- TikTok’s overseas rise began in March, coincided with its traction-gaining in China.

- The app applied the same data-driven operation approach in its overseas markets, only shunned aggressively going after celebrities and online influencers.

- ByteDance has been making heavy investments in growing TikTok, with an aim to make bigger profits.

- However, the app is challenged by mobile advertising markets abroad, which are quite different from its home turf.

Early 2018, TikTok’s founding team in Japan rented a small office in Tokyo’s Shibuya district, the part of the Japanese capital that is known for its sleeplessness and sky-high property price, and started the app’s local operation.

The office is so small that, the team, staffed by less than five for most of the time then, couldn’t fit in all at once.

Yet, it’s this inadequately-equipped office that would, later on, give rise to a Chinese short video app’s sweeping success in a country known for being a hard nut for foreign internet products to crack.

Ambition to expand

TikTok, also known as Douyin domestically in China, always has its eyes set on the globe.

Back in August 2017, barely one year old, TikTok has been logging horns with local nemeses including Tencent-backed Kuaishou and even its own siblings, Xigua and Huoshan, two other short video apps incubated by their shared parent ByteDance.

And in the face of fierce siege by its domestic competitor at that time, TikTok’s management team stealthily launched the app into the Japanese market.

“China is home to only one fifth of the world’s internet users. If we don’t expand globally, we are bound to lose to our peers eyeing the rest of the world. So, going global is a must,” said ZHANG Yiming, founder and CEO of Bytedance in an interview with 36Kr. Needless to say, “overseas expansion” was always on the company’s agenda. Zhang’s vision is that international users would eventually make up more than half of Bytedance’s user base.

In August 2015, China’s largest news aggregator Jinri Toutiao, owned by Bytedance, debuted its overseas version TopBuzz in North America. Soon afterward, Bytedance went on to establish its presence in countries and regions including North America, Japan, India, Brazil, and Southeast Asia, either by introducing its own products on the local markets or by acquiring other similar products.

Yet, it was only until two years later that Bytedance saw explosive growth in overseas markets. This could all be credited to Tik Tok. Bytedance’s overseas-oriented products, including Tik Tok and Musical.ly, can now be found in 150 countries, which altogether see more than 100 million monthly active users and counting.

Tik Tok was not the only one seeking overseas expansion. Around the same time (the second half of 2017), Kuaishou embarked on its global expansion as well. Kuaishou, to date, has already established its presence in the regions including Europe, Southeast Asia, and South America, garnering outstanding performance particularly in South Korea, Russia and Vietnam. Clearly, Tik Tok and Kuaishou have each snared territory in the overseas markets. As for Tencent, which is also competing with Tik Tok in the short video industry with Weishi, its top-performing overseas-oriented product is its music streaming platform Joox, in addition to its games. Ultimately, Tik Tok is mainly competing with itself in the short video space.

Thanks to the rapid growth of Tik Tok in the overseas markets, Bytedance had, until March 2018, nearly 20% of registered overseas users. In Thailand, a country with a population of 68 million, Tik Tok has altogether garnered over 10 million downloads, according to data published on App Annie.

Besides Alipay and WeChat Pay, which target predominantly “overseas Chinese”, the overseas expansion attempts of Chinese companies in recent years have all, at some point, hit stumbling blocks. Bytedance, too, has encountered its fair share of challenges during its 3-year global expansion. At any rate, Tik Tok has risen above as a top-performing short video app in the overseas market.

Cracking overseas markets

For content-focused products, going global is never easy. Tik Tok is no exception: How could it gain its very first user on markets shaped by a completely different culture and language?

Tik Tok embarked on this task by replicating its content-centered approach in China. According to people familiar with Tik Tok’s development in China, Tik Tok, in the very first six months since its launch, was bent wholeheartedly on content operation. Specifically, everyone on its operation team was tasked with roping in internet influencers.

Eventually, they managed to get on board around 300 internet influencers from the short video app Xiaokaxiu, Weibo, a micro blog, the lip-syncing app Musical.ly and art colleges, who were then asked by Tik Tok to create contents based on the themes it designed. This was basically how Tik Tok built up its initial content pool.

The whole process involved two essential elements: scouring internet influencers who are adept at creating contents and creating appealing features.

During its overseas expansion, Tik Tok took this approach to a whole new level by going after only the most popular internet influencers and stars.

