Subscribe to our newsletter to read this first thing on Friday morning. This is the preview of what you will receive in your inbox.

Earlier this week, share prices of newly listed tech startups including food delivery firm Zomato, beauty retailer Nykaa, fintech major Paytm, insurance marketplace Policybazaar, and automobile platform Cartrade plummeted to an all-time-low as stock markets fell sharply on a correction in the global equity markets.

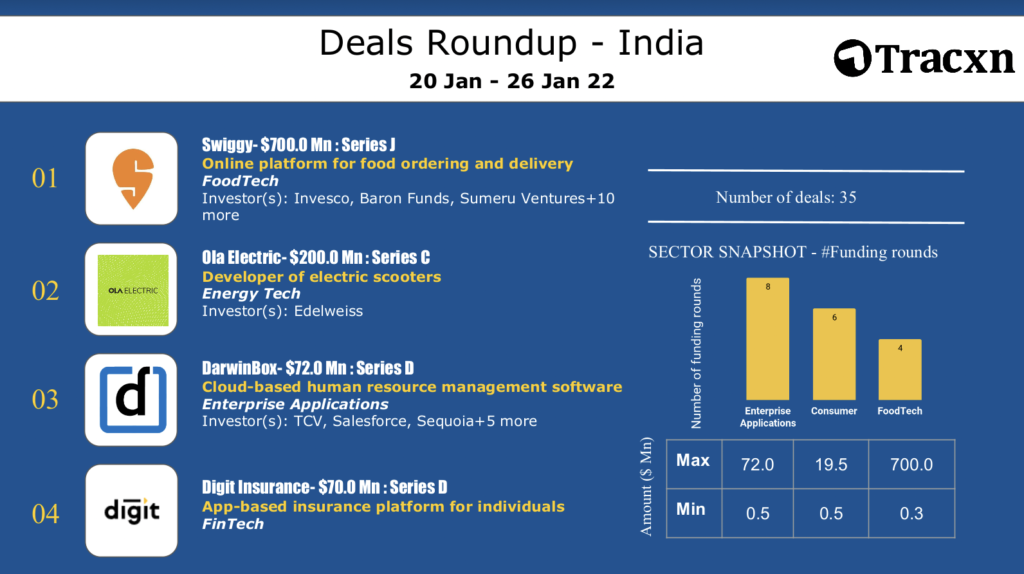

Industry experts believe that there might be an impact on private markets as well. But as of now, investors seem to be generously shelling out money for startups that have seen exponential growth or are projected to grow phenomenally. For instance, food delivery giant Swiggy has just raised a whopping USD 700 million at a valuation of USD 10.7 billion. And Swiggy isn’t alone in landing big checks from investors. Moreover, a recent report found, about 75% of Indian startup founders believe they will have a better fundraising environment in 2022.

Notably, investments in local AI companies have been steadily rising. For this week’s big read, KrASIA looked at how venture funding in the Indian AI sector is going mainstream, and how local AI startups have evolved over the last few years.

The Big Read

AI investments go mainstream in India

Investments in artificial intelligence (AI) companies are picking up in India, with heavyweight venture capitalists like SoftBank writing checks for startups that are either developing in-house AI platforms to power their core offerings or building AI services and products that aid operations of their clients.

The funding in local AI startups has more than doubled to USD 654 million in 2021 from USD 283 million in 2020, as per the data collated by research firm Venture Intelligence. The trend is continuing well into 2022.

Earlier this month, AI startup Pixis received a USD 100 million check from SoftBank and General Atlantic. The four-year-old startup, which operates out of Bengaluru, offers codeless AI infrastructure for marketing to over 90 local and global companies including food delivery giant Swiggy, cosmetic brand L’Oreal, and wealth-management platform Groww.

On the other end of the spectrum, Fractal Analytics, which provides AI and advanced analytics solutions to Fortune 500 size companies raised USD 360 million from TPG in the first week of January, which landed it in the unicorn club.

Pixis and Fractal’s big funding rounds imply the increasing investor appetite for local AI companies. And it didn’t happen overnight.

Over the last few years, AI startups have been growing silently yet robustly. When the COVID-19 pandemic hit India in March 2020, it led consumer companies to accelerate their digitization as more and more people began spending money online. A lot of consumer tech firms and consumer brands witnessed hypertrophic growth and needed better systems in place to support that growth and scale even faster. This has increased the demand for AI services and products among startups as well as larger enterprises.

The Weekly Buzz

1. Cashing in on strong investor sentiment, major Indian startups have kicked off 2022 with big checks. Food delivery giant Swiggy has raised USD 700 million in a new funding round led by Invesco, which has catapulted it into a decacorn. Separately, Ola Electric, the EV arm of cab-hailing giant Ola, has landed another USD 200 million check from Tekne Private Ventures, Alpine Opportunity Fund, and Edelweiss, among others at a valuation of USD 5 billion.

2. After a record venture capital inflow of USD 38 billion in the Indian startup ecosystem in 2021, local entrepreneurs believe this year will turn out even better than last year. About 75% or three out of four Indian founders expect the fundraising environment to be more favorable in 2022, found “India Startup Outlook Report 2022” by venture debt firm InnoVen Capital. The report also noted that 92% of founders who tried to raise capital in 2021 had a favorable fundraising experience, up from 69% in 2020.

Q&A Of The Week

4 thoughts on India’s early-stage startup ecosystem from accelerator Huddle

Huddle is a Gurugram-based accelerator that invests in pre-seed to pre-Series A startups across sectors like mobility, food, consumer goods, creator economy, healthcare, and climate tech. In the four years since it was established, Huddle has made 52 investments, 18 of which were closed in 2021. And, last October, Huddle established a USD 6.7 million accelerator fund to back startups in 2022.

In an interview with KrASIA, Sanil Sachar, founding partner at Huddle, discussed how he catches consumer trends early on and backs founders who are building solutions for the consumers of 2025.

Top Deals This Week