Imagine a pig farm. The scene in your mind’s eye is likely set in a rural area with farmhands doing back-breaking work. Hundreds of pigs are raised together, perhaps in a cramped space: they eat, they sleep, they play, they breed; and when the time comes, they are sent to the slaughterhouse by the truckload.

But the nature of pig farms is changing in China. Some of the country’s biggest names in the tech industry–Alibaba, JD–are lining up to become disruptors of this traditional business. The ace up their sleeves: artificial intelligence.

In late 2017, Laozhang’s family pig farm in a Beijing suburb received an unusual group of visitors—20 engineers from JD Finance’s artificial intelligence (AI) department.

The group came with DSLR cameras and video cameras in tow, and they set up eight filming points surrounding Laozhang’s outdoor pigpen. Their mission was to film each individual of Laozhang’s 105-head herd and use the images to establish a raw database of the pig farm.

The task was more difficult than one might expect. Pigs don’t stay still and they certainly don’t look into the cameras like humans do. And even when the cameras were able to snap well-aligned photos, there was often mud or dirt on the pigs’ faces. Beyond those technical issues, the smell of pig manure made the filming process arduous, particularly for the AI engineers who were used to spending most of their working hours in air-conditioned office buildings. In all, filming took more than ten hours. By the time JD’s engineers were done, the sun was already setting.

Weeks later, part of the data collected at Laozhang’s farm that day surfaced as raw material for participants of one of JD’s data exploration competitions. Participants were given 30 one-minute video clips showing pigs and the task was to develop a new algorithm that could reliably match the identities of these 30 pigs against 3,000 photos in the dataset.

Getting this right, pig facial recognition, was a key component of the smart farm management solution JD was working on, and above this towered the firm’s ambitious plan to “digitalize traditional agriculture practices.”

