Chinese smart gadgets maker Xiaomi’s widely-anticipated IPO is on the countdown.

We reported earlier this week that the Beijing-based gadget maker has filed with China Securities Regulatory Commission (CSRC) on its way to become the first company to issue China Depositary Receipts (CDR), following a CSRC announcement came out last week encouraging overseas-listed Chinese tech giants to duo-list at home bourses.

This Thursday, Xiaomi updated its CDR prospectus with CSRC, contents updated include the size of the CDR offering, it’s fintech business and ecosystem play among other things.

The Beijing-based company is expected to hold a press conference for its IPOs on June 23 followed by the floatation on June 25.

Xiaomi is intended to issue Class B common stock as a basic stock to be converted into CDR. And CDR portion will account for no less than 7% of its enlarged share capital. Additionally, the basic stocks corresponding to CDR issuance would account for no less than 50% of the total scale of the CDR and Hong Kong public offering (including the proportion of the old shares issued).

Some other noteworthy highlights from the updates.

CDR pricing strategy: bookbuilding.

When it comes to CDR stock price, the smartphone maker said it’d determine the price by the bookbuilding practice commonly adopted by HKEX listings, meaning the CDR price would be priced at the low end of the price range.

IPO valuation between $75 billion and 85 billion. CDR size between $5.3 billion and $6 billion.

The much-hyped IPO’s valuation, according to people familiar with the matter told 36Kr/KrASIA, was pegged at between US$ 75 billion and $85 billion, indicating the CDR size (7% of the share capital) would be around $5.3 – $6 billion.

Xiaomi has no plans for dividends distribution in the next five years.

Its rationale is that the company is still growing at quick pace with decent capital efficiency. And by leveraging capital it could use, the company could generate more value for both itself and shareholders.

To spin off finance business in five years.

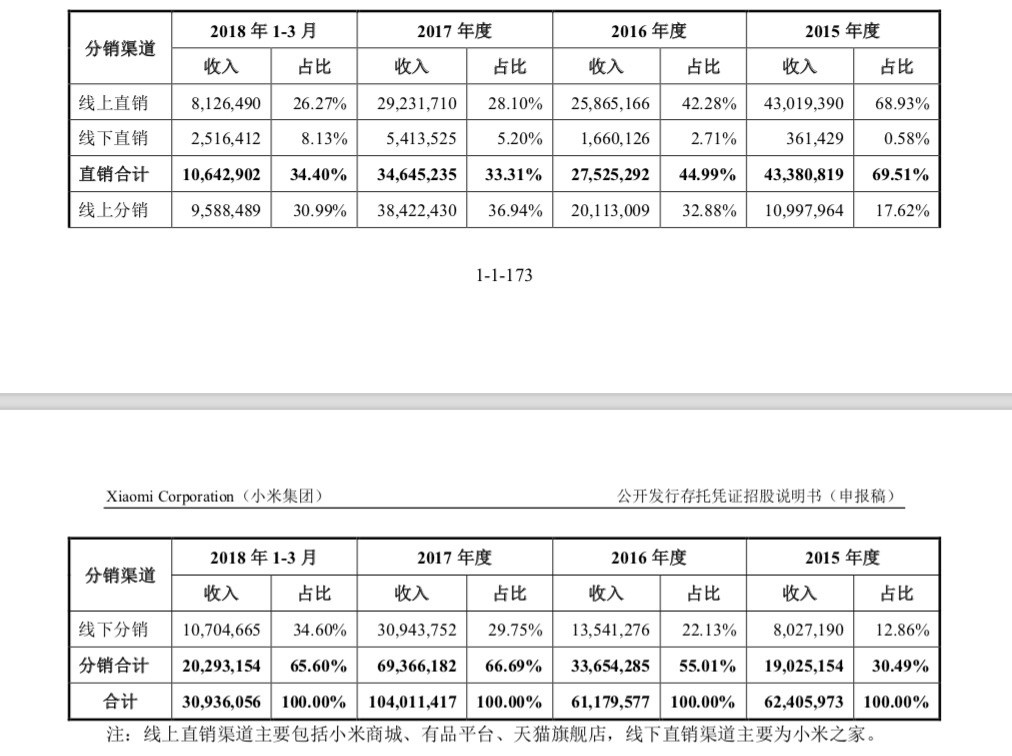

Offline channels sales rise rapidly.

First started primarily selling its products through the internet, Xiaomi found its inspirations in Apple Store and started launching its own version, named Xiaomi Home (小米之家), in 2011.

The updated CDR prospectus shows that sales from the physical channels have been rising very quickly, from 2015’s RMB 360 million (representing a mere 0.56% out of total sales coming from online, offline and distributions channels) to the first quarter of 2018’s RMB 2.5 billion, representing 8.13% of total sales.

As of now, there are 331 such Xiaomi Home for its fanbase in China and another 40 or so in India, where Xiaomi dethroned long-term rival Samsung late last year. And according to Mr. LEI Jun, founder and CEO of Xiaomi, the company expects to roll out 1,000 such homes in China in the next three years.

Mobile gaming contributed RMB 297 million in first quarter 2018.

Xiaomi claims the company is changing course to become more of an internet services provider, as, the profit margin for hardware business is quite low and the market is somewhat saturated.

Furthermore, by selling devices Xiaomi only gets to charge its users one time every few years when they phase out the old models, but by providing internet services it’s possible for the hardware maker to charge users every day, so to speak.

The prospectus reveals that for the first quarter of 2018, Xiaomi took in RMB 297 million from mobile gaming business, out of which blockbuster Arena of Valor, produced by Tencent, pitched in RMB 200 million, accounting for 68% of total gaming business revenue.

Xiaomi’s overly dependent on one single game to churn out a large proportion of revenue for gaming business which could be an important component of its internet services matrix might raise the alarm for its course changing, though.

Read more about Xiaomi IPO and CDR policies:

China’s Xiaomi files for what could be the world’s largest IPO since 2014

Xiaomi to issue CDR and become the first dual-listing Chinese unicorn soon

What Xiaomi revealed in its CDR filings: A slow shift to internet services