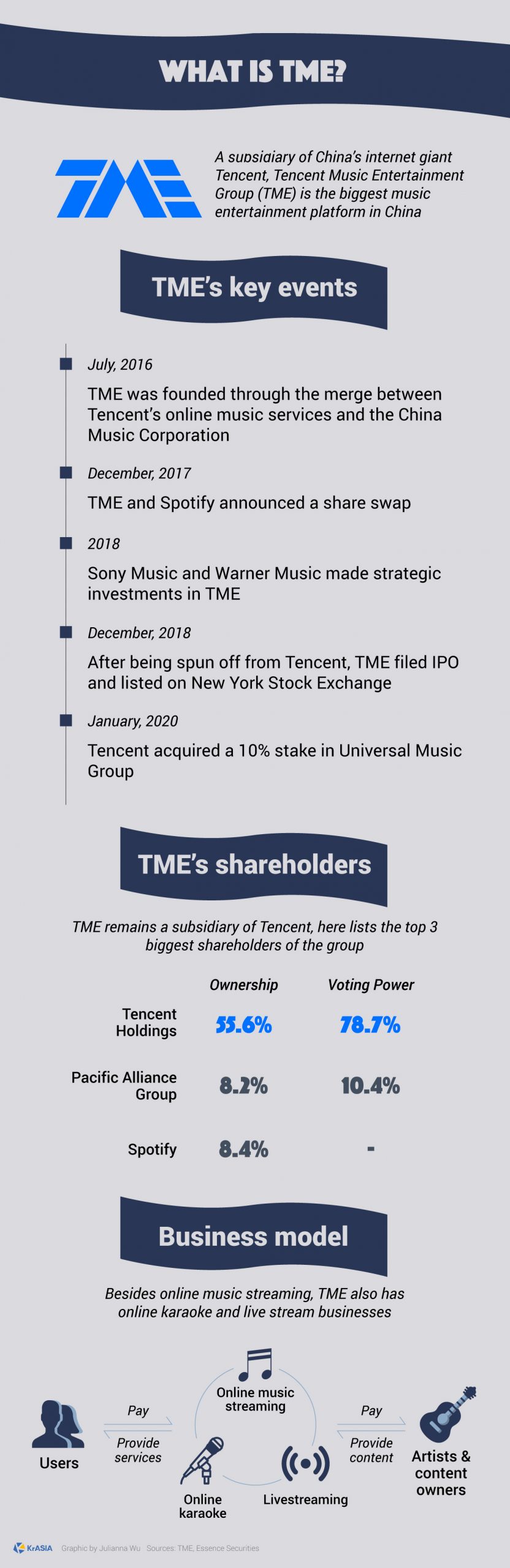

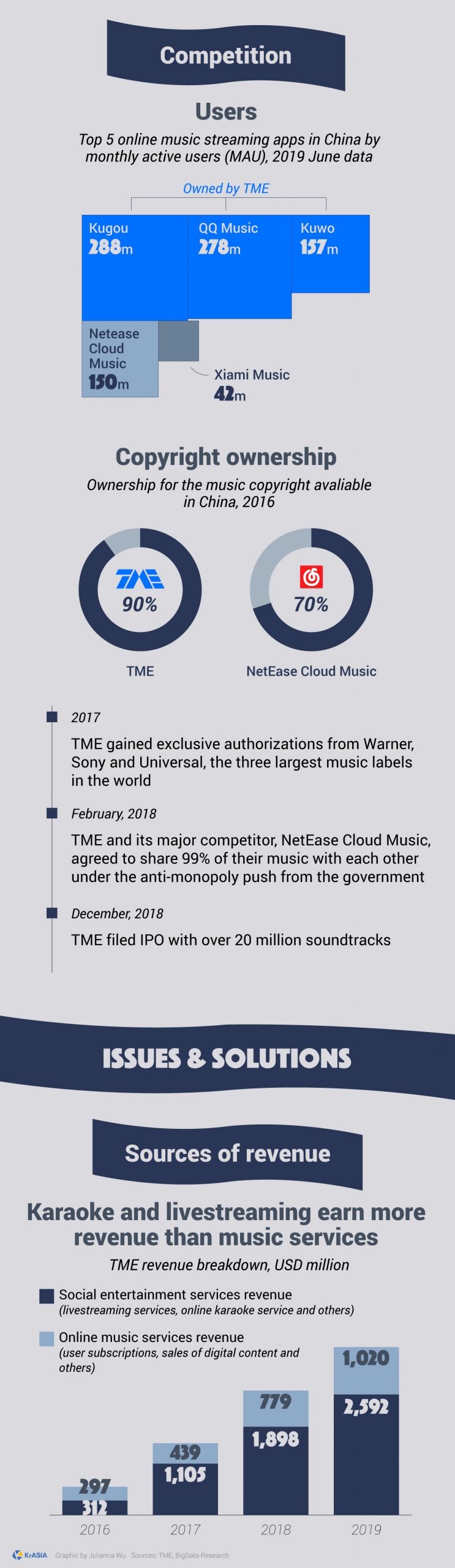

As China’s first, largest, and only US-listed online music company, Tencent Music Entertainment (NYSE: TME) dominates the Chinese online music streaming market with over 75% of market share and more than 20 million songs in its library, more than any other company in the industry.

On the surface, it looks like TME is a Chinese analog of Spotify. But, as we