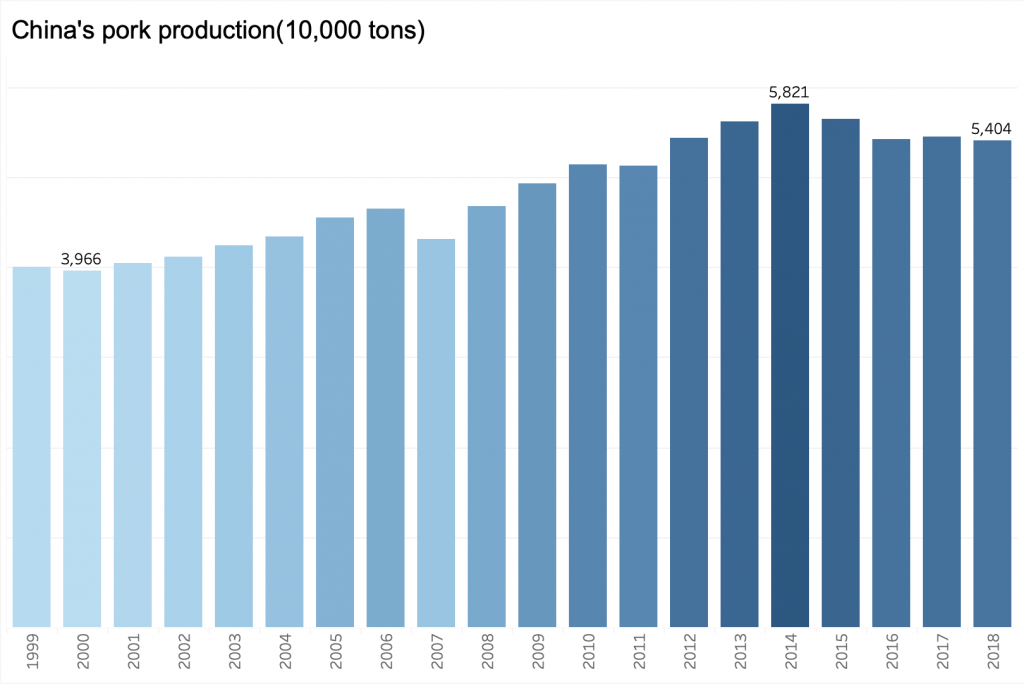

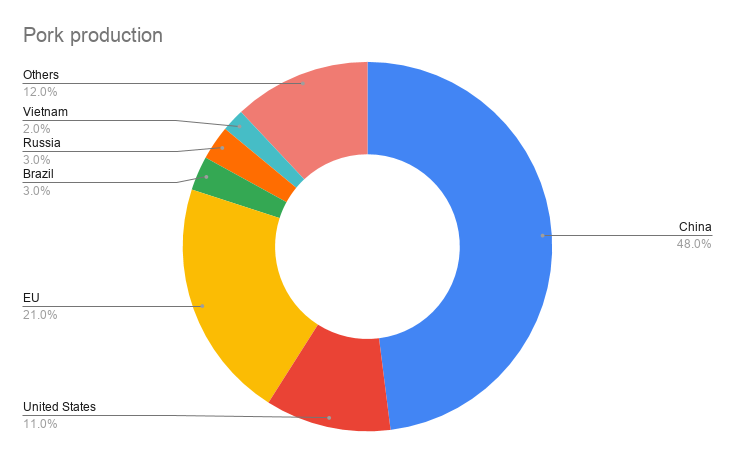

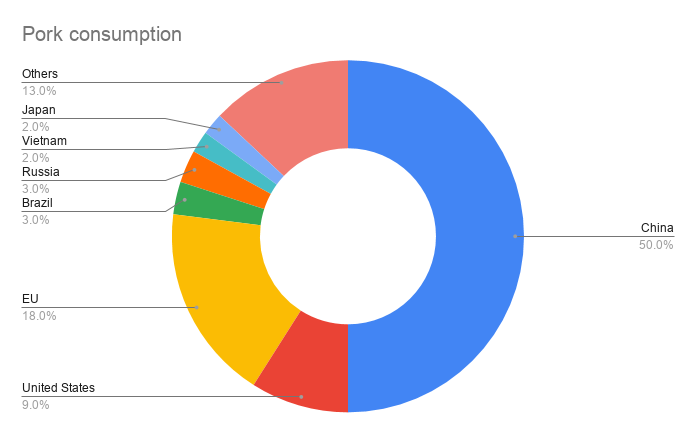

Nearly 700 million pigs, which translate to more than half of the world’s supply of pork, are reared in China, where the annual pork consumption per capita has reached more than 30 kg in the past decade. It’s preferred over other proteins. In 2018, the Chinese population consumed as much as 54.9 million tons of pork, which accounted for more than 62% of their total meat consumption. Domestically, RMB 1.4 trillion worth of pork was sold during its peak in 2016, making up nearly 2% of the annual GDP.

But the production cost of Chinese pork is strikingly higher than that of many other countries, including the United States. The cost of feed needed to generate one kilogram of pork is twice that of what American hog farmers pay; for any unit of pork, the labor cost needed to produce that is about four times more than in the US.

“The cost for us to rear one pig is roughly the same as the cost of rearing two pigs in the United States,” Li Defa, an academician with the Chinese Academy of Engineering, said at the JD Discovery conference last November. He specializes in animal nutrition and feed science.

“In other words, if we now decide to import pork from the United States and sell it in the Chinese market, even if we take into account the cost for shipping, it would still be cheaper than our cost [to produce pork domestically],” he added.

And it isn’t just the cost where Chinese farms can improve. China’s pig farming industry also lags far behind its US counterpart in another key efficiency indicator—pigs per sow per year (PSY). China’s average PSY is 15, about 10 less than that of the United States.

One of the biggest problems with Chinese pig farms is its labour-intensive nature. US pig farms tend to hire fewer people and put far less human resources into their operations than their Chinese counterparts, Guangxi Yangxiang’s vice president Gao Yuanfei observed. Gao’s company is one of the country’s biggest names in pig farming – it has 39 branches across China and produced 2 million pigs last year.

“US pig farms are mostly modernized. Chinese pig farms, meanwhile, are more likely rely on more workers,” he said.

Tech giants like JD think that they have solutions that can help Chinese farms modernize quickly.

Having learned from such experiments as on Laozhang’s family pig farm, JD’s smart farm management solution now offers ways to use pig facial recognition technology to identify pigs and keep track of their growth profiles, immunization information, and physical conditions. It notifies the farm’s workers if it detects unusual behaviors in the pens. On top of that, a fleet of inspection robots, automated feeders, and other Internet-of-Things devices are deployed to control the pigs’ living environment, feed supply, and waste processing, handling much of what used to be labor-intensive tasks.

Last year, Chen Shengqiang, the CEO of JD Digits, the Chinese e-commerce giant’s fintech arm formerly known as JD Finance, told fellow attendees at the World Internet Conference that its solution can lower the labor costs of midsize pig farms by 30% to 50% within a year of its deployment, and cut the time for rearing a pig by five to eight days (it takes about 180 days to raise a pig for slaughter). If all pig farms in China were to adopt their solution, then “we can help the whole industry lower its costs by more than RMB 50 billion,” Chen said.

