While the COVID-19 pandemic came as a boon for many online businesses, none has seen the kind of growth and demand as the online education sector did. From the likes of Byju’s, Unacademy, and Vedantu, to relatively lesser-known companies such as Classplus, Winuall, and Teachmint, saw an unprecedented growth in March 2020 when the country went under lockdown due to COVID-19.

At the time when B2C edtech startups were adding new users at a breakneck speed, B2B focused companies that never made it to the big league also saw an uptick in new signups from schools and tuition centers.

Last year, when the COVID-19 pandemic forced educational institutes to temporarily shut down they had to make do with online classes over Zoom and other video call platforms. However, they needed a better and long-term solution, something that can emulate teaching students in a classroom.

This is where the offerings of B2B edtech startups came in handy for schools and tuition centers.

“Within two weeks of lockdown, we helped our partner schools shift their entire curriculum and teaching mechanism onto a digital platform. We also worked closely with schools to train teachers how to conduct online classes,” Vinay Sharma, business head, Mylestone, told KrASIA.

Launched in 2016, Mylestone is the product of S Chand, one of India’s oldest and largest publishers of academic books. The edtech platform provides schools with digital teaching and learning tools along with content and a structured training program.

The pandemic has helped this erstwhile virtually non-existent sector (B2B edtech) find its footing as more and more schools have opened up to adopt their offerings.

In May 2020, Cybernetyx, a Bengaluru-headquartered company which offers AI-driven platform to educational institutions, launched Kneura, an all-in-one digital classroom. And in less than five months, it onboarded more than 4,000 institutions on the platform.

The transition process

Industry players believe that the pandemic has forced institutes to at least try tech-led solutions as they have realized they can’t afford to function in silos. This change in mindset has also highlighted the importance of B2B edtech startups which were so far suppressed over the rise of B2C edtech companies.

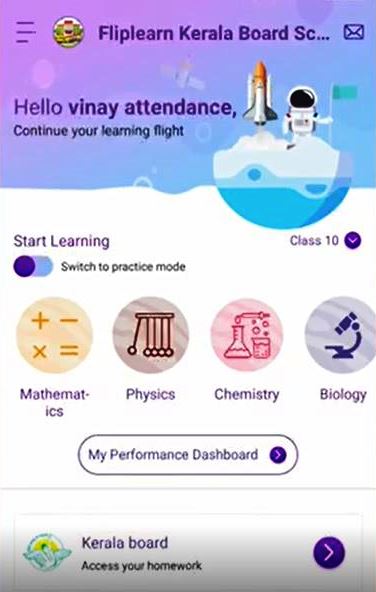

“While digital learning tools and online resources have been around for some time and many progressive schools were in various stages of adopting them, there were no pressing external circumstances to change that status quo,” Divya Lal, founder of Fliplearn, told KrASIA.

Fliplearn works with schools to create tailor-made features and services to suit the requirement of teachers and students.

After educational establishments shut down, the first choice for schools was to transfer the classes on Zoom and use platforms like WhatsApp to share course material and assignments. But these solutions couldn’t be scaled to factor in other facets of classroom teaching, such as taking attendance, paying attention to individual needs of students, and conducting exams.

Schools understood that adopting digital solutions, which are solely designed for educational purposes, is the only way to address these problems, and they could probably use them even after schools reopen.

Lal from Fliplearn said that video and voice call platforms like Zoom and Microsoft Teams, don’t have any specific features to cater to the needs of online education. To address this problem, Fliplearn works directly with schools to create visually immersive educational content with animation videos, that can help students learn everything from specific timelines in history to climate change.

“Unlike other edtech apps, we do not offer alternative study material, but rather work as a true partner with schools to enhance efficacy and productivity of teachers and students,” Lal said.

Similarly, Cybernetyx also boasts of designing school-focused online teaching solutions such as allowing teachers to take attendance online and track student performance. Its edtech platform, Kneura lets administrators mimic the structure of education in schools by creating different classrooms virtually. Besides, teachers can create new lessons that can be stored and managed from one place.

The pandemic has not only changed how students attend classes but has also impacted teachers as they faced challenges in adapting to online teaching. So, while designing new features, it was important for these B2B edtech companies to keep teachers’ needs in mind as well.

Mylestone said it has a special training session for teachers to ensure they are prepared to use the features efficiently and make the virtual classroom experience for students engaging and enriching.

“We provide teachers handbooks that help them with detailed strategies, methods, activities, and daily lesson plans to help them better navigate various concepts and subjects,” said Sharma of Mylestone.

Read this: Classplus keeps Indian tutors’ entrepreneurial dreams alive: Startup Stories

As the adoption of technology by educational institutes has gone up, investors, who have been till now pouring millions of dollars in consumer-focused edtech companies, have now started to back B2B edtech startups as well.

Last year, Classplus raised USD 9 million (over INR 68 crore) in its Series A round led by RTP Global. The round also saw participation from existing investors, including Blume Ventures, Sequoia Capital’s Surge, Spiral Ventures, and Strive. In May last year, another online tutoring startup Teachmint raised USD 3.5 million in Seed round from Lightspeed India, existing investors Better Capital and Titan Capital. Similarly, in October, Bengaluru-based Winuall, which digitizes tuition centers, bagged USD 2 million from Prime Venture Partners, Beenext, and Ramakant Sharma, the founder of LivSpace, among other angel investors.

David vs. Goliath

Sharma of S Chand claimed that selling online education products directly to end customers involves higher customer acquisition costs.

“We consciously chose to create products for schools as we already have a huge network and existing relationships with them as our books reach nearly 40,000 schools and 20 million students every year,” he said.

“We want to leverage this, and it also helps us keep our acquisition costs low. Secondly, we believe that if we align our solutions to the requirements of schools, we can drive better learning outcomes.”

Experts believe that the market size of edtech sector, which is estimated to grow from USD 2.8 billion to USD 10.4 billion in the next five years, will provide enough opportunity for everyone to grow. By 2025, there will be more unicorns from this sector which will offer many unique solutions.

Blended learning—a mix of online and classroom tutoring—is in fact set to become the new normal in the coming years as it brings together benefits of both worlds.