delve deeper into its service offerings and business model, it becomes clear that is not the case.

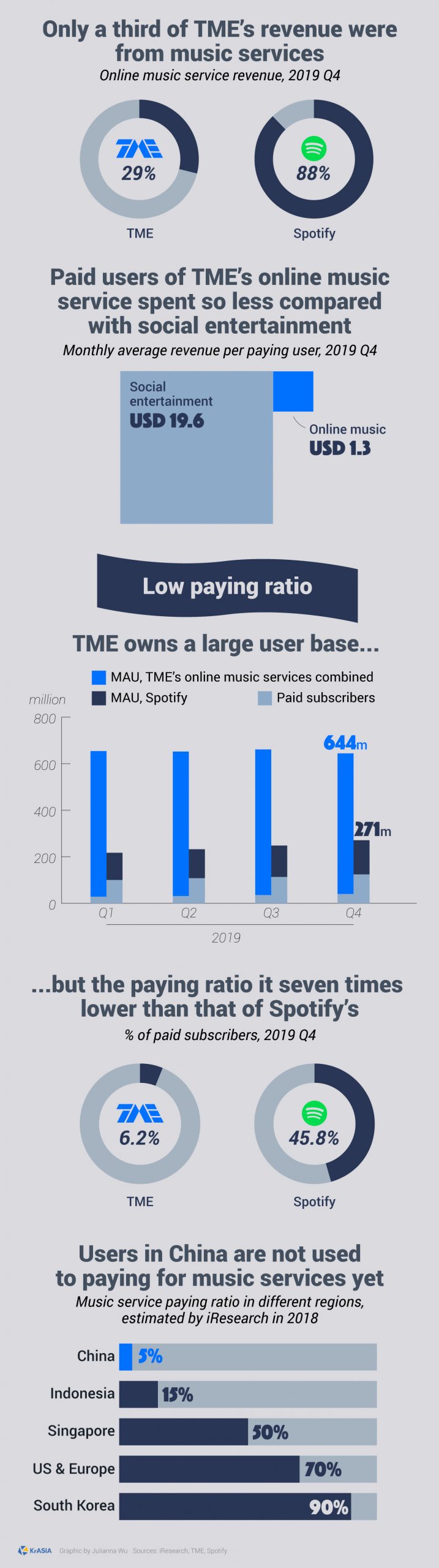

Most notably, TME’s revenue streams are completely different from Spotify’s. Unlike Spotify, which took almost 90% of revenue from subscribers who pay to stream its colossal music library, 75% of TME’s 2019 revenue came from social entertainment businesses including online karaoke and livestreaming.