These internet influencers and stars, who has amassed an established pool of followers and content distribution channels, and are, in a way, an icon of the local culture, served as a key stepping stone for Tik Tok’s initial development abroad.

Kinoshita Yukina, who boasts 4 million followers on Twitter, was the first star Tik Tok had “painstakingly roped in” in Japan. “It took around six or seven rounds of discussions to finally seal the deal. The star studios in Japan are particularly prudent, so we need to talk to them time and again to familiarize them with our product and show our sincerity for cooperation,” the director of Tik Tok Japan told 36Kr.

After its few initial successes in signing stars, the road to convincing other star studios in Japan had thus become increasingly less bumpy for Tik Tok.

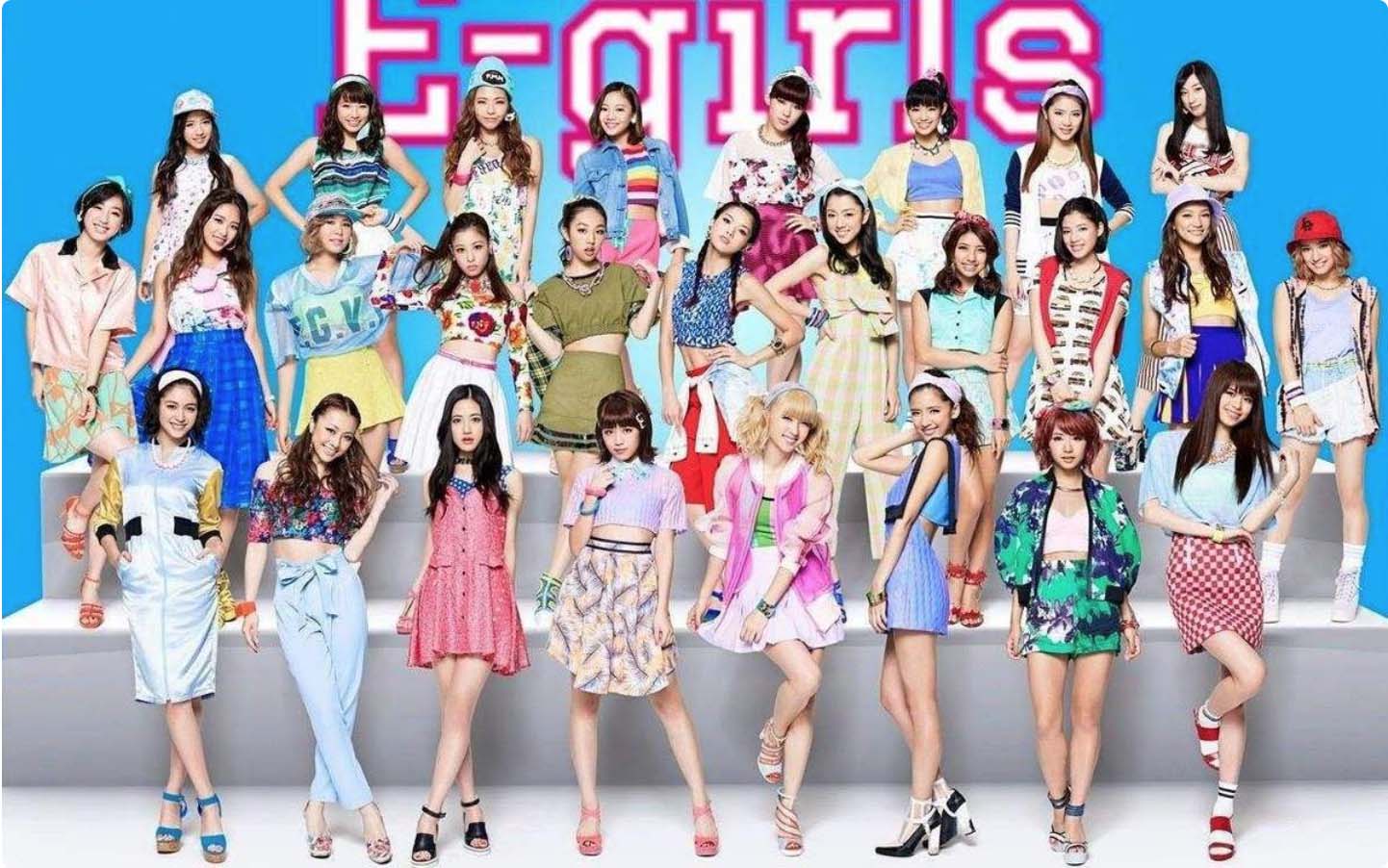

In the end, Tik Tok got several popular stars and internet influencers on board in Japan, including Kyary Pamyu Pamyu, a Japanese singer who has more than 5 million followers on Twitter, E-girls, a Japanese collective girl group that is ranked among the top three on Oricon all the year-round, and Ficher’s, a blogger on Youtube who has 4.5 million followers.

Tik Tok’s expansion in Southeast Asia followed, more or less, the same path. In Indonesia, for example, Tik Tok organized an offline gathering of 100+ stars and bloggers on the day of its launch, in an attempt to bond with these content creators. Likewise, Tik Tok’s operation team in Thailand had managed to scoop up some seasoned content creators on Instagram, who eventually became the very first users of Tik Tok.

“These gatherings offer a platform for the content creators to share their experiences. More importantly, they evoke a sense of belonging and loyalty among content creators,” an influential content creator on Tik Tok told 36Kr, China’s biztech media and also KrASIA’s parent company.

Tik Tok’s gaining traction in overseas markets, undoubtedly, was also facilitated by its sophisticated content operation, localized content operation specifically.

The director of Tik Tok Japan, who has been studying and working in Japan for 17 years since 2001, has essentially fully blended into Japanese society. The other team members are either Japanese or people who have studied in Japan. As you can see, the operation team of Tik Tok Japan is one that’s well aware of Japanese culture.

“Japan has a strong campus culture, therefore we designed contests that allowed students to participate in groups, like cheerleading,” the director told 36Kr.

There are many more similar examples. To cater to the Japanese’s “respect for similarity”, Tik Tok launched contests that allowed people to play in groups. In Thailand, Tik Tok had rolled out three festival stickers specifically for its traditional Water Festival, which garnered more than 40,000 uses in the three weeks of the Water Festival.