Around the same time as the conference, JD Digits announced its first commercial AI pig farming deal with Jingqishen, a pig farming company specializing in raising free-range pigs in Jilin Province. Jingqishen said it would convert two of its pig farms, which were tucked away at the foot of Changbai Mountain, into testing grounds for JD’s AI suite. The two companies aimed to integrate Jingqishen’s husbandry system with JD’s smart farming management solution within three years and rear one million pigs annually.

JD became a strategic investor in Jingqishen’s pig farming business this May. Weeks later, and days before JD’s 618 annual shopping promotion campaign, the first batch of Jingqishen’s smart pig farming products made their debut on JD’s e-commerce platform and its brick-and-mortar retail stores 7Fresh.

While JD was developing porcine facial recognition methods, its rival and China’s e-commerce top dog Alibaba dispatched a team of programmers to Yibin, the hometown of Wuliangye, China’s finest Baijiu liquor.

These programmers bunkered down in a pig farm run by local farming company Dekang Group and called themselves “piggy men” (there was also one “piggy girl”). They were on a mission to find an easier entry point into a business that has existed for millennia.

In February 2018, Alibaba Cloud partnered with Tequ Group and Dekang Group to introduce AI technologies to pig farming.

But instead going down JD’s route of reading pigs’ faces, Alibaba’s visual recognition scans tattoos on the pigs’ skin—in line with what some pig rearing companies already do. Its smart farming system, the ET Agricultural Brain, identifies pigs by matching their tattoos to stored records, and builds profiles for them, keeping track of their weight, eating behavior, and daily activities. It’s a feature that Alibaba Group’s senior vice president Simon Hu considered to be revolutionary. The standard of good pork would shift from each pig’s weight to its record of activity because of this feature, he said at the launch of ET Agricultural Brain in June 2018. “In the future, we will say we want a pig that runs 200 km rather than a pig that weighs 200 kg,” he exclaimed.

If a pig has been relatively inactive throughout the day, the algorithm could analyze its profile and determine whether it is sick or pregnant. The system also uses voice recognition technology—it can identify the sounds made by pigs and send out alerts before sows accidentally roll onto their piglets and crush them to death.

Alibaba said its system could drag the mortality rate down by 3% and significantly increase PSY to 32, on par with the best industry standard.

“The pig industry is all about its production efficiency,” Rao Demeng, an associate at Eastern Bell Capital said. Rao, who has been watching the pig-rearing businesses for years, said AI pig farming’s competitive edge, beyond the most PR-friendly features such as pig facial recognition and voice recognition, lies in its ability to collect and analyze data in a way that helps improve efficiency and lower costs.

Both JD and Alibaba promise exactly that, as well as a high-tech redefinition of a millennia-old business. But will farms across the country—even the world—come on board?

While acknowledging AI’s potential and calling it “a historical trend,” industry insiders also see its limitations. The tools developed by JD and Alibaba are mostly designed for midsized or large pig farms. These pig farms have the capital to invest in AI technology makeovers, as well as the scale necessary to reap the benefits of boosted efficiency and trimmed costs.

But unlike those in the United States, more than half of China’s pigs are raised on farms with a herd size smaller than 500. The owners and operators of these facilities may not see a reason to adopt JD and Alibaba’s AI systems.

Smaller pig farms, as Rao describes them, have yet to adopt modern methods of husbandry, so the expectation for their proprietors to appreciate the strengths of using AI in their pens is far-fetched.

“If small-scale hog raising operations do not embrace it, and they happen to represent the majority of the industry, it would hold up the introduction process of AI in pig farming,” Selena Lin, a pig farming industry reporter from Zhuwang.cc, told KrASIA. “Some people will always consider it to be a white elephant that does not have much practical use,” she said.

Pig farmers in China have a more pressing problem. This year, so far, China’s sow and hog inventories have both suffered drops of more than 30% due to the deadly outbreak of African swine fever (ASF) across the country, according to data released by the China’s agricultural ministry. Beijing said it had recorded more than 150 ASF cases in 32 provinces and culled more than one million pigs to contain the epidemic. Industry analysts said the real damage could be much bigger.

With more than a third of China’s pork production being wiped out by ASF, pork prices have soared. “As the price rises, for pig farms, efficiency becomes less of a problem because as long as they can keep the pigs alive and sell them, they can make good profits,” Eastern Bell Capital’s Rao said.

In the long run, the deadly epidemic could aid the promotion of AI pig farming. Many smaller pig farms are being driven out of business, while larger operations that have a better capacity to limit the damage wreaked by ASF are able to keep their livestock alive and ride out the storm—and eventually adopt new solutions to keep track of their herd.