One of the many reasons for this divergence is the fact that Chinese netizens are still getting used to paying for online content such as music, TV series, and movies. TME has to expand its services—based on the huge music library resources they possess—in order to goad Chinese into paying for livestreaming services.

SEE ALSO: Video | Chinese netizens are increasingly turning to livestreaming during the COVID-19 pandemic

As part of that strategy, it has been developing over the past several years an “all-in-one music entertainment” ecosystem that offers more than just music streaming.

That’s how, given the low willingness to pay for music service in the domestic market, TME still successfully pulled off a USD 664 million operating profit in 2019, as showed in the company’s latest financial result.

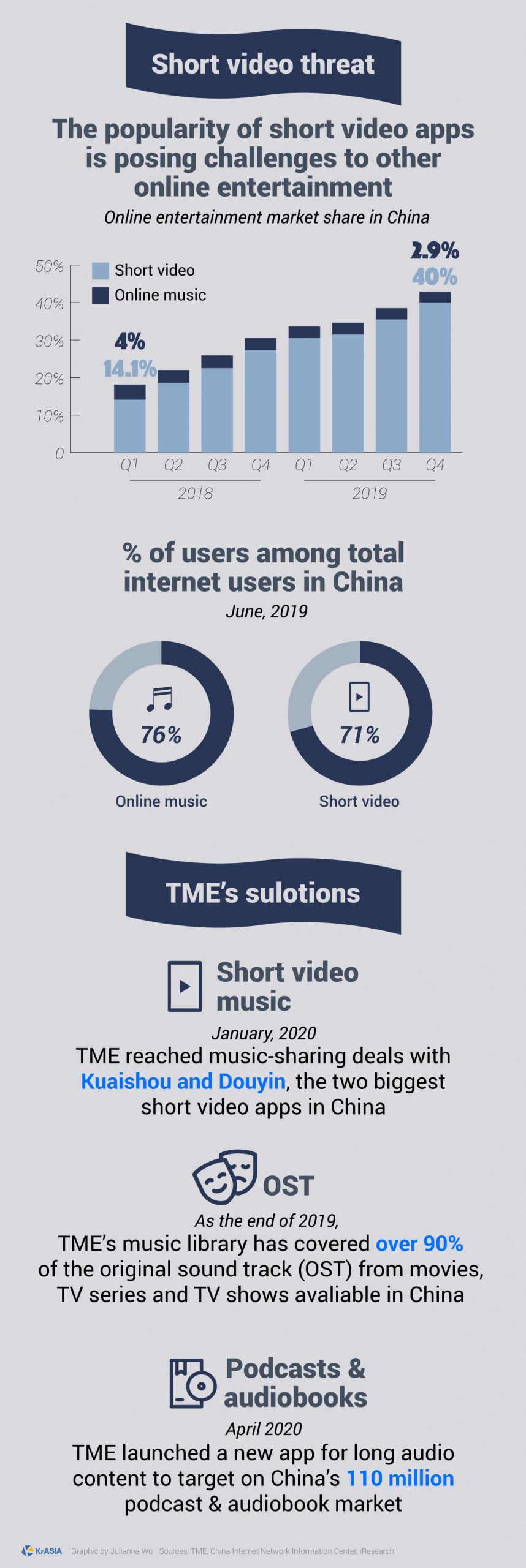

While it clearly doesn’t need to worry about cash flow, TME does face a serious threat from short video apps.

Rising to become the most popular type of social entertainment, short video apps like Douyin and Kuaishou have squeezed other online entertainment companies of screen time, while also presenting a concern as they reportedly expand into music streaming.

While its parent company Tencent had tried and failed hard in its battle with short video apps, TME chose to work with them for now, while utilizing its music ecosystem and deploying resources to develop long-audio content, such as audiobooks and podcasts.