Explosive growth

Tik Tok’s rise overseas began in March this year, around the same time it gained traction in China.

Kaykai Salaider, an internet celebrity from Thailand, boasting 5.33 million followers on YouTube, has seen her Tik Tok following swell since this March to 1.9 million. Meanwhile, the Japanese Tik Tok user Kotachumu experienced his first massive growth of followers this May. Before this, despite having registered as early as last November, he had then only built a following of 10,000. Now he has over 50,000.

For some celebrities, although their fan base on Tik Tok is still only one third or one fourth the size of their following on YouTube, the content they publish on the two platforms have been generatinga similar number of views. As the few well-established platforms have hit a ceiling, Tik Tok has increasingly become the go-to place for aspiring cyber celebrities. In China, Daigula K’s shooting to fame is one example.

The rapid rise of Tik Tok had also caught the attention of local agencies.

Since March, Bytedance has been approached by numerous agencies hoping to sign influencers from Tik Tok. “I receive dozens of calls from Japan’s talent agencies each day. They would say that they like certain influencers on Tik Tok a lot and ask if we could introduce them,” the Japan director told 36Kr. “This past March and April each saw five or six Tik Tok influencers signed by talent agencies, including one by the company of Satomi Ishihara.”

Behind this growth of users and influence is Tik Tok’s heavy investment in marketing.

Tik Tok had recently kicked off an extensive online marketing campaign in Japan, the idea behind which is to cover as many channels as they can, as they did in China. Among the foreign Tik Tok users 36Kr spoke to, quite a few had downloaded the app after seeing its ads on Twitter. To complement its digital marketing presence, Tik Tok also invested in traditional channels like TV.

Tik Tok began to gain attention in China in the second half of 2017, after it had cooperated with several Chinese variety shows through title sponsorship or product placement deals. “Japanese TV networks don’t allow product placement, so we just fed their producers with numerous stories on Tik Tok that were interesting and report-worthy.” As a result, between May and June, Japanese TV programs covering Tik Tok anecdotes began to grow. “It was almost a daily occurrence in early June,” said the Japan director.

Now that a massive user base had been established, the focus was shifted to user retention, through the use of technology, product optimization and operation.

