek to acquire a stake, which later fell through. Meanwhile, in China, where it shut down its market place in July last year, it now sells “overseas goods and cloud services.”

“If you look at the other parts of Asia such as China and Southeast Asia and even Pacific Region including Australia and New Zealand, Amazon has not been successful in launching and penetrating deeper and faster as much as they would have liked to,” said Kolla.

“It needs to have a strong presence in India because it could be their last and best bet of strong Asia presence.”

The real challenger

When Amazon entered the India market with its core proposition, e-commerce marketplace in 2013, it became a competitor to homegrown online retailers, Flipkart and Snapdeal. It brought Amazon Prime Video in the country in late 2016 and started locking horns with global streaming giant Netflix. Over the next couple of years, it launched Amazon Pay and with use cases such as bill payments and travel, pitched itself against the likes of Paytm and PhonePe. In the recent past, the company has been splurging money in the country’s nascent online grocery market to go up against incumbents BigBasket and Grofers, as well as its arch-rival Flipkart’s grocery venture Supermart.

However, at the ecosystem level, there is one emerging competitor that can give it a run for its money: Reliance Jio, the telecom venture arm of Reliance Industries, India’s largest conglomerate by market capitalization.

“Reliance Jio is a full-fledged competitor in terms of size and scale and end to end ambitions,” said Kolla. “No one knows the Indian market and an average Indian consumer as Reliance does.”

Over the last few years, Reliance has been slowly diversifying its business from oil and petroleum to telecom and retail. It entered the telecom business in late 2015, rolled out its services for the public at dirt-cheap prices a year later, and within three years, it became the number one player with almost 370 million subscribers.

A May 2019 Forrester report said Reliance Jio is building on these mobile subscribers by investing in related services to create an ecosystem that gives customers access to content like music streaming app Saavn, BalajiTelefilms, and Eros, as well as payment options like Jio Money, Jio Payments Bank, and point-of-sale (PoS) terminals for retail stores.

“This ecosystem will be available for Reliance Retail to build on,” the report added.

Meena believes Reliance will eventually bring together telecom and retail arms, and provide an omnichannel experience to the customers.

Kolla said there would be a combination of things that he expects to work in favor of Reliance when it launches its full-fledged e-commerce platform.

“I expect Reliance to play an omnichannel role–a combination of online and offline retail, with tightly integrated supply chain on the supply side and brand building and pricing strategy on the demand side for the consumer,” he said. “That would be extremely difficult for Amazon to withstand.”

According to Kolla, Amazon already identifies Reliance as an upcoming competitor and has been preparing for the stand-off since last year.

“It has seen what Reliance has done very recently in the mobile telecom space, in terms of, Jio coming in with a big bang and forcing the merger of Vodafone and Idea,” Kolla said. “And now it is literally dragging them to bankruptcy, making the other remaining competitor Airtel, weak at its knees with the combination of the supply and demand side moves as well as regulatory moves.”

Kolla said the moves that Amazon is making in India is essentially gearing up for Reliance’s onslaught.

Last year, the American online retailer acquired a 49% stake in Indian conglomerate Future Group’s subsidiary Future Coupons Ltd., which holds a 7.3% stake of Future Retail. The latter is the owner of supermarket chains Big Bazaar, HyperCity, and grocery chain Easyday. The deal gives Amazon a 3.58% stake in the Future Retail.

“Amazon is trying to get control of offline assets legally, whatever is allowed based on our current regulations,” said Meena. “Most of this is targeted at two categories: Fashion and Food. Because these are the two very important categories that can not be delivered without offline presence.”

“The only thing Amazon is relying on is, Reliance will take a lot of time to deliver goods and the customer experience is very difficult to meet,” he added. “Reliance can be a big hit in e-groceries because grocery is going to be a pricing game as people would go for saving, but in other categories, Amazon is not yet worried.”

Although Reliance has a huge presence in retail with Reliance Retail, which owns and runs offline store chains across grocery, fashion, electronics, and jewelry in the country, and is running a pilot for its e-grocery service JioMart for select Jio users, e-commerce won’t be an easy battle to win.

“If you have to deliver goods to customers without any hiccups, on-time, and do refunds with no questions asked, making that kind of machine will take time,” Meena said. “It requires a lot of technology, manpower, expertise, and employee training to make sure customer experience is the top priority.”

“This is not into the Reliance DNA,” he added. “If it was that easy, Future Group would have already done it. They have been trying it for a long time, they have stores, they have money, but it is not very easy.”