At the heart of Bytedance’s efforts to bring its products to overseas markets is a set of globally applicable technologies. ZHANG referred to it as “going global with technologies.” A product built on strong technologies is often easier to use and, to some extent, can smoothen cultural differences.

“Tik Tok’s overseas versions for Thailand, Indonesia and Japan all use the same design and technology,” said Tik Tok’s Indonesia and Thailand director. Such technologies include the mechanisms for content creation, distribution, interaction and management, the company’s signature recommendation system as well as video analytics and retrieval, automatic cover image selection and facial/body keypoint detection.

It is thanks to these technologies, backed by Bytedance’s AI Labs, that Tik Tok has earned itself a reputation as an easy-to-use video filming tool. It is also what enabled Tik Tok to capture young users quickly in overseas markets. In a sense, Tik Tok has filled a void in overseas short-video markets – Neither YouTube nor Instagram offers that many editing options or special effects.

Kotachumu first picked up Tik Tok because he thought it was a “good video making software.” At first, he used it merely as a tool to film and edit videos which he then posted on Instagram and Twitter, but it later occurred to him that an increasing number of his fans were following him on Tik Tok as well. That prompted him to publish content and interact with users on Tik Tok too ever since.

That means unlike the cutthroat competition between Bytedance and Tencent in China, overseas video platforms actually direct traffic to each other. When people publish the videos they make using Tik Tok on Facebook, Twitter, Instagram or YouTube, they are in fact helping Tik Tok acquire new users.

As the operational level, Tik Tok would design features tailored for a specific region, but many features, especially those that have proved extremely popular, are launched worldwide. This has made overseas operation easier for Tik Tok as it can quickly emulate its success in one region in others.

“Whenever something gains widespread popularity in China, our operational staff would discuss whether it could be successful in other markets, like ‘Dance Battle’ and ‘Dura Dance’,” the above Thailand and Indonesia director told 36 Kr. “Likewise, when a feature becomes all the rage in an overseas country, it would be introduced to our operational staff in China too.”

With massive localized content in place, what’s left to be done is matching content with the right users, and this is where Bytedance’s repeatedly proven recommendation algorithm comes into play. Tik Tok, like Bytedance’s other products, is built on algorithms. It’s essentially an app that matches users with content according to their tags. In this respect, cultural differences are not really a problem.

Spend big and earn big

Spending big so as to earn big has been Bytedance’s way of doing business.

The company was generous with spending when it promoted Douyin in China in the early days, and it still is today. A person close to the company told 36Kr that Douyin has been spending as much as 20 million yuan a day on traffic acquisition alone since this April, more than quadruple its spending during the Spring Festival. The heavy investment translated into satisfactory results: Douyin’s daily active users had skyrocketed from 30 million to 70 million in the Spring Festival and, as of mid-June, doubled again to reach 150 million.

It’s unclear how much Tik Tok is spending abroad. An industry insider said the figure may reach tens of millions of USD a month, but Bytedance denied this when 36Kr tried to confirm.

While spending heavily on marketing, Douyin quickly established a profit model for the Chinese market. It set foot in the advertising business less than a year into operation and, according to LI Liang, vice president of Bytedance, has become a favorite with advertisers. 36Kr estimated Tik Tok’s annual advertising revenue to reach 10 billion yuan.

Unlike in China, Tik Tok has yet to start generating revenue abroad.

According to Bytedance, Tik Tok does not take ads, nor do they sign contracts with any of their influencers. Content creators may monetize their following on the platform, but Tik Tok doesn’t get a cut. As far as ZHANG is concerned, the overseas markets are huge, adding up to almost five times the size of the Chinese market. Given that Tik Tok and Musical.ly still have plenty of room to grow before their user bases hit a ceiling, the priorities for now should still be market expansion and user education, said ZHANG.

Indeed, Tik Tok continues to post strong download numbers. According to a report compiled by Sensor Tower on the mobile app market, Douyin and its overseas versions Tik Tok were downloaded 45.8 million times from the Apple App Store in Q1 2018, making it the most downloaded iOS app globally.

However, the challenge ahead is going to be tough – Tik Tok will face a much more fiercely competed mobile advertising market abroad than it does in China. The in-feed ads segment, for example, has already been dominated by Facebook, Twitter and Instagram. Snatching market share from these giants won’t be an easy task.