According to Meena, the worrying factor for Amazon is regulations, and how they are going to change because of Reliance’s entry and mounting criticism from small retailers against its deep-discounting and preferential treatment practices. Amazon tried to show its importance in the country by announcing an investment of USD 1 billion this January, but the move failed to impress the Indian government.

The caveat

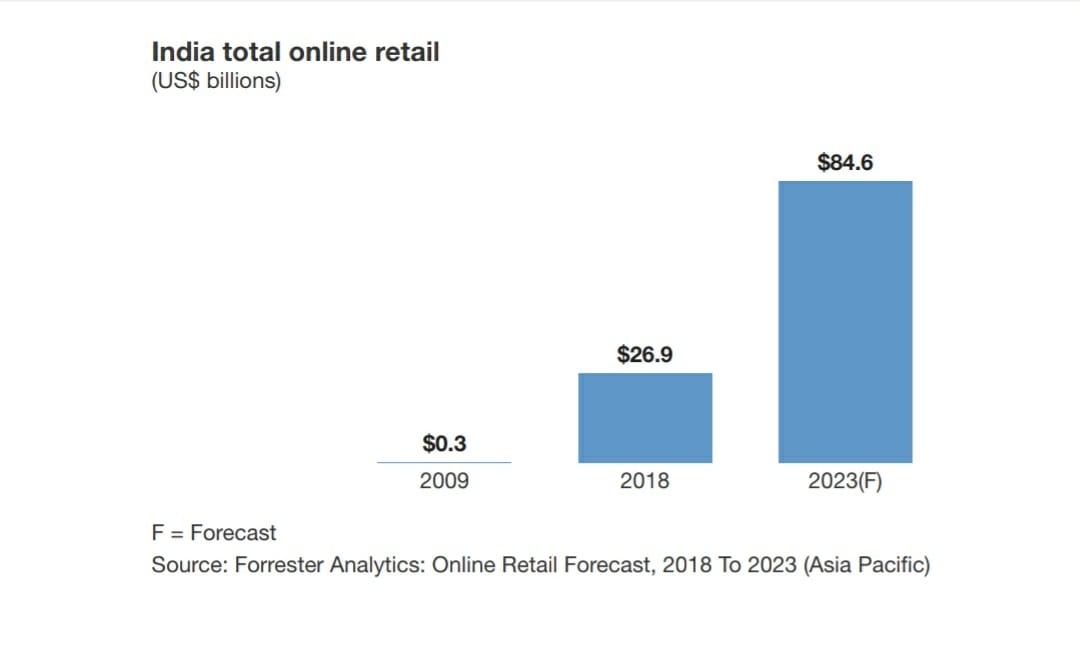

Even as Amazon is going full throttle to get Indians hooked onto its ecosystem, it can tap only those who are shopping online. According to Forrester, about 130 million Indians shopped at least once online in 2019. This is the user pool that Amazon is going after that leaves out the remaining one billion population.

“Amazon is trying to sell more to the same customers. For instance, for Amazon Prime customers, they are trying to sell goods, tickets, and groceries. The same person can order food also,” Meena said. “Ultimately, they want to become a default ecosystem for households and get a larger share of consumers’ spends.”

While Amazon’s offline play will strengthen its inventory and supply chain, it won’t give the company access to the huge offline consumers. In comparison, Reliance is way better placed.

“Reliance is going to attack on both fronts–the top 130-150 million online shoppers and the rest of 900 million Indians with its wide-spread offline reach, distribution, and low pricing,” Kolla said.

Even as experts believe Amazon is trying to reach out to the next 50-100 million aspirational customers beyond metros and tier 1 cities, it lacks presence in smaller towns compared to Flipkart and Myntra.

According to various industry estimates, Flipkart is the dominant player, claiming over 60% of the market share, in India’s soon-to-be USD 84 billion e-commerce market, while Amazon has about 30-35% market share. Even though Amazon has become more powerful in top cities, Flipkart and Myntra have a bigger reach in tier 2, tier 3, and tier 4 markets, Meena said.

“The factor that plays in Myntra’s favor, they are very good in fashion. The kind of products that they have, Amazon is nowhere close,” Meena said. “And fashion is often the starting point of any online purchase.”

“Amazon would need a separate strategy for offline customers, and buyers in tier 3, and tier cities. But they are hopeful that what they have done in metros and tier 1, they will be able to replicate in other markets